Table of Contents

IRS Form 13588 – Native Americans and the Earned Income Credit – Navigating tax credits as a Native American taxpayer can unlock significant savings, especially with the Earned Income Tax Credit (EITC)—one of the IRS’s most valuable refunds for low- to moderate-income workers. But unique income sources like per capita distributions or tribal wages often require extra documentation to claim it successfully. That’s where IRS Form 13588—EITC Proof Guide for Native American Taxpayers—comes in. This specialized worksheet helps you gather and organize evidence to substantiate your EITC eligibility, reducing audit risks and ensuring smooth processing. For tax year 2025, with maximum EITC amounts up to $8,046 for families with three or more children, proper proof is more important than ever. This SEO-optimized guide, based on the latest IRS resources, breaks down Form 13588’s purpose, requirements, and tips for Native American filers.

What Is IRS Form 13588?

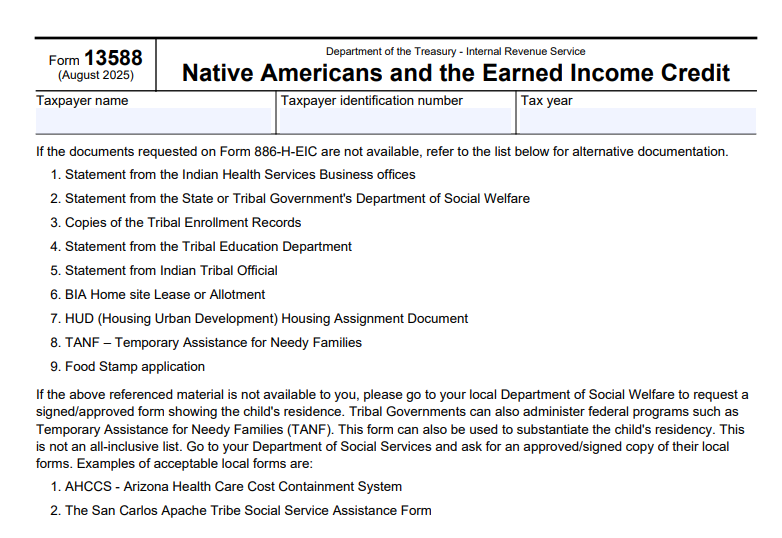

IRS Form 13588 is a non-filing worksheet designed specifically for Native American individuals claiming the EITC on Form 1040 or 1040-SR. It serves as a checklist and guide to compile supporting documents proving that certain income—often exempt or special for tribal members—doesn’t disqualify you from the credit. Under IRC Section 32, the EITC rewards earned income, but Native Americans may need to verify exclusions like income from treaty lands or per capita payments from casino revenues.

Key features:

- Documentation Checklist: Lists required proofs for wages, self-employment, and nontaxable income.

- Audit Protection: Helps demonstrate compliance with EITC rules, such as the investment income limit ($11,600 for 2025).

- Tribal-Specific Guidance: Addresses unique situations like Bureau of Indian Affairs (BIA) employment or restricted allotments.

The form (Rev. December 2024) is available as a PDF on IRS.gov and aligns with Publication 5424, Income Tax Guide for Native American Individuals and Sole Proprietors. It’s not submitted to the IRS but retained in your records for potential audits.

Who Needs IRS Form 13588 in 2025?

Any Native American taxpayer claiming EITC who has income from tribal sources, restricted property, or per capita distributions should use Form 13588 to organize proofs. General EITC eligibility requires earned income under $63,398 (single with three kids) and no foreign income disqualification, but tribal nuances add layers.

| Eligibility Factor | Details for Native American Taxpayers |

|---|---|

| Basic EITC Rules | U.S. citizen/resident, qualifying child or no child, earned income $1–$63,398 (varies by family size). |

| Tribal Income | Wages from BIA or tribal employers: Provide Form W-2 with Box 15 code “L” or affidavit. |

| Per Capita Distributions | From net gaming revenues: Exempt if under treaty; document with tribal resolution or 1099-MISC. |

| Restricted Allotments | Income from use of allotted lands: Nontaxable; attach BIA statement or lease agreement. |

| Self-Employment | Tribal business income: Schedule C with receipts; exclude nontaxable portions. |

If your only income is nontaxable (e.g., pure per capita), you may not qualify for EITC—use Form 13588 to clarify. Enrolled members of federally recognized tribes qualify; consult Publication 5424 for details.

IRS Form 13588 Download and Printable

Download and Print: IRS Form 13588

Step-by-Step Guide to Completing IRS Form 13588

Form 13588 is a simple two-page checklist—no calculations, just verification. Download it from IRS.gov and complete it alongside your 1040. Retain copies for at least three years.

- Section I: Taxpayer Information – Enter name, SSN, filing status, and EITC amount claimed.

- Section II: Earned Income Proof – For each W-2 or 1099, note employer (tribal or non), amount, and attach copies. For BIA jobs, include Form 5003 or pay stubs.

- Section III: Nontaxable Income Documentation – List per capita or allotment income; attach tribal statements, treaties, or BIA Form 4430.

- Section IV: Qualifying Child Info – If applicable, provide birth certificates or SSNs; confirm relationship and residency.

- Section V: Certification – Sign and date, affirming accuracy under penalty of perjury.

- Attachments – Staple all docs; scan for e-file if using software like TurboTax.

For 2025, include any COVID-era relief proofs if carryovers apply. Free help via VITA/TCE sites often assists Native filers.

Common Native American Income Sources and EITC Proofs

Native taxpayers face special rules: Income from reservation-based activities may be exempt, but earned portions count for EITC.

- Tribal Wages: Taxable unless on treaty land; prove with W-2 and tribal ID.

- Per Capita Payments: Generally nontaxable (IRC §7871); document via Form 1099 and tribal disbursement notice.

- Fishing/Hunting Rights: Earnings from treaty-protected activities: Affidavit from tribe or BIA.

- Casino or Gaming Income: Net revenues distributed: Exempt; attach IGRA-compliant resolution.

- Allotment Rentals: Nontaxable if restricted; BIA valuation report required.

Use Form 13588’s checklist to map these—omissions can delay refunds up to 40% of your credit.

Recent Updates to IRS Form 13588 for Tax Year 2025

The December 2024 revision of Form 13588 incorporates inflation adjustments and post-Inflation Reduction Act clarifications:

- EITC Thresholds: Investment income cap rises to $11,600; max credit $8,046 (three+ kids).

- Digital Submission: Enhanced guidance for e-file attachments via Form 8453.

- Tribal Consultations: New section for Low-Income Taxpayer Clinic (LITC) referrals, per IRS’s ongoing tribal outreach.

- Audit Safeguards: Aligns with Publication 596 updates, emphasizing digital proofs like scanned tribal docs.

These changes stem from IRS’s annual review and feedback from Native American tax coalitions. Always use the 2025 version for returns filed in 2026.

Common Mistakes When Using Form 13588 and How to Avoid Them

Even with its simplicity, errors can trigger EITC disallowance (up to 25% recapture penalty):

- Incomplete Proofs: Forgetting tribal affidavits—cross-check against Publication 5424.

- Misclassifying Income: Treating all per capita as earned—review IRC §139E for COVID exclusions.

- No Child Verification: Skipping SSN proofs—use Form 13588 Section IV fully.

- Outdated Forms: Using pre-2025 versions—download fresh from IRS.gov.

- Non-Retention: Discarding docs post-filing—keep for seven years if self-employed.

Partner with a tax pro familiar with tribal law; the IRS’s Native American helpline (800-829-1040) offers free guidance.

Penalties for EITC Errors and How Form 13588 Helps

Claiming EITC incorrectly invites scrutiny:

- Disallowance: Full credit repayment plus 20% negligence penalty.

- Fraud: 75% penalty and possible jail time.

- Audit Rates: Higher for EITC claims (1.5% vs. 0.4% average).

Form 13588 mitigates this by providing a ready audit trail—IRS examiners recognize it as proactive compliance. If audited, submit the completed form promptly.

Frequently Asked Questions About IRS Form 13588

Do all Native Americans need Form 13588 for EITC?

No—only those with tribal income sources; it’s optional but recommended for proof organization.

Where can I download Form 13588?

From IRS.gov/forms-pubs/about-form-13588; search “EITC Native American” for the PDF.

Does per capita income disqualify me from EITC?

Not if nontaxable—document it to exclude from earned income calculations.

Can I e-file with Form 13588 attachments?

Yes—scan and upload via your software; mail paper if needed.

What’s the deadline for 2025 EITC claims?

April 15, 2026, or October 15 with extension; claim within three years of original due date.

For more, visit IRS.gov/eitc or Publication 596.

Final Thoughts: Maximize Your EITC with Form 13588 in 2025

IRS Form 13588 empowers Native American taxpayers to claim the EITC confidently, bridging cultural income realities with federal rules. With 2025’s boosted credits and streamlined proofs, it’s a small step yielding big refunds—potentially thousands for families. Download the form today, gather your docs, and consider free VITA assistance tailored for tribes.

Remember, tax season is about equity—use these tools to secure yours.

This article is for informational purposes only and not tax advice. Consult IRS.gov or a qualified professional for personalized guidance.