Table of Contents

IRS Form 6112 – Order for Prior Year Tax Products – Tax time can bring surprises, especially when you need forms or instructions from previous years for amendments, audits, or historical records. Whether you’re correcting a 2022 return or supporting a 2023 audit, IRS Form 6112—Order for Prior Year Tax Products—streamlines the process of requesting these essential documents by mail. In 2025, with the IRS prioritizing digital access via IRS.gov, Form 6112 remains a vital tool for those without reliable internet or preferring paper copies, ensuring compliance without delays. This SEO-optimized guide, based on the latest IRS resources (Rev. July 2025), covers everything from eligibility to processing times, helping you secure prior year forms like 1040 or Schedules A efficiently.

What Is IRS Form 6112?

IRS Form 6112 is a simple order form used to request free paper copies of tax forms, instructions, and publications from prior years (generally back to 2018) that are no longer available for direct download in certain formats. It’s designed for taxpayers, tax professionals, or businesses needing physical versions for filing, record-keeping, or reference. Unlike the online ordering system at IRS.gov/Ordering, Form 6112 allows bulk or specific requests mailed directly to you.

Key features:

- Free Shipping: No cost for up to 100 copies per product; excess may incur fees.

- Product Coverage: Includes forms like 1040, W-2 instructions, and Pub. 17 (Your Federal Income Tax).

- Limitations: Not for current year (2025) products or bulk employer forms (use Form 8508 for extensions).

The July 2025 revision (Catalog No. 37731M) updates mailing addresses and aligns with IRS’s push for e-delivery, per Publication 2053A. Download the PDF from IRS.gov/pub/irs-pdf/f6112.pdf for the most current version.

Who Needs IRS Form 6112 in 2025?

Anyone unable to access prior year products digitally—such as low-income filers, seniors, or those in remote areas—can use Form 6112. It’s ideal for amending returns (e.g., via Form 1040-X) or responding to IRS notices requiring specific year instructions.

| User Type | Common Scenarios |

|---|---|

| Individual Taxpayers | Amending 2023 taxes; needing Pub. 501 for 2021 dependency tests. |

| Tax Professionals | Bulk orders for client audits; historical Schedule C instructions. |

| Businesses | Prior year employer forms like 941 for 2022 payroll disputes. |

| Libraries/Nonprofits | Educational copies of Pub. 17 from 2019. |

No SSN/EIN required, but provide contact info for delivery. For 2025, requests for 2024 products (filed in 2025) are treated as “prior year” after April 15. Avoid if digital suffices—IRS.gov/prior-year-forms-and-instructions offers free PDFs back to 1864.

Filing Deadlines and Processing for Form 6112

There’s no strict deadline—submit anytime—but allow 7–15 business days for processing and U.S. mail delivery. For urgent needs (e.g., audit deadlines), order early or use online alternatives.

- Peak Season Delays: January–April requests may take 10–20 days due to volume; off-peak (May–December) averages 7 days.

- No Extensions Needed: Continuous availability, but stock for very old years (pre-2010) is limited.

- Where to Mail: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0015 (updated July 2025 for efficiency).

- Tracking: No official tracking; certified mail recommended for high-value requests.

For 2025, IRS encourages online orders at IRS.gov/forms-pubs/forms-and-publications-by-us-mail, which processes in 7–10 days without a form.

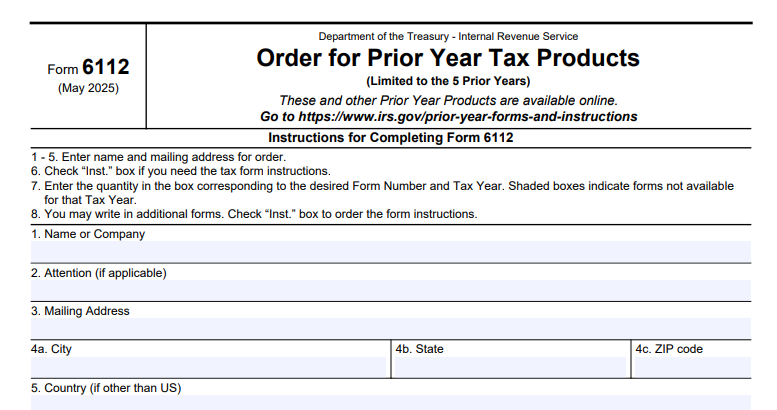

Step-by-Step Guide to Completing IRS Form 6112

Form 6112 is a two-page checklist—easy to fill by hand or PDF. Gather product numbers from IRS.gov/catalog (e.g., Form 1040 is 1040, Pub. 17 is 50117).

- Section A: Requester Info – Name, address, phone, email; optional organization if applicable.

- Section B: Product Requests – List up to 10 items: Enter product number (e.g., “1040”), tax year (e.g., “2023”), quantity (1–100 free).

- Section C: Shipping Instructions – Confirm address; note if APO/FPO for military.

- Section D: Certification – Sign and date, affirming legitimate use (no resale).

- Optional Notes: Add comments for special requests (e.g., large print via Pub. 2053A).

- Mail It: Use USPS First-Class; photocopy for records.

For bulk (over 100), expect a call for payment. Use the accessible PDF for screen readers.

Available Prior Year Tax Products on Form 6112

Request a wide range, but availability varies—check IRS.gov first for digital.

| Category | Examples (Tax Year) | Product Number |

|---|---|---|

| Individual Forms | Form 1040 (2023), Schedule A (2022) | 1040, Sch A |

| Instructions | Instructions for Form 1040 (2021), Pub. 17 (2020) | 1040-I, 50117 |

| Business Forms | Form 1120 (2019), Pub. 334 (Tax Guide for Small Business, 2018) | 1120, 50334 |

| Specialty | Form W-4 (2023), Pub. 501 (Dependents, 2022) | W4, 50501 |

Large print versions available for select items; Braille on request via (800) 829-4059. 2025 updates include more 2024 products post-filing season.

IRS Form 6112 Download and Printable

Download and Print: IRS Form 6112

Online Alternatives to IRS Form 6112 in 2025

While Form 6112 is mail-based, IRS promotes digital options for faster access:

- IRS.gov Ordering: Search and order up to 100 free copies per product at IRS.gov/forms-pubs/forms-and-publications-by-us-mail—ships in 7–10 days.

- Prior Year Archive: Free PDFs at IRS.gov/prior-year-forms-and-instructions; no shipping.

- Employer Returns: Order paper info returns (e.g., W-2) via IRS.gov/businesses/order-paper-information-returns-and-employer-returns—15-day delivery.

- Draft Forms: Preview 2025/2026 at IRS.gov/draft-tax-forms, but don’t file drafts.

For 2025, e-delivery via email is piloted for select users, reducing paper waste per IRS green initiatives.

Common Mistakes When Using Form 6112 and How to Avoid Them

Simple form, but errors delay shipments:

- Wrong Product Numbers: Using “1040” for instructions—verify at IRS.gov/catalog.

- Over-Ordering: Requesting >100 copies without prepayment—start small.

- Outdated Addresses: Using pre-2025 mailing—always check the form’s header.

- No Signature: Unsigned forms rejected—double-check Section D.

- Current Year Requests: Form 6112 is prior only—use online for 2025.

Pro tip: Order in batches; track via USPS Informed Delivery.

Processing Times and What to Expect After Submitting Form 6112

- Acknowledgment: None automatic; expect shipment notice if issues.

- Delivery: 7–15 days post-processing; international adds 4–6 weeks.

- If Lost: Reorder after 21 days; reference original date.

- Post-Release Changes: Some products updated mid-year (e.g., 2025 Form 8830 per Notice 2025-32)—request revised versions.

For 2025, IRS aims for 95% on-time delivery amid supply chain improvements.

Frequently Asked Questions About IRS Form 6112

Can I use Form 6112 for current 2025 tax products?

No—use IRS.gov for 2025 forms; 6112 is prior years only.

How far back can I request products?

Typically to 2018; older via IRS.gov/prior-year archive or (800) 829-3676.

Is there a fee for Form 6112 orders?

Free up to 100 copies; contact IRS for bulk pricing.

What if I need large print or Braille?

Specify on form; or call Accessibility Helpline at (800) 699-7813.

Can tax pros order for clients?

Yes—list firm address; no client SSNs needed.

Visit IRS.gov/forms-instructions for more.

Final Thoughts: Simplify Prior Year Access with IRS Form 6112 in 2025

IRS Form 6112 bridges the gap for paper-based tax needs, ensuring you have the right prior year products without hassle—even as IRS.gov expands digital options. With the July 2025 updates streamlining mailings, it’s easier than ever to support amendments or audits. Download the form from IRS.gov today, verify your product numbers, and mail it confidently to stay compliant.

Tax history shouldn’t be a hurdle—order smart and file right.

This article is for informational purposes only and not tax advice. Consult IRS.gov or a professional for your situation.