Table of Contents

IRS Form 1098 – Mortgage Interest Statement – Homeownership comes with tax perks, especially the mortgage interest deduction that can save thousands on your federal return. But to claim it, you need accurate reporting from your lender. IRS Form 1098—the Mortgage Interest Statement—is the key document that details your deductible interest, points, and related expenses. For tax year 2025, lenders must issue forms for interest over $600, with e-filing mandatory for 10+ returns and deadlines approaching in early 2026. This SEO-optimized guide, based on the IRS’s April 2025 revision, covers everything from eligibility to common errors, empowering homeowners and lenders to maximize deductions amid the $750,000 acquisition debt limit (set to revert to $1 million in 2026).

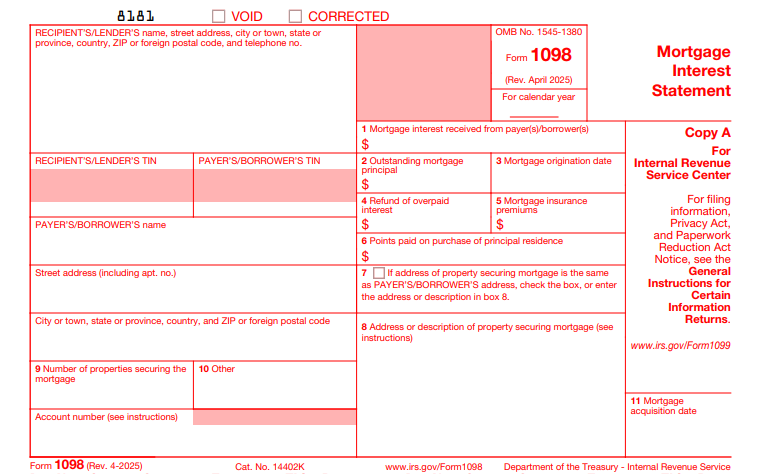

What Is IRS Form 1098?

IRS Form 1098 is an information return used by mortgage lenders to report interest received from borrowers on qualified home loans, including points (prepaid interest) and mortgage insurance premiums (MIP). It helps the IRS match reported income and enables taxpayers to deduct eligible amounts on Schedule A (Form 1040) if itemizing. Unlike Form 1098-E (student loans) or 1098-T (tuition), Form 1098 focuses on residential mortgages, cooperatives, and refinances.

Key components:

- Interest Reporting: Box 1 captures annual interest ≥$600.

- Points and MIP: Boxes 6 and 5 detail upfront fees and insurance.

- Online Fillable Copy B: For 2025, recipients can access a PDF version at IRS.gov/Form1098 for easy digital furnishing.

The April 2025 revision (Rev. 4-2025) is a continuous-use form, streamlining reporting for multiple mortgages. Download the PDF and instructions from IRS.gov/Form1098.

Who Needs to File IRS Form 1098 in 2025?

Lenders (banks, finance companies) or their agents must file Form 1098 for each borrower paying ≥$600 in mortgage interest during 2025. Borrowers receive Copy B to claim deductions; no form if under $600, even for multiple loans.

| Filer Type | Filing Requirement | Notes |

|---|---|---|

| Mortgage Lenders | Interest ≥$600 from individuals (including sole proprietors) | File per mortgage; separate form if multiple borrowers. |

| Collection Agents | If receiving payments on behalf of lender | Report under lender’s EIN. |

| Cooperative Housing Corporations | For shares in qualifying co-ops | Treated as home equity loans. |

| Exemptions | Interest from corporations, partnerships, trusts, or estates | Even if co-borrower is individual. |

Foreign lenders report if U.S.-sourced interest. Use EIN for lenders; validate borrower TINs via IRS matching.

Filing Deadlines and Extensions for Form 1098

For 2025 interest (reported in 2026), prioritize recipient copies. E-filing extends IRS deadline.

| Deadline | Date | Details |

|---|---|---|

| Furnish to Borrower (Copy B) | January 31, 2026 | Mail/email; use online PDF for efficiency. |

| File with IRS (Copy A) | February 28, 2026 (paper) or March 31, 2026 (e-file) | Include Form 1096; e-file if ≥10 returns. |

| Extensions | Automatic 30 days via Form 8809 (by original due) | IRS only; hardship adds 30 more. |

- E-Filing: Required for 10+ info returns; use FIRE/IRIS.

- Where to File: Paper to IRS per Pub. 1220; e-file via providers like TaxBandits.

- State Filings: Some states (e.g., CA) require copies.

File corrections promptly; no penalty for minor errors.

Step-by-Step Guide to Completing IRS Form 1098

Lenders use the April 2025 fillable PDF; borrowers reference for deductions. Gather payment records and escrow statements.

- Lender Info: Name, EIN, address, phone; account number for tracking.

- Borrower (Boxes 1–3): Name, address, TIN (truncate on Copy B); check “2nd TIN not” if errors.

- Box 4: Date of Acquisition – If lender acquired mortgage in 2025 (MM-DD-YYYY).

- Box 1: Mortgage Interest Received – Total ≥$600; excludes seller-paid points.

- Box 2: Outstanding Mortgage Principal – Balance as of January 1, 2026.

- Box 3: Mortgage Insurance Premiums (MIP) – Deductible if AGI ≤$109,000 (phaseout to $129,000).

- Box 5: Real Estate Taxes Paid from Escrow – Itemizable on Schedule A.

- Box 6: Points Paid on Purchase – Deductible if for main home purchase.

- Box 7: Transferor/Transferee Info – If ownership changed.

- Sign & Distribute: Officer signs Copy A; furnish Copy B by January 31.

For multiple borrowers, report under primary; aggregate interest.

Key Boxes on IRS Form 1098 Explained

Form 1098’s boxes align with deduction rules in Pub. 936.

| Box | Description | 2025 Tax Tip |

|---|---|---|

| 1 | Mortgage interest | Deduct up to $750,000 debt (acquisition + home equity); reverts to $1M in 2026. |

| 2 | Principal balance | Confirms debt limit for deduction. |

| 3 | MIP | Deductible through 2025; phaseout starts at $109K AGI. |

| 5 | Escrow taxes | Deduct on Schedule A, line 5b. |

| 6 | Points | Fully deductible if for purchase; amortize if refinance. |

No Box 8–10 in 2025—reserved for future use.

E-Filing vs. Paper: Options for Form 1098 in 2025

E-filing is required for 10+ returns and speeds processing; paper for fewer.

- E-Filing Pros: March 31 deadline; error checks; bulk via IRIS.

- Paper Pros: For <10 forms; mail by February 28 with Form 1096.

- Threshold: Aggregates with other 1099s/1098s.

Providers like TaxZerone offer TIN validation and state compliance.

Common Mistakes When Filing Form 1098 and How to Avoid Them

Lenders risk audits; borrowers overclaim—top errors:

- Threshold Misses: Not filing for $600+—track per mortgage.

- TIN Errors: Invalid SSNs—use IRS matching pre-filing.

- Points Misreporting: Including seller-paid—report only borrower-paid.

- Late Copies: Missing January 31—automate delivery.

- Debt Limit Oversights: Reporting on >$750K loans—verify principal.

Review Pub. 936; software flags issues.

Penalties for Late or Incorrect Form 1098 Filings

Tiered penalties apply under §6721/6722, adjusted for 2025:

| Violation | Penalty per Form | Max (Small Business, <$5M Receipts) |

|---|---|---|

| Within 30 Days Late | $60 | $239,000/year |

| 31+ Days to Aug 1 | $130 | $683,000/year |

| After Aug 1/No File | $340 | $1,366,000/year |

| Intentional | $680 or 10% of interest | No max |

Interest accrues; reasonable cause waives. E-file reduces risks by 90%.

IRS Form 1098 Download and Printable

Download and Print: IRS Form 1098

Frequently Asked Questions About IRS Form 1098

Do I get a Form 1098 if interest is under $600?

No—but track payments for deduction; voluntary filing possible.

What’s the 2025 furnish deadline?

January 31, 2026—earlier for accuracy.

Can I deduct MIP in 2025?

Yes, if AGI ≤$109K; phaseout to $129K.

Who files if multiple lenders?

Each reports their portion; primary gets TIN.

Is e-filing required for 5 forms?

No—but ≥10 total info returns triggers it.

Visit IRS.gov/Form1098 for more.

Final Thoughts: Maximize Your Mortgage Deduction with IRS Form 1098 in 2025

IRS Form 1098 unlocks valuable itemized deductions, potentially saving homeowners thousands amid the $750,000 debt cap—before it doubles in 2026. Lenders, furnish by January 31, 2026, and e-file by March 31 to sidestep $340 penalties; borrowers, cross-check with statements for accuracy. Download the April 2025 form from IRS.gov today and consult Pub. 936 for deduction details.

Home loans build equity—smart reporting builds savings.

This article is informational only—not tax advice. Verify with IRS or a professional.