Table of Contents

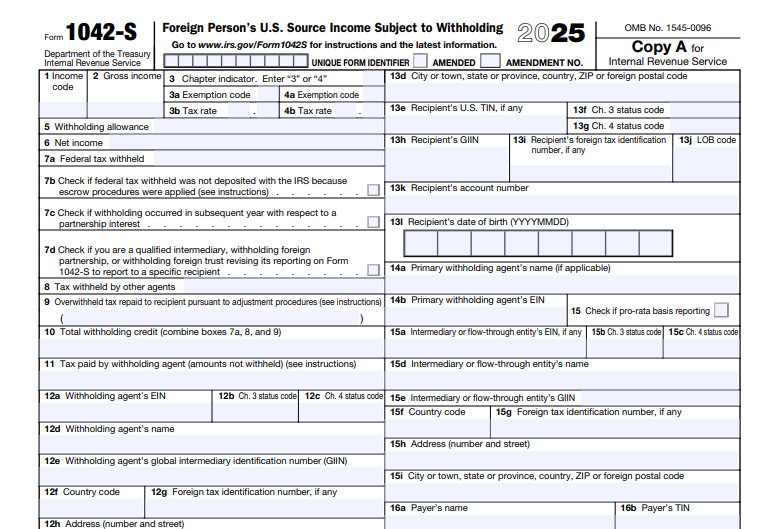

IRS Form 1042-S – Foreign Person’s U.S. Source Income Subject to Withholding – In an era of global business and cross-border investments, U.S. withholding agents must accurately report payments to foreign recipients to comply with chapters 3 and 4 of the Internal Revenue Code (FATCA). IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, is the cornerstone for documenting fixed, determinable, annual, or periodical (FDAP) income like dividends, interest, royalties, and scholarships paid to nonresident aliens, foreign corporations, partnerships, and trusts. For the 2025 tax year, the IRS has introduced key updates, including a new Box 7d for revisions, optional income codes 59–61, and a fax-based extension process via Form 15397—aimed at easing compliance while enforcing stricter e-filing for 10+ forms.

This SEO-optimized guide, sourced from the official 2025 Instructions for Form 1042-S (Rev. December 2024) and related IRS publications, demystifies the form: its purpose, who files, step-by-step completion, deadlines, and penalty avoidance. With penalties escalating to $340 per form (up to $630 for intentional disregard) and e-filing mandates tightening, withholding agents— from banks to universities—can’t afford errors. Download the 2025 form from IRS.gov and prepare for March 16, 2026, filing to safeguard compliance and support foreign recipients’ tax credits.

What Is IRS Form 1042-S?

Form 1042-S reports U.S.-source income paid to foreign persons subject to 30% chapter 3 withholding (or reduced treaty rates), plus chapter 4 (FATCA) withholdings on withholdable payments like U.S. equities or derivatives. It’s an informational return filed by withholding agents (U.S. or foreign entities paying U.S.-source FDAP) to the IRS, with copies to recipients for their Form 1040-NR or 1120-F filings.

The form details:

- Income type (Box 1 codes, e.g., 06 for dividends).

- Gross income (Box 2), withheld tax (Box 7a), and exemptions (Boxes 3a/4a).

- Recipient status (e.g., chapter 3: individual vs. corporation).

For 2025, enhancements include Box 7d (checkbox for rate pool revisions to specific recipients) and new optional income codes: 59 (consent fees), 60 (loan syndication fees), 61 (settlement payments). It also allows “US” as a country code in Boxes 12f/13b, reflecting domestic foreign persons. Reliance on proposed regulations (REG-132881-17) continues for burden reduction, like subsequent-year withholding.

Key Fact: Over 10 million 1042-S forms are filed annually; accurate reporting prevents double taxation via foreign tax credits and supports FATCA compliance.

Who Must File Form 1042-S?

Every withholding agent—defined as any U.S. or foreign person (e.g., employer, broker, university) who pays U.S.-source income subject to withholding—must file a Form 1042-S for each foreign recipient, even if no tax was withheld due to exemptions or treaties. This includes:

- Financial Institutions: Banks, investment firms reporting FDAP like interest (code 01) or dividends (06).

- Employers/Universities: For wages (code 18) or scholarships (16) to nonresident aliens.

- Partnerships/Trusts: QIs, WPs, WTs reporting pooled payments; QDDs for derivatives under extended phase-in (Notice 2024-44).

Threshold: Any reportable payment, regardless of amount—no de minimis rule.

Exceptions:

- U.S. citizens/residents: Use Form W-2/1099.

- Non-reportable income (e.g., foreign-source).

- Joint owners: One form unless separate requested.

E-filing required for 10+ forms (or partnerships >100 partners); financial institutions always e-file via FIRE system. Foreign agents get 2025 relief from e-filing (Notice 2024-26).

Step-by-Step Guide: How to Complete IRS Form 1042-S for 2025

Use the 2025 form (Rev. Dec. 2024) from IRS.gov; e-file via FIRE or software like Tax1099 for validation. Assign a unique 10-digit identifier (not TIN/FTIN) for each form. Gather W-8 forms for status/exemptions.

1. Header and Identification

- Unique Form Identifier: 10-digit numeric (e.g., for amendments).

- Amended: Check if correcting; enter amendment number.

- Withholding Agent (Boxes 12a–12g): Name, GIIN (if FFI), address, EIN/GIIN, chapter indicator (3/4), status code (e.g., new 41 for U.S. gov/tax-exempt).

2. Recipient Information (Boxes 13a–13e)

- Name/Country Code: Full name; “US” now valid for foreign addresses in U.S.

- TIN/FTIN: Recipient’s U.S. TIN or foreign equivalent; GIIN if FFI.

- Address: Foreign mailing address.

3. Income and Withholding Details (Boxes 1–10)

- Box 1 (Income Code): E.g., 37 for public trading; new optional 59–61.

- Box 2 (Gross Income): Total paid.

- Box 3 (Chapter 3 Exemption Code): E.g., 02 (treaty); required if <30% withheld (mandatory 2026).

- Box 4 (Chapter 4): Exemption/status codes.

- Box 5 (Withholding Allowance): Treaty-based.

- Box 6 (Net Income): Gross minus allowance.

- Box 7a (Federal Tax Withheld): Chapter 3 amount.

- Box 7b (Check if Withheld by QI/WP/WT): For pooled reporting.

- Box 7c (Tax Assumed by Withholding Agent): If payer covered.

- Box 7d: New checkbox for rate pool revisions to specific recipient.

- Box 8–10: Overwithheld repaid, exemptions from reporting.

4. Primary Withholding Agent (Boxes 11–14) & Sign (Box 15)

- Detail if different from filer.

- Sign as responsible party.

Pro Tip: For QDDs, report notional principal separately; use Pub. 515 for codes.

Deadlines and How to File Form 1042-S for 2025

For 2025 payments (filed in 2026):

- Furnish to Recipients (Copy B): March 16, 2026 (Monday; electronic if consented).

- File with IRS (Copy A + Form 1042-T if paper): March 16, 2026 (e-file for 10+; paper <10).

- Form 1042 Reconciliation: June 15, 2026 (with deposits via Form 1042).

Methods:

- E-File: FIRE system (mandatory for financial institutions/10+ forms); test files by Feb. 2026.

- Paper: With Form 1042-T to IRS, Austin, TX; limited to <10.

- Extensions: Automatic 30 days via Form 8809 (file by March 16); additional via Form 15397 fax for furnishing.

Common Mistakes to Avoid When Filing Form 1042-S

Noncompliance costs average $340 per form in 2025—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Missing/Incorrect Codes (Boxes 1/3/4) | Overlooking new optional codes or exemptions. | Use Pub. 515; validate W-8 for treaties (e.g., code 02). | $60–$340/form; up to $630 intentional. |

| TIN/GIIN Errors | No FTIN collection. | Request via W-8; use “XXXXXX0000” if unavailable. | $310/recipient statement. |

| Underwithholding/Non-Deposit | Ignoring 30% rate or FATCA. | Deposit quarterly via EFTPS; reconcile on Form 1042. | 2–15% of unpaid tax + $340/form. |

| Late Furnishing | Missing March 16 deadline. | E-deliver with consent; fax Form 15397 for 30 days. | $310/statement. |

| No Unique ID | Reusing numbers for amendments. | Assign 10-digit numeric per form. | Rejection; refiling costs. |

| E-Filing Waiver Oversight | Filing paper >10 forms. | Apply for waiver if hardship; foreign agents exempt 2025. | $340/form. |

Amend with “AMENDED” checked; respond to IRS notices promptly.

IRS Form 1042-S Download and Printable

Download and Print: IRS Form 1042-S

2025 Updates and Special Considerations for Form 1042-S

The 2025 instructions (Rev. Dec. 2024) introduce:

- Box 7d: Checkbox for QI/WP/WT rate pool revisions to individuals.

- New Codes: Chapter 3 status 41 (U.S. gov/tax-exempt); optional income 59–61 (2026 mandatory).

- Extensions: Form 15397 fax for 30-day furnishing relief.

- E-Filing: Threshold 10+ forms; foreign agents exempt through 2025 (Notice 2024-26).

- Section 871(m): Phase-in extended to 2025 for QDDs (Notice 2024-44).

- Reliance: On proposed regs for FATCA/chapter 3 burdens.

For derivatives, report notional separately; monitor Rev. Proc. 2023-36 for elections.

Final Thoughts: Streamline Compliance with Form 1042-S in 2025

IRS Form 1042-S is vital for transparent U.S. withholding on foreign income, preventing penalties while enabling credits for recipients. For 2025, embrace updates like Box 7d and e-filing to navigate FATCA seamlessly—file by March 16, 2026, via FIRE for efficiency. Withholding agents: Validate W-8s early; consult Pub. 515 for codes.

For complex FATCA setups, partner with a tax expert. This guide is informational; always reference IRS.gov.

Not tax advice. Verify with official sources.

FAQs About IRS Form 1042-S

Who must file Form 1042-S in 2025?

Withholding agents paying U.S.-source FDAP to foreign persons, even if no withholding.

What is the 2025 filing deadline for Form 1042-S?

March 16, 2026 (e-file/paper); furnish to recipients same date.

What are the penalties for late 2025 Form 1042-S filing?

$60–$340 per form; up to $630 intentional or 10% of unreported tax.

Is e-filing required for 2025 Form 1042-S?

Yes, for 10+ forms or financial institutions; foreign agents exempt.