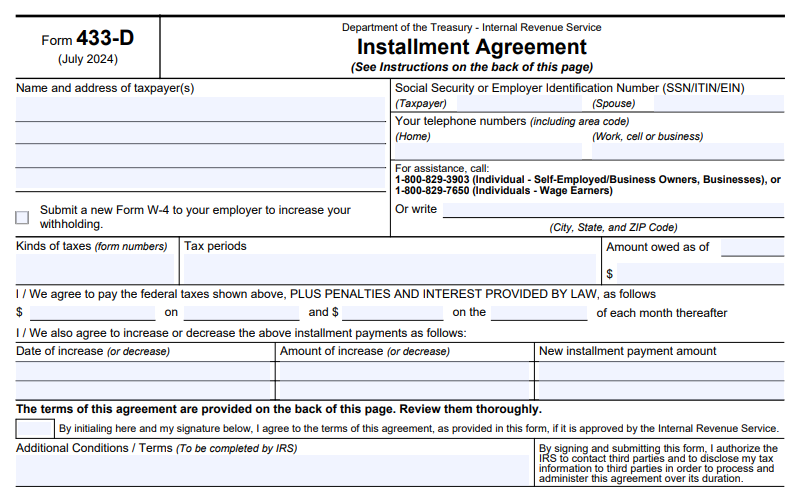

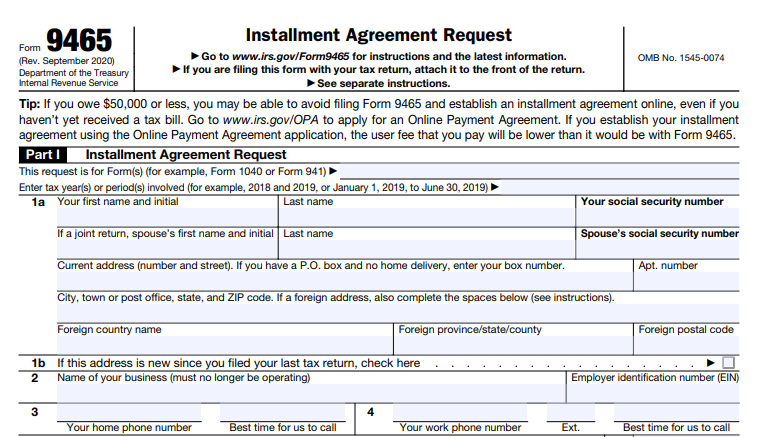

IRS Form 9465 – Installment Agreement Request – Struggling to pay your federal taxes in full? IRS Form 9465, the Installment Agreement Request, allows eligible taxpayers to set up a monthly payment plan. This option helps avoid aggressive collection actions while paying off your balance over time. As of 2025, the IRS encourages online applications for faster approval and lower fees, but Form 9465 remains essential for certain situations.

This comprehensive guide covers everything you need to know about IRS Form 9465, including eligibility, application steps, fees, and alternatives, based on the latest IRS guidelines.

What Is IRS Form 9465?

IRS Form 9465 is the official Installment Agreement Request form used to ask the IRS for a monthly payment plan when you cannot pay your full tax liability at once. It applies to amounts owed on your tax return or from an IRS notice.

The form is ideal for:

- Individuals owing income taxes (Form 1040 or 1040-SR)

- Those responsible for trust fund recovery penalties

- Former sole proprietors with employment tax debts from closed businesses

Most requests qualify for streamlined processing, meaning no detailed financial statements are required if you meet specific criteria.

Note: If you can pay your balance within 180 days, consider a short-term payment plan instead—no setup fee applies.

When Should You Use Form 9465 vs. the Online Application?

The IRS strongly recommends applying online through the Online Payment Agreement (OPA) tool for eligible taxpayers. Benefits include:

- Immediate approval notification

- Lower setup fees

- Easy revisions to your plan

Use the online tool if:

- You’re an individual owing $50,000 or less (tax, penalties, and interest combined)

- You’ve filed all required returns

- You qualify for a short-term plan (less than $100,000 owed)

Use Form 9465 when:

- Your balance exceeds online limits

- The online tool rejects your proposed payment (it will direct you to Form 9465)

- You need a partial payment plan or have complex circumstances

- You’re applying by mail or phone

Businesses owing more than $25,000 generally cannot use the online tool and may need to call or mail Form 9465.

Eligibility for IRS Installment Agreements in 2025

To qualify for an installment agreement:

- All required tax returns must be filed

- You must propose payments that clear the debt within the collection statute expiration date (usually 10 years) or 72 months, whichever is shorter

Streamlined Installment Agreement Criteria (no financial info required):

- Individuals: $50,000 or less owed

- Certain cases up to $50,000 with direct debit or payroll deduction

Guaranteed Installment Agreement: Available if you owe $10,000 or less, have a strong compliance history, and can pay within 3 years.

For higher balances or financial hardship, you may need to submit Form 433-F (Collection Information Statement).

How to Apply Using IRS Form 9465

- Download the Form: Get the latest Form 9465 from IRS.gov.

- Complete Key Lines:

- Personal/business information and SSN/EIN

- Total amount owed

- Proposed monthly payment (as much as you can afford)

- Preferred payment date (1st–28th)

- Payment method (direct debit recommended for lower fees)

- Attach Supporting Documents: Form 433-F if required, or Form 2159 for payroll deduction.

- Submit:

- With your tax return: Attach to the front

- Separately: Mail to the address listed on IRS.gov based on your location

- By phone: Call 800-829-1040 (individuals)

The IRS typically responds within 30 days. Interest and penalties continue to accrue until the balance is paid in full.

Current IRS Installment Agreement Fees (Updated 2025)

Setup fees vary by application method and payment type (effective as of April 2025 updates):

| Application Method | Direct Debit | Manual Payment (Check/Card) | Low-Income Waiver/Reimbursement |

|---|---|---|---|

| Online | $22 | $69 | Waived (direct debit) or $43 reimbursable |

| Phone/Mail/In-Person | $107 | $178 | Reduced rates available |

- Short-term plans (180 days or less): $0 fee

- Revision/reinstatement: $10 online (often reimbursable for low-income)

- Low-income taxpayers (AGI ≤ 250% of federal poverty guidelines) qualify for waivers or reimbursements

Direct debit often qualifies for the lowest fees and is recommended to avoid default.

What Happens After Approval?

- You’ll receive a confirmation letter with terms

- Make timely monthly payments

- File future returns and pay taxes on time

- Refunds may be applied to your balance

If you default (miss payments or fail to file/pay future taxes), the IRS may terminate the agreement and resume collections, including levies or liens.

IRS Form 9465 Download and Printable

Download and Print: IRS Form 9465

Alternatives to Form 9465

- Online Payment Agreement: Faster and cheaper for most

- Offer in Compromise: Settle for less if you qualify

- Currently Not Collectible Status: Temporary hardship delay

- Bank Loan or Credit: Often lower interest than IRS penalties

Always pay as much as possible upfront to reduce interest.

Frequently Asked Questions About IRS Form 9465

Can I apply if I haven’t received a bill yet?

Yes, attach Form 9465 to your return.

Does the agreement stop penalties and interest?

No— they continue until paid in full.

Can I request lien withdrawal?

Yes, under certain conditions after setup.

What if I’m rejected?

You can appeal or explore other options.

Final Thoughts

IRS Form 9465 provides a reliable way to manage tax debt through affordable monthly payments. For the best experience in 2025, start with the online application if eligible. Always consult a tax professional for personalized advice, as this information is general and based on IRS guidelines from irs.gov.

Sources: IRS.gov pages on Form 9465, Instructions for Form 9465 (Rev. July 2024), Payment Plans (updated May 2025), and Online Payment Agreement Application (updated October 2025).