Table of Contents

IRS Form 1040-NR – U.S. Nonresident Alien Income Tax Return – Nonresident aliens earning U.S.-source income—whether from wages, investments, or rentals—must navigate unique tax rules to stay compliant with the IRS. IRS Form 1040-NR, “U.S. Nonresident Alien Income Tax Return,” is the primary tool for reporting this income, claiming treaty benefits, and securing refunds on overwithheld taxes. For the 2025 tax year, with stable brackets under the extended Tax Cuts and Jobs Act (TCJA) provisions and new allowances like enhanced senior deductions, accurate filing can minimize liabilities and unlock credits.

This SEO-optimized guide, based on the latest IRS drafts and publications, covers Form 1040-NR essentials for filing by April 15, 2026 (or June 15 without wages). From residency tests to step-by-step instructions, we’ll help international students, professionals, and investors optimize their 2025 returns. Download the draft 2025 Form 1040-NR from IRS.gov/Form1040NR to get started.

What Is IRS Form 1040-NR?

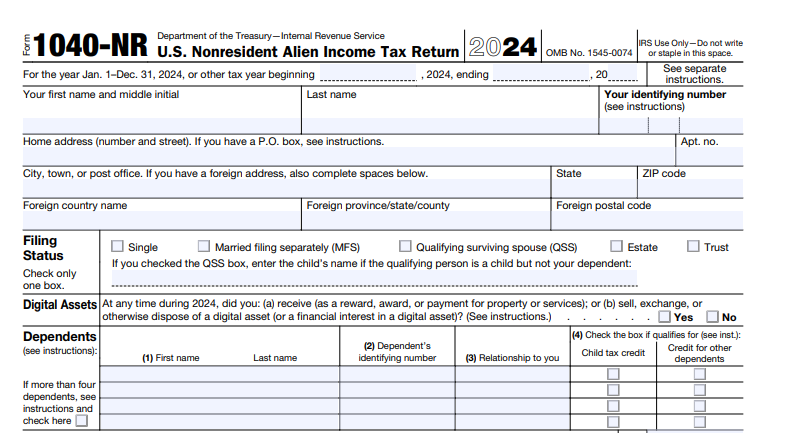

IRS Form 1040-NR is the dedicated U.S. income tax return for nonresident aliens (NRAs), dual-status taxpayers, and certain electing spouses. It reports income effectively connected with a U.S. trade or business (ECI) at graduated rates, plus fixed, determinable, annual, or periodical (FDAP) income like dividends or royalties at 30% (or treaty rates). Unlike Form 1040, it excludes worldwide income and limits deductions to those allocable to U.S. sources.

Key features for 2025:

- Two Main Sections: Schedule OI for other information (residency, treaties) and Schedule NEC for non-ECI income.

- Attachments: Schedules 1–3 (additional income/deductions/credits), Form 8843 (exempt individuals), and Form 8833 (treaty disclosures).

- Refunds: Claim overwithheld tax from Forms W-2, 1042-S, or 1099.

- E-Filing: Available via IRS Modernized e-File (MeF) for faster processing.

Per Publication 519, NRAs file if U.S. tax wasn’t fully withheld or to claim refunds/deductions. The draft 2025 form (Rev. Dec. 2025) integrates new Schedule 1-A for additional deductions like qualified tips and overtime.

Who Needs to File IRS Form 1040-NR in 2025?

File Form 1040-NR if you’re a nonresident alien with:

- ECI: Wages, self-employment, or business income subject to graduated rates (e.g., F-1/J-1 visa holders with U.S. jobs).

- FDAP Income: Dividends, interest, rents, or royalties where withholding <30% (or treaty rate).

- U.S. Tax Liability: Not fully satisfied by source withholding.

- Refund Claims: Overwithheld tax or credits like foreign tax (Form 1116).

- Dual-Status: Part-year resident/nonresident (attach statement).

Exemptions: No filing if only exempt income (e.g., portfolio interest) and full withholding. All F/J/M/Q visa holders file Form 8843 by June 15, 2026, even without income. Spouses of U.S. residents may elect joint filing on Form 1040.

Thresholds: No minimum income, but self-employment tax (15.3%) applies if net earnings ≥$400. Estates/trusts use Form 1041.

Determining Nonresident Alien Status for 2025

Alien status hinges on tests in Publication 519:

- Green Card Test: Lawful permanent resident (ignores abandonment).

- Substantial Presence Test: Present ≥31 days in 2025 and 183 days over 3 years (2025: 1 day; 2024: 1/3; 2023: 1/6).

- Exemptions: F/J/M/Q visa holders (first 5/2 years); teachers/students closer ties to home country.

Dual-status: File Form 1040-NR with dual-status statement. Elect resident treatment for married couples via joint return. Treaty ties may override.

| Test/Status | Key Rule | 2025 Implication |

|---|---|---|

| Nonresident Alien | Fail both tests | Tax only U.S.-source; Form 1040-NR |

| Resident Alien | Pass either test | Worldwide income; Form 1040 |

| Dual-Status | Change mid-year | Separate resident/nonresident sections |

Key Changes to IRS Form 1040-NR for 2025

The 2025 draft aligns with Form 1040 updates from the One Big Beautiful Bill Act (OBBBA):

- Schedule 1-A Integration: New “Additional Deductions” for qualified tips, overtime (up to $12,500 deductible), passenger vehicle loan interest, and enhanced senior deduction (from AGI on line 13b).

- Digital Assets: Expanded questions on crypto/disposition; report on Schedule 1.

- Gig Economy: Clearer reporting for 1099-K income ≥$600.

- Dependent Claims: IRS accepts returns even if dependent claimed elsewhere, with IP PIN.

- Filing Flexibility: E-file Form 1040-NR with Schedules; direct deposit refunds standard.

No AMT changes for NRAs; self-employment tax rate steady at 15.3%. Standard deduction: $15,000 single (up from $14,600).

IRS Form 1040-NR Download and Printable

Download and Print: IRS Form 1040-NR

How to Complete IRS Form 1040-NR: Step-by-Step Guide for 2025

Gather Forms W-2, 1042-S, 1099; use tax software like Sprintax for NRAs. Round to dollars; attach statements.

Header and Filing Status

- Enter name, U.S. address (if any), foreign address, ITIN/SSN (apply via Form W-7).

- Tax year: Jan. 1–Dec. 31, 2025.

- Status: Single, Married filing separately, Qualifying surviving spouse (nonresidents can’t file jointly unless electing).

Income Section (Lines 1–11)

- Line 1a–1h: Wages/salaries (ECI from W-2); tips, taxable scholarships.

- Line 8: Other ECI (business from Schedule C; attach).

- Line 9: Total ECI (sum lines 1–8).

- Line 10: Adjustments (Schedule 1, e.g., educator expenses, student loan interest if treaty allows).

- Line 11a: AGI (line 9 – 10).

Schedule NEC: Non-ECI Income (Attachment)

- Line 1–16: FDAP items (e.g., dividends line 12 at 30%; treaty rate on line 22).

- Total tax: Line 23d × rate.

Tax Computation (Lines 12–24)

- Line 12: Standard/itemized deduction (Schedule A limited to U.S. sources).

- Line 13: Qualified business income deduction (Form 8995).

- Line 14: Taxable income (line 11b – 12 – 13).

- Line 16: Tax on ECI (use 2025 Tax Table; 10–37% brackets).

- Line 22: Add Schedule NEC tax.

- Line 24: Total tax.

Payments and Refundable Credits (Lines 25–33)

- Line 25d: Withheld tax (W-2 box 2, 1042-S box 7).

- Line 27: Estimated payments (Form 1040-ES(NR)).

- Line 33: Refund (overpayment) or amount owed.

Schedules and Attachments

- OI: Treaty info, virtual currency question.

- 1: Additional income (e.g., gig from 1099-K).

- 2/3: Credits (e.g., child tax up to $2,000; foreign tax).

- 8843: Exempt status.

Sign; e-file or mail to Austin, TX.

Example: NRA with $50,000 ECI wages ($5,000 withheld) and $10,000 dividends (30% withheld = $3,000). AGI $50,000; standard deduction $15,000; taxable $35,000; tax ~$4,000. Total tax $7,000; refund $4,000.

Common Mistakes to Avoid on Form 1040-NR

- Status Misclassification: Failing substantial presence test—use Pub. 519 worksheet.

- Treaty Oversights: Forgetting Form 8833; e.g., India treaty reduces FDAP to 15%.

- Withholding Errors: Not attaching 1042-S; delays refunds (up to 6 months).

- Deduction Limits: Claiming non-U.S. expenses on Schedule A.

- No Form 8843: Required for visa holders; mail separately.

Penalties: 5% monthly for late filing (25% max); interest on unpaid tax.

Tips for Nonresident Aliens Filing Form 1040-NR in 2025

- Leverage Treaties: 60+ U.S. agreements reduce rates; check Pub. 901.

- E-File for Speed: Use approved software; refunds in 21 days vs. 6 months paper.

- Claim Credits: Child tax ($2,000), education (Form 8863 if eligible).

- Extend if Needed: Form 4868 to Oct. 15; pay estimated tax.

- Track ITIN: Renew if expired; apply early.

- Use Tools: Sprintax or Glacier Tax for NRAs; consult Pub. 519.

For self-employment, pay SE tax quarterly.

Final Thoughts: Navigate 2025 Nonresident Taxes with Confidence Using Form 1040-NR

IRS Form 1040-NR ensures fair taxation on U.S. income for nonresident aliens, with 2025 enhancements like Schedule 1-A offering new deduction opportunities. Timely filing by April 15, 2026, secures refunds and avoids penalties—empowering global professionals and students.

For the official draft 2025 Form 1040-NR and Pub. 519, visit IRS.gov/Form1040NR. Complex treaties or dual-status? A tax advisor specializing in international returns can maximize savings. Begin gathering your 1042-S and W-2 forms today for a seamless 2026 filing season.