Table of Contents

Illinois W4 Form 2023 Printable – Keeping up with ever-changing tax laws can be daunting for individuals and businesses. One of the most important documents to remember is the Illinois W4 Form 2023 Printable document. This document helps employers and employees understand how much state income tax they must pay. This form ensures that all taxes are paid on time by providing accurate information on an individual’s wages and deductions.

New Article: W4 Form 2025.

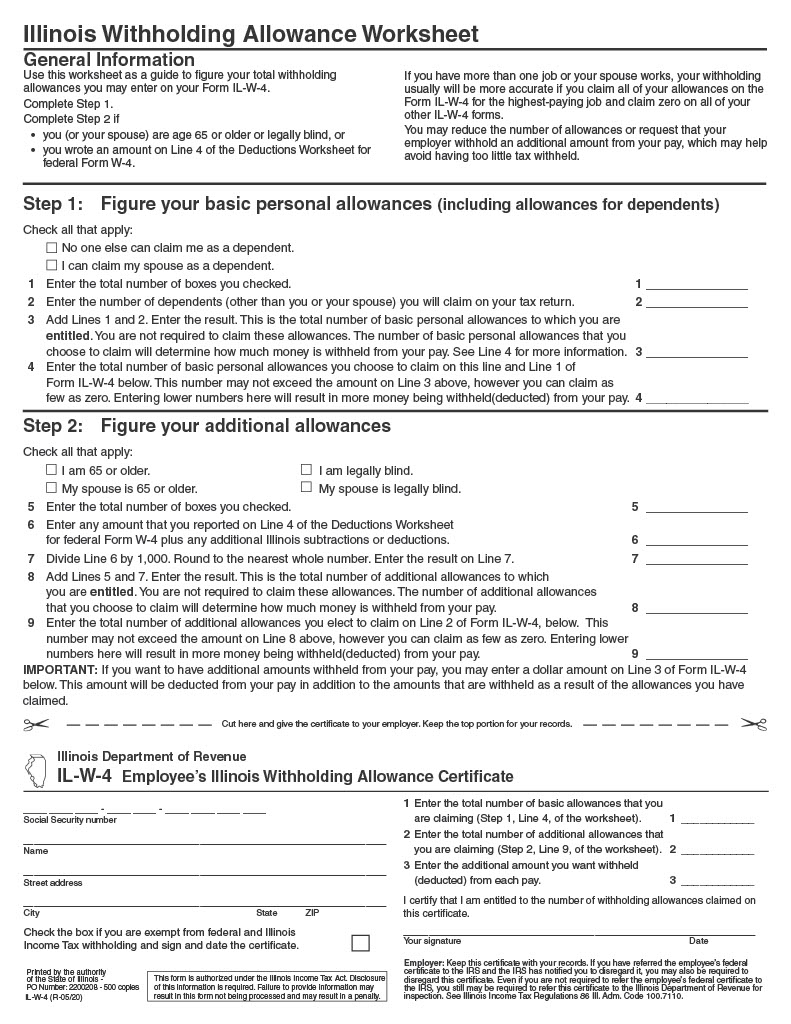

The Illinois W4 Form 2023 Printable document has specific requirements depending on a person’s wages and deductions. It requires personal data, total income earned during the year, filing status, number of dependents claimed, number of allowances claimed, any additional local or state taxes withheld from payrolls, and any other adjustments or credits allowed by law.

The Illinois W4 Form, Employee’s and other Payee’s Illinois Withholding Allowance Certificate is a crucial document for employees and other payees in Illinois. It allows employers to determine the correct amount of state income tax to withhold from employees’ paychecks. In this article, we’ll take a closer look at the Illinois W4 form and provide helpful tips on how to fill it out correctly.

What is the Illinois W4 Form, Employee’s and other Payee’s Illinois Withholding Allowance Certificate?

The Illinois W4 form is a tax document used by employers to determine how much state income tax to withhold from an employee’s paycheck. It asks for information about the employee’s filing status, number of allowances, and any additional withholding. This information calculates the amount of state income tax to withhold from the employee’s paycheck.

Why is the Illinois W4 Form Important?

The Illinois W4 form is important because it ensures that the correct amount of state income tax is withheld from an employee’s paycheck. If an employee has too much tax withheld, they will receive a refund when they file their tax return. If employees have too little tax withheld, they may owe money when filing their tax returns. Filling the Illinois W4 form correctly can help employees avoid unexpected tax bills or refunds.

How long is Form IL-W-4 Valid: Understanding the Validity of your Tax Withholding Form

As an Illinois taxpayer, it’s important to understand the validity of your Form IL-W-4. This tax withholding form determines how much Illinois Income Tax will be withheld from your paycheck. But how long does it remain valid? Let’s take a closer look.

Validity of Form IL-W-4

Your Form IL-W-4 remains valid until you submit a new form or the Department requires your employer to disregard it. You don’t need to submit a new form yearly unless your tax situation changes.

Disregard of Form IL-W-4

However, there are certain circumstances in which your employer is required to disregard your Form IL-W-4. One of these is if you claim a total exemption from Illinois Income Tax withholding but have not filed a federal Form W-4 claiming a total exemption. In this case, your employer must disregard your Form IL-W-4 and withhold taxes as if you didn’t claim an exemption.

Another circumstance in which your employer must disregard your Form IL-W-4 is if the Internal Revenue Service (IRS) has instructed your employer to disregard your federal Form W-4. This could happen if the IRS determines that the allowances you claimed on your federal Form W-4 are incorrect or if you’ve claimed total exemption from federal income tax withholding.

Keeping Your Tax Withholding Form Up to Date

To ensure that your tax withholding is accurate, it’s important to keep your Form IL-W-4 up to date. If your tax situation changes, such as getting married or having a child, you should submit a new form to your employer. Similarly, if you receive a notice from the IRS instructing you to change your federal Form W-4, you should also submit a new Form IL-W-4 to your employer.

Tips For Filling Out the Illinois W4 Form

- Be sure to read the instructions carefully before filling out the form.

- Use the Personal Allowances Worksheet to calculate the number of allowances you’re entitled to claim.

- Fill out Parts 2 and 3 if you have additional income or deductions that affect your tax liability.

- Be sure to sign and date the form.

Who is Required to Fill Out Form IL W-4?

All employees must complete this form to ensure that their employer withholds the correct amount of Illinois Income Tax from their pay. The number of allowances claimed on this form will determine the amount withheld from each paycheck.

It is important to note that even if you claimed exemption from federal income tax withholding on your Form W-4, you might still be required to have Illinois Income Tax withheld from your pay. To determine if you are required to have Illinois Income Tax withheld, please refer to Publication 130, “Who is Required to Withhold Illinois Income Tax?”

If you wish to claim exempt status from Illinois withholding, you must indicate this by checking the box for exempt status on Form IL-W-4 and signing and dating the certificate. Please note that if you claim exempt status, you do not need to complete Lines 1 through 3.

For residents of IOWA, Kentucky, Michigan, and Wisconsin, or military spouses, Form W-5-NR, “Employee’s Statement of Nonresidence in Illinois,” should be consulted to determine if you are exempt.

Suppose you are an Illinois resident working for an employer in a non-reciprocal state but working from home or in locations in Illinois for more than 30 working days. In that case, you may need to adjust your withholding or begin making estimated payments.

Failure to file a completed Form IL-W-4, failure to sign the form or include all necessary information, or altering the form may result in your employer withholding Illinois Income Tax on the entire amount of your compensation without any exemptions.

| Topic | Form IL-W-4 |

| Who needs to fill it out? | All employees to ensure correct Illinois Income Tax withholding |

| What determines the withholding amount? | Number of allowances claimed |

| Exemption from federal income tax withholding | Doesn’t necessarily exempt from Illinois Income Tax withholding |

| How to claim exempt status | Check the box on Form IL-W-4 |

| Residents of certain states or military spouses | Refer to Form W-5-NR to determine the exemption |

| Illinois residents working for the non-reciprocal state | May need to adjust withholding or make estimated payments |

| Consequences of not filing or altering the form | The employer may withhold Illinois Income Tax on entire compensation without exemptions. |

Frequently Asked Questions

Q: Do I need to fill out a new Illinois W4 form annually?

A: It’s a good idea to review your withholding annually and make any necessary changes. You may want to fill out a new form if your personal or financial situation has changed.

Q: How do I know how many allowances to claim?

A: Use the Personal Allowances Worksheet to calculate the number of allowances you’re entitled to claim. The worksheet considers your filing status, number of dependents, and any deductions you may be eligible for. The more allowances you claim, the less tax will be withheld from your paycheck. However, claiming too many allowances can result in insufficient tax being withheld, which may lead to a tax bill when you file your tax return. On the other hand, claiming too few allowances can result in too much tax being withheld, which means you’ll receive a refund when you file your tax return. Finding the right balance when filling out the Personal Allowances Worksheet is important to avoid unexpected tax bills or refunds.

Illinois W4 Form 2023 Printable PDF – IL W-4 Withholding 2023

Download and Print Here: Illinois W4 Form 2023 Printable.