Table of Contents

IRS Form 1042 – Annual Withholding Tax Return for U.S. Source Income of Foreign Persons – In an increasingly global economy, U.S. businesses and organizations often make payments to foreign persons, such as nonresident aliens, foreign corporations, and trusts. These payments can trigger withholding tax obligations under U.S. tax law. Enter IRS Form 1042, the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This essential form ensures compliance with chapters 3 and 4 of the Internal Revenue Code, including FATCA (Foreign Account Tax Compliance Act) requirements.

If you’re a withholding agent—whether a U.S. company paying royalties to a foreign entity or a financial institution handling dividends for nonresidents—filing Form 1042 correctly is crucial to avoid penalties. In this comprehensive guide, we’ll break down everything you need to know about Form 1042 instructions, who must file, deadlines, and best practices. Updated for the 2025 filing season (covering 2024 tax year returns), this article draws from official IRS resources to help you navigate the process seamlessly.

What Is IRS Form 1042?

IRS Form 1042 is an annual tax return used by withholding agents to report taxes withheld on certain U.S.-source income paid to foreign persons. It covers withholdings under chapter 3 (nonresident alien withholding), chapter 4 (FATCA withholdings on withholdable payments), and other specific provisions like section 5000C for federal procurement payments.

The form serves as a reconciliation tool, summarizing total withholdings, deposits, and adjustments for the calendar year. It’s not just about reporting withheld amounts—it’s a key mechanism for the IRS to track compliance with international tax treaties and prevent tax evasion. For instance, it includes taxes on fixed, determinable, annual, or periodical (FDAP) income like interest, dividends, and rents paid to foreign recipients.

Foreign persons include nonresident aliens, foreign partnerships, corporations, estates, and trusts. U.S.-source income encompasses earnings effectively connected with a U.S. trade or business or sourced from U.S. real property. Failing to withhold at the statutory 30% rate (or reduced treaty rate) can lead to personal liability for the agent.

Who Must File Form 1042?

Not every payer of U.S. income to foreigners needs to file Form 1042, but most withholding agents do. A withholding agent is any U.S. or foreign person (including individuals, corporations, partnerships, trusts, or estates) that has control, receipt, custody, disposal, or payment of income subject to withholding.

You must file Form 1042 if:

- You’re required to file Form 1042-S (more on this below) for chapter 3 or 4 purposes, even if no tax was withheld.

- You withheld tax under chapter 3 on FDAP income to foreign persons.

- You made withholdable payments under chapter 4 (FATCA), such as to non-participating foreign financial institutions (FFIs).

- You’re a publicly traded partnership (PTP) or nominee withholding under section 1446 on effectively connected taxable income (ECTI).

- You paid specified federal procurement payments to foreign persons under section 5000C.

- You distributed eligible deferred compensation to covered expatriates under section 877A.

- You’re a qualified intermediary (QI), withholding partnership (WP), or withholding trust (WT) claiming a collective refund.

Exceptions are rare but include certain foreign withholding agents exempt from electronic filing in 2025. Intermediaries like nonqualified intermediaries (NQIs) or custodians also qualify as agents. Remember: Even if you didn’t withhold tax due to a treaty exemption, reporting is often still required.

What Does Form 1042 Report?

Form 1042 captures a snapshot of your withholding activities. Key reporting elements include:

- Tax Withheld Under Chapter 3: Amounts on FDAP income (e.g., royalties, pensions) at 30% or treaty rates.

- Chapter 4 Withholdings: FATCA taxes on payments to recalcitrant account holders or passive NFFEs.

- Section 5000C Taxes: 2% withholding on payments to foreign contractors for U.S. government contracts.

- Section 1445/1446 Distributions: From REITs, PTPs, or on U.S. real property sales.

- Reconciliations: Total gross income reported on Form 1042-S, deposits made via EFTPS, over/underwithholding adjustments, and refunds claimed.

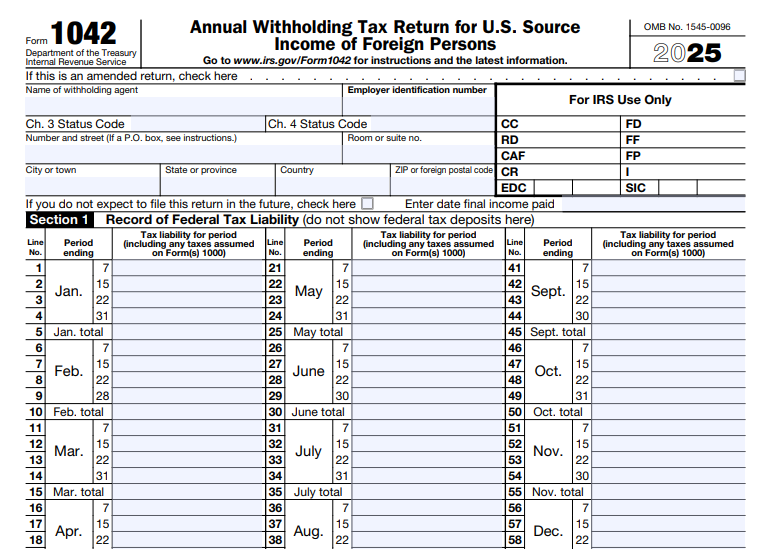

The form has two main sections:

- Record of Federal Tax Liability (lines 1–64): Quarterly breakdowns of liabilities and deposits.

- Annual Return (lines 65–71): Totals, variances, and refund requests.

For 2024 returns (filed in 2025), ensure you designate chapter-specific taxes accurately on lines 64b–64d to avoid reconciliation errors.

Related Forms: Form 1042-S and Form 1042-T

Form 1042 doesn’t stand alone—it’s part of a trio of reporting forms.

- Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding: This details payments to each recipient, income type, withholding amounts, and exemptions. File one per recipient, income type, and tax rate. It’s due March 15 (or extended) and must be provided to recipients by the same date.

- Form 1042-T, Annual Summary and Transmittal of Forms 1042-S: Use this only for paper submissions of Form 1042-S; one per income type. Electronic filers skip it.

These forms interconnect: Totals from Form 1042-S feed into Form 1042’s reconciliation. Always cross-check to ensure accuracy.

Filing Deadlines and Extensions for Form 1042

Timely filing is non-negotiable. For calendar year 2024:

- Due Date: March 17, 2025 (the next business day after March 15, as March 15 falls on a Saturday).

- Extensions: File Form 7004 by the original due date for an automatic 6-month extension to September 15, 2025. Note: This extends filing, not payment—deposits are due quarterly.

- Form 1042-S Deadline: March 15, 2025 (extendable via Form 8809).

Late filings trigger penalties, so mark your calendar. Use the IRS’s Interactive Tax Assistant for deadline confirmations.

IRS Form 1042 Download and printable

Download and print: IRS Form 1042

How to File IRS Form 1042: Electronic vs. Paper Options

The IRS encourages electronic filing for efficiency, but options vary.

- Electronic Filing (MeF): Mandatory for financial institutions, those filing 10+ information returns, or partnerships with >100 partners. Use Modernized e-File (MeF) via approved software. Foreign withholding agents (including FFIs) get an administrative exemption for 2025 filings per Notice 2024-26—no waiver needed.

- Paper Filing: Allowed for exempt entities. Mail to: Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409. Include Form 1042-T if transmitting paper 1042-S forms.

Deposits must be made electronically via EFTPS quarterly (by the 15th of the month following the quarter). For refunds, attach proof of overwithholding.

Reconciliation Procedures and Adjustments on Form 1042

Reconciliation ensures your reported withholdings match deposits and Forms 1042-S. Key steps:

- Section 1: Record quarterly tax liabilities (lines 1–60) and total them (line 64a). Designate chapter taxes separately.

- Section 2: Reconcile U.S.-source FDAP income, explaining variances (line 5).

- Adjustments: Report overwithholding repayments on line 59 and claim credits on line 71. For underwithholding, increase future deposits. Escrow arrangements defer reporting until resolution.

Proposed regulations allow partnerships and trusts to withhold/report in a subsequent year for prior-year income, easing administrative burdens.

Penalties for Late or Incorrect Form 1042 Filings

Non-compliance is costly. Common penalties include:

- Late Filing: 5% of unpaid tax per month (up to 25%).

- Late Payment: 0.5% per month (up to 25%).

- Failure to Deposit: 2–10% based on lateness.

- Negligence/Fraud: 20–75% of underpayment, plus interest at the section 6621 rate.

Reasonable cause (e.g., natural disasters) may waive penalties. Withholding agents are personally liable, so accuracy matters.

Common Mistakes to Avoid When Filing Form 1042

Steer clear of these pitfalls, straight from IRS guidance:

- Omitting withholding agent details (name, EIN, chapter status codes).

- Misclassifying chapter 3 vs. 4 taxes.

- Failing to reconcile Form 1042-S totals.

- Incorrect rounding (use whole dollars) or negative entries on liability lines.

- Forgetting adjustments for over/underwithholding or escrow amounts.

- Filing separate forms for multiple roles (e.g., QI and NQI).

Double-check against Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities.

Recent Updates for the 2025 Form 1042 Filing Season

For returns filed in 2025 (2024 tax year):

- Electronic Filing Exemption: Extended for foreign agents via Notice 2024-26.

- Section 871(m) Relief: Transition rules extended two more years (Notice 2024-44).

- Partnership Audit Regime: Centralized regime may require additional withholding on adjustments.

- Proposed Regs: Reliance allowed for FATCA/chapter 3 simplifications, like subsequent-year reporting.

Stay tuned to IRS.gov for final rules.

Final Thoughts: Stay Compliant with IRS Form 1042

Mastering IRS Form 1042 safeguards your organization from penalties while fulfilling U.S. tax obligations to foreign persons. Whether you’re new to withholding or refining your process, consult the official 2025 Instructions for Form 1042 and Publication 515.

Need help? Use the IRS withholding calculator or consult a tax professional. For the latest forms and pubs, visit IRS.gov/Form1042. File on time, report accurately, and keep your international payments compliant.

This article is for informational purposes only and not tax advice. Always refer to official IRS sources for your situation.