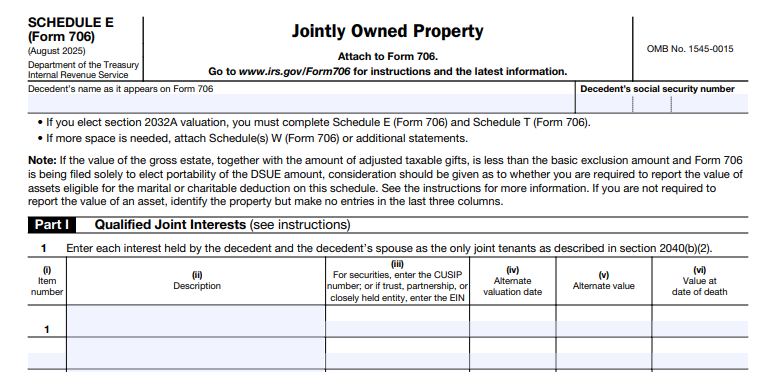

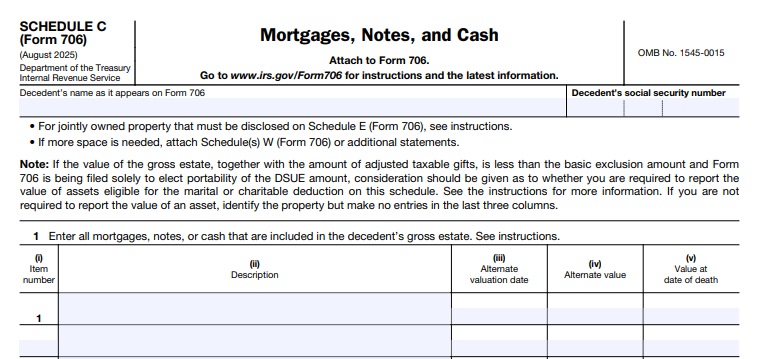

IRS Form 706 (Schedule C) – Mortgages, Notes, and Cash – Filing an estate tax return can be a complex process, especially when dealing with diverse assets like debts owed to the decedent or liquid holdings. If you’re an executor or administrator handling a deceased loved one’s estate, IRS Form 706 Schedule C plays a crucial role in reporting mortgages, notes, and cash included in the gross estate. This schedule ensures accurate valuation for federal estate tax purposes, helping avoid penalties and maximize deductions.

In this comprehensive guide, we’ll break down everything you need to know about Schedule C of Form 706, from filing requirements to valuation methods, using the latest 2025 IRS instructions. Whether you’re new to estate planning or refreshing your knowledge, this article covers key details to streamline your tax filing.

What Is IRS Form 706 Schedule C?

IRS Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return, required for estates exceeding the federal exemption threshold (adjusted annually for inflation). Schedule C – Mortgages, Notes, and Cash specifically lists certain liquid and debt-based assets that form part of the decedent’s gross estate.

According to the IRS, you must complete and attach Schedule C to Form 706 if the gross estate includes any mortgages, notes, or cash. This includes receivables like mortgages payable to the decedent, promissory notes, and even uncollected rents tied to real property. Importantly, these assets are reported at their full fair market value (FMV) without reductions for exemptions like homestead or dower rights.

Unlike other schedules, Schedule C focuses on assets the estate is owed, not debts the estate owes (those go on Schedule K for deductions). For 2025, the form revision date is August 2025, with instructions updated in September 2025—no major structural changes from prior years, but inflation adjustments apply to related sections like deferred interest under § 6166.

Who Needs to File Schedule C?

Not every estate requires Form 706, let alone Schedule C. Here’s a quick overview:

| Scenario | Filing Requirement |

|---|---|

| Gross Estate Value | Over $13.61 million (2025 exemption amount, subject to final IRS confirmation). Portability elections may apply for spouses. |

| Assets Included | Any mortgages receivable, promissory notes, land sale contracts, cash on hand, or bank deposits. |

| Exceptions | Skip if no such assets; report life insurance on Schedule D or joint property on Schedule E instead. |

| Special Rule | For estates qualifying under Reg. § 20.2010-2(a)(7)(ii) (e.g., marital/charitable deductions with gross estate under exclusion), estimate values and report totals on Form 706 Part V only—omit detailed Schedule C entries. |

Executors must file Form 706 within nine months of death (extensions available via Form 4768). Retain supporting documents like bank statements for IRS audits.

Key Assets Reported on Schedule C: Mortgages, Notes, and Cash

Schedule C organizes assets into five main categories. List them in this order on the form, providing detailed descriptions in Columns A–E. Use attachments if space is limited.

1. Mortgages

Report mortgages receivable by the decedent (i.e., loans secured by real property where the estate is the lender). Include:

- Face value and unpaid balance.

- Date of the mortgage.

- Maker’s (borrower’s) name and address.

- Description of mortgaged property.

- Maturity date and interest rate.

- Interest payment schedule.

Example: A $50,000 bond and mortgage with an unpaid balance of $17,000, dated January 1, 1992, from J. Doe to R. Roe on premises at 22 Clinton Street, Newark, NJ, due January 1, 2025, with 10% annual interest payable January 1 and July 1.

Do not reduce for unpaid interest—report it separately if accrued.

2. Promissory Notes

Similar to mortgages, list unsecured or secured notes owed to the decedent. Detail face value, unpaid balance, date, payor’s info, maturity, and interest terms. Valuation is typically the outstanding principal plus accrued interest as of the date of death.

3. Contracts by Decedent to Sell Land

For installment sale contracts where the decedent was the seller:

- Purchaser’s name and address.

- Contract date and property description.

- Total sale price, initial payment, and installment schedule.

- Unpaid principal balance and interest rate.

Report the full contract value; deduct any estate liabilities on Schedule K.

4. Cash in Possession of Decedent

Simple yet often overlooked: List currency, checks, or money orders held by the decedent at death. Separate from bank deposits—value at face amount. If foreign currency, convert to USD using the exchange rate on the date of death.

5. Cash in Financial Organizations

Detail all bank accounts, savings, CDs, or similar holdings:

- Institution name and address.

- Amount on deposit.

- Account number and type (e.g., checking, money market).

- Accrued but unpaid interest from last payment to death date.

Pro Tip: Attach copies of statements; the IRS may request them. For uncollected rents (e.g., $8,100 quarterly on a $550,000 property), report as separate cash items.

Valuation Methods for Schedule C Assets

All Schedule C items must be valued at fair market value (FMV) on the date of death—the price a willing buyer and seller would agree upon. For cash, this is straightforward (face value). For mortgages and notes, calculate unpaid principal plus accrued interest, discounted if necessary for collectibility risks (attach appraisals).

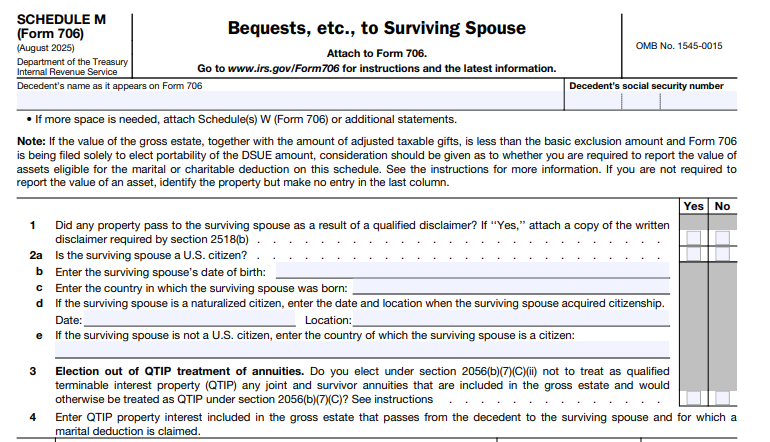

Alternate Valuation Election

Elect under § 2032 to value assets six months post-death (if sold/disposed within that window). Check Part III, line 1 of Form 706. This can lower taxes but applies estate-wide—consult a tax professional.

Special Considerations for 2025

- Interest Rates: Use Rev. Rul. 2025-16 for § 6166 deferral calculations (e.g., 2% rate on first $1,900,000 of adjusted taxable estate).

- Estimates for Portability: If eligible, use “due diligence” estimates for qualifying assets; map to Part V Table (items 10/23).

- No log scales or complex formulas needed—stick to IRS FMV guidelines.

-

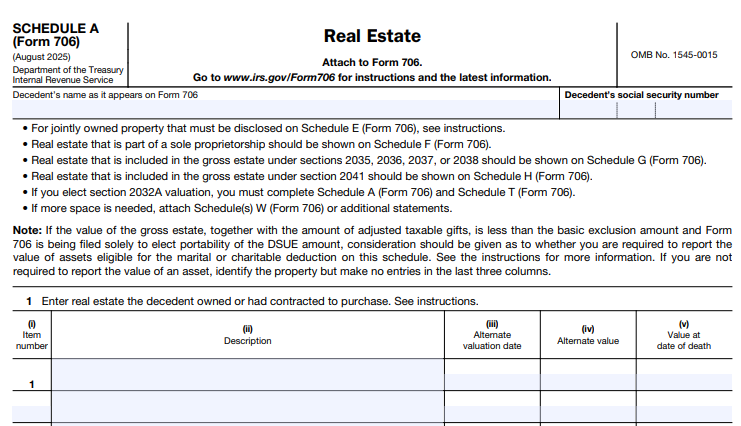

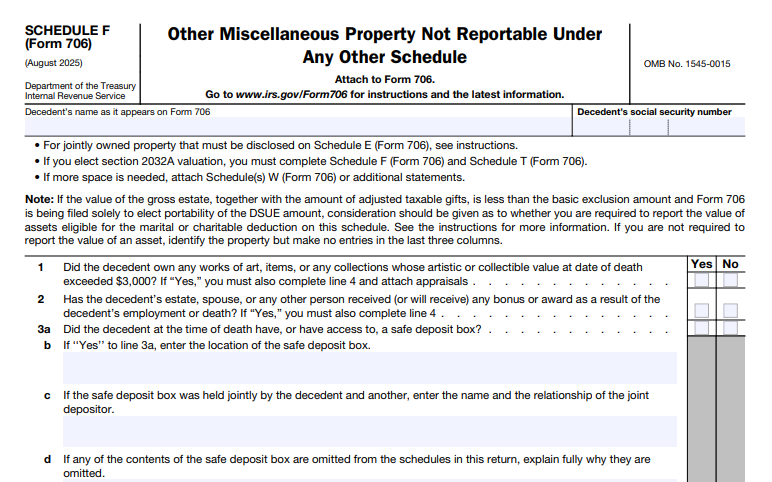

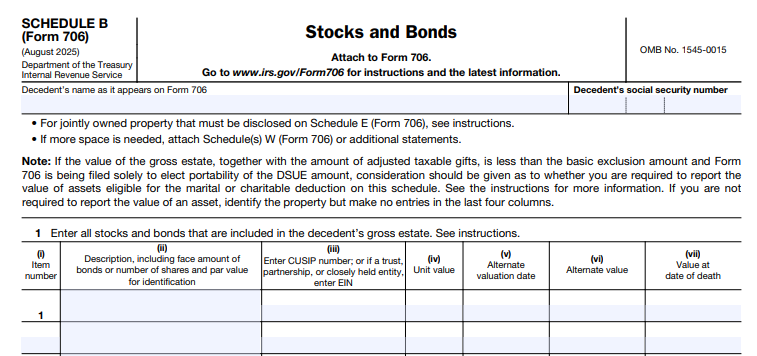

IRS Form 706 (Schedule C) Download and Printable

Download and Print: IRS Form 706 (Schedule C)

Step-by-Step Guide: How to Complete Schedule C for Form 706

- Gather Documents: Collect mortgage papers, note agreements, bank statements, and rent ledgers.

- List Assets: Enter in order on lines 1–5; use Columns A (description), B (alternate value date), C (date of death value), D (alternate value), E (total).

- Calculate Totals: Sum Column C for Part 5, line 6 of Form 706.

- Cross-Reference: Link to Schedule A for related real property; deduct liens on Schedule K.

- Attach and File: Submit with Form 706 electronically or by mail to the IRS Ogden, UT service center.

Common Mistakes to Avoid:

- Reporting payable debts here (use Schedule K).

- Omitting accrued interest.

- Forgetting foreign cash conversions.

Why Accurate Schedule C Reporting Matters in 2025

With the federal estate tax exemption potentially sunsetting post-2025 (under TCJA provisions), precise reporting on Form 706 Schedule C could save thousands in taxes or audits. Overvaluing cash/notes inflates the gross estate; undervaluing invites penalties up to 40%.

For complex estates, consider professional help from CPAs or estate attorneys specializing in IRS compliance.

Frequently Asked Questions (FAQs) About IRS Form 706 Schedule C

What if the estate has no mortgages or notes—do I still file Schedule C?

No, only if cash or these assets exist. Even small bank balances trigger it.

How does Schedule C interact with other Form 706 schedules?

It feeds into the gross estate total (Part 5); liens reduce taxable value via Schedule K.

Are there 2025 updates to Schedule C valuation?

No major changes, but check IRS Pub. 559 for estate tax overviews.

Where can I download the 2025 Form 706 Schedule C?

From IRS.gov—search for “Form 706 Schedule C August 2025.”

For personalized advice, consult a tax advisor. This guide is for informational purposes only and based on IRS resources as of December 2025. Stay compliant and honor your loved one’s legacy.