Table of Contents

IRS Form 13981 – VITA Grant Agreement – Securing funding to provide free tax preparation services can transform communities, especially for low-income families navigating complex returns. The IRS Volunteer Income Tax Assistance (VITA) Grant Program empowers nonprofits, faith-based organizations, and community centers to deliver these services, and IRS Form 13981—the VITA Grant Agreement—is the binding document that formalizes your award. For the 2025 grant cycle, with $53 million awarded to 315 VITA recipients from 445 applications, this agreement ensures compliance while supporting over 2.7 million tax returns annually. This SEO-optimized guide, based on the latest IRS resources (Rev. June 2025), demystifies Form 13981, from terms to execution, helping grant recipients maximize impact under the $68,675 income threshold for VITA eligibility.

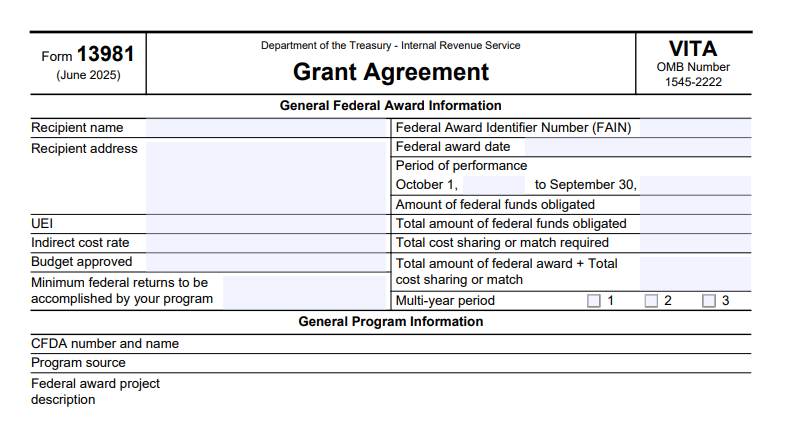

What Is IRS Form 13981?

IRS Form 13981 is the official grant agreement for recipients of the VITA Matching Grant Program, outlining the terms, conditions, and performance expectations for using federal funds to provide free tax preparation and electronic filing to underserved populations. It incorporates by reference the detailed provisions in Publication 5247, Volunteer Income Tax Assistance (VITA) Terms and Conditions (Rev. August 2025), ensuring alignment with federal regulations under 2 CFR 200.

The form binds the recipient to non-discriminatory practices, accurate return preparation, and reporting requirements, while specifying the grant period (typically January 1–December 31, 2025) and award amount. Signing signifies acceptance of all conditions, including matching funds (100% cash or in-kind) and adherence to the IRS Volunteer Standards of Conduct.

Key sections:

- Grant Details: Award amount, period of performance, and recipient obligations.

- Compliance Certifications: Affirmations on drug-free workplaces, trafficking prohibitions, and Buy American provisions.

- Termination Clauses: IRS rights to end the agreement for non-compliance, with seven days’ notice.

Download the June 2025 revision (Catalog No. 51540F) from IRS.gov for the current template.

Who Needs IRS Form 13981 in 2025?

Form 13981 is mandatory for all VITA grant awardees—new, renewing, or multi-year—following successful applications submitted via Grants.gov from May 1–31, 2025. It’s issued after IRS review and requires signature by an authorized representative (e.g., executive director) and return within the specified timeframe.

| Recipient Type | Requirements |

|---|---|

| New Grantees | Sign upon award notification; demonstrate need via Form 13978 (Projected Operations). |

| Renewing Recipients | Check prior Form 13981 for cycle year; submit abbreviated application if in years 2–3. |

| Sub-Awardees | Primary recipient oversees; sub-sites agree to terms via sponsor documentation. |

| Multi-Site Sponsors | One agreement covers all sites; ensure uniform compliance. |

Eligible organizations include nonprofits, universities, and faith-based groups certified by the IRS. Awards prioritize underserved areas, with a focus on electronic filing and accuracy rates above 90%.

IRS Form 13981 Download and Printable

Download and Print: IRS Form 13981

Signing and Submission Process for Form 13981

Once awarded (notifications typically by December 2025), review the pre-filled Form 13981 sent via email to your Authorized Official Representative (AOR) contact on Standard Form 14335.

- Review Period: Examine Publication 5247 in full—non-review voids claims of unawareness.

- Execution: Sign, date, and return with supporting docs (e.g., matching fund pledges) by the deadline (usually 20–30 days post-notification).

- Submission: Email scanned PDF to [email protected]; retain originals for records.

- Post-Signing: Access funds via SF-270 (Request for Advance); report progress via Form 13980 (Year-End Report) by July 31, 2026.

For revisions (e.g., budget changes), submit updated Form 13977 within 20 days. Failure to sign timely risks fund suspension.

Step-by-Step Guide to Reviewing and Executing IRS Form 13981

Form 13981 is concise but legally binding—treat it as a contract. Use Publication 4883, Grant Programs Resource Guide, for context.

- Verify Details (Section I): Confirm award amount, grant period (e.g., 1/1/2025–12/31/2025), EIN, and site info.

- Review Terms (Section II): Cross-reference Publication 5247 for specifics like 100% matching, non-discrimination, and FAPIIS reporting (for awards >$10M cumulative).

- Certify Compliance (Section III): Affirm adherence to drug-free policies (31 CFR Part 20), anti-trafficking (22 U.S.C. 7104), and Buy American (except IT/commercial items under $10K).

- Performance Commitments: Note minimum returns (e.g., based on prior year) and accuracy targets.

- Sign and Date: Authorized rep signs; IRS countersigns.

- Attach Exhibits: Include Form 13978 projections and volunteer agreements (Form 13615).

Exhibit 2 in Pub. 4883 provides a sample; consult IRS webinars for walkthroughs.

Key Terms and Conditions in Form 13981 for 2025

The agreement enforces federal standards via Publication 5247 (Rev. August 2025):

- Matching Funds: Equal federal request (e.g., $50K grant needs $50K match via cash, donated space at FMV, or volunteer hours at minimum wage).

- Allowable Costs: Salaries, training (Pub. 4491), software; no indirect overhead or luxuries.

- Reporting: Quarterly progress (Form 14655), final expense (Form 13979) by July 31, 2026; 90%+ electronic filing.

- Non-Discrimination: Adopt policies for race, gender, disability; sub-recipients must comply.

- Termination: IRS may end with 7-day notice for cause (e.g., misuse); recipients get appeal rights under 2 CFR 200.340.

- Buy American: Prefer U.S. products unless unavailable or excepted (e.g., trade agreements).

For 2025, emphasis on financial education (up to 10% funds) and VITA’s $68,675 AGI cap.

Recent Updates to IRS Form 13981 for 2025

The June 2025 revision (Catalog No. 51540F) reflects post-award feedback:

- FAPIIS Integration: Mandatory for high-value recipients (> $10M cumulative federal awards).

- Addendum Expansions: Item IV in Pub. 5247 details new reporting for sub-awards and anti-trafficking certifications.

- Digital Signing: Encouraged via DocuSign for faster processing.

- Threshold Adjustments: Aligns with VITA’s updated $68,675 income limit and $53M total awards.

These changes support IRS goals for 3M+ returns in 2026, per Pub. 6086.

Common Mistakes When Handling Form 13981 and How to Avoid Them

Delays in execution can halt funding—top errors:

- Overlooking Pub. 5247: Signing without full review—dedicate a team meeting.

- Insufficient Matching Docs: Vague pledges—attach bank statements or valuations.

- Missed Deadlines: Late returns—calendar notifications from Grants.gov.

- Non-Compliance Oversights: Ignoring Buy American—audit purchases quarterly.

- Sub-Award Gaps: Forgetting to bind partners—include MOUs.

Engage a grants specialist; IRS’s VITA helpline (800-906-9887) offers free support.

Consequences of Non-Compliance with Form 13981

Breach risks severe actions under 2 CFR 200:

- Fund Suspension/Reduction: For under-matching or low performance (e.g., <90% e-filing).

- Termination and Clawback: Full repayment plus 25% penalty for misuse.

- Debarment: Barred from future federal grants; FAPIIS reporting for fraud.

- Audits: Single audits for >$750K awards; IRS spot-checks.

Reasonable cause (e.g., disasters) allows appeals—document proactively.

Frequently Asked Questions About IRS Form 13981

When do I receive Form 13981 for 2025?

Post-award, typically December 2025 via email to your AOR.

Can I revise terms after signing?

Yes—submit changes (e.g., budget) within 20 days via email.

What if my organization has sub-sites?

The primary agreement covers them; enforce via sub-agreements.

Is Form 13981 the same as Form 9661?

No—9661 is for TCE; 13981 is VITA-specific.

Where can I find a sample Form 13981?

In Exhibit 2 of Publication 4883 on IRS.gov.

Visit IRS.gov/vita-grant for more.

Final Thoughts: Seal Your 2025 VITA Success with Form 13981

IRS Form 13981 isn’t just paperwork—it’s the foundation for delivering equitable tax services, keeping refunds in communities that need them most. With 2025’s $53 million in awards and heightened focus on electronic filing, signing this agreement positions your organization for sustainable impact. Download the June 2025 version from IRS.gov today, review Pub. 5247 thoroughly, and connect with fellow recipients via the IRS partner network.

Empowering taxpayers starts with strong partnerships—make yours unbreakable.

This article is for informational purposes only and not legal or grant advice. Consult IRS.gov or a grants expert for your situation.