Table of Contents

IRS Form 8653 – Tax Counseling for the Elderly Program Application Plan – As America’s aging population grows—projected to reach 80 million seniors by 2040—access to free, specialized tax help becomes more critical than ever. The IRS Tax Counseling for the Elderly (TCE) program, established in 1978, empowers nonprofits and community organizations to provide tailored assistance on pensions, retirement issues, and basic returns for those 60 and older. At the heart of applying for TCE grant funding is IRS Form 8653—the Tax Counseling for the Elderly Program Application Plan. For the 2025 grant cycle, with applications accepted from May 1 to May 31 via Grants.gov and $53 million awarded to 41 TCE recipients from 445 applicants, Form 8653 outlines your proposed budget, volunteer projections, and program operations. This SEO-optimized guide, based on the latest IRS resources (Rev. 4-2016, with 2025 guidelines in Pub. 1101), demystifies Form 8653 to help eligible organizations secure funding for year-round tax education and preparation.

What Is IRS Form 8653?

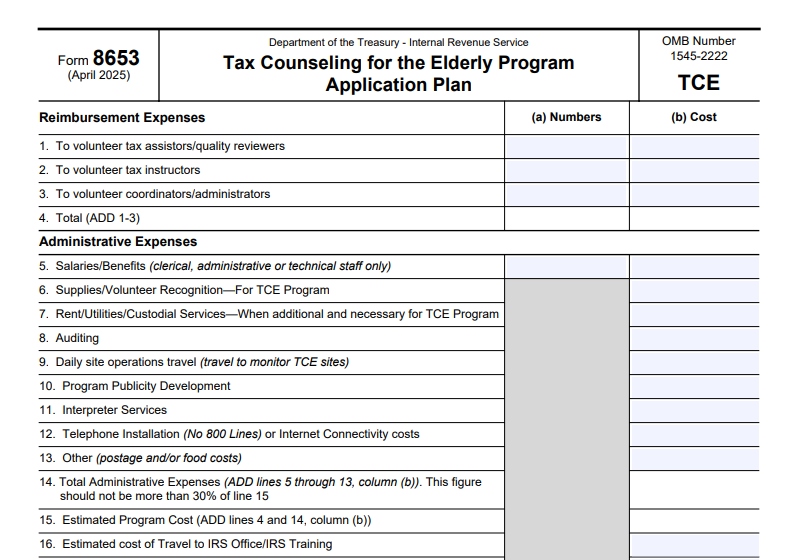

IRS Form 8653 is the core budget and planning document for organizations applying to the TCE grant program under Assistance Listing 21.006. It details estimated expenses, volunteer staffing, site projections, and expected taxpayer outreach, ensuring alignment with IRS priorities like electronic filing (90%+ target) and accuracy. As part of the full application package, it supports up to three-year multi-year awards, with funding covering training, publicity, and operations—no indirect costs allowed.

Key elements:

- Budget Breakdown: Lines 1–25 categorize costs like salaries, supplies, and outreach.

- Program Projections: Estimates returns prepared (lines 19–20) and sites operated (line 21).

- Volunteer Focus: Tracks tax assistors, instructors, and coordinators (lines 1–3).

The form (Rev. 4-2016) remains current, but 2025 applications incorporate updated guidelines from Pub. 1101 (Rev. 2025), emphasizing digital tools and underserved areas. Download Form 8653 and the full package from IRS.gov or Grants.gov (CFDA 21.006).

Who Needs IRS Form 8653 in 2025?

Form 8653 is required for all new and renewing applicants to the TCE grant, including nonprofits, faith-based groups, and educational institutions committed to free tax help for seniors. Eligibility demands IRS certification, a track record of compliance, and focus on taxpayers 60+ with incomes under $64,000 AGI (aligned with VITA thresholds). Multi-year recipients (years 2–3) submit abbreviated versions.

| Applicant Type | Requirements |

|---|---|

| New Applicants | Full Form 8653 + narrative; demonstrate community need and volunteer capacity via Pub. 1101. |

| Renewing Grantees | Abbreviated if eligible (notification by April 2025); include prior-year Form 8654 (Semi-Annual/Annual Report). |

| Multi-Site Sponsors | One form covering all sites; detail per-site projections. |

| Matching Funds | 100% match required (cash/in-kind); document in Form 8653 lines 26–30. |

Organizations like AARP Tax-Aide dominate TCE sites, but diverse partners qualify if prioritizing seniors. Register in SAM.gov and Grants.gov by April 2025.

Application Deadlines and Submission Process for Form 8653 in 2025

The 2025 cycle opened May 1, closing May 31 via Grants.gov—awards announced December 2025 for January 1–December 31 operations. Multi-year continuations notified late April.

- Initial Submission: Attach Form 8653 to full package (Form 14204 checklist, Form 14335 contacts, narrative).

- Post-Award Revisions: Updated Form 8653 within 20 days of notice via email to [email protected].

- Reporting: Use Form 8654 semi-annually/annually by July 31, 2026.

- Where to Submit: Exclusively through Grants.gov; no paper.

Late applications disqualify—mark calendars for 2026 cycle (May 1–31).

Step-by-Step Guide to Completing IRS Form 8653

Form 8653 is a multi-page worksheet—use the TCE Grant Workbook for calculations. Gather prior budgets, volunteer rosters, and expense estimates.

- Header: Organization name, EIN, contact; grant period (e.g., 1/1/2025–12/31/2025).

- Lines 1–3: Volunteers – Estimate tax assistors/reviewers (1a), instructors (1b), coordinators (2); total hours (3).

- Lines 4–18: Training/Outreach – Project sessions (4), materials (5–10), publicity (11–14), site costs (15–18).

- Lines 19–21: Taxpayer Projections – Returns for 60+ (19a), others (19b), total (19c); sites/e-file (21a–c).

- Lines 22–25: Expenses – Salaries (22), supplies (23), travel (24), other (25); total program cost (26).

- Lines 27–30: Matching Funds – Federal request (27), cash match (28), in-kind (29), total match (30)—must ≥ federal.

- Signature: Responsible officer signs; attach narrative and Form 14204 checklist.

For multi-year, focus on updates; Pub. 1101 provides line-by-line guidance.

Allowable Expenses and Matching Funds on Form 8653

TCE grants fund direct program costs per OMB 2 CFR 200—no overhead or unallowable items like entertainment.

| Line Category | Examples | Match Rules |

|---|---|---|

| Volunteers (1–3) | Training for 100 assistors at $200/session | In-kind (donated time at $15/hr). |

| Outreach (11–14) | Flyers, ads targeting seniors | Cash preferred; document pledges. |

| Expenses (22–25) | Salaries ($50K coordinator), supplies ($10K software) | 100% match; ≤$500/volunteer stipends. |

| Projections (19–21) | 5,000 returns, 50 sites (40 e-file) | Tie to community need data. |

Matching: Verifiable cash/in-kind (e.g., space at FMV); shortfalls reduce awards.

IRS Form 8653 Download and Printable

Download and Print: IRS Form 8653

Recent Updates to IRS Form 8653 for 2025

The 2016 revision endures, but 2025 guidelines in Pub. 1101 (Rev. 2025) reflect post-pandemic shifts:

- E-File Emphasis: 90%+ electronic returns; new metrics for digital outreach.

- Multi-Year Streamlining: Abbreviated apps for continuations; $53M pool from $82.9M requests.

- Equity Focus: Prioritizes rural/underserved seniors; integrated VITA/TCE FAQs.

- Workbook Enhancements: Auto-calcs for budgets; aligns with Pub. 4883 resource guide.

These support 2.7M+ returns filed in 2025.

Common Mistakes When Completing Form 8653 and How to Avoid Them

Grant denials often trace to Form 8653 errors—sidestep these:

- Under-Matching: Vague in-kind values—appraise at FMV with docs.

- Overstated Projections: Inflating returns without data—base on prior Form 8654.

- Non-Allowable Costs: Including indirects—stick to Pub. 1101 lists.

- Incomplete Attachments: Missing Form 14204—use checklist early.

- Math Discrepancies: Totals mismatch—leverage workbook Excel.

Attend IRS webinars; CPA review recommended.

Penalties for Non-Compliance with TCE Grant Rules

Mismanagement risks under 2 CFR 200:

- Underperformance: Award reduction (e.g., <90% e-file = 10% cut).

- Misuse: Repayment + 25% penalty; audit for >$750K.

- Late Reports: Cycle suspension; debarment for fraud.

- Appeals: Reasonable cause (e.g., disasters) via grant officer.

Document rigorously; single audits required for large awards.

Frequently Asked Questions About IRS Form 8653

Is Form 8653 required for all TCE applicants?

Yes—for new/renewing; abbreviated for multi-year continuations.

What’s the 2025 TCE application window?

May 1–31 via Grants.gov (CFDA 21.006).

Can in-kind donations count as matching funds?

Yes—e.g., volunteer hours at minimum wage; verify per Pub. 1101.

What’s the max TCE grant for 2025?

Varies; total $53M awarded to 41 recipients.

Where do I find the TCE Grant Workbook?

IRS.gov under “VITA/TCE Grants” resources.

Visit IRS.gov/tce for more.

Final Thoughts: Unlock TCE Funding with Form 8653 in 2025

IRS Form 8653 is your gateway to empowering seniors with free tax expertise, securing a slice of the $53M TCE pool to file 2.7M+ returns. With May 1–31 deadlines and multi-year options, craft a robust plan emphasizing e-filing and outreach—download from IRS.gov today and align with Pub. 1101 for success. Partnering with TCE isn’t just funding; it’s financial security for America’s elders.

This article is informational only—not grant advice. Consult IRS.gov or a specialist.