Table of Contents

IRS Form 1065 – U.S. Return of Partnership Income – If you’re a partner in a business partnership or managing an LLC taxed as one, understanding IRS Form 1065 is essential for staying compliant with U.S. tax laws. As the primary information return for partnerships, Form 1065 ensures that income, deductions, and credits flow through to individual partners without the entity itself paying taxes. With tax season approaching for the 2024 tax year (filed in 2025), this guide breaks down everything you need to know about Form 1065—from eligibility and deadlines to filing tips and recent updates. Whether you’re a first-time filer or refining your process, we’ll cover how to navigate this form efficiently to avoid penalties and maximize deductions.

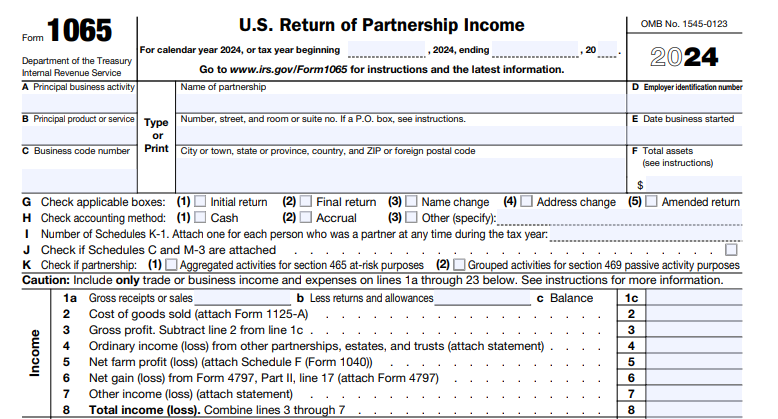

What Is IRS Form 1065?

IRS Form 1065, officially titled the U.S. Return of Partnership Income, is an informational tax return used by domestic and certain foreign partnerships to report their financial activities for the tax year. Unlike corporations, partnerships are pass-through entities, meaning they don’t pay federal income taxes at the business level. Instead, profits, losses, deductions, and credits are allocated to partners, who report them on their personal tax returns (e.g., Form 1040).

The form captures a partnership’s total income from sources like gross receipts, interest, royalties, and capital gains, minus deductions such as salaries, rent, and depreciation. Key to this process is Schedule K-1 (Form 1065), which details each partner’s share and must be distributed to them by the filing deadline. This pass-through mechanism helps prevent double taxation while ensuring transparency for the IRS.

For tax year 2024 (filed in 2025), Form 1065 applies to calendar-year partnerships ending December 31, 2024, or fiscal-year partnerships with years beginning or ending in 2024–2025. Short tax years may require adjustments if the 2025-specific form isn’t available yet.

Who Must File IRS Form 1065?

Not every business entity files Form 1065—it’s reserved for partnerships under U.S. tax rules. Here’s a breakdown of who qualifies:

- Domestic Partnerships: Any unincorporated organization with two or more members, including multi-member LLCs taxed as partnerships (default classification unless elected otherwise via Form 8832).

- Foreign Partnerships: Those with effectively connected income or U.S.-source income, unless exceptions apply (e.g., $20,000 or less in U.S.-source income with less than 1% U.S. partners and no withholding).

- Qualified Domestic Trusts (QDDs): Required regardless of income.

- Religious Organizations Under Section 501(d): Treated as partnerships for reporting dividends.

Exceptions:

- Partnerships with no income or expenditures during the year.

- Qualified Joint Ventures (QJVs) between spouses filing jointly—report on Schedule C or E/F of Form 1040.

- Terminating partnerships must file a final return on the wind-up date.

If your entity elects corporate status, you’ll file Form 1120 instead. Always confirm classification with a tax professional, as misclassification can trigger audits.

Key Components of Form 1065: Schedules and Line Items

Form 1065 is comprehensive, spanning multiple pages and schedules. Here’s an overview of the essentials:

Main Form (Page 1)

This section reports overall partnership income and deductions:

- Lines 1–8: Gross receipts, cost of goods sold (via Schedule A or Form 1125-A), interest, royalties, capital gains (Schedule D), farm profit (Schedule F), and other income.

- Lines 9–21: Deductions like salaries, guaranteed payments, repairs, bad debts, rent, taxes, interest (subject to Section 163(j) limits), depreciation (Form 4562), and amortization.

- Line 22: Ordinary business income (or loss)—the starting point for pass-through items.

- Additional lines cover look-back interest, BBA adjustments, and elective payments for credits.

Critical Schedules

- Schedule K-1 (Form 1065): The cornerstone—issues one per partner (or two for estates/trusts). Reports shares of ordinary income (Box 1), rental income (Boxes 2–3), interest/dividends (Boxes 5–6), capital gains (Boxes 8–9), Section 1231 gains (Box 9), and other items (Box 10 with codes A–ZZ for specifics like portfolio income or foreign transactions). Partners use this for their returns.

- Schedule K: Aggregates all K-1 data for the partnership.

- Schedule M-3: Required for partnerships with $10 million+ in assets; reconciles book income to tax income.

- Schedules K-2 and K-3: For international tax items (e.g., foreign gross income, credits). Expanded exceptions for 2024 filers simplify reporting for smaller entities.

- Schedule D: Capital gains/losses from Form 8949.

- Schedule B: Partner details, foreign status, elections (e.g., Section 754 basis adjustments), and BBA audit opt-outs.

Other schedules include A (COGS), C (portfolio income), E (depreciation), F (farming), G (foreign info), and H (Section 179 expense).

For a full line-by-line walkthrough, refer to the official 2024 Instructions for Form 1065.

Filing Deadlines and Extensions for Form 1065 in 2025

Timing is critical to avoid penalties. For calendar-year partnerships:

- Due Date: March 17, 2025 (adjusted from March 15 due to weekend/holiday).

- Fiscal-Year Partnerships: The 15th day of the third month after year-end.

Extensions: File Form 7004 by the original due date for an automatic six-month extension (to September 15, 2025, for calendar years). Note: This extends filing, not payment of any owed taxes (though partnerships rarely owe entity-level tax).

Late Schedules K-1 to partners? Due by the Form 1065 deadline—no separate extension.

IRS Form 1065 Download and Printable

Download and Print: IRS Form 1065

How to File IRS Form 1065: Electronic vs. Paper

The IRS strongly encourages electronic filing for efficiency and accuracy. Key requirements for 2025:

- Mandatory E-Filing: If your partnership files 10+ returns annually (e.g., Forms 1099) or has more than 100 partners, e-file Form 1065 and K-1s via Modernized e-File (MeF).

- Exemptions: Hardship waivers (Form 8508), religious exemptions (Notice 2024-18), or bankruptcy cases.

- Where to File:

- Paper: Kansas City, MO (under $10M assets, no M-3) or Ogden, UT (larger or with M-3).

- Foreign addresses: Ogden P.O. Box.

- Software and Assistance: Use IRS-approved e-file providers or tax software like TurboTax Business. Preparers need a PTIN.

Amended returns? Use Form 1065-X (revised October 2025 for post-2024 years) or mark “Amended” on the original with an explanation.

Recent Changes to IRS Form 1065 for 2025

The IRS continually refines Form 1065 to align with tax law evolution. Key updates for tax year 2024 (filed in 2025):

- Schedules K-2/K-3 Exceptions Expanded: New relief for smaller partnerships, reducing international reporting burdens (effective June 4, 2025).

- Schedule K-1 Instructions Corrections: Updates to Box 15 codes and distribution reporting (June 5, 2025, and January 23, 2025).

- E-File Enhancements: New Modernized e-File Assurance Testing System (ATS) for TY 2025, with schema updates through November 2025.

- Form 1065-X Revision: October 2025 version for amended returns post-2024.

- General Relief: Easier M-3 filing for under $50M asset partnerships; emphasis on clean energy credits and corporate alternative minimum tax (CAMT) elections.

Stay current via IRS.gov’s post-release changes page.

Common Mistakes, Penalties, and How to Avoid Them

Errors on Form 1065 can lead to audits, delays, or fines. Watch for:

- Incomplete K-1s or late partner distributions.

- Incorrect accounting methods (e.g., cash vs. accrual; changes require Form 3115).

- Overlooking foreign reporting or BBA audit elections.

Penalties:

- Late filing: $245 per month per partner (max 12 months).

- Failure to furnish K-1: $330 per schedule (max $3.987 million).

- Intentional disregard: Doubled penalties, plus trust fund recovery.

Pro Tips:

- Use whole-dollar rounding and retain records for 3+ years.

- Attach statements for elections (e.g., Section 754) and complex items.

- Double-check NAICS codes for principal business activity.

- Consult a CPA for at-risk (Section 465), passive activity (Section 469), or NIIT (Section 1411) rules.

- Leverage free IRS resources like the Interactive Tax Assistant.

Conclusion: Streamline Your Partnership Tax Compliance Today

Filing IRS Form 1065 doesn’t have to be overwhelming—it’s your gateway to accurate pass-through taxation and compliance. By understanding its purpose, gathering required data early, and embracing e-filing, you can minimize errors and focus on growing your partnership. For the 2025 filing season, prioritize the latest instructions and updates to handle any nuances like international exceptions or credit elections.

Ready to get started? Download Form 1065 and instructions from IRS.gov, or partner with a tax expert. Proper filing not only avoids penalties but also positions your business for deductions and credits that boost bottom lines. If you have questions, the IRS Small Business and Self-Employed Tax Center is a great next stop.

This article is for informational purposes only and not tax advice. Consult a qualified professional for your specific situation.