Table of Contents

IRS Form 1099-S – Proceeds from Real Estate Transactions – Real estate transactions—whether a home sale, land exchange, or commercial property transfer—often trigger federal reporting requirements to ensure accurate capital gains taxation. IRS Form 1099-S, Proceeds from Real Estate Transactions, is the essential information return that captures gross proceeds from these deals, helping the IRS verify seller income while allowing taxpayers to calculate exclusions like the $250,000/$500,000 primary residence gain exclusion. For 2025, with the form revised in April (Rev. 4-2025) and e-filing mandatory for 10+ returns, timely compliance avoids penalties up to $340 per form. This SEO-optimized guide, based on the latest IRS instructions, covers filing obligations, deadlines, and best practices for closing agents, attorneys, and sellers navigating 2025 transactions.

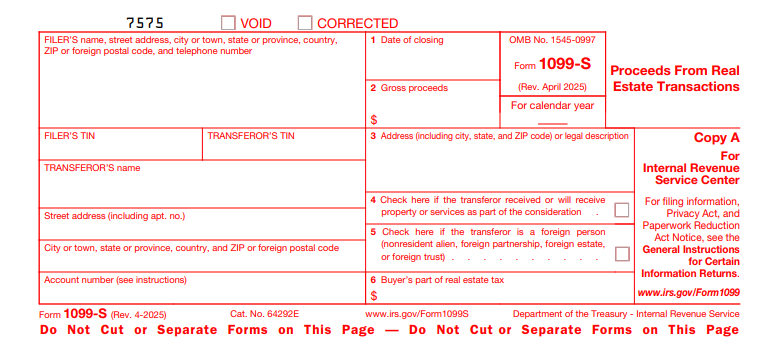

What Is IRS Form 1099-S?

IRS Form 1099-S reports the gross proceeds from the sale or exchange of real estate, including land, buildings, condominiums, stock in a real estate investment trust (REIT), or timber royalties under pay-as-cut contracts (per section 6050N). Issued by the person responsible for closing the transaction (e.g., attorney, title company, or escrow agent), it provides the IRS with key details like date of sale and proceeds amount, which sellers use to report capital gains on Schedule D (Form 1040).

Key features:

- Gross Proceeds Only: Reports total sales price (not net after expenses or basis)—sellers calculate gain/loss separately.

- No Threshold: File for all reportable transactions, even under $600; de minimis exceptions apply (e.g., < $600 with certainty).

- Fillable Copy B: For 2025, Copy B is online fillable at IRS.gov/Form1099S, easing digital furnishing to transferors.

The April 2025 revision (Cat. No. 64292E) is a continuous-use form, incorporating e-filing guidance from Pub. 1220. Download the PDF and instructions from IRS.gov/Form1099S.

Who Needs to File IRS Form 1099-S in 2025?

The closing agent or responsible party must file Form 1099-S for each real estate sale or exchange where title passes, unless exempt. Sellers receive Copy B to report on their tax return; no filing if the transaction is non-reportable.

| Filing Requirement | Details for 2025 |

|---|---|

| Reportable Transactions | Sales/exchanges of land/buildings; REIT stock; timber royalties; condemnations. |

| Responsible Filer | Attorney, title/escrow company, or mortgage lender handling closing. |

| Multiple Transferors | One form per transferor; allocate proceeds if undivided interests. |

| Exemptions | Personal property (e.g., furniture); cemetery plots; security interests; de minimis (<$600); foreign sellers (use Form W-8BEN). |

For partnerships/LLCs, file one form if treated as a single entity. Use TINs from Form W-9; foreign transferors may need ITINs.

Filing Deadlines and Extensions for Form 1099-S

Deadlines for 2025 transactions (reported in 2026) emphasize recipient furnishing first. E-filing extends IRS submission.

| Deadline | Date for 2025 Transactions | Notes |

|---|---|---|

| Furnish to Transferor (Copy B) | February 18, 2026 | Mail/email; use fillable PDF for ease. |

| File with IRS (Copy A) | March 2, 2026 (paper) or March 31, 2026 (e-file) | Include Form 1096; e-file if 10+ returns. |

| Extensions | Automatic 30 days via Form 8809 (by original due) | IRS filing only; no extension for recipients. Hardship adds another 30 days. |

- E-Filing: Required for 10+ info returns (aggregated); use FIRE/IRIS system.

- Where to File: Paper to IRS per Pub. 1220 (state-based); e-file via approved providers.

- State Requirements: Many states (e.g., CA, TX) require copies; check local rules.

File corrections promptly to minimize penalties.

Step-by-Step Guide to Completing IRS Form 1099-S

Gather closing statements, TINs, and property details. Use the April 2025 fillable form for accuracy.

- Filer Section: Enter closing agent’s name, EIN, address; account number if applicable.

- Transferor Info (Boxes 1–3): Name, address, TIN (truncate on Copy B); check “2nd TIN not” if notified of errors.

- Date of Closing (Box 4): Sale/exchange date (MM-DD-YYYY).

- Gross Proceeds (Box 5): Total sales price (money + FMV of property/services); exclude buyer financing.

- Box 6: Address or Legal Description: Property location or description.

- Box 7: Property or Service Description: E.g., “Single-family residence” or “Timber royalties.”

- Box 8: Buyer’s Part of Real Estate Tax – If buyer pays seller’s share.

- Box 9: Buyer’s Federal Tax ID Number – If Box 8 > $0.

- Box 10: Net/Basis Reported to IRS – Check if basis reported (rare).

- Sign & Distribute: Officer signs Copy A; furnish Copy B by February 18.

For multiple transferors, allocate proceeds proportionally. E-file includes Form 1096.

Key Boxes on IRS Form 1099-S Explained

Form 1099-S’s boxes focus on transaction essentials—sellers use them for Schedule D reporting.

| Box | Description | 2025 Tip |

|---|---|---|

| 2 | Transferor TIN | Validate via W-9 to avoid $340 penalties. |

| 4 | Date of sale | Critical for gain exclusion timing (e.g., 2-of-5-year rule). |

| 5 | Gross proceeds | Includes all payments; subtract selling expenses for net gain. |

| 6 | Property address | Use legal description if no address (e.g., vacant land). |

| 7 | Description | Specify type (e.g., “Co-op shares” for REITs). |

No Box 10 check unless basis reported—most are unchecked.

E-Filing vs. Paper: Options for Form 1099-S in 2025

E-filing is required for 10+ returns and recommended for error reduction; paper for fewer.

- E-Filing Pros: Deadline March 31; instant acknowledgment; bulk upload via IRIS.

- Paper Pros: For <10 forms; mail with Form 1096 by March 2.

- Threshold: Aggregates all info returns (e.g., 1099-MISC + 1099-S).

Providers like TaxBandits handle TIN matching and state filings.

Common Mistakes When Filing Form 1099-S and How to Avoid Them

Errors delay closings and invite audits—top 2025 pitfalls:

- Missing TINs: No W-9 collected—request pre-closing.

- Incorrect Proceeds: Including/excluding financing—use HUD-1/closing disclosure.

- Wrong Date: Using contract vs. closing date—verify title transfer.

- No Recipient Copy: Forgetting February 18 furnish—use certified mail/e-delivery.

- Exempt Transaction Oversight: Reporting de minimis sales—confirm < $600 certainty.

Pre-validate data; software flags issues.

Penalties for Late or Incorrect Form 1099-S Filings

The IRS enforces via tiered penalties under sections 6721/6722, adjusted for 2025:

| Violation | Penalty per Form | Max (Small Business, <$5M Gross Receipts) |

|---|---|---|

| Within 30 Days Late | $60 | $239,000/year |

| 31 Days–Aug 1 Late | $130 | $683,000/year |

| After Aug 1/No File | $340 | $1,366,000/year |

| Intentional Disregard | $680 or 10% of proceeds | No max |

Interest accrues; reasonable cause (e.g., disaster) waives. First-time abatement possible.

IRS Form 1099-S Download and Printable

Download and Print: IRS Form 1099-S

Frequently Asked Questions About IRS Form 1099-S

Do I file Form 1099-S for transactions under $600?

No, if de minimis and certain—otherwise, yes for all reportable sales.

What’s the 2025 furnish deadline for recipients?

February 18, 2026—earlier than prior years for some 1099s.

Is e-filing required if I file only 5 Form 1099-S?

No—but if total info returns ≥10, yes.

How do sellers use Form 1099-S on taxes?

Report proceeds on Schedule D; exclude up to $250K/$500K for primary homes (Pub. 523).

What if the transaction involves multiple sellers?

Allocate proceeds; file separate forms per transferor.

Visit IRS.gov/Form1099S for more.

Final Thoughts: Stay Compliant with IRS Form 1099-S Filings in 2025

IRS Form 1099-S streamlines real estate tax reporting, ensuring proceeds are tracked while empowering sellers with exclusion opportunities. With the April 2025 revision’s fillable Copy B and February 18 recipient deadline, closing agents can furnish efficiently—e-file for 10+ to hit March 31 IRS deadline and dodge $340 penalties. Download the form from IRS.gov today, collect W-9s pre-closing, and partner with tax software for seamless compliance.

Real estate moves markets—accurate reporting moves your filings forward.

This article is informational only—not tax advice. Consult IRS.gov or a professional.