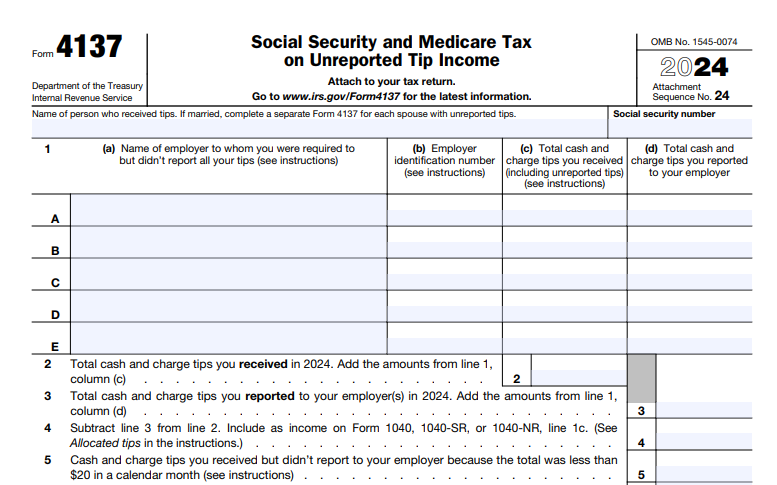

IRS Form 4137 – Social Security and Medicare Tax On Unreported Tip Income – Tipped workers in hospitality, beauty services, and beyond often face the challenge of tracking cash tips that go unreported to employers. But skipping these can lead to underpaid FICA taxes and hefty penalties—up to 50% of the owed amount. IRS Form 4137, the “Social Security and Medicare Tax on Unreported Tip Income,” is your solution for calculating and paying these taxes accurately on your individual return. If you’re a server searching for “Form 4137 instructions 2025,” a bartender wondering about “unreported tips penalty 2025,” or a gig worker navigating “tip deduction under OBBBA,” this SEO-optimized guide has you covered.

Drawing from the IRS’s latest 2025 form and instructions (Rev. Aug. 2025), Notice 2025-69 on tip deductions, and IR-2025-114 guidance, we’ll break down eligibility, step-by-step filing, and key updates like the new $25,000 qualified tip deduction for 2025–2028. File by April 15, 2026 to avoid the escalated late penalty (up to $510 for returns over 60 days late) and ensure Social Security credits. Let’s tip the scales in your favor.

What Is IRS Form 4137?

Form 4137 helps employees compute the additional Social Security (6.2%) and Medicare (1.45%) taxes—totaling 7.65%—owed on tips not reported to their employer, including allocated tips from Form W-2, Box 8. These tips are still considered wages, so you must pay the employee share of FICA taxes, even if your employer didn’t withhold them. The form also supports the new qualified tip deduction under the One Big Beautiful Bill Act (OBBBA), allowing up to $25,000 in deductions from federal income tax (phasing out above $150,000 AGI single/$300,000 joint)—but FICA still applies.

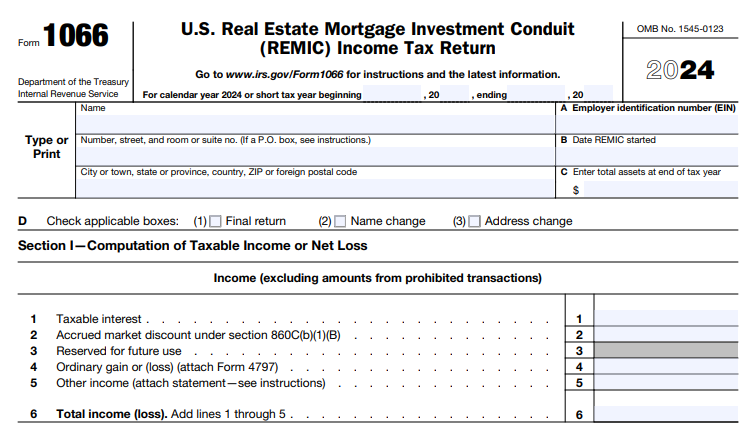

Unlike reported tips (withheld by employers), unreported ones require self-reporting via Form 4137, attached to your Form 1040 (Line 25c of Schedule 2) or 1040-SS. It’s a one-page form with two main sections: unreported tips subject to each tax. For 2025, the Social Security wage base is $176,100 (up from $168,600 in 2024), capping SS tax on tips exceeding that. This form ensures you earn credits toward retirement and healthcare while complying—failure risks audits and 50% penalties.

Who Must File IRS Form 4137 in 2025?

File Form 4137 if you received $20 or more in cash/charge tips per month without reporting all to your employer, or if your W-2 shows allocated tips (Box 8) you must include as income. Self-employed? Report tips on Schedule C; don’t use 4137.

Eligible Taxpayers

| Scenario | Filing Required? | Key Notes |

|---|---|---|

| Tipped Employees (servers, drivers, barbers) | Yes | For unreported tips ≥$20/month; include in qualified tip deduction. |

| Allocated Tips (W-2 Box 8) | Yes | Report as income; subject to full 7.65% FICA. |

| Government Employees | Yes, with adjustment | Deduct from SS calculation; see instructions. |

| RRTA Workers (railroad) | No | Report to employer for retirement credit. |

| Self-Employed/Gig Workers | No | Use Schedule SE for self-employment tax. |

Exclusions: Tips under $20/month (Medicare only if total >$0); foreign employers without U.S. withholding.

IRS Form 4137 Download and Printable

Download and Print: IRS Form 4137

Recent Changes to IRS Form 4137 for Tax Year 2025

The IRS released the 2025 Form 4137 in August 2025, with instructions updated per Notice 2025-69 (Nov. 21, 2025) for OBBBA’s “No Tax on Tips” provision. While the form structure holds, key shifts include:

- Qualified Tip Deduction: Up to $25,000 deductible from income tax (not FICA) for tips in customary industries; use W-2 Box 7, Form 4070 totals, or employer statements—plus Line 4 unreported tips. Phases out over $150K AGI; temporary for 2025–2028.

- Transition Relief: No penalties for employers on 2025 W-2/1099 updates (Notice 2025-62); employees can self-certify tips for deductions.

- Wage Base Increase: SS tax caps at $176,100 total wages/tips.

- Penalty Hike: Late filing >60 days: Smaller of tax due or $510.

- No Form Changes: W-2/1099 not updated for tips/overtime; use existing boxes.

These ease compliance amid OBBBA’s retroactive start (Jan. 1, 2025).

Step-by-Step Guide: How to Complete IRS Form 4137 for 2025

Gather tip logs (Form 4070A recommended), W-2, and 1099s. Use the 2025 form; attach to your return. Based on Rev. Aug. 2025 instructions:

Preparation

- Track tips daily; report to employer by 10th of next month.

- For deductions: Tally qualified tips via W-2 Box 7 or 4070 (include Line 4 unreported).

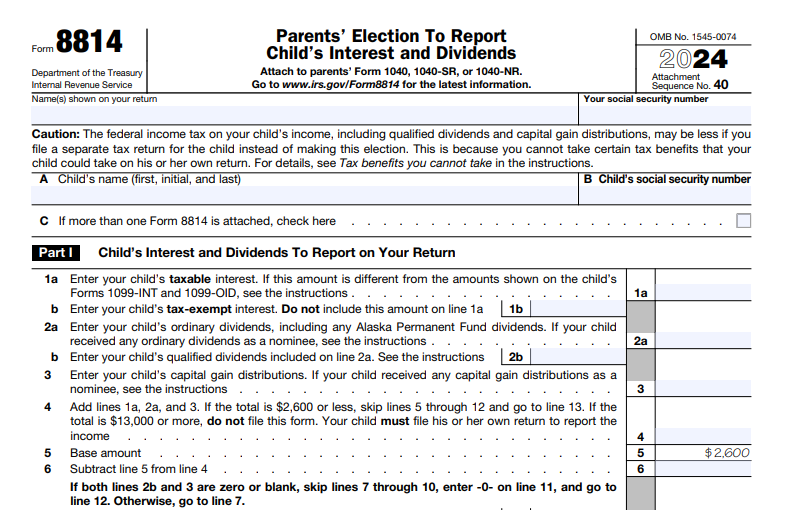

Section A: Unreported Tips Subject to Social Security Tax (Lines 1-6)

- Line 1: Tips from Jan-Nov not reported by Dec 10 (include on 2025 W-2).

- Line 2: Dec tips reported by Jan 10, 2026 (2026 W-2, but 2025 taxes).

- Line 3: Allocated tips (W-2 Box 8).

- Line 4: Other unreported tips (cash/charge ≥$20/month).

- Line 5: Total (Lines 1-4).

- Line 6: Less tips <$20/month (SS exempt).

Example: $5,000 unreported (Line 4) + $1,000 allocated (Line 3) = $6,000 (Line 5).

Section B: Unreported Tips Subject to Medicare Tax (Lines 7-13)

- Line 7: Total unreported (Line 5 + <$20 tips).

- Line 8: Multiply by 0.0145 (1.45% Medicare).

- Line 9: Wages subject to SS (from W-2 Boxes 3/5 + reported tips).

- Line 10: Smaller of Line 5 or ($176,100 – Line 9).

- Line 11: Multiply Line 10 by 0.062 (6.2% SS).

- Line 12: Government employee adjustment (if applicable; deduct from Line 10 for SS).

- Line 13: Total tax (Line 8 + Line 11); enter on Schedule 2, Line 5.

Example: $6,000 unreported × 1.45% = $87 Medicare; if under base, $6,000 × 6.2% = $372 SS; total $459.

Filing Tips

- Attach: To Form 1040/1040-SS; e-file preferred.

- Deadlines: April 15, 2026; extend via Form 4868 (pay estimates).

- Records: Keep logs 3+ years.

Common Mistakes to Avoid When Filing Form 4137

Unreported tips trigger audits—here’s how to evade:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Omitting <$20 Tips | Thinking exempt from all taxes | Report for Medicare (Line 7); SS only ≥$20/month. |

| Forgetting Allocated Tips | Ignoring W-2 Box 8 | Include on Line 3; full FICA due. |

| Overlooking Wage Base | No cap adjustment | Limit SS to $176,100 total (Line 10). |

| Missing Deduction Calc | Not adding Line 4 to OBBBA | Include unreported in $25K qualified tips. |

| Late Reporting | No monthly employer notice | Report by 10th; penalty 50% of FICA due. |

Why File Form 4137? Real-World Impact for 2025 Tipped Workers

A server with $10,000 unreported tips owes $765 FICA ($620 SS + $145 Medicare), but can deduct up to $10,000 from income tax under OBBBA—saving ~$2,200 at 22% bracket. Plus, reporting builds SS credits for retirement. With 2025’s transition relief, it’s easier than ever to comply without employer glitches.

Final Thoughts: Report Unreported Tips Confidently with Form 4137 in 2025

IRS Form 4137 ensures tipped income counts toward your future while leveraging OBBBA’s $25K deduction— but accuracy is key to dodging 50% penalties. Track tips diligently, include allocated amounts, and consult a pro for high earners.

Download the 2025 form from IRS.gov and use Pub. 531 for details. For OBBBA guidance, see Notice 2025-69. Questions on “unreported tips FICA 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your situation.