Table of Contents

IRS Form 720 – Quarterly Federal Excise Tax Return – Federal excise taxes fund essential programs like highway infrastructure and environmental protection, but compliance can be tricky for businesses dealing in regulated goods and services. IRS Form 720—the Quarterly Federal Excise Tax Return—is the key document for reporting and paying these taxes on time. For calendar year 2025, with updates including inflation-adjusted rates for air travel ($22.90 segment tax) and the Patient-Centered Outcomes Research (PCOR) fee ($3.47 per covered life), accurate filing prevents penalties that can reach 25% of unpaid taxes. Whether you’re in fuel distribution, air transportation, or vaccine manufacturing, this SEO-optimized guide draws on the latest IRS instructions (Rev. June 2025) to cover eligibility, deadlines, steps, and pitfalls for seamless 2025 compliance.

What Is IRS Form 720?

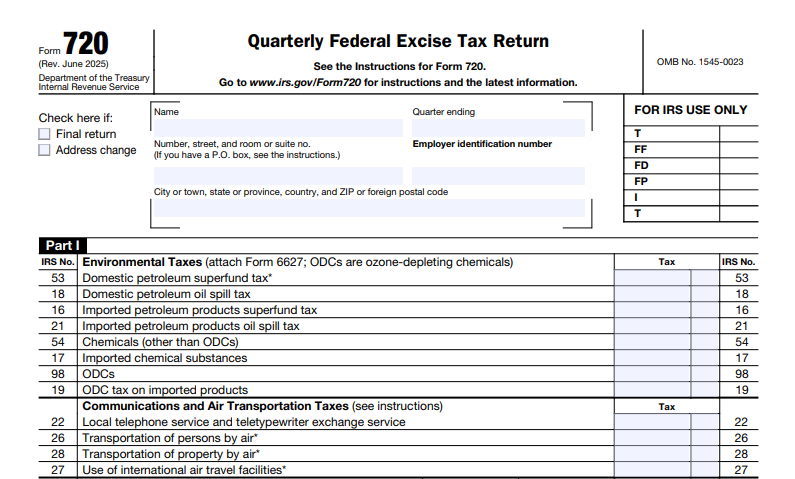

IRS Form 720 is a quarterly return used to calculate, report, and pay federal excise taxes on specific goods, services, and activities under Chapters 31, 32, 33, and 34 of the Internal Revenue Code. It includes environmental taxes, fuel taxes, communications and air transportation taxes, and fees like the PCOR charge. Businesses file to remit collected taxes or claim credits/refunds via Schedule C.

Key components:

- Part I: Environmental and related taxes (e.g., fuel, chemicals).

- Part II: Other excise taxes (e.g., air travel, vaccines).

- Schedule A: Tracks semimonthly deposits.

- Schedule C: Fuel and alternative fuel credits.

The June 2025 revision incorporates T.D. 9948 for aircraft exemptions and Rev. Proc. 2023-20 for taxable substances. Download the form and instructions from IRS.gov/Form720.

Who Needs to File IRS Form 720 in 2025?

File Form 720 if your business incurs excise tax liability exceeding $1,000 in a quarter, or even if zero due for certain one-time filers (e.g., gas guzzler imports). Exemptions apply for small liabilities under $2,500 with timely deposits.

| Tax Category | Examples for 2025 Filers |

|---|---|

| Environmental Taxes | Coal ($1.10–$1.45/ton), inland waterways ($0.29/gallon diesel), ODCs (up to $9.02/lb). |

| Fuel Taxes | Gasoline ($0.184/gallon), diesel ($0.244/gallon); biodiesel credits expired post-2024. |

| Communications & Air | Local phone (3.0%), air passenger ($4.80–$22.90/segment, inflation-adjusted). |

| Health-Related | Vaccines ($0.41–$0.94/dose), PCOR fee ($3.47/life for Q2 filers). |

| Other | Indoor tanning (10%), arrow shafts ($0.49 each, adjusted). |

Foreign insurers use it for policies (1.0–2.0%). No filing if only zero-liability PCOR in non-Q2 quarters. Use EIN; apply via IRS if needed.

Filing Deadlines and Extensions for Form 720 in 2025

Form 720 is due the last day of the month following each calendar quarter. Semimonthly deposits (days 15 and last day) are required for most taxes—use Schedule A even if under $2,500.

| Quarter | Period | Filing Deadline | Deposit Windows |

|---|---|---|---|

| Q1 | Jan–Mar | April 30, 2025 | Mar 16–31 (Apr 7), Apr 1–15 (Apr 30) |

| Q2 | Apr–Jun | July 31, 2025 | May 16–31 (Jun 13), Jun 1–15 (Jul 14); Special Jun 16–30 (Jul 25) |

| Q3 | Jul–Sep | October 31, 2025 | Aug 16–31 (Sep 12), Sep 1–15 (Sep 30); Special Sep rule if weekend |

| Q4 | Oct–Dec | January 31, 2026 | Nov 16–30 (Dec 9), Dec 1–15 (Dec 31) |

- Extensions: No automatic; request via letter to IRS (up to 6 months) but pay/deposit on time to avoid interest (0.5%/month).

- E-Filing: Optional but encouraged via IRS e-file providers; paper to: Internal Revenue Service, P.O. Box 94221, Kansas City, MO 64194-4221 (or PDS equivalent).

- Special Rules: PCOR fee only in Q2; air travel alternative method for June collections due July 25.

Pay via EFTPS; new IRS Direct Pay option from October 2024.

Step-by-Step Guide to Completing IRS Form 720

Gather sales records, deposit logs, and Pub. 510 for rates. Use e-file software for accuracy.

- Header: Enter EIN, quarter/year (e.g., 2025-2 for Q2), address; check final/amended if applicable.

- Part I (Environmental Taxes): Report gallons/tons by IRS No. (e.g., No. 60 gasoline: gallons × $0.184); attach Form 6627 for ODCs.

- Part II (Other Taxes): Line-by-line (e.g., No. 26 air passenger: segments × rate); gas guzzler via Form 6197.

- Schedule A (Deposits): Detail semimonthly periods; net liability per box.

- Part III (Claims): Complete Schedule C for fuel credits (e.g., off-highway use); total on line 4.

- Line 3 (Total Tax): Sum Parts I/II minus prior overpayments (line 6).

- Line 10 (Balance Due): Pay if >$2.50; overpayments apply to next.

- Sign & File: Under perjury; attach statements for claims.

For PCOR (No. 133), report only in Q2 at $3.47 × average lives.

Key Excise Tax Rates and Calculations for 2025

Rates are mostly stable, with inflation tweaks. Use Pub. 510 for full details.

| IRS No. | Tax Type | 2025 Rate |

|---|---|---|

| 26 | Air Passenger (Domestic) | $4.80/segment |

| 27 | Air Passenger (International) | $22.90/segment |

| 108 | Gasoline | $0.184/gallon |

| 109 | Diesel | $0.244/gallon |

| 120 | PCOR Fee (Q2 only) | $3.47/covered life |

| 97 | Vaccines (e.g., MMR) | $1.23/dose |

| 140 | Indoor Tanning | 10% of payment |

Prorate for partial quarters; reduced bus credits apply (type 5 use). Example: 1,000 gallons diesel = $244 tax.

IRS Form 720 Download and Printable

Download and Print: IRS Form 720

Claiming Credits and Refunds on Form 720

Use Schedule C for:

- Fuel Credits: $0.183/gallon off-highway (No. 1); biodiesel expired post-2024.

- Alternative Fuels: $0.50/gallon mixtures (if eligible).

- Overpayments: Carry to next quarter or refund via Form 8849.

Attach explanations; one-time filers for gas guzzlers attach Form 6197.

Common Mistakes When Filing Form 720 and How to Avoid Them

Errors trigger audits—top issues for 2025:

- Missed Deposits: Semimonthly lapses despite timely filing—use EFTPS reminders.

- Wrong Quarter: Reporting stock repurchases or PCOR in non-Q2—standardize processes.

- Incomplete Schedule A: Omitting even low liabilities—always include if Part I taxes.

- Rate Misapplication: Using outdated inflation adjustments—check Pub. 510 quarterly.

- Unsigned Returns: Forgetting perjury declaration—double-check before e-file.

E-file reduces math errors by 90%; review with a CPA.

Penalties for Late or Incorrect Form 720 Filings

The IRS enforces strictly:

- Late Filing: 5%/month (max 25%) of unpaid tax.

- Late Payment/Deposit: 0.5%/month + interest (0.54%/month).

- Trust Fund Recovery: 100% personal liability for willful nonpayment.

- Negligence/Fraud: 20–75% of underpayment.

Safe harbor: Pay underpayment by due date and check line 5. Reasonable cause waives via response to notice.

Frequently Asked Questions About IRS Form 720

Do I file Form 720 if my excise liability is under $1,000?

No, but deposit semimonthly and file if over in any quarter.

Can I e-file Form 720?

Yes—via IRS-approved providers; instant acceptance.

What’s new for PCOR fee in 2025?

$3.47 per life (up from $3.22); report only in Q2.

How do I handle semimonthly deposits?

Via EFTPS by 8 p.m. ET on due dates; special September rules for weekends.

Is there an extension for Form 720?

Request in writing; no automatic, but pay timely.

Visit IRS.gov/Form720 for more.

Final Thoughts: Master IRS Form 720 Compliance for 2025

IRS Form 720 ensures your business contributes fairly to public goods while claiming rightful credits—noncompliance risks thousands in penalties. With 2025’s adjusted rates and e-pay options, quarterly reviews keep you audit-proof. Download the June 2025 version from IRS.gov today and consult a tax advisor for tailored strategies.

This article is informational only—not tax advice. Verify with IRS or a professional.