Table of Contents

IRS Form 1098-MA – Mortgage Assistance Payments – If you’re a homeowner navigating financial challenges like job loss or reduced income, mortgage assistance programs can provide crucial relief. But when it comes to tax time, understanding how these payments impact your deductions is essential. Enter IRS Form 1098-MA, Mortgage Assistance Payments—a key document that helps ensure accurate reporting of assistance received through the Housing Finance Agency (HFA) Hardest Hit Fund. In this comprehensive guide, we’ll break down everything you need to know about Form 1098-MA for the 2025 tax year, including its purpose, how to use it for deductions, and filing tips. Whether you’re a filer or recipient, this article will help you stay compliant and maximize your tax benefits.

What Is IRS Form 1098-MA?

IRS Form 1098-MA is an information return used to report mortgage assistance payments made under the HFA Innovation Fund for the Hardest Hit Housing Markets (HFA Hardest Hit Fund). Established in response to the 2008 housing crisis, this program provides targeted aid to states hit hardest by foreclosures, helping eligible homeowners with mortgage payments, principal reductions, or other relief.

The form serves two primary functions:

- For the IRS: It reports payments to ensure proper tracking of government-funded assistance.

- For homeowners: It details the breakdown of total mortgage payments, distinguishing between funds you contributed and those covered by the program.

Unlike the more common Form 1098 (Mortgage Interest Statement), which reports interest paid directly to lenders, Form 1098-MA focuses specifically on HFA-funded aid. It’s not filed by individual homeowners but issued by state HFAs or their designees. As of 2025, the form remains unchanged from recent years, with no major updates announced by the IRS.

Key Fact: The HFA Hardest Hit Fund, administered by the U.S. Department of the Treasury, has distributed billions in aid since 2010, but its reporting requirements tie directly into your itemized deductions on Schedule A of Form 1040.

Who Needs to File Form 1098-MA?

Form 1098-MA is filed by state Housing Finance Agencies (HFAs) or authorized entities that receive and distribute HFA Hardest Hit Fund allocations. These include:

- State agencies overseeing the program in eligible states (e.g., California, Florida, Michigan).

- Third-party administrators or servicers acting on behalf of the HFA.

Homeowners do not file this form—it’s provided to you if you participated in a qualifying program during the tax year. Lenders may reference it alongside Form 1098 to avoid overreporting interest.

Filing is mandatory if any assistance payments were made, regardless of amount, to comply with IRS information return rules under the general instructions for Forms 1097, 1098, and 1099 series.

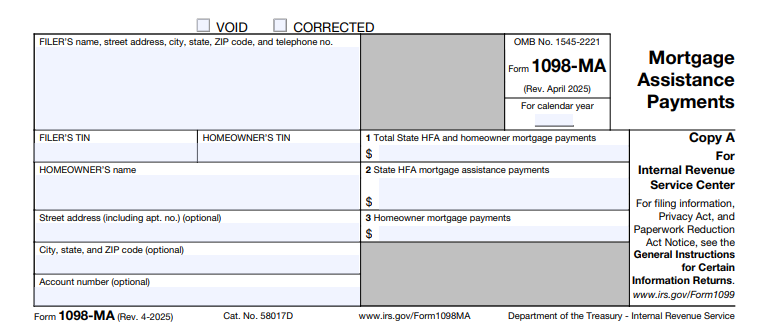

Understanding the Boxes on Form 1098-MA (2025 Revision)

The 2025 version of Form 1098-MA (Rev. April 2025) is straightforward, with just three main reporting boxes. Here’s what each means:

| Box | Description | What It Reports |

|---|---|---|

| Box 1 | Total Mortgage Assistance and Homeowner Payments | The combined total of State HFA assistance payments and your own mortgage contributions for the year. This helps reconcile with your Form 1098. |

| Box 2 | State HFA Mortgage Assistance Payments | The exact amount of program-funded aid applied to your mortgage (e.g., principal, interest, or escrow). This is non-taxable income but affects deductible interest. |

| Box 3 | Homeowner Mortgage Payments | The portion of mortgage payments you made out-of-pocket to the HFA, servicer, or HUD. Use this to calculate your actual deductible interest. |

Additional fields include:

- Homeowner’s Name and Address: Your details as the recipient.

- Homeowner’s TIN: Taxpayer Identification Number (SSN or ITIN), often masked for privacy (last four digits shown).

- Account Number: Optional, for internal tracking.

- State HFA’s Name, Address, and TIN: The filer’s information.

For a blank form, download it from the IRS website. Always cross-reference with your Form 1098 to avoid discrepancies.

IRS Form 1098-MA Download and Printable

Download and Print: IRS Form 1098-MA

How Does Form 1098-MA Affect Your Taxes?

Receiving Form 1098-MA doesn’t trigger taxable income from the assistance itself—the HFA payments are government subsidies, not personal funds. However, it directly influences your mortgage interest deduction on Schedule A (Form 1040).

Safe-Harbor Deduction Method

If you meet two IRS tests:

- You qualify for the full mortgage interest deduction, mortgage insurance premiums (MIP, if deductible), and real property taxes on your main home.

- You participated in an HFA Hardest Hit Fund program where payments could cover interest.

You can use a safe-harbor method to deduct:

- All payments you actually made (from Box 3 of Form 1098-MA) to your servicer, HFA, or HUD.

- Capped at the totals from Form 1098 (Box 1: interest; Box 5: MIP; Box 10: taxes).

This prevents overclaiming interest that the program covered. For example:

- If Box 3 shows $5,000 in your payments and Form 1098 Box 1 shows $8,000 in total interest, you can deduct up to $8,000—but only the $5,000 you paid counts toward your out-of-pocket limit.

Failure to adjust can lead to IRS adjustments or penalties. See IRS Publication 530 for more on homeowner tax info.

Related Programs

Form 1098-MA also applies to similar aid under Section 235 of the National Housing Act, where the government subsidizes part of your interest.

When and Where to File Form 1098-MA

Deadlines:

- Furnish to Homeowner: By January 31, 2026, for 2025 payments.

- File with IRS: By February 28, 2026 (paper) or March 31, 2026 (electronic, required if filing 10+ forms).

How to File:

- Paper: Mail Copy A with Form 1096 transmittal to the IRS.

- Electronic: Use the IRS FIRE system for bulk filings.

- Extensions: Request via Form 8809 up to 30 days.

Penalties for late or non-filing start at $60 per form (up to $630,500 annually for small businesses in 2025), escalating for intentional disregard. Always use the latest general instructions for information returns.

Common Mistakes and How to Avoid Them

- Overclaiming Deductions: Don’t deduct HFA-covered interest—use Box 3 only.

- Ignoring Form 1098 Cross-Reference: Always compare with your lender’s statement.

- Missing the Form: If you think you qualify but didn’t receive it, contact your state HFA.

- Privacy Oversights: Ensure TINs are handled securely.

Pro Tip: Tax software like TurboTax or H&R Block can import Form 1098-MA data for seamless Schedule A entry.

Frequently Asked Questions (FAQs) About IRS Form 1098-MA

Do I Owe Taxes on HFA Assistance Payments?

No, these are nontaxable subsidies, but they reduce your deductible interest.

What If I Didn’t Receive Form 1098-MA?

Contact your state HFA immediately—delays can affect your filing.

Is Form 1098-MA Required for All Mortgage Assistance?

Only for HFA Hardest Hit Fund programs; other aid (e.g., FHA) may use different reporting.

Can I E-File Form 1098-MA as a Homeowner?

No, homeowners don’t file it—HFAs handle submission.

Has Form 1098-MA Changed for 2025?

No significant updates; the April 2025 revision maintains prior structure.

Final Thoughts: Maximize Your Mortgage Deductions with Form 1098-MA

IRS Form 1098-MA is more than paperwork—it’s a tool for financial clarity during tough times. By accurately reporting assistance and adjusting your deductions, you can avoid IRS scrutiny while claiming what you’re entitled to. As programs like the HFA Hardest Hit Fund wind down, staying informed ensures you don’t miss out on relief. For personalized advice, consult a tax professional or visit IRS.gov.

Last Updated: December 2025. This article is for informational purposes only and not tax advice.