Table of Contents

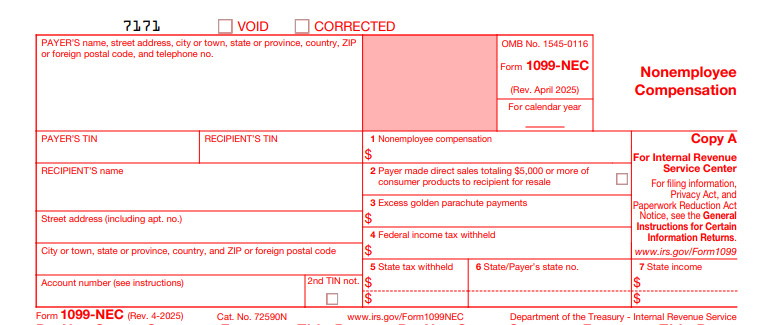

IRS Form 1099-NEC – Nonemployee Compensation – In today’s gig economy, businesses increasingly rely on independent contractors, freelancers, and consultants for flexibility and expertise. But with great power comes great responsibility—accurately reporting payments to these nonemployees is crucial to avoid IRS scrutiny and penalties. IRS Form 1099-NEC, Nonemployee Compensation, is the go-to form for documenting these transactions, ensuring compliance while helping recipients claim business deductions. For tax year 2025, the reporting threshold remains $600, but the “One Big Beautiful Bill Act” (signed July 4, 2025) introduces a significant change: starting in 2026, it rises to $2,000 (indexed for inflation thereafter), offering relief for smaller payments. With the April 2025 form revision now designating Box 3 for excess golden parachute payments, this SEO-optimized guide—drawn from official IRS resources—covers filing essentials, deadlines, and pitfalls to keep your 2025 reporting seamless.

What Is IRS Form 1099-NEC?

IRS Form 1099-NEC is an information return used by businesses to report payments of $600 or more to nonemployees, such as independent contractors, attorneys, or freelancers, for services performed in the course of trade or business. Revived in 2020 after Box 7 of Form 1099-MISC caused confusion, it streamlines reporting under IRC Section 6041(d). Recipients use it to report income on Schedule C (Form 1040) and claim expenses, while the IRS matches it against tax returns to prevent underreporting.

Key features:

- Threshold: $600+ in a calendar year; no de minimis for backup withholding.

- Box Updates: Box 3 now reports excess golden parachute payments (up from Form 1099-MISC Box 13); Box 4 for federal withholding.

- Continuous-Use Form: The April 2025 revision (Cat. No. 72590N) is fillable online for Copies B/1/2, per Pub. 1220.

Download the 2025 form and instructions from IRS.gov/Form1099NEC for the latest PDF.

Who Needs to File IRS Form 1099-NEC in 2025?

Businesses, nonprofits, and government entities must file Form 1099-NEC for each nonemployee receiving $600+ in compensation. No filing for payments to corporations (except attorneys) or under the threshold. Use it for services like consulting, legal fees, or graphic design—not goods or employee wages (use W-2).

| Filer Type | Filing Trigger | Notes |

|---|---|---|

| Businesses/Nonprofits | $600+ to individuals, partnerships, LLCs for services | Includes attorney fees (even to corps); exclude C corps except lawyers. |

| Attorneys | Payments to other attorneys for services | Report regardless of amount if in business. |

| Recipients | N/A—receive Copy B | Report on Schedule C; self-employment tax (15.3%) applies. |

| Exemptions | Payments to corporations (non-attorneys), tax-exempt orgs, or < $600 | Foreign payees with W-8BEN exempt if no U.S. source. |

Validate TINs via W-9; use IRS TIN Matching for pre-filing checks.

Filing Deadlines and Extensions for Form 1099-NEC in 2025

The 1099-NEC deadline is among the earliest: January 31 for both recipients and IRS, reflecting its focus on timely income reporting. For 2025 payments (filed in 2026), the due date falls on Saturday, January 31, 2026—postponed to Tuesday, February 3, 2026.

| Deadline | Date | Method |

|---|---|---|

| Furnish to Recipient (Copy B) | February 3, 2026 | Mail/email; online fillable PDF available. |

| File with IRS (Copy A) | February 28, 2026 (paper) or March 31, 2026 (e-file) | Include Form 1096; e-file if ≥10 returns. |

| Extensions | Automatic 30 days via Form 8809 (by January 31) | IRS filing only; no extension for recipients. Hardship adds 30 more days. |

- E-Filing: Required for 10+ info returns (aggregated with other 1099s); use IRIS/FIRE system.

- Where to File: Paper to IRS per Pub. 1220 (state-based); e-file via providers like TaxBandits.

- State Requirements: 40+ states mandate copies; e-file combined federal/state where possible.

File corrections ASAP—penalties escalate daily.

Step-by-Step Guide to Completing IRS Form 1099-NEC

Gather W-9s, payment records, and withholding details. Use the April 2025 fillable PDF; no red ink needed for Copies B/2.

- Payer Section: Business name, EIN, address; account number if tracking multiples.

- Recipient (Boxes 1–2): Name, address, TIN (truncate on Copy B); check “2nd TIN not” if notified of errors.

- Box 4: Federal Income Tax Withheld: Backup withholding (24% if TIN invalid).

- Box 1: Nonemployee Compensation: Total $600+ for services; include fees, commissions, prizes.

- Box 3: Excess Golden Parachute Payments: New for 2025—report amounts subject to 20% excise tax.

- Box 5: State Tax Withheld: If applicable; Box 6: State/Payer’s State No.; Box 7: State Income.

- Sign & Distribute: Officer signs Copy A; furnish Copy B by February 3.

For attorneys, report in Box 1 regardless of amount. E-file includes Form 1096 transmittal.

Understanding Key Boxes on IRS Form 1099-NEC

The form’s five boxes (plus state fields) focus on compensation—recipients use Box 1 for Schedule C income.

| Box | Description | 2025 Tip |

|---|---|---|

| 1 | Nonemployee compensation | $600+ services; report prizes/awards here if business-related. |

| 3 | Excess golden parachute payments | Subject to 20% excise; report if over reasonable comp in control changes. |

| 4 | Federal withholding | 24% backup; creditable on recipient’s Form 1040. |

| 5–7 | State details | Withheld state tax and ID; varies by state. |

No Box 2 (previously for direct sales)—reserved.

E-Filing vs. Paper: Best Practices for Form 1099-NEC in 2025

E-filing is mandatory for 10+ returns and slashes errors; paper for fewer.

- E-Filing Pros: March 31 deadline; instant IRS acknowledgment; TIN matching built-in.

- Paper Pros: For <10 forms; mail by February 28 with Form 1096.

- Threshold: Counts all info returns; vendors like BoomTax handle bulk/state filings.

E-file reduces penalties by 90%; low volume? Use online fillable Copies B.

Common Mistakes When Filing Form 1099-NEC and How to Avoid Them

Gig economy growth amplifies errors—top 2025 issues:

- Threshold Confusion: Filing under $600—confirm $600+ per recipient/year.

- TIN Mismatches: Invalid SSNs/ITINs—collect W-9s upfront; use IRS matching.

- Employee vs. Contractor: Issuing 1099 to W-2 workers—review worker classification (Pub. 15-A).

- Late Recipient Copies: Missing February 3—automate via e-delivery.

- Box 3 Oversight: Forgetting golden parachutes—check executive terminations.

Quarterly audits; software flags issues.

Penalties for Late or Incorrect Form 1099-NEC Filings

The IRS tiers penalties under §6721/6722, inflation-adjusted for 2025:

| Violation | Penalty per Form | Max (Small Business, <$5M Receipts) |

|---|---|---|

| Within 30 Days Late | $60 | $239,000/year |

| 31+ Days to Aug 1 | $130 | $683,000/year |

| After Aug 1/No File | $340 | $1,366,000/year |

| Intentional Disregard | $680 or 10% of amount | No max |

Interest (0.5%/month) accrues; reasonable cause waives. First-time abatement available via Form 843.

IRS Form 1099-NEC Download and Printable

Download and Print: IRS Form 1099-NEC

Frequently Asked Questions About IRS Form 1099-NEC

What’s the 2025 filing threshold?

$600+ for nonemployee services; rises to $2,000 in 2026 per the One Big Beautiful Bill Act.

Is the deadline January 31 or February 2 for 2025?

February 3, 2026 (adjusted from Saturday, January 31); both furnish and file by then for paper.

Do I file for corporate contractors?

No, except attorneys; use W-9 to confirm entity type.

What’s new in the 2025 Form 1099-NEC?

Box 3 for excess golden parachute payments; continuous-use with online fillables.

How do recipients report 1099-NEC income?

On Schedule C (Form 1040); subject to self-employment tax—deduct half on line 15.

Visit IRS.gov/Form1099NEC for more.

Final Thoughts: Master IRS Form 1099-NEC Compliance for 2025

IRS Form 1099-NEC is the backbone of fair reporting in the freelance era, ensuring businesses track payments while empowering contractors to deduct expenses amid the $600 threshold (soon $2,000). With the April 2025 revision’s Box 3 update and February 3 deadline, e-file early to evade $340 penalties and streamline state filings. Download from IRS.gov today, collect W-9s proactively, and leverage tools like TIN matching for accuracy.

Gig work fuels innovation—precise 1099s fuel compliance.

This article is informational only—not tax advice. Consult IRS.gov or a professional.