Table of Contents

IRS Form 13977 – VITA Grant Budget Plan – Nonprofits, community organizations, and educational institutions play a vital role in helping underserved Americans access free tax preparation through the Volunteer Income Tax Assistance (VITA) program. But to secure federal funding, a detailed financial roadmap is essential. Enter IRS Form 13977—the VITA Grant Budget Plan. This form outlines estimated program expenditures, matching funds, and in-kind contributions, ensuring your grant application aligns with IRS priorities. For the 2025 grant cycle, with applications accepted from May 1 to May 31 and over $30 million in available funding, Form 13977 is your key to unlocking resources that served more than 2.7 million taxpayers last year. This SEO-optimized guide, based on the latest IRS revisions (Rev. July 2025), covers everything from eligibility to common pitfalls, empowering your organization to maximize impact.

What Is IRS Form 13977?

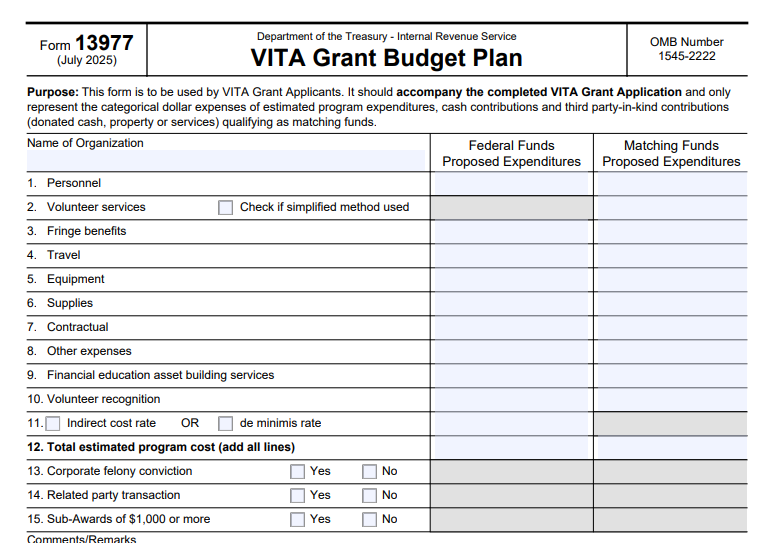

IRS Form 13977 is a mandatory budget template for applicants to the VITA Matching Grant Program under Assistance Listing 21.009. It categorizes projected costs for operating VITA sites, volunteer support, and related activities, while documenting cash and third-party in-kind matching funds (e.g., donated services or property) that equal or exceed the federal request. The form ensures transparency and compliance with IRS cost principles from the Office of Management and Budget (OMB) Uniform Guidance (2 CFR 200).

Key elements:

- Federal Request vs. Match: Line 1 shows the requested grant amount; Lines 2–11 detail program costs and matches.

- Allowable Expenses: Covers salaries, training materials, site operations, and up to 10% for financial education.

- No Indirect Costs: Line 11 is N/A—overhead isn’t match-eligible.

The July 2025 revision streamlines reporting for sub-awards and aligns with updated grant terms in Publication 6086. Download the PDF from IRS.gov for the current version.

Who Needs to File IRS Form 13977 in 2025?

Form 13977 is required for all VITA grant applicants—new or renewing—seeking matching funds to expand free tax services for low-to-moderate-income individuals (under $64,000 AGI), seniors, disabled persons, and limited English proficient taxpayers. Eligibility hinges on IRS certification as a VITA site coordinator and a track record of accurate, electronic return preparation.

| Applicant Type | Requirements |

|---|---|

| New Applicants | Must submit via Grants.gov; demonstrate community need and volunteer capacity. |

| Renewing Grantees | Include prior-year performance from Form 13980 (Year-End Report). |

| Sub-Awardees | Report through primary sponsor; detail cash/third-party transactions in workbook. |

| Matching Funds | 100% match required (e.g., $50,000 federal request needs $50,000 in cash/in-kind). |

Organizations like universities (e.g., Purdue Extension’s 2025 expansion to eight Indiana counties) and nonprofits qualify if they prioritize underserved areas. Register in SAM.gov and Grants.gov by April 2025.

Filing Deadlines and Submission Process for Form 13977

The 2025 VITA grant cycle opened May 1, with applications due May 31 via Grants.gov. Awards were announced December 2, 2024, totaling $53 million across 315 VITA and 41 TCE grantees from 445 applications requesting $82.9 million.

- Initial Submission: Attach Form 13977 to your full application package, including Form 13978 (Projected Operations) and Form 14335 (Contact Info).

- Post-Award Revisions: Submit updated Form 13977 with narrative and matching documentation within 20 days of award notice via email to [email protected].

- Reporting: Use Form 13979 (Final Expense Report) by July 31, 2025, post-tax season.

- Where to Submit: Electronically through Grants.gov; paper not accepted.

Late submissions risk disqualification—set reminders for key dates.

Step-by-Step Guide to Completing IRS Form 13977

Form 13977 is a one-page spreadsheet-style worksheet. Use the VITA Grant Workbook for templates and calculations. Gather prior budgets, donor pledges, and expense projections.

- Header: Enter organization name, EIN, contact info, and grant period (e.g., January 1–December 31, 2025).

- Line 1: Federal Request: Total grant amount sought (up to $30 million pool-wide).

- Lines 2–8: Program Expenses: Detail salaries (Line 2), training (Line 3), software (Line 4), etc. Limit volunteer stipends to $500/person.

- Line 9: Financial Education (FEAB): Up to 10% of federal award for asset-building services.

- Line 10: Volunteer Recognition: Items ≤$10/volunteer (e.g., certificates).

- Line 11: Indirect: Enter N/A—no overhead allowed.

- Line 12: Total Program Cost: Sum Lines 1–11; ensure match ≥ federal request.

- Columns B–D: Break out federal, cash match, and in-kind match per line.

- Certification: Sign under penalty of perjury; attach supporting docs like pledges.

For sub-awards, use the workbook’s transaction log. Review Publication 4671 for full instructions.

Allowable Expenses and Matching Funds on Form 13977

VITA grants fund ordinary, necessary costs per OMB guidelines—no luxury items or unrelated overhead.

| Line | Category | Examples | Match Rules |

|---|---|---|---|

| 2 | Salaries | Coordinators, instructors (not volunteers). | Cash or in-kind (e.g., donated staff time at $50/hr). |

| 3 | Training | Publication 4491 guides, webinars. | Up to 100% match. |

| 4 | Software/Supplies | Tax prep software, laptops (IRS provides some). | Document purchases. |

| 5 | Site Operations | Rent, utilities for VITA locations. | In-kind (donated space). |

| 6 | Outreach | Posters, flyers for recruitment. | Cash preferred. |

| 9 | FEAB Services | Financial literacy workshops. | ≤10% federal; match required. |

Matching funds must be verifiable (e.g., bank statements, valuation reports for in-kind). Undocumented matches lead to reductions.

IRS Form 13977 Download and Printable

Download and Print: IRS Form 13977

Recent Updates to IRS Form 13977 for 2025

The July 2025 revision (Catalog No. 51502R) incorporates feedback from the 2024 cycle:

- Sub-Award Tracking: Enhanced workbook for cash/third-party reporting.

- FEAB Expansion: Clarified 10% cap with new examples in Pub. 6086.

- Digital Tools: Alignment with Grants.gov for seamless uploads; no paper.

- Inflation Adjustments: Higher salary benchmarks per OMB.

These changes support the IRS’s goal of 3 million+ returns in 2025, focusing on electronic filing and accuracy.

Common Mistakes When Completing Form 13977 and How to Avoid Them

Grant denials often stem from budget errors—avoid these:

- Insufficient Match: Underestimating in-kind values—use fair market rates and appraisals.

- Overstated Expenses: Including non-allowable items like travel—stick to Pub. 4883 guidelines.

- Double-Counting Volunteers: Listing stipends and recognition separately—cap at $500 total.

- Missing Documentation: No pledges attached—compile early.

- Math Errors: Totals don’t align—use Excel workbook for auto-calcs.

Pilot your budget with a CPA; IRS webinars (via IRS.gov) offer free training.

Penalties for Non-Compliance with VITA Grant Budget Rules

Mismanagement triggers audits and clawbacks:

- Under-Matching: Grant reduction or termination (e.g., 20% shortfall = 20% cut).

- Misuse of Funds: Repayment plus 25% penalty under 2 CFR 200.

- Late Reports: Suspension from future cycles.

- Fraud: Debarment from federal grants.

Document everything; reasonable cause (e.g., emergencies) may waive via appeal to grant officer.

Frequently Asked Questions About IRS Form 13977

Is Form 13977 required for all VITA applicants?

Yes—for initial and renewal applications via Grants.gov.

What counts as in-kind matching funds?

Donated space, volunteer hours (at minimum wage), or supplies—valued per IRS guidelines.

Can I revise my budget post-submission?

Yes, within 20 days of award; email updates to [email protected].

What’s the max grant amount for 2025?

Varies by need; total pool $30M+, with awards up to $200K+ for large programs.

Where do I find the VITA Grant Workbook?

On IRS.gov under “VITA Grant Recipient” resources (for 2023+ cycles).

For more, visit IRS.gov/vita-grant.

Final Thoughts: Leverage Form 13977 to Amplify VITA Impact in 2025

IRS Form 13977 transforms grant dreams into funded realities, enabling organizations to file millions of accurate returns and keep refunds in underserved communities. With $53 million awarded for 2025 and applications closed, prepare now for 2026—download the July 2025 form and workbook from IRS.gov to build a rock-solid budget. Partnering with the IRS isn’t just funding; it’s empowering financial stability.

This article is informational only—not grant advice. Consult IRS.gov or a grants specialist for your application.