Table of Contents

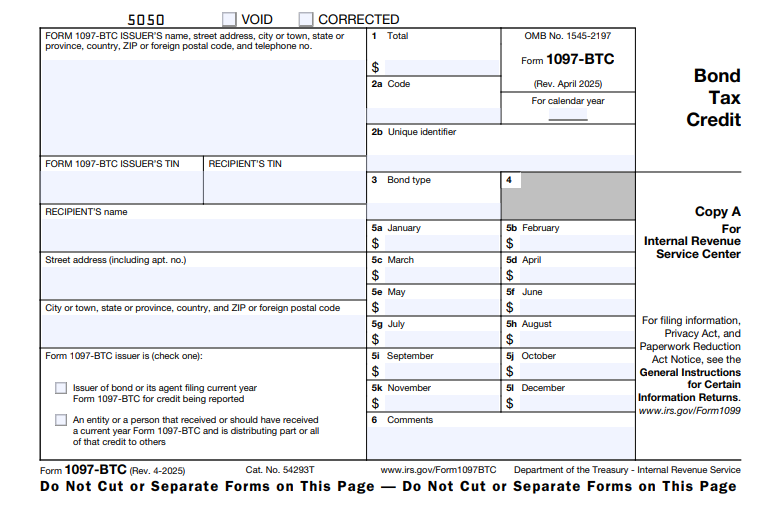

IRS Form 1097-BTC – Bond Tax Credit – Tax credit bonds have long been a tool for funding public infrastructure and renewable energy projects, offering investors direct credits against their federal tax liability instead of taxable interest. But with issuance authority for most types expired after 2017, ongoing compliance for outstanding bonds remains essential. IRS Form 1097-BTC—Bond Tax Credit—is the information return that reports these credits to the IRS and recipients, ensuring accurate claims on tax returns. For calendar year 2025, issuers must furnish quarterly statements and file annually by March 31, 2026, if e-filing, with penalties up to $330 per form for late submissions. This SEO-optimized guide, based on the April 2025 revision (Cat. No. 54293T), covers filing requirements, deadlines, and step-by-step instructions to help issuers, agents, and recipients navigate Form 1097-BTC efficiently.

What Is IRS Form 1097-BTC?

IRS Form 1097-BTC reports tax credits allowed to holders of specified tax credit bonds, enabling them to claim nonrefundable credits on Form 1040, 1120, or other returns under IRC Sections 54A through 54F. Issued by bond issuers (e.g., states, localities) or their agents (e.g., trustees), the form details quarterly credit allowances—typically 25% of the annual credit—based on the bond’s outstanding principal. It’s an information return, not a payment form, but failure to file triggers IRS matching and potential audits.

Key purposes:

- Credit Allocation: Tracks quarterly credits (March 15, June 15, September 15, December 15) for bonds held during allowance periods.

- Recipient Reporting: Provides data for claiming credits, reducing tax liability dollar-for-dollar.

- Intermediary Passthrough: Mutual funds, partnerships, or RICs use it to distribute credits to shareholders or partners.

The April 2025 revision introduces continuous use and online fillable PDFs due to low paper volume, per General Instructions for Certain Information Returns. Download the form and instructions from IRS.gov/Form1097BTC.

Who Needs to File IRS Form 1097-BTC in 2025?

Issuers of qualified tax credit bonds (or agents like bond trustees) must file for each recipient (e.g., bondholder) receiving $10+ in credits annually. Intermediaries (e.g., mutual funds, partnerships) file if redistributing credits received via Form 1097-BTC.

| Bond Type | Who Files | Notes |

|---|---|---|

| Qualified Tax Credit Bonds (e.g., energy conservation, zone academy) | Issuers/agents | Credits up to 100% of interest equivalent; quarterly reporting required. |

| Clean Renewable Energy Bonds | Issuers/agents | 25% quarterly credits; no new issuances post-2010. |

| Build America Bonds (Tax Credit) | Issuers/agents | 35% direct credit; outstanding from ARRA 2009-2010. |

| Intermediaries (RICs, Partnerships) | If passthrough | Report proportionate shares; use Box 6 for additional info. |

No filing for credits under $10 or non-qualifying bonds. Use EIN for issuers; validate recipient TINs via IRS matching.

Filing Deadlines and Extensions for Form 1097-BTC in 2025

Form 1097-BTC requires quarterly furnishing to recipients and annual IRS filing for 2025 credits. Credit allowance dates drive timing: March 15, June 15, September 15, December 15.

| Period | Furnish to Recipient | File with IRS |

|---|---|---|

| Q1 (Mar 15, 2025) | May 15, 2025 | Annual only (see below) |

| Q2 (Jun 15, 2025) | August 15, 2025 | Annual only |

| Q3 (Sep 15, 2025) | November 15, 2025 | Annual only |

| Q4/Annual (Dec 15, 2025) | February 16, 2026 | March 2, 2026 (paper) or March 31, 2026 (e-file) |

- E-Filing Threshold: Mandatory if 10+ info returns (aggregate with other 1099s); use FIRE system.

- Extensions: Automatic 30 days via Form 8809 (by original due); additional for hardship. No extension for recipient furnishing.

- Where to File: Paper with Form 1096 to IRS per Pub. 1220; e-file via approved software.

The annual form summarizes all quarters; corrections for prior quarters go on the annual statement.

Step-by-Step Guide to Completing IRS Form 1097-BTC

Use the April 2025 fillable PDF; calculate credits as 25% of annual rate times principal held on allowance date, prorated for partial periods.

- Issuer Info: Name, EIN, address, phone; check if issuer/agent or intermediary.

- Recipient Info: Name, address, TIN (truncate on Copy B); account/CUSIP number.

- Box 1: Total Credit – Annual cumulative credit (100% for full year).

- Box 2a: Bond Type – Code (e.g., 1 for qualified tax credit bond, 4 for Build America).

- Box 2b: Unique ID – CUSIP or other bond identifier.

- Boxes 3–4: Date of sale/maturity (if applicable).

- Boxes 5a–5l: Quarterly credits (e.g., Box 5a for March 15; enter 0.25 × annual for full quarter).

- Box 6: Additional Info – Explanations or intermediary passthrough details.

- Sign & Distribute: Officer signs Copy A; furnish Copy B quarterly (or annual summary).

For annual: Box 5l = Q4 credit; explain prior corrections in Box 6. E-file includes Form 1096 transmittal.

Key Boxes on IRS Form 1097-BTC Explained

The form’s structure supports quarterly tracking while annualizing for IRS filing.

| Box | Description | 2025 Tip |

|---|---|---|

| 1 | Total annual credit | Sum of quarterly allowances; claimable on Form 3800. |

| 2a | Bond type code | Select from 1–6; affects credit rate (e.g., 35% for BABs). |

| 5a–5l | Monthly/quarterly credits | Prorate for bonds issued/redeemed (e.g., 0.25 for full Q1). |

| 6 | Supplemental data | Use for passthrough shares or corrections. |

Recipients use Box 1 for credit claims; document holdings for audits.

E-Filing vs. Paper Filing for Form 1097-BTC in 2025

E-filing is required for 10+ returns and preferred for speed; paper allowed for fewer due to low volume.

- E-Filing: Via FIRE/IRIS; instant acknowledgment, error checks; deadline March 31, 2026.

- Paper: Black-and-white Copy A with Form 1096; mail by March 2, 2026; scannable red ink for Copy A.

- Threshold: Aggregates with other 1097/1099 forms.

Vendors like TaxZerone or Accountable offer bulk e-filing with TIN matching.

Common Mistakes When Filing Form 1097-BTC and How to Avoid Them

Compliance errors can delay credits—top issues for 2025:

- Proration Oversights: Not adjusting for partial quarters—use bond records for exact days held.

- Wrong Bond Codes: Misclassifying types—reference issuance docs for Box 2a.

- Missed Quarterly Furnishing: Late Copy B—automate reminders for May 15, etc.

- TIN Errors: Invalid recipient TINs—pre-validate via IRS system.

- Annual Summary Gaps: Omitting Q1–Q3 corrections—consolidate in Box 6.

Map CUSIPs to codes early; review with trustees.

Penalties for Late or Incorrect Form 1097-BTC Filings

Penalties under IRC §6721/6722 are tiered and inflation-adjusted for 2025:

| Violation | Penalty per Form | Annual Max (Small Business) |

|---|---|---|

| Within 30 Days Late | $60 | $239,000 |

| 31+ Days to Aug 1 | $130 | $683,000 |

| After Aug 1/No File | $340 | $1,366,000 |

| Intentional | $680 + 10% of credit | No max |

Waivers for reasonable cause; e-filing reduces errors by 90%.

IRS Form 1097-BTC Download and Printable

Download and Print: IRS Form 1097-BTC

Frequently Asked Questions About IRS Form 1097-BTC

Who receives Form 1097-BTC in 2025?

Bondholders or intermediaries claiming $10+ in credits; furnished quarterly, summarized annually.

Is e-filing required for all Form 1097-BTC?

Only if 10+ info returns; paper OK otherwise, but e-file extends deadline to March 31.

What bonds qualify for 2025 reporting?

Outstanding qualified tax credit bonds, clean renewable energy bonds, Build America (tax credit), etc.—no new issuances.

How do recipients claim the credit?

On Form 3800; use Box 1 total from annual statement.

What’s the penalty for missing the quarterly furnish?

Up to $340 per form if intentional; focus on timely Copy B delivery.

Visit IRS.gov/Form1097BTC for more.

Final Thoughts: Ensure Seamless Bond Tax Credit Compliance with Form 1097-BTC in 2025

IRS Form 1097-BTC sustains the legacy of tax credit bonds by facilitating direct credits for investors in green and public projects, even as new issuances wane. With 2025’s quarterly deadlines and e-file mandates for larger filers, proactive tracking of allowance dates and CUSIPs keeps you penalty-free. Download the April 2025 form from IRS.gov today and consider FIRE system training to streamline annual submissions.

Tax credits fuel innovation—report them right to unlock full value.

This article is informational only—not tax advice. Consult IRS.gov or a professional.