Table of Contents

IRS Form 1098-C – Contributions of Motor Vehicles, Boats, and Airplanes – Donating a car, boat, or airplane to charity is a generous act that can also yield significant tax benefits. But to claim those deductions properly, understanding IRS Form 1098-C is crucial. This form ensures transparency in vehicle donations and helps the IRS verify charitable contributions. In this comprehensive 2025 guide, we’ll break down everything from filing requirements to deduction rules, helping donors and charities navigate the process seamlessly.

Whether you’re a donor seeking a tax break or a nonprofit handling incoming vehicles, mastering Form 1098-C can maximize your impact while staying compliant. Let’s dive in.

What Is IRS Form 1098-C?

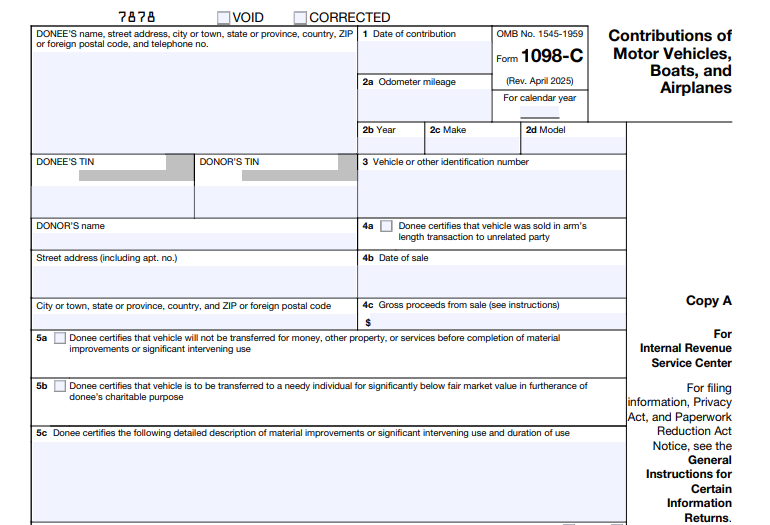

IRS Form 1098-C, titled “Contributions of Motor Vehicles, Boats, and Airplanes,” is an information return used by charitable organizations (donees) to report donations of qualified vehicles. It provides donors with the documentation needed to substantiate their charitable deduction on their tax return.

The form was last revised in April 2025, with no major structural changes from prior years, ensuring continuity for tax year 2024 filers preparing for 2025 returns. It’s part of the broader IRS framework under Section 170(f)(12) of the Internal Revenue Code, which tightened rules after the American Jobs Creation Act of 2004 to prevent overvaluation of donations.

Purpose of Form 1098-C

The primary goal of Form 1098-C is to create a “contemporaneous written acknowledgment” for donors, detailing the vehicle’s disposition—whether sold, used by the charity, or transferred to a needy individual. This prevents inflated deductions and promotes accurate reporting. For charities, it’s a safeguard against penalties for inaccurate acknowledgments.

Key benefits include:

- For Donors: Proof for claiming fair market value (FMV) or gross proceeds as a deduction.

- For Charities: Compliance tool to avoid fines under Section 6720.

Who Needs to File Form 1098-C?

Only donee organizations—qualified 501(c)(3) nonprofits—file Form 1098-C with the IRS. Donors do not file it but must attach Copy B to their Form 1040 when itemizing deductions.

Filing Requirements

- Mandatory for Claims Over $500: File a separate form for each qualified vehicle donation where the donor claims a value exceeding $500.

- Exceptions for $500 or Less: No IRS filing required; instead, check Box 7 and provide Copies B and C as acknowledgment without completing Boxes 4a–5c.

- Donor TIN Requirement: The donor must provide their Taxpayer Identification Number (TIN). If not, treat as ≤$500 and check Box 7.

Nonprofits like Habitat for Humanity or Ronald McDonald House routinely issue these forms for vehicle programs, emphasizing record-keeping for tax-deductible donations.

What Qualifies as a Vehicle for Form 1098-C?

Not every donated item counts. The IRS defines a “qualified vehicle” narrowly to target high-value assets prone to abuse:

- Motor Vehicles: Any car, truck, or similar manufactured primarily for public streets, roads, and highways (e.g., sedans, SUVs, motorcycles).

- Boats: Any watercraft, identified by hull number.

- Airplanes: Any aircraft, identified by its registration number.

Exclusions: Inventory held for sale (e.g., a car dealer’s stock) or non-motorized items like bicycles. Odometer readings apply only to motor vehicles; convert kilometers to miles if needed (multiply by 0.62137).

When Is Form 1098-C Required? Key Thresholds

Timing hinges on the claimed value and the charity’s plans for the vehicle:

| Scenario | Filing Threshold | Deduction Limit | Form Boxes to Complete |

|---|---|---|---|

| Sold in arm’s length transaction (no use/improvements) | >$500 claimed value | Gross proceeds from sale | 4a, 4b, 4c |

| Significant intervening use or material improvements | >$500 claimed value | FMV at donation | 5a, 5c |

| Transferred to needy individual below FMV | >$500 claimed value | FMV at donation | 5b |

| Goods/services provided to donor | Any value | FMV reduced by value of goods | 6a, 6b, 6c |

| ≤$500 claimed value or no TIN | No IRS filing | Up to $500 FMV | Box 7 only |

For 2024 and 2025 tax years, these rules remain unchanged, per IRS Publication 526.

IRS Form 1098-C Download and Printable

Download and Print: IRS Form 1098-C

How to Complete and File IRS Form 1098-C: Step-by-Step

Furnish Copy B to the donor and file Copy A with the IRS. Use e-filing via the IRS FIRE system for volumes over 10 forms.

Essential Boxes to Fill

- Box 1: Date of Contribution – Record the receipt date.

- Boxes 2a–2d: Vehicle Details – Odometer (miles only for cars), year, make, model.

- Box 3: Identification Number – VIN (17 chars for cars), hull ID (12 for boats), or aircraft ID (6 chars).

- Boxes 4a–4c: Sale Reporting – Check if sold unrelated party; include date and gross proceeds (no deductions for fees).

- Boxes 5a–5c: Use or Transfer – Detail plans for use (e.g., “10,000 miles of delivery service over 1 year”) or improvements (major repairs adding value).

- Boxes 6a–6c: Goods/Services – Disclose any exchange, valuing intangible benefits like religious services.

- Box 7: Low-Value or No TIN – For simplified acknowledgment.

Truncate the donor’s TIN on donor copies for privacy, but include full on IRS filings. Provide acknowledgment within 30 days of sale (Box 4a) or contribution (Boxes 5a/5b).

Deadlines for 2025

- To Donor: Within 30 days of vehicle disposition.

- To IRS: By February 28, 2026 (paper) or March 31, 2026 (electronic) for 2025 tax year.

Maximizing Your Vehicle Donation Tax Deduction in 2025

Vehicle donations offer itemized deductions, but the amount depends on the charity’s actions—not just the vehicle’s Kelley Blue Book value.

Deduction Rules

- General Rule (> $500): Deduct the smaller of gross proceeds from charity’s sale or FMV at donation. Attach Form 1098-C Copy B to your return.

- Exceptions for Full FMV:

- Charity makes significant intervening use (e.g., ongoing program transport).

- Performs material improvements (e.g., engine rebuild increasing value).

- Gives to a needy individual at substantially below FMV for charitable purposes (not auctions).

- For ≤ $500: Deduct FMV up to $500 without Form 1098-C, but keep records.

Per IRS Publication 526 (2024), these rules apply to cars, boats, and airplanes alike—no inventory donations qualify for special treatment. State deductions vary; check local laws.

Pro Tip: Use tools like TurboTax or H&R Block software to import Form 1098-C data for accurate filing.

Common Mistakes to Avoid and Penalties

- Error: Failing to provide timely acknowledgment—leads to donor deduction denial.

- Pitfall: Overstating use/improvements without documentation; IRS presumes false if sold within 6 months without proof.

- Oversight: Not truncating TINs on donor copies.

Penalties under Section 6720: Up to the larger of gross proceeds or 39.6% of claimed value for false acknowledgments. Nonprofits face additional fines for non-compliance.

FAQs: IRS Form 1098-C and Vehicle Donations

Do I need Form 1098-C for a boat or airplane donation?

Yes, if claimed >$500—same rules apply as cars.

Can I deduct towing fees for my vehicle donation?

No, but include them as separate travel expenses if qualified.

What if the charity doesn’t issue Form 1098-C?

Contact them immediately; without it, your >$500 deduction may be disallowed.

Are there 2025 changes to vehicle donation rules?

No major updates; rules stable from 2024.

Donating a vehicle isn’t just tax-smart—it’s transformative for nonprofits. Consult a tax professional for personalized advice, and always verify charity status via IRS Exempt Organizations Select Check. Ready to donate? Start with trusted programs and keep this guide handy for a smooth 2025 tax season.