Table of Contents

IRS Form 1065-X – Amended Return or Administrative Adjustment Request (AAR) – In the complex world of partnership taxation, errors happen. Whether it’s a misreported income figure or an overlooked deduction, correcting your partnership’s tax return is essential to avoid penalties, interest, and compliance issues. Enter IRS Form 1065-X, the official tool for filing an amended return or an Administrative Adjustment Request (AAR). As of 2025, this form remains a cornerstone for partnerships and Real Estate Mortgage Investment Conduits (REMICs) seeking to rectify past filings under the Bipartisan Budget Act (BBA) regime.

This guide breaks down everything you need to know about Form 1065-X, from its purpose and eligibility to step-by-step filing instructions. Drawing from the latest IRS resources, including the October 2025 revision of the form and instructions, we’ll help you navigate this process efficiently. If you’re a partnership representative (PR), designated individual (DI), or tax professional, read on to ensure compliance and minimize risks.

What Is IRS Form 1065-X?

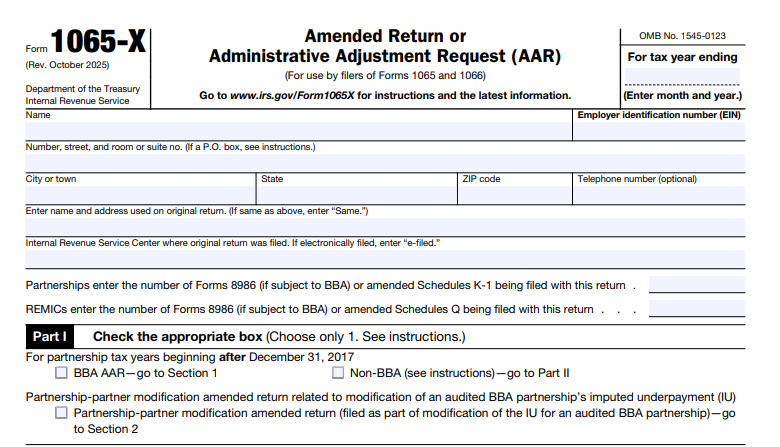

IRS Form 1065-X, titled “Amended Return or Administrative Adjustment Request (AAR),” is used by partnerships filing Form 1065 (U.S. Return of Partnership Income) and REMICs filing Form 1066 (U.S. Real Estate Mortgage Investment Conduit Income Tax Return). Its primary purpose is to correct errors or omissions on previously filed returns or to request adjustments under the centralized partnership audit regime introduced by the BBA of 2015.

Key uses include:

- Correcting items like ordinary business income, capital gains, deductions, or credits reported on the original return.

- Filing an AAR for BBA-applicable partnerships to adjust partnership-related items (PRIs) without triggering an audit.

- Handling modifications to an imputed underpayment (IU) from a prior BBA audit.

The form cannot be used for notices of inconsistent treatment (use Form 8082 instead) or initial filings. For tax years beginning after December 31, 2024, use the October 2025 revision of Form 1065-X. Earlier years (post-2022 but before 2025) require the August 2023 version.

Form 1065-X is available as a fillable PDF on the IRS website, but electronic filing is often mandatory if your original return was e-filed. Paper filing is allowed via the form, with attachments like supporting schedules and statements.

Amended Return vs. AAR: Key Differences for Partnerships

One common confusion with Form 1065-X is distinguishing between an amended return and an AAR. These serve similar goals but apply under different rules, especially post-BBA.

Amended Returns

- For non-BBA partnerships: These are traditional corrections to prior Form 1065 or Form 1066 filings.

- Process: File amended Schedules K-1, K-2, and K-3 (marked “Amended”) and furnish them to partners or residual interest holders.

- No IU calculation: Adjustments flow directly to partners’ individual returns.

- Eligibility: Partnerships that elected out of BBA or for tax years before 2018.

Administrative Adjustment Requests (AAR)

- For BBA partnerships: Required for tax years beginning after December 31, 2017 (unless elected out). BBA partnerships cannot file traditional amended returns; they must use AARs to adjust PRIs.

- Process: Filed by the PR or DI. Compute any IU (a partnership-level tax on net adjustments). Options include paying the IU, electing a “push-out” to partners (via Form 8986), or applying modifications (Form 8980).

- No amended K-1s: Instead, furnish Forms 8985/8986 to reviewed-year partners.

- Impact: Adjustments not resulting in an IU are pushed out to partners; those creating an IU may incur interest and penalties at the partnership level.

In short, amended returns simplify corrections for smaller or opted-out entities, while AARs enforce centralized accountability under BBA. For REMICs, similar rules apply, but use Part III of the form and amended Schedules Q (non-BBA) or Forms 8986 (BBA).

Who Needs to File Form 1065-X?

Not every partnership error requires Form 1065-X. It’s essential if:

- You’re a partnership (filing Form 1065) or REMIC (filing Form 1066) that discovers inaccuracies post-filing.

- Your entity is BBA-applicable (most partnerships with 100+ partners must opt out to avoid it) and needs to adjust PRIs like income, deductions, or credits.

- You’re filing a partnership-partner modification related to a prior BBA audit’s IU.

- REMICs with multiple residual interest holders (non-elected out) seek refunds over $1 million (attach Form 8302).

Exemptions: Electing large partnerships (pre-BBA) or TEFRA entities (phased out). Always check if e-filing your original return triggers e-filing requirements here.

When and Where to File IRS Form 1065-X

Timing is critical to avoid late penalties.

Filing Deadlines

- General rule: Within 3 years of the later of:

- The date the original return was filed, or

- The due date of the original return (excluding extensions).

- BBA AAR specifics: Before the IRS mails a Notice of Administrative Proceeding (NAP) under section 6231, or within the modification period under section 6225(c).

- IU payments: Due with the AAR if applicable; interest accrues from the reviewed year’s due date.

File as soon as errors are identified to preempt audits.

IRS Form 1065-X Download and printable

Download and print: IRS Form 1065-X

Where to File

- Paper filings: Mail to the IRS service center where your original return was filed (e.g., Ogden, UT for most).

- E-filings: Use approved software; attach Form 8082 to a revised Form 1065 (check “Amended Return” box) for BBA AARs.

- Payments: Use EFTPS, Direct Pay, or check (payable to “United States Treasury”); specify “2025 Form 1065-X IU” or similar.

Step-by-Step Guide: How to Complete and File Form 1065-X

Completing Form 1065-X requires precision. Use tax software for accuracy, or consult a professional. Here’s a breakdown based on the October 2025 form.

Header and Basic Info

- Enter the tax year ending (MM/YYYY).

- Provide entity name, EIN, address, and phone.

- Note the original return details (name/address used, IRS center).

- Indicate number of Forms 8986 (BBA) or amended K-1s/Schedules Q.

Part I: Check the Appropriate Box

Choose one:

- BBA AAR: For post-2017 years. Answer items A-E on PR changes, IU results, push-out elections, and modifications.

- Non-BBA: Proceed to Part II.

- Partnership-partner modification: For IU adjustments from audits.

Sign as PR/DI (BBA) or authorized partner (non-BBA).

Part II: Amended or AAR Items for Partnerships (Form 1065 Filers)

Use columns for original amount (a), net change (b) (positive/negative), and correct amount (c = a + b). Lines cover:

- Income: Ordinary business (Line 1), rentals (2-3), interest (5), dividends (6a-c), royalties (7), capital gains (8-9), etc.

- Deductions: Section 179 (12), contributions (13a-b), investment interest (13c).

- Credits: Low-income housing (15a-b), other (15f).

- Other: Self-employment (14a), AMT items (17a-f), distributions (19a-b), foreign taxes (21).

Explain changes in Part V. For BBA, compute IU in Part IV; no K-1s needed.

Part III: Amended or AAR Items for REMICs (Form 1066 Filers)

Similar columns for item descriptions, with tax computations:

- Lines 6-8: Taxes on prohibited transactions, foreclosure, contributions.

- Line 9: Total tax.

- Lines 10-16: Payments, overpayments, balances due.

Part IV: Imputed Underpayment (IU)

- Line 1: Calculate IU (net adjustments × highest individual rate + credits).

- Line 2: Add interest/penalties.

- Line 3: Enter payment.

- Line 4: Balance due.

Group adjustments (e.g., recharacterizations, credits) and apply modifications if elected.

Part V: Explanation of Changes

Detail each adjustment: Line number, reason, computations, and partner allocations (box/code from K-1). Attach extra sheets if needed.

Attachments and Signing

- Required: Supporting docs, Form 8979 (PR change), Form 8980 (modifications), amended K-1s (non-BBA).

- Sign: Under penalties of perjury; include paid preparer section.

File electronically if mandated, or mail paper forms.

Common Mistakes to Avoid and Potential Penalties

Pitfalls include:

- Missing the 3-year deadline, leading to barred adjustments.

- Failing to furnish Forms 8986 to partners (BBA), triggering penalties.

- Incorrect IU calculations, resulting in underpayments.

- Not updating state returns (rules vary).

Penalties:

- Late payment: 0.5% per month (up to 25%) on unpaid tax.

- Interest: At section 6621 rates from due date.

- Accuracy-related: 20% for negligence/understatements (section 6662).

- BBA-specific: Partnership-level penalties on IUs, plus fraud (75%).

Recent Updates for Form 1065-X in 2025

The October 2025 revision removes outdated TEFRA/electing large partnership references and incorporates BBA amendments (sections 6221-6241). Key reminders:

- Section 174A: New rules for domestic R&E expenditures—deduct currently or amortize (see Rev. Proc. 2025-28 for elections).

- Item C2 (Part I): Added for BBA AARs to flag non-IU adjustments.

- No major developments beyond these; check IRS.gov/BBAAAR for ongoing guidance.

FAQs: IRS Form 1065-X

Can I e-file Form 1065-X?

Yes, if your original was e-filed; use revised Form 1065 + Form 8082 for BBA AARs.

What if my AAR results in no IU?

Push adjustments to partners via Form 8986; no payment required.

How do I handle international items?

Report on amended Schedules K-2/K-3 (non-BBA) or via AAR explanations.

Is Form 1065-B still relevant?

Phased out; use Form 1065-X for legacy corrections.

Conclusion: Stay Compliant with Form 1065-X

Mastering IRS Form 1065-X ensures your partnership avoids costly errors and maintains BBA compliance. Whether filing an amended return or AAR, accuracy and timeliness are key. For complex cases—like IU modifications or multi-state filings—consult a tax advisor.

Download the latest form and instructions at IRS.gov. Ready to amend? Start today to protect your bottom line.

This article is for informational purposes only and not tax advice. Always verify with the IRS or a professional.