Table of Contents

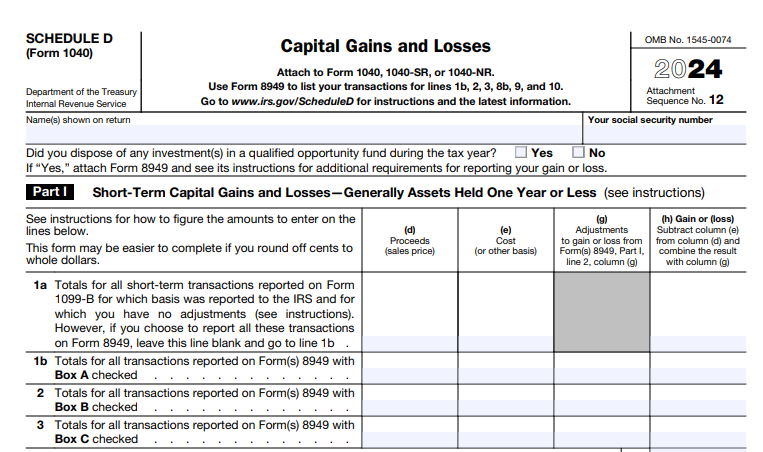

IRS Form 1040 (Schedule D) – Capital Gains and Losses – Selling stocks, crypto, or real estate? If you realized profits or losses from investments in 2025, IRS Schedule D (Form 1040)—the “Capital Gains and Losses” attachment—is your key to accurate reporting and potential tax savings. Whether you’re a day trader searching for “Schedule D instructions 2025,” a homeowner wondering about “capital gains tax on home sale,” or an investor optimizing “long-term capital gains rates 2025,” this SEO-optimized guide breaks it down. We’ll cover eligibility, step-by-step filing, and inflation-adjusted updates, helping you avoid common pitfalls like the $3,000 net loss limit and unlock lower tax rates up to 20% on long-term gains.

Based on the IRS’s draft 2025 Schedule D form (released October 2025) and 2024 instructions (applicable with minor corrections), plus Rev. Proc. 2024-40 for rate brackets, this resource ensures compliance by your April 15, 2026 deadline. With crypto reporting enhanced via Form 1099-DA and a March 2025 correction to Line 21 instructions, staying current is crucial. Let’s turn your transactions into tax-smart moves.

What Is Schedule D (Form 1040)?

Schedule D is an attachment to Form 1040 (or 1040-SR) that summarizes your capital gains and losses from selling or exchanging “capital assets”—think stocks, bonds, mutual funds, real estate, or even collectibles like art. It calculates your net gain or loss, which flows to Form 1040, Line 7, and determines if you owe tax at preferential long-term rates or can deduct up to $3,000 of net losses against ordinary income.

Key features:

- Short-Term vs. Long-Term: Holdings ≤1 year are short-term (taxed as ordinary income); >1 year qualify for 0-20% rates.

- Integration with Form 8949: Details transactions here; subtotals go to Schedule D.

- Carryovers: Unused losses carry forward indefinitely.

- Special Rules: Includes capital gain distributions from mutual funds (reported on Form 1099-DIV) and nonbusiness bad debts.

For 2025, expect no major form redesign, but enhanced digital asset questions and QOF (Qualified Opportunity Fund) reporting via Form 8997. This schedule isn’t just paperwork—it’s your ticket to lower taxes on gains up to $48,350 (single filers) at 0%.

Who Must File Schedule D in 2025?

You must file Schedule D if you:

- Sold or exchanged a capital asset (e.g., stocks, crypto, rental property).

- Received capital gain distributions (Box 2a on Form 1099-DIV).

- Have a capital loss carryover from 2024.

- Report gains from Forms 2439 (undistributed capital gains), 6252 (installment sales), or 4797 (business property).

Even if your net is zero or a loss, file to document carryovers. Exemptions: Pure ordinary income sales (e.g., inventory) go on Schedule C, not D.

Eligible Taxpayers

| Scenario | Filing Required? | Notes |

|---|---|---|

| Individual Investors | Yes | Report all brokerage sales; attach Form 8949 for details. |

| Homeowners | Yes, if gain > exclusion | Up to $250K single/$500K joint exclusion; excess on Schedule D. |

| Crypto Traders | Yes | Use Form 1099-DA; report as property sales. |

| Mutual Fund Holders | Yes, for distributions | Box 2a on 1099-DIV; long-term by default. |

| Estates/Trusts | Yes (Form 1041) | Separate Schedule D; carryovers apply. |

No filing if only tax-deferred accounts (e.g., 401(k)s) are involved—gains aren’t reported until withdrawal.

2025 Updates to Schedule D: What Filers Need to Know

The IRS released a draft Schedule D on October 6, 2025, with instructions mirroring 2024’s (Rev. Feb. 27, 2025) but incorporating a March 25, 2025, correction to Line 21 (Qualified Dividends and Capital Gain Tax Worksheet reference). Broader changes stem from inflation adjustments in Rev. Proc. 2024-40:

- Inflation-Adjusted Brackets: Long-term rates unchanged (0/15/20%), but thresholds rise ~2.8% (e.g., 0% up to $48,350 single from $47,025 in 2024).

- Crypto Enhancements: Form 1099-DA debuts for digital assets; report on Form 8949 with basis.

- QOF Reporting: Attach Form 8997 if disposing of investments; no major changes.

- Carryover Worksheet: Updated for 2024-to-2025 losses; enter on Lines 6/14.

- No TCJA Sunset Impact: Rates hold through 2025; post-2025 changes possible.

Fiscal-year filers prorate brackets. E-file preferred for accuracy.

2025 Long-Term Capital Gains Tax Rates

Long-term gains (assets held >1 year) get preferential rates. Short-term? Taxed as ordinary income (10-37%). Plus, watch for 3.8% NIIT if MAGI >$200K single/$250K joint, and 28% on collectibles.

| Rate | Single | Married Filing Jointly | Head of Household | Married Filing Separately |

|---|---|---|---|---|

| 0% | $0–$48,350 | $0–$96,700 | $0–$64,750 | $0–$48,350 |

| 15% | $48,351–$533,400 | $96,701–$600,050 | $64,751–$566,700 | $48,351–$300,000 |

| 20% | Over $533,400 | Over $600,050 | Over $566,700 | Over $300,000 |

*Source: IRS Rev. Proc. 2024-40; thresholds apply to taxable income. Example: Single filer with $40K gain and $30K income pays 0% on gain.

IRS Form 1040 (Schedule D) Download and Printable

Download and Print: IRS Form 1040 (Schedule D)

Step-by-Step Guide: How to Complete Schedule D for 2025

Use the draft form; attach to Form 1040. Gather 1099-B (brokerage), 1099-S (real estate), and basis records. Complete Form 8949 first for transaction details.

Preparation

- Categorize: Short-term (Part I) or long-term (Part II).

- Basis: Use FIFO default unless specified; adjust for wash sales.

- QOF Check: Answer Page 1 question; attach Form 8997 if yes.

Part I: Short-Term Capital Gains and Losses (Lines 1-7)

- Line 1a/1b: Totals from Form 8949 (short-term, basis reported/not reported to IRS).

- Lines 2-5: Gains/losses from Forms 6252 (installment), 4684 (casualty), 6781 (straddles), 8824 (like-kind exchanges).

- Line 6: 2024 short-term carryover (from worksheet).

- Line 7: Net short-term (combine; if loss >$3K, carry forward).

Example: $5K short-term gain (Line 1b) – $2K loss (Line 3) + $1K carryover (Line 6) = $4K net (Line 7).

Part II: Long-Term Capital Gains and Losses (Lines 8-15)

- Line 8a/8b: Form 8949 long-term totals.

- Lines 9-13: From Forms 2439, 6252, 4684, 6781, 8824, and K-1s.

- Line 14: 2024 long-term carryover.

- Line 15: Net long-term.

Part III: Summary (Lines 16-25)

- Line 16: Combine Parts I/II.

- Line 21: If eligible for Qualified Dividends Worksheet (Form 1040 instructions), skip tax lines; else, use Schedule D Tax Worksheet.

- Line 22: Enter on Form 1040, Line 7.

- Lines 23-25: If net loss, deduct up to $3K ($1.5K MFS); carryover remainder.

Carryover Worksheet: In instructions; figures 2025 losses from 2024.

Filing Tips

- E-File: Via IRS Free File or software; validates entries.

- Deadlines: April 15, 2026; extend to October 15 via Form 4868 (pay estimates).

- Records: Keep 3+ years (1099s, basis docs).

Common Mistakes to Avoid on Schedule D

Audits spike on mismatched 1099s—here’s how to dodge:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Wrong Holding Period | Misclassifying short/long-term | Check acquisition date; >1 year = long-term. |

| Basis Errors | Forgetting adjustments (e.g., wash sales) | Use broker statements; recalculate per Pub. 550. |

| Omitting Carryovers | Skipping 2024 worksheet | Use instructions; enter on Lines 6/14. |

| Crypto Oversight | No 1099-DA reporting | Treat as property; detail on Form 8949. |

| Line 21 Misuse | Wrong worksheet post-correction | Use Qualified Dividends if eligible; see March 2025 fix. |

Why File Schedule D Correctly? Real-World Impact for 2025

A single filer with $50K long-term gain and $40K income pays 0% on $8,350 ($48,350 threshold – $40K), then 15% on the rest—saving ~$7,500 vs. ordinary rates. With 2025 brackets up 2.8%, more gains qualify for 0/15%, per Kiplinger analysis. Harvest losses to offset; carryovers shield future years.

Final Thoughts: Optimize Your 2025 Capital Gains with Schedule D

IRS Schedule D transforms investment activity into tax efficiency, especially with 2025’s higher brackets and crypto rules. Master Form 8949 details, apply carryovers, and use the right worksheet to minimize liability.

Download the draft from IRS.gov and consult a tax pro for complex sales. For more, see Pub. 550 or our Form 8949 guide. Questions on “capital loss carryover 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your situation.