IRS Form 2848 – Power of Attorney and Declaration of Representative – In the complex world of U.S. taxes, navigating IRS interactions can feel overwhelming. Whether you’re facing an audit, need help with a tax return, or simply want professional assistance, IRS Form 2848—the Power of Attorney and Declaration of Representative—is your key to authorizing a trusted expert to act on your behalf. This form empowers eligible professionals like CPAs, attorneys, or enrolled agents to represent you, access your confidential tax info, and handle IRS communications without you lifting a finger.

As of 2025, Form 2848 remains unchanged from its 2021 revision, with no major updates reported by the IRS. In this comprehensive guide, we’ll break down everything you need to know about IRS power of attorney, including its purpose, eligibility, step-by-step filing instructions, common pitfalls, and FAQs. If you’re searching for “how to fill out IRS Form 2848” or “what is a power of attorney for taxes,” you’ve landed in the right place.

What Is IRS Form 2848 and Why Do You Need It?

IRS Form 2848 is an official document that grants a qualified individual the authority to represent you before the Internal Revenue Service (IRS). This power of attorney for IRS matters allows your representative to:

- Receive and inspect your confidential tax records.

- Perform actions you could do yourself, such as signing agreements, consents, or waivers related to specified tax issues.

- Communicate directly with the IRS on your behalf.

Unlike Form 8821 (which only allows inspection of records without representation powers), Form 2848 gives full advocacy rights. It’s essential for scenarios like:

- Tax audits or examinations.

- Appeals, collections, or penalty disputes.

- Preparing and filing returns (with limitations).

- Handling Foreign Bank and Financial Accounts (FBAR) exams tied to income taxes.

Without it, you must handle everything personally, which can be time-consuming and stressful. Pro tip: It’s free to file and can be submitted online via the IRS e-Services for faster processing.

Who Can Use IRS Form 2848? Eligibility for Taxpayers and Representatives

Taxpayer Eligibility

Anyone dealing with IRS matters can use Form 2848, including:

- Individuals (use your SSN or ITIN).

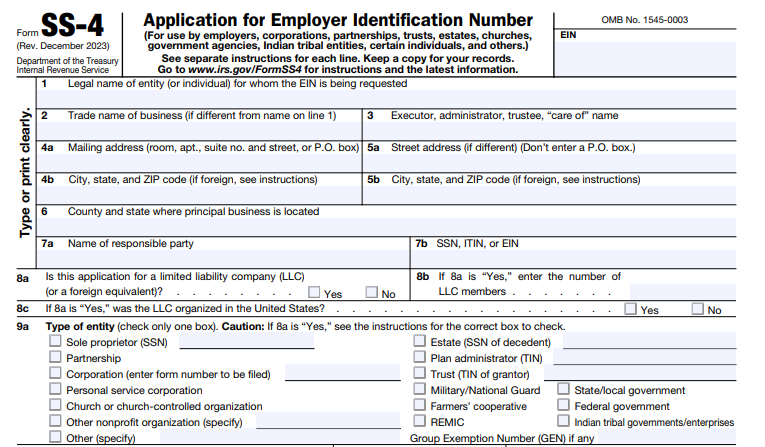

- Businesses (corporations, partnerships, S corps—use EIN).

- Estates, trusts, or exempt organizations.

- Joint filers (each spouse needs a separate form, even if authorizing the same representative).

Special cases include:

- BBA Partnerships: Authorize the Partnership Representative (PR) for Centralized Partnership Audit Regime matters.

- Deceased Taxpayers: Executors or administrators sign on behalf of the estate.

- Minors: Parents or guardians sign.

Who Can Be Your Representative?

Your rep must be “eligible to practice before the IRS” under Treasury Department Circular 230. Options include:

- Attorneys (a): Licensed in any state or U.S. territory.

- Certified Public Accountants (CPAs) (b): Active license holders.

- Enrolled Agents (EAs) (c): IRS-enrolled professionals.

- Unenrolled Return Preparers (h): Limited to exams on returns they prepared (requires PTIN and Annual Filing Season Program completion).

- Family Members (f): Immediate relatives like spouses or children (limited powers).

- Students/Law Graduates (k): In Low Income Taxpayer Clinics (LITCs) or Student Tax Clinic Programs (STCPs), with special authorization.

You can authorize up to four representatives, but only two can receive IRS notices per matter. For more, attach additional Forms 2848.

Important Limitation: Representatives cannot endorse government checks, disclose your info to third parties (unless specified), or sign returns except in rare cases like illness or absence from the U.S.

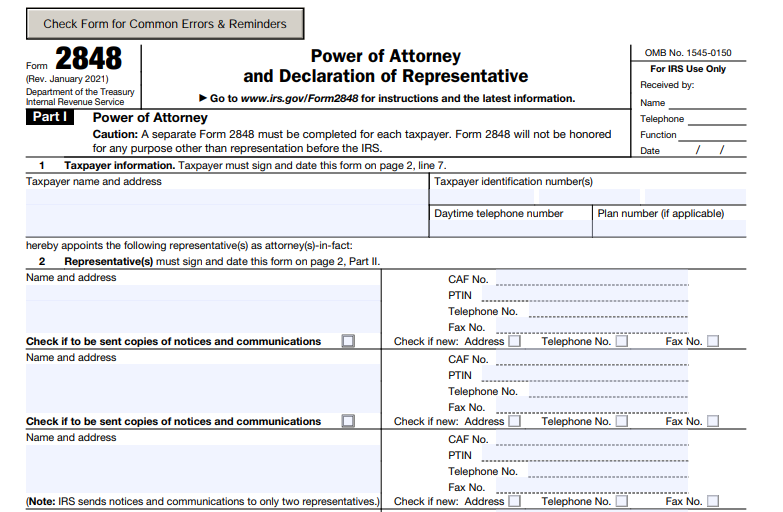

Step-by-Step Guide: How to Fill Out IRS Form 2848 in 2025

Filling out Form 2848 is straightforward but requires precision to avoid rejection. Download the latest PDF from IRS.gov (Rev. January 2021, still current in 2025). Use black ink for paper forms or e-sign for online submission. Here’s a line-by-line breakdown:

Part I: Power of Attorney

This section identifies you, your rep(s), and the scope of authority.

- Line 1: Taxpayer Information

Enter your full name, address, TIN (SSN/ITIN/EIN), phone number, and plan number (if applicable, e.g., for employee plans). For entities, include titles like “Trustee” or “Executor.” Do not list spouses or unrelated parties here—use separate forms. - Line 2: Representative(s)

List up to four reps with name, address, phone/fax, CAF number (if known), and PTIN. Check boxes for address updates or to receive notices (limit two). For LITCs, list the lead attorney first. - Line 3: Acts Authorized

Describe the tax matter (e.g., “Income Tax Audit”), form number (e.g., “1040”), and years/periods (e.g., “2023-2025”). Be specific—no vague terms like “all taxes.” For future years, limit to three ahead. Examples:- Civil penalties: “Civil Penalty, Not Applicable, 2024.”

- Innocent spouse relief: “Innocent Spouse Relief, 8857, 2022.”

- Line 4: Specific Use Not Recorded on CAF

Check if this is for one-time matters like EIN applications or FOIA requests. These aren’t stored in the IRS’s Centralized Authorization File (CAF). - Line 5a: Additional Acts Authorized

Check boxes for extras like substituting reps, third-party disclosures, or accessing records via Intermediate Service Providers. For signing returns, explain the reason (e.g., “Taxpayer abroad”). - Line 5b: Specific Acts Not Authorized

List restrictions, e.g., “No authority to negotiate checks.” - Line 6: Retention/Revocation of Prior Powers

By default, this revokes old authorizations for the same matters. Check to retain priors and attach copies. - Line 7: Taxpayer Declaration and Signature

Sign and date (e-sign okay online). Include title for entities. Joint filers: Separate signatures.

Part II: Declaration of Representative

Each rep must complete this under penalty of perjury:

- Select designation (a-r).

- Enter licensing jurisdiction (e.g., state) and number (e.g., bar or enrollment ID).

- Sign and date in the order listed on Line 2.

Pro Tip: For multiple reps, number them sequentially across attached sheets.

IRS Form 2848 Download and printable

Download and Print: IRS Form 2848

How to Submit IRS Form 2848 and Track It

- Online: Use IRS e-Services (for tax pros) or mail/fax.

- Mail/Fax: Send to the IRS office based on your location (e.g., Ogden, UT for Western states; fax numbers: 855-214-7522). See the “Where To File” chart in the instructions.

- Processing time: 4-6 weeks for CAF entry. Track via your rep’s CAF number.

To revoke: Write “REVOKE” across the top, sign/date, and resubmit. Reps can withdraw similarly.

Common Mistakes to Avoid When Filing Form 2848

- Vague Descriptions: Always specify forms and years—general terms get rejected.

- Missing Signatures: Both taxpayer and reps must sign, or it’s invalid.

- Over-Authorizing: Don’t grant unnecessary powers; it could lead to unintended disclosures.

- Joint Return Pitfall: Spouses need separate forms, even for the same rep.

- Outdated Info: Use the current form; electronic signatures are now standard.

FAQs: IRS Form 2848 Power of Attorney Explained

How long is Form 2848 valid?

It lasts until revoked, the rep withdraws, or the tax periods expire. No expiration date needed.

Can I use a state power of attorney instead?

No—a durable POA isn’t sufficient for IRS matters; Form 2848 is required.

What’s the difference between Form 2848 and Form 56?

Form 56 notifies the IRS of fiduciaries (e.g., bankruptcy trustees); it’s not for representation.

Can unenrolled preparers use it fully?

Limited to exam representation on returns they prepared—no appeals or settlements.

Is there a 2025 update to Form 2848?

No changes; the 2021 version applies.

Final Thoughts: Empower Your Tax Strategy with IRS Form 2848

Mastering IRS Form 2848 is a smart move for anyone serious about tax compliance and peace of mind. By authorizing a pro, you streamline IRS dealings and avoid costly errors. Download the form today from IRS.gov, fill it out meticulously, and submit—your representative will thank you.

For personalized advice, consult a tax professional. Stay updated via IRS.gov/Form2848. Questions? Drop them in the comments below!

This article is for informational purposes only and not tax advice. Always verify with official IRS sources.