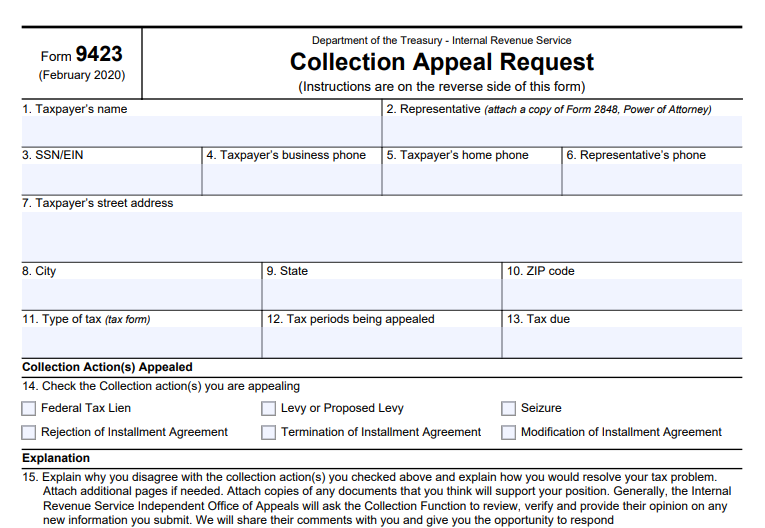

IRS Form 9423 – Collection Appeal Request – In the complex world of tax collections, knowing your rights can make all the difference. If you’re facing IRS actions like liens, levies, or issues with installment agreements, IRS Form 9423—also known as the Collection Appeal Request—provides a crucial pathway to challenge those decisions. This form is part of the Collection Appeals Program (CAP), designed to give taxpayers a fair opportunity to dispute collection efforts without immediately escalating to court. In this comprehensive guide, we’ll break down everything you need to know about Form 9423, including its purpose, filing process, and tips for success, drawing from official IRS resources to ensure accuracy and reliability.

What Is IRS Form 9423?

IRS Form 9423 is a official document used by taxpayers or third parties to request an appeal of specific IRS collection actions under the Collection Appeals Program (CAP). Its primary purpose is to allow you to disagree with and seek review of actions that could impact your finances, such as the seizure of property or the denial of payment plans. Unlike more formal appeals, CAP focuses on quick resolutions for targeted collection issues.

The form itself is straightforward, revised as of February 2020, and includes sections for taxpayer information (name, SSN/EIN, address, phone), representative details (if using an attorney or CPA, with Form 2848 required), tax type and periods, the specific collection actions being appealed, and a detailed explanation of your disagreement. You’ll need to sign and date it, and there’s space for IRS internal use, like revenue officer and manager signatures.

Key appealable actions include:

- Filing or proposed filing of a Notice of Federal Tax Lien (NFTL).

- Levy or proposed levy on your assets.

- Seizure of property.

- Rejection, modification, or termination of an installment agreement.

- Denial of requests for lien certificates (e.g., subordination, withdrawal, or discharge).

- Disallowance of requests to return levied or seized property under IRC sections 6343(b) or 6343(d).

- Third-party claims, such as alter-ego or nominee liens.

This form ensures that collection actions are paused in most cases until the appeal is resolved, providing temporary relief while your case is reviewed.

When Should You Use Form 9423?

Form 9423 is ideal for situations where you believe an IRS collection action is unfair, premature, or erroneous. For instance, if the IRS has filed a lien against your property or rejected your installment agreement proposal, this is your tool to push back. It’s particularly useful for quick disputes, as CAP decisions are typically fast and handled by the IRS Independent Office of Appeals.

However, note that CAP differs from Collection Due Process (CDP) hearings, which use Form 12153 and allow broader discussions like offers in compromise or alternative payment options. CAP strictly reviews whether the specific collection action was appropriate and does not offer those alternatives. If you’re eligible for CDP (e.g., within 30 days of a lien or levy notice), consider that route for more comprehensive relief.

Eligibility extends to taxpayers, their representatives, or third parties affected by collection actions, making it accessible for a wide range of scenarios.

Step-by-Step: How to File IRS Form 9423

Filing Form 9423 is a structured process to ensure your appeal is heard promptly. Here’s how to do it:

- Discuss with IRS First: Before filing, request a conference with the Collection employee’s manager. Contact the number on your IRS notice or the revenue officer involved. This step is required unless your appeal involves a rejected, modified, or terminated installment agreement.

- Complete the Form: Download the form from the IRS website. Fill in your personal details, specify the tax type (e.g., Form 1040), periods, and check the boxes for the actions you’re appealing. In Section 15, provide a clear explanation of why you disagree and suggest a resolution—attach supporting documents like financial statements or proof of hardship.

- Sign and Submit: Sign as the taxpayer or authorized representative. Submit the form to the Collection office that issued the action (e.g., the revenue officer). Do not send it directly to Appeals.

- Include Representation if Needed: If using a professional, attach Form 2848 (Power of Attorney and Declaration of Representative).

The IRS will forward your case to Appeals if the managerial conference doesn’t resolve it. Remember, providing false information can void the appeal.

IRS Form 9423 Download and Printable

Download and Print: IRS Form 9423

Deadlines and Timelines for Filing Form 9423

Timing is critical to halt collection actions:

- For liens, levies, or seizures: Submit within 3 business days of your manager conference (or 4 if postmarked).

- For seizures specifically: Appeal within 10 business days of the Notice of Seizure.

- For installment agreements: File within 30 calendar days of the IRS decision.

In general, appeals must be filed within 30 days of the collection action or notice. Missing these deadlines could allow the IRS to proceed with enforcement.

What Happens After You File Form 9423?

Once submitted, the Collection office reviews and forwards your case to the Office of Appeals. They’ll hold a conference (often by phone) to review your arguments. Decisions are final and binding, with no option for court review under CAP. Collection actions typically stop until resolution, unless the IRS determines the collection is at risk.

If your appeal is denied, explore other options like CDP or contacting the Taxpayer Advocate Service (TAS) at 877-777-4778 for assistance with economic hardship.

Tips for a Successful Collection Appeal Request

- Be Proactive: Respond to IRS notices immediately to avoid escalation.

- Gather Evidence: Support your explanation with documents showing financial hardship or errors in IRS actions.

- Consider Professional Help: Use a tax professional or Low Income Taxpayer Clinic if eligible.

- Update Your Info: Keep your address current with the IRS to receive timely notices.

- Explore Alternatives: If unable to pay, look into installment agreements or offers in compromise outside of CAP.

- Avoid Common Pitfalls: Don’t ignore deadlines, and verify if CDP might better suit your needs for broader relief.

Related IRS Resources and Publications

For deeper insights:

- Publication 1: Your Rights as a Taxpayer.

- Publication 594: The IRS Collection Process.

- Publication 1660: Collection Appeal Rights.

These publications provide detailed explanations of your rights and the overall collection process.

Navigating IRS collections can be daunting, but Form 9423 empowers you to advocate for fair treatment. By understanding and utilizing this tool effectively, you can potentially resolve disputes quickly and avoid severe financial impacts. If you’re dealing with a collection issue, consult the official IRS website or a tax advisor to get started today.