IRS Form 1099-C – Cancellation of Debt – In today’s economy, debt relief can feel like a lifeline—whether it’s forgiving a mortgage shortfall after foreclosure or settling credit card balances through negotiation. But there’s a catch: the IRS often views canceled debt as taxable income. Enter IRS Form 1099-C, Cancellation of Debt, a document that reports these events and could significantly impact your tax bill. If you’re dealing with debt forgiveness in 2025, knowing how this form works is crucial to avoid surprises come tax time.

This comprehensive guide breaks down everything you need to know about Form 1099-C, from issuance triggers to reporting requirements and key exclusions. We’ll draw on official IRS guidance to ensure you’re armed with accurate, up-to-date information for the 2025 tax year.

What Is IRS Form 1099-C?

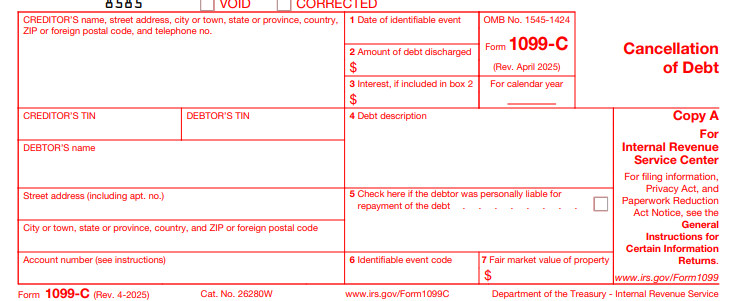

IRS Form 1099-C is an information return used by creditors to report the cancellation, forgiveness, or discharge of a debt of $600 or more. It’s not a bill or a penalty—it’s simply a notification to both you (the debtor) and the IRS that a portion of your debt has been erased.

Key Details on the Form

- Box 1: The amount of canceled debt.

- Box 2: The date of identifiable event (e.g., when the cancellation occurred).

- Box 3: Interest included in the canceled amount.

- Box 4: Description of the debt (e.g., nonrecourse vs. recourse).

Creditors, such as banks or financial institutions, must file this form if an “identifiable event” happens, like a foreclosure or the expiration of the statute of limitations on collection. For 2025, the threshold remains $600, with no changes to filing requirements.

When Is Form 1099-C Issued?

Lenders aren’t required to send a 1099-C for every small write-off. It’s triggered only when:

- The canceled debt totals $600 or more.

- You’re dealing with an “applicable financial entity” (e.g., banks, credit unions).

- An identifiable event occurs, such as:

- Bankruptcy filing.

- Foreclosure or repossession.

- Cancellation due to insolvency.

- Expiration of the collection statute (typically 3-6 years).

Expect to receive your form by January 31 of the year following the cancellation—for instance, debt forgiven in 2025 means a form by January 31, 2026. If you don’t get one but suspect debt was canceled, contact your creditor; the IRS still expects you to report it.

Tax Implications of Cancellation of Debt in 2025

Here’s the big one: The IRS treats most canceled debt as ordinary income, just like wages or interest. Why? Because forgiveness means you received economic benefit without paying for it.

How It Affects Your Taxes

- Taxable Amount: Add the canceled debt to your gross income, potentially pushing you into a higher bracket.

- Example: If $10,000 of credit card debt is forgiven in 2025, you could owe taxes on that full amount at your marginal rate (e.g., 22% federal = $2,200 owed, plus state taxes).

- Secured vs. Unsecured Debt:

- Unsecured (e.g., credit cards): Straight income.

- Secured (e.g., mortgage): Treated as a sale of the property. For recourse loans, calculate gain/loss based on fair market value (FMV); for nonrecourse, the full debt is the amount realized.

In 2025, with inflation-adjusted brackets, this could sting more for middle-income filers. Always consult a tax pro for personalized math.

IRS Form 1099-C Download and Printable

Download and Print: IRS Form 1099-C

Exceptions and Exclusions: When Canceled Debt Isn’t Taxable

Not all forgiveness triggers a tax hit. The IRS offers several exclusions for Form 1099-C in 2025, but you must qualify and often file Form 982 to claim them.

| Exclusion Type | Details | Eligibility Window (2025) |

|---|---|---|

| Bankruptcy (Title 11) | Debt discharged in bankruptcy isn’t income. | Any time; no expiration. |

| Insolvency | Exclude up to the amount you’re insolvent (liabilities > assets). Use IRS worksheet in Pub. 4681. | Applies if calculated at cancellation date. |

| Qualified Principal Residence | Mortgage forgiveness on your main home. | Discharged before Jan. 1, 2026, or under agreement before then. |

| Student Loans | Forgiveness for public service, teaching, or certain programs. | Discharges from Jan. 1, 2021, to Dec. 31, 2025, are tax-free federally. |

| Farm/Real Property Business Debt | Qualified farm or business real estate loans. | Ongoing exclusion. |

| Gifts/Inheritances | Debt canceled as a gift. | No tax if truly a gift. |

Pro Tip: Exclusions may require reducing your basis in assets or other tax attributes—track this carefully to avoid future audits.

How to Report Form 1099-C on Your 2025 Tax Return

Even if you qualify for an exclusion, report the income and subtract it via Form 982.

Step-by-Step Reporting

- Gather Forms: Use your 1099-C and any supporting docs (e.g., insolvency worksheet).

- Nonbusiness Debt: Report on Schedule 1 (Form 1040), line 8c as “other income.” Attach Form 982 for exclusions.

- Business Debt: Use Schedule C or F.

- If Incorrect: Dispute with the creditor before filing; the IRS won’t accept “they were wrong” without evidence.

- E-Filing: Tools like TurboTax handle 1099-C imports seamlessly.

File by April 15, 2026 (or October extension). Missing it? Penalties start at $50 per form, plus interest.

Common Scenarios Involving Form 1099-C

- Home Foreclosure: If your lender forgives the shortfall, expect a 1099-C. But the principal residence exclusion could save you through 2025.

- Debt Settlement: Negotiating a lump-sum payoff often triggers this—factor taxes into your settlement math.

- Student Loan Forgiveness: Biden-era programs remain tax-free for 2025 discharges.

FAQs About IRS Form 1099-C and Cancellation of Debt

Do I have to pay taxes on all canceled debt in 2025?

No—check exclusions like insolvency or student loans. But report everything anyway.

What if I never receive a 1099-C?

You’re still responsible for reporting; contact your lender.

Can I deduct canceled debt taxes?

No, but exclusions prevent inclusion in income.

Is there a 2025 update to Form 1099-C rules?

No major changes; student and mortgage relief windows close soon (end of 2025/2026).

Final Thoughts: Navigate Cancellation of Debt Wisely in 2025

Receiving an IRS Form 1099-C doesn’t have to derail your finances—it’s a signal to review your tax strategy. With exclusions available for student loans and home debt through 2025, many can offset the income hit. Stay proactive: Track your debts, consult a CPA, and download Pub. 4681 from IRS.gov for worksheets.

Debt relief is progress, but taxes are part of the equation. For personalized advice, visit IRS.gov or a trusted tax advisor. Have questions? Drop them in the comments below!

Last updated: December 2025. Always verify with official IRS sources for your situation.