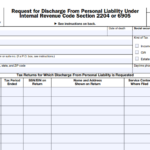

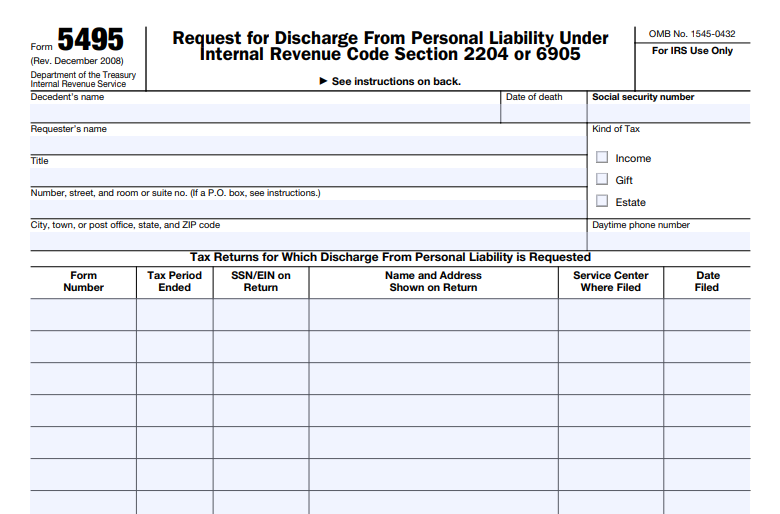

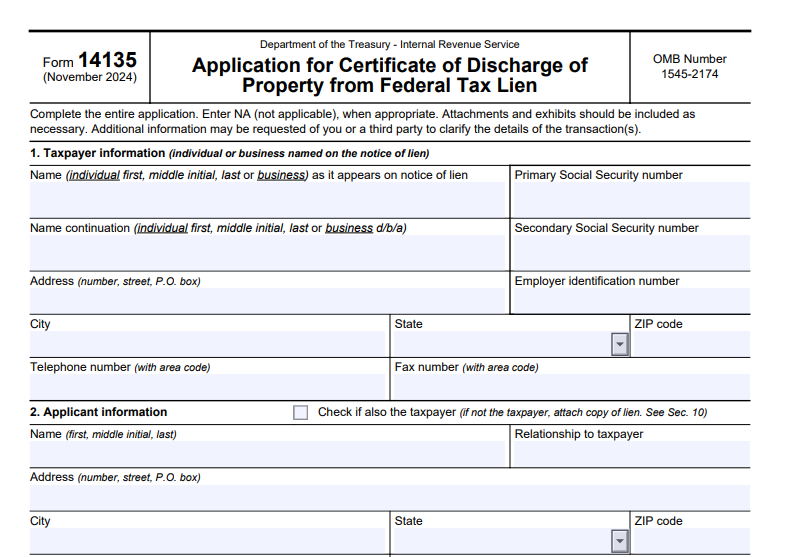

IRS Form 14135 – Application for Certificate of Discharge of Property from Federal Tax Lien – If you’re dealing with a federal tax lien on your property and need to sell, refinance, or transfer it, IRS Form 14135 could be the key to removing that burden. This form, officially known as the Application for Certificate of Discharge of Property from Federal Tax Lien, allows eligible taxpayers or property owners to request the IRS to discharge a specific property from the lien under certain conditions. In this comprehensive guide, we’ll cover everything you need to know about Form 14135, including its purpose, eligibility, step-by-step filing instructions, and tips to avoid common pitfalls. Whether you’re a homeowner facing a tax debt or a third-party owner affected by someone else’s lien, understanding this process can help you navigate IRS requirements efficiently.

What Is a Federal Tax Lien?

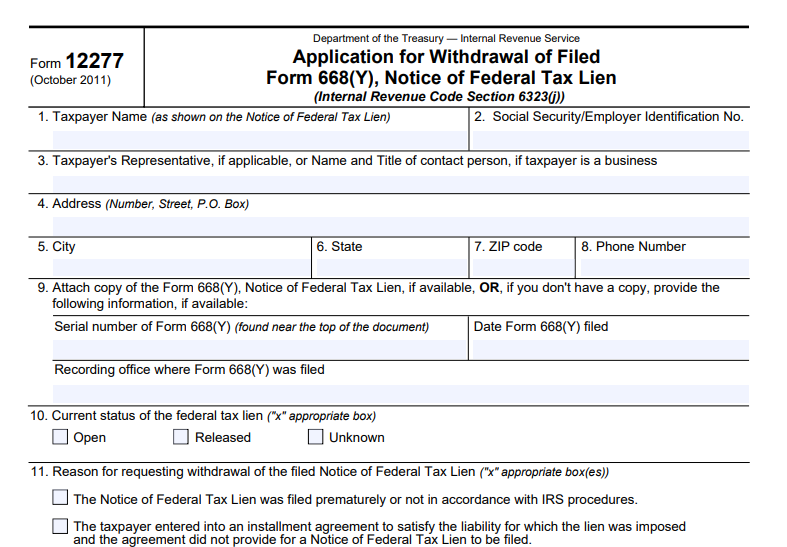

A federal tax lien is a legal claim by the IRS against your property when you owe unpaid taxes. It’s filed publicly as a Notice of Federal Tax Lien (NFTL), alerting creditors and potential buyers to the government’s interest in your assets, including real estate, vehicles, and business equipment. This lien attaches to all your current and future property until the debt is paid in full or otherwise resolved. It can complicate property sales or loans because it prioritizes the IRS’s claim over other creditors in many cases.

What Is a Certificate of Discharge?

A Certificate of Discharge removes the federal tax lien from a specific piece of property, allowing you to sell or transfer it without the lien’s encumbrance. It’s not a full release of the lien—it only applies to the designated property, and the overall tax debt remains. The IRS issues this certificate under Internal Revenue Code (IRC) Section 6325(b) if you meet specific criteria, such as paying the government’s interest in the property or proving the lien has no value. Note that this differs from a lien release (which happens after full payment) or subordination (which allows another creditor priority).

Who Needs to File IRS Form 14135?

You should file Form 14135 if:

- You’re the taxpayer named on the NFTL and want to discharge a property to facilitate a sale or refinance.

- You’re a third-party owner (not liable for the tax) whose property is affected by the lien, such as in cases of tenancy by the entirety.

- You’re selling property at a public auction or through escrow where proceeds can satisfy the IRS’s interest.

- The remaining property subject to the lien is worth at least twice the tax liability plus senior encumbrances.

Third parties, like buyers or lenders, may also be involved in the application process. If you’re dealing with an estate tax lien under Section 6325(c), use Form 4422 instead.

Eligibility Criteria for Discharge

The IRS grants discharges based on these IRC provisions:

- IRC 6325(b)(1): The value of your other property remaining under the lien is at least double the tax liability plus any senior encumbrances (e.g., mortgages).

- IRC 6325(b)(2)(A): The IRS receives payment equal to its interest in the property, often from sale proceeds after senior claims.

- IRC 6325(b)(2)(B): The government’s interest in the property is worthless (e.g., senior debts exceed the property’s value).

- IRC 6325(b)(3): Sale proceeds are held in escrow and distributed according to priorities, with the IRS getting its share.

- IRC 6325(b)(4): A third-party owner deposits or bonds an amount equal to the IRS’s interest and may challenge the determination in court.

For principal residences, you might qualify for relocation expense allowances if unable to pay the full amount. Eligibility requires proving the basis through appraisals, valuations, and documentation.

How to Complete IRS Form 14135 Step by Step

Form 14135 (revised November 2024) has 17 sections. Enter “NA” for not applicable items and attach supporting documents. Here’s a breakdown:

- Section 1: Taxpayer Information – Provide name, address, last four digits of SSN/EIN, and contact details as they appear on the NFTL.

- Section 2: Applicant Information – If you’re not the taxpayer, include your details and relationship; attach a copy of the lien.

- Section 3: Purchaser/Transferee/New Owner – Detail the new owner’s info if applicable.

- Section 4: Attorney/Representative – Include if using a rep; attach Form 2848 or 8821.

- Section 5: Lender/Finance Company – For escrow-related applications under 6325(b)(3).

- Section 6: Monetary Information – State proposed sale price and expected IRS proceeds.

- Section 7: Basis for Discharge – Check the applicable IRC section.

- Section 8: Description of Property – Give a detailed description (e.g., “3-bedroom house”) and address; attach deed/title.

- Section 9: Appraisal and Valuations – Attach a professional appraisal plus one additional valuation (e.g., county assessment).

- Section 10: Copy of Federal Tax Lien(s) – Attach or list serial numbers if applicant differs from taxpayer.

- Section 11: Sales Contract – Attach or describe divestment.

- Section 12: Title Report – Attach or list senior encumbrances.

- Section 13: Closing Statement – Attach HUD-1 or itemize costs.

- Section 14: Additional Information – Attach any relevant docs like affidavits.

- Section 15: Escrow Agreement – For 6325(b)(3); attach draft.

- Section 16: Waiver – Third parties waive certain rights if applying under 6325(b)(2).

- Section 17: Declaration – Sign under penalties of perjury.

Always review Publication 783 for examples and detailed guidance.

Required Documents and Attachments

To avoid delays, include:

- Copy of the NFTL (if applicant ≠ taxpayer).

- Professional appraisal and one additional valuation.

- Deed/title for the property (and remaining property for 6325(b)(1)).

- Sales contract, title report, and closing statement (or equivalents).

- Escrow agreement draft if applicable.

- Forms 2848/8821 for representatives.

Incomplete applications may lead to requests for more info or denial.

IRS Form 14135 Download and Printable

Download and Print: IRS Form 14135

How to File Form 14135

Mail the completed form and attachments to: IRS Advisory Consolidated Receipts, 7940 Kentucky Drive, Stop 2850F, Florence, KY 41042. Submit at least 45 days before your transaction date. For questions, call 859-594-6090 or 800-913-6050 to check your balance. Do not send payments with the application—wait for IRS instructions.

Fees and Processing Time

There are no filing fees for Form 14135. Processing typically takes time for review by Advisory staff and approval by the Group Manager. For foreclosures, expect a conditional commitment letter within 30 days of a complete application. If denied, you’ll receive Form 9423 with appeal rights under the Collection Appeals Program.

Common Mistakes and Tips for Success

Avoid these pitfalls:

- Submitting incomplete documentation, like missing appraisals or titles, which can delay or deny your request.

- Not allowing enough time—file early to meet transaction deadlines.

- Incorrectly selecting the basis for discharge; review IRC sections carefully.

- Failing to verify lien details or amounts owed.

Tips:

- Use certified mail for tracking.

- Consult Publication 783 thoroughly.

- If issues arise, contact the Taxpayer Advocate Service (TAS) for help, especially if facing financial hardship.

- Pay in full if possible for a full lien release, but discharge is ideal for specific properties.

Frequently Asked Questions About IRS Form 14135

How long does it take to get a Certificate of Discharge?

Aim for at least 45 days, but it varies based on completeness and complexity.

Can I apply if I’m not the taxpayer?

Yes, third-party owners can apply, especially under 6325(b)(4), with court challenge options.

What if my application is denied?

Appeal via Form 9423; you have rights under the Taxpayer Bill of Rights.

Is there a fee to file Form 14135?

No, but you may need to pay the IRS’s interest in the property.

Where can I download Form 14135?

From the IRS website at irs.gov/forms.

Conclusion

Navigating a federal tax lien can be challenging, but IRS Form 14135 provides a structured way to discharge specific property and move forward with sales or refinances. By gathering the right documents, choosing the correct basis, and filing promptly, you increase your chances of approval. Always refer to official IRS resources for the most accurate guidance, and consider professional tax advice for complex situations. Resolving tax liens promptly can protect your credit and financial future—start by checking your lien status today.