Table of Contents

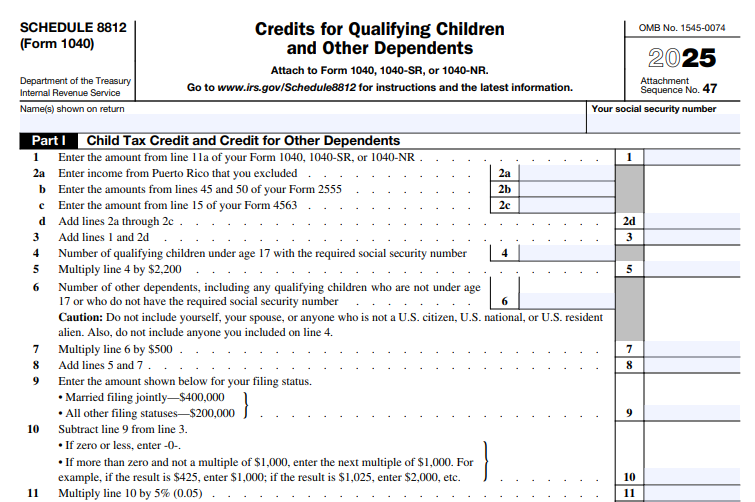

IRS Form 1040 (Schedule 8812) – Credits for Qualifying Children and Other Dependents – If you’re a parent or guardian filing your taxes, claiming credits for your dependents can significantly reduce your tax bill or even result in a refund. One key form for this is IRS Form 1040 Schedule 8812, officially titled “Credits for Qualifying Children and Other Dependents.” This schedule helps you calculate the Child Tax Credit (CTC), the Credit for Other Dependents (ODC), and the Additional Child Tax Credit (ACTC). In this comprehensive guide, we’ll break down what Schedule 8812 is, who qualifies, how to fill it out, and the latest updates for the 2025 tax year. Whether you’re new to tax filing or looking to maximize your credits, this article will provide the insights you need.

What Is IRS Schedule 8812?

Schedule 8812 is an attachment to Form 1040, 1040-SR, or 1040-NR. Its primary purpose is to help taxpayers figure out tax credits related to dependents. These credits can lower your federal income tax liability and, in some cases, provide a refund if the credit exceeds what you owe.

The form is divided into several parts:

- Part I: Calculates the CTC and ODC.

- Part II-A: Determines the ACTC for all filers.

- Part II-B: Applies to filers with three or more qualifying children or bona fide residents of Puerto Rico.

- Part II-C: Finalizes the ACTC amount.

Using this schedule is essential if you have qualifying children under 17 or other dependents, as it ensures you claim the maximum allowable credits.

Eligibility for the Child Tax Credit (CTC)

The CTC is a valuable credit designed to help families with the costs of raising children. To qualify for the CTC in 2025:

- The child must be your dependent and under age 17 at the end of the tax year.

- They must meet the IRS’s dependent qualifications (see Steps 1–3 in the Form 1040 instructions).

- The child needs a valid Social Security Number (SSN) issued before your return’s due date (including extensions).

- If filing jointly, at least one spouse must have a valid SSN; the other can have an SSN or Individual Taxpayer Identification Number (ITIN).

- You must check the “Child tax credit” box for the dependent on Form 1040 (row 7) or 1040-NR (row 6).

Note: You can’t claim the CTC if the child was born and died in 2025 without an SSN (though you may attach supporting documents for other purposes). Also, improper claims due to fraud or disregard can lead to penalties, including a ban on claiming the credit for up to 10 years.

Eligibility for the Credit for Other Dependents (ODC)

The ODC is for dependents who don’t qualify for the CTC, such as children 17 or older, elderly parents, or other relatives. Eligibility requirements include:

- The dependent must be claimed on your return and be a U.S. citizen, national, or resident alien.

- They need an SSN, ITIN, or Adoption Taxpayer Identification Number (ATIN) issued on or before your return’s due date.

- Check the “Credit for other dependents” box on Form 1040 (row 7) or 1040-NR (row 6).

- Adopted children are treated as your own if lawfully placed for adoption and meet residency rules.

You can’t claim the same dependent for both CTC and ODC. If the required taxpayer identification number isn’t issued on time, the credit is disallowed.

Eligibility for the Additional Child Tax Credit (ACTC)

The ACTC is the refundable portion of the CTC, meaning you can get money back even if you owe no tax. To qualify:

- You must have qualifying children under 17 with a valid SSN.

- Your CTC must exceed your tax liability after accounting for the ODC.

- You can’t claim it if filing Form 2555 (Foreign Earned Income).

- Bona fide residents of Puerto Rico may claim it under special rules, potentially using Form 1040-SS.

The ACTC requires earned income above $2,500 for phase-in, and refunds for claims are delayed until mid-February 2026. Importantly, ACTC refunds don’t count as income for most federal benefit programs like SNAP or Medicaid for at least 12 months.

IRS Form 1040 (Schedule 8812) Download and Printable

Download and Print: IRS Form 1040 (Schedule 8812)

Credit Amounts and Income Phaseouts for 2025

For the 2025 tax year, the credit amounts have been adjusted:

- CTC: Up to $2,200 per qualifying child.

- ODC: $500 per qualifying other dependent.

- ACTC: Up to $1,700 per qualifying child (refundable).

These credits phase out based on your modified adjusted gross income (AGI):

- Phaseout starts at $400,000 for married filing jointly or $200,000 for other filing statuses.

- The credit reduces by 5% for every $1,000 (or part thereof) above the threshold.

For example, if your modified AGI is $210,000 (single filer), the phaseout amount is $1,000 (next multiple of $1,000), reducing the credit by $50 (5% of $1,000). The ACTC phases in at 15% of earned income over $2,500.

| Credit Type | Maximum Amount | Refundable? | Phaseout Threshold (Single/Other) | Phaseout Threshold (Joint) |

|---|---|---|---|---|

| CTC | $2,200 per child | Partially (via ACTC) | $200,000 | $400,000 |

| ODC | $500 per dependent | No | $200,000 | $400,000 |

| ACTC | $1,700 per child | Yes | N/A (earned income threshold: $2,500) | N/A |

How to Fill Out Schedule 8812: A Step-by-Step Guide

Filling out Schedule 8812 involves referencing your Form 1040 and other worksheets. Here’s a high-level overview:

Part I: CTC and ODC

- Enter your AGI from Form 1040 (line 11a).

- Add excluded income (e.g., from Puerto Rico or foreign sources).

- Calculate modified AGI (line 3).

- Enter the number of qualifying children under 17 with SSNs (line 4); multiply by $2,200 (line 5).

- Enter other dependents (line 6); multiply by $500 (line 7).

- Add lines 5 and 7 (line 8).

- Subtract phaseout threshold (line 9) from modified AGI and apply 5% reduction (lines 10–11).

- Subtract reduction from total credits (line 12).

- Use Credit Limit Worksheet A to find your tax liability limit (line 13).

- Take the smaller of line 12 or 13 (line 14) – this is your CTC/ODC; enter on Form 1040 line 19.

Part II-A: ACTC for All Filers

- Subtract line 14 from line 12 (line 16a).

- Multiply qualifying children by $1,700 (line 16b).

- Enter earned income (line 18a) and subtract $2,500 if over that amount (line 19); multiply by 15% (line 20).

Part II-B: For 3+ Children or Puerto Rico Residents

- Add withheld taxes and certain Schedule 2 amounts (lines 21–23).

- Subtract other credits (line 24) to get line 25.

- Compare with line 20 and enter the smaller amount on line 27 (your ACTC; Form 1040 line 28).

If you’ve had credits denied in prior years, attach Form 8862. Always complete relevant worksheets like the Earned Income Worksheet or Credit Limit Worksheet A/B.

Key Changes for the 2025 Tax Year

The IRS has made notable updates for 2025:

- CTC increased to $2,200 per child (from previous years’ amounts).

- ACTC maximum raised to $1,700.

- New emphasis on SSN requirements for CTC/ACTC (ITINs insufficient).

- Introduction of Trump accounts for children born 2024–2029, with potential $1,000 contributions (file Form 4547 if electing).

- Refunds delayed to mid-February 2026 for ACTC claims.

These changes reflect inflation adjustments and policy tweaks.

Frequently Asked Questions About Schedule 8812

Can I claim the CTC if my child doesn’t have an SSN?

No, a valid SSN is required for CTC and ACTC. However, an ITIN may work for ODC.

What if my income is too high?

The credits phase out gradually. Use the form to calculate your reduced amount.

Do I need to file Schedule 8812 every year?

Only if you’re claiming these credits. Consult a tax professional for personalized advice.

How does this affect my state taxes?

Federal credits like these don’t directly impact state taxes, but check your state’s rules.

Final Thoughts

IRS Schedule 8812 is a powerful tool for reducing your tax burden through dependent-related credits. By understanding eligibility, amounts, and how to complete the form, you can ensure you’re getting every dollar you deserve in 2025. Always use the latest IRS forms and instructions, and consider consulting a tax advisor for complex situations. Filing accurately not only maximizes your refund but also avoids penalties. For more details, visit the official IRS website.