Table of Contents

IRS Form 1040-ES (NR) – U.S. Estimated Tax for Nonresident Alien Individuals – As a nonresident alien earning U.S.-source income, navigating the American tax system can feel overwhelming—especially when it comes to paying taxes throughout the year rather than all at once. Enter IRS Form 1040-ES (NR), the essential tool for calculating and remitting estimated tax payments on income not subject to withholding. Whether you’re a freelancer, investor, or international business owner, understanding this form ensures compliance, avoids penalties, and keeps your finances on track.

In this guide, we’ll break down everything you need to know about Form 1040-ES (NR) for tax year 2025: from eligibility and calculations to due dates and common pitfalls. Updated for the latest IRS guidelines, this resource is your go-to for nonresident alien estimated tax mastery. Let’s dive in.

What Is IRS Form 1040-ES (NR)?

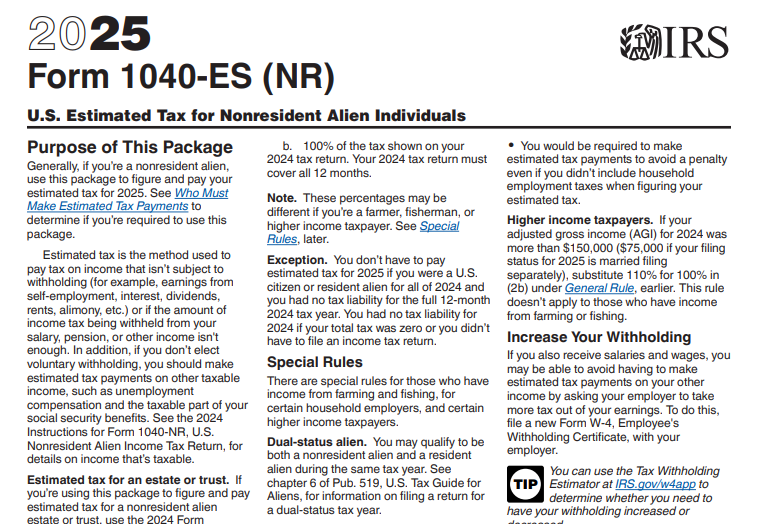

Form 1040-ES (NR) is the IRS’s designated package for nonresident alien estimated tax payments. It includes worksheets, payment vouchers, and instructions to help you estimate your annual U.S. tax liability and pay it in quarterly installments. This form is specifically tailored for non-U.S. citizens or residents who don’t qualify for the standard Form 1040-ES used by U.S. citizens and residents.

The purpose? To prevent a large tax bill (and potential underpayment penalties) at filing time by spreading payments across the year. It’s crucial for income sources like self-employment earnings, dividends, royalties, or rental income from U.S. properties—types of U.S. source income often not withheld at the source. For 2025, the form reflects updated tax rate schedules and deduction limits, ensuring accuracy in your projections.

Unlike your annual Form 1040-NR (U.S. Nonresident Alien Income Tax Return), which reconciles everything at year-end, Form 1040-ES (NR) is proactive. Download the latest version from IRS.gov—released February 20, 2025—for tax year 2025.

Who Needs to File Form 1040-ES (NR) in 2025?

Not every nonresident alien must make estimated payments, but if your situation fits the criteria below, you’re likely required to use this form. The IRS mandates payments if you expect significant U.S. tax liability without sufficient withholding.

Key Eligibility Criteria:

- Nonresident Alien Status: You’re not a U.S. citizen or green card holder and fail the substantial presence test (generally, fewer than 183 days in the U.S. over a three-year weighted period). Dual-status taxpayers (part-year resident) may also need it for nonresident portions.

- Expected Tax Owed: You anticipate owing at least $1,000 in federal income tax for 2025 after subtracting withholdings and refundable credits.

- Insufficient Withholding: Your expected withholdings and credits cover less than the smaller of:

- 90% of your 2025 tax liability, or

- 100% of your 2024 tax (110% if your 2024 AGI exceeded $150,000, or $75,000 if married filing separately).

- Income Types: Primarily for effectively connected income (ECI) with a U.S. trade or business (taxed at graduated rates) or fixed, determinable, annual, or periodical (FDAP) income like interest or royalties (taxed at 30% flat rate, unless reduced by treaty).

| Scenario | Do You Need Form 1040-ES (NR)? | Example |

|---|---|---|

| Self-employed consultant with U.S. clients | Yes | $50,000 ECI with no withholding—expect $8,000 tax owed. |

| Investor receiving U.S. dividends | Yes, if >$1,000 owed after 30% withholding | $10,000 dividends; treaty reduces rate to 15%. |

| Employee with full W-2 withholding | No | Withholding covers 100%+ of liability. |

| No U.S. income | No | Exempt entirely. |

Farmers, fishers, or higher-income taxpayers (AGI >$150,000) have special rules—check Pub. 505 for details. If you’re unsure, use the IRS’s interactive tools or consult a tax professional specializing in international taxation.

How to Calculate Your 2025 Estimated Tax Using Form 1040-ES (NR)

Calculating estimated tax isn’t guesswork—follow the form’s worksheets step-by-step. The goal: Project your adjusted gross income (AGI), deductions, credits, and tax on U.S.-source income.

Step-by-Step Calculation Guide:

- Estimate Your Income:

- Line 1: Expected AGI from U.S. sources (wages, business income, etc.). Exclude foreign income unless ECI.

- Use your 2024 Form 1040-NR as a baseline, adjusting for 2025 changes like raises or new ventures.

- Subtract Deductions:

- Line 2: Standard deduction? Nonresidents generally can’t claim it—itemize instead (e.g., state taxes, charitable contributions tied to U.S. income).

- Line 3: Taxable income = AGI minus deductions.

- Figure Your Tax:

- Line 4: Use 2025 Tax Rate Schedules (Schedules X/Z for single or married filing separately—nonresidents can’t file jointly). ECI is taxed at graduated rates (10%-37%); FDAP at 30% (or treaty rate).

- Line 5: Add self-employment tax (15.3% on net earnings) and other taxes (e.g., alternative minimum tax).

- Apply Credits and Withholdings:

- Line 6: Subtract non-refundable credits (e.g., foreign tax credit).

- Line 7: Subtract expected withholdings.

- Determine Required Payments:

- Total estimated tax (Line 11): Multiply by 90% (or 66⅔% for farmers/fishers).

- Divide by 4 for quarterly amounts, or annualize if income is uneven.

Pro Tip: Nonresidents can’t claim many U.S. citizen credits (e.g., Earned Income Tax Credit). Factor in tax treaties—use Pub. 901 to check reduced rates for your country. Tools like the IRS Tax Withholding Estimator can help, but note it’s limited for nonresidents.

For complex cases (e.g., capital gains), reference Pub. 519: U.S. Tax Guide for Aliens.

2025 Payment Due Dates for Form 1040-ES (NR)

Estimated taxes are due quarterly to match income flow. For calendar-year filers in 2025:

| Quarter | Income Period | Due Date |

|---|---|---|

| 1st | Jan 1–Mar 31 | April 15, 2025 |

| 2nd | Apr 1–May 31 | June 16, 2025 |

| 3rd | Jun 1–Aug 31 | September 15, 2025 |

| 4th | Sep 1–Dec 31 | January 15, 2026* |

*Skip the January 15, 2026, payment if you file your 2025 Form 1040-NR by February 2, 2026, and pay the full balance then. Nonresidents without U.S. wages make only three payments (first covers 50%). Holidays shift dates—see Pub. 509.

IRS Form 1040-ES (NR) Download and Printable

Download and Print: IRS Form 1040-ES (NR)

How to Make Payments with Form 1040-ES (NR)

Ease into compliance with these options—no need to mail everything:

- Electronic (Preferred): Use IRS Direct Pay, EFTPS, or credit/debit card at IRS.gov/Payments. No voucher required.

- Mail: Detach vouchers from the form, payable to “United States Treasury.” Include your SSN/ITIN and “2025 Form 1040-ES (NR).” Send to the IRS address for international filers (Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215).

- Track It: Use the form’s Record of Estimated Tax Payments section.

Overpay? Credit it to next year or your refund.

Penalties for Late or Underpaid Estimated Taxes

Miss a deadline or underpay? The IRS imposes an underpayment penalty under IRC 6654—calculated daily on the shortfall at the federal short-term rate +3% (currently around 8%, compounded daily). It’s based on the lesser of 90% current-year tax or 100% prior-year tax.

- Avoid It: Pay 90% on time, or use safe harbors.

- Exceptions: Reasonable cause (e.g., disaster), first-time abatement, or if total tax < $1,000.

- Nonresidents: Same rules apply, but only three installments for some.

File Form 2210 to calculate or waive penalties. Interest accrues until paid—act fast to minimize costs.

Frequently Asked Questions (FAQs) About Form 1040-ES (NR)

Q: Can I e-file estimated payments?

A: Yes, via IRS.gov—no paper needed.

Q: What if my income changes mid-year?

A: Recalculate and adjust future payments; no penalty for good-faith estimates.

Q: Do tax treaties affect calculations?

A: Absolutely—reduce FDAP rates (e.g., 15% for many countries). See Pub. 901.

Q: What’s new for 2025?

A: Updated rate schedules and no major changes from 2024, but check for OBBBA impacts on deductions.

Final Thoughts: Stay Ahead on Your Nonresident Alien Estimated Tax

Mastering Form 1040-ES (NR) isn’t just about compliance—it’s about financial peace of mind. By estimating accurately and paying on time, you sidestep penalties and focus on what matters: growing your U.S. opportunities. For personalized advice, consult a tax advisor or use IRS Free File for nonresidents.

Ready to get started? Download your 2025 Form 1040-ES (NR) today at IRS.gov. Questions? Visit IRS.gov/Individuals/International-Taxpayers or call 267-941-1000 (international). Your tax journey just got simpler.

This article is for informational purposes only and not tax advice. Always verify with the IRS or a professional.