Table of Contents

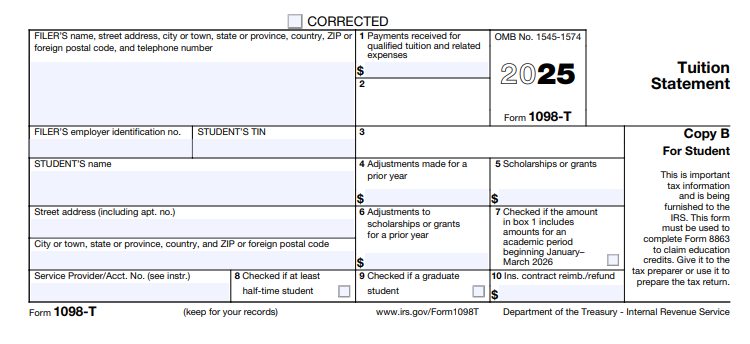

IRS Form 1098-T – Tuition Statement – As college costs continue to rise—with average in-state tuition exceeding $11,000 annually—students and parents need every tool to maximize tax savings. Enter IRS Form 1098-T, the Tuition Statement, a critical document that reports payments for qualified education expenses, unlocking credits like the American Opportunity Credit (up to $2,500 per student) and Lifetime Learning Credit (up to $2,000 per return). For the 2025 tax year, eligible educational institutions must issue these forms by January 31, 2026, with no major structural changes but continued emphasis on accurate reporting amid inflation-adjusted limits.

This SEO-optimized guide, based on the official 2025 Instructions for Forms 1098-E and 1098-T (released December 2024), covers the form’s purpose, filing requirements, step-by-step completion, deadlines, and tips for claiming credits. Whether you’re a student, parent, or school administrator, understanding Form 1098-T ensures compliance and potential refunds averaging $1,800 for education credits. Let’s dive in to help you navigate tuition tax breaks for 2025.

What Is IRS Form 1098-T?

Form 1098-T is an informational tax form used by eligible educational institutions (e.g., colleges, universities, vocational schools) to report payments received or billed for qualified tuition and related expenses (QTRE) during the calendar year. It also flags enrollment status and adjustments, aiding students in claiming education tax benefits on Form 1040 (via Schedule 3 and Form 8863).

Key elements include:

- Total QTRE payments (Box 1).

- Scholarships/grants (Box 5).

- Half-time student status (Box 7).

- Prior-year adjustments (Box 4).

Institutions switched to “payments received” reporting in 2018, but Box 1 still captures reimbursements/refunds related to 2025 payments. Boxes 2 and 3 remain reserved for future use. For 2025, the form supports credits without changes to limits, though income phase-outs adjust for inflation (e.g., full American Opportunity Credit phases out above $180,000 MAGI for joint filers).

Key Fact: Form 1098-T doesn’t calculate your tax benefit—use IRS Publication 970 or tax software to apply it, but inaccuracies can trigger IRS mismatches.

Who Must File and Receive Form 1098-T?

Filers: Eligible educational institutions must issue Form 1098-T for each student enrolled in any academic period in 2025 where a reportable transaction occurs (e.g., QTRE payments received or adjustments made). This includes public/private colleges, but not non-qualifying entities like online-only platforms without IRS eligibility.

Recipients:

- Students: Copy B by January 31, 2026 (electronic consent encouraged; opt-out deadline often January 1).

- IRS: Copy A with Form 1096 transmittal.

Exceptions: No form required for:

- Students whose QTRE are fully covered by scholarships (unless adjustments apply).

- Non-enrolled individuals with no reportable payments.

- International students without U.S. TINs (collect via Form W-9S).

E-filing is mandatory for 10+ forms; all filers must verify TINs to avoid $60–$310 penalties per error.

Step-by-Step Guide: How to Complete IRS Form 1098-T for 2025

Use the 2025 form (Rev. December 2024) from IRS.gov—fillable PDFs ease Copy B furnishing. Software like NACUBO-recommended tools automates TIN matching. Gather student records, including payments via 529 plans or employer assistance.

1. Header and Student Info

- Institution’s Name/Address/TIN: Full details; no truncation.

- Student’s TIN/Name/Address: SSN/ITIN; truncate on Copy B only.

- Account Number: Optional for tracking.

2. Boxes 1–4: Payments and Adjustments

- Box 1: Total QTRE payments received in 2025 (tuition, fees; exclude room/board).

- Box 2: Reserved—leave blank.

- Box 3: Reserved—leave blank.

- Box 4: Negative adjustments for prior-year QTRE overreported (e.g., refunds); positive for underreported.

3. Boxes 5–6: Scholarships and Reimbursements

- Box 5: Total scholarships/grants administered by the institution (taxable unless used for QTRE).

- Box 6: Reimbursements/refunds of QTRE in 2025 (e.g., from scholarships).

4. Boxes 7–8: Enrollment Status

- Box 7: Check if at least half-time in 2025 (key for American Opportunity Credit).

- Box 8: Check if graduate-level enrollment (affects credit eligibility).

5. State Boxes (9–14): If applicable, report state-specific amounts.

Pro Tip: For multi-year payments (e.g., prepaid tuition), prorate across years; report 529 rollovers as payments in the year received.

Deadlines and How to File Form 1098-T for 2025

Compliance is key—late filing risks penalties up to $630 per form (intentional disregard).

- Furnish to Students: January 31, 2026 (or next business day; electronic if consented).

- File with IRS:

- Paper: February 28, 2026 (with Form 1096).

- Electronic: March 31, 2026 (via IRIS system for 10+ forms).

No extensions for student furnishing; Form 8809 grants 30 days for IRS filing. Mail paper to IRS per instructions; e-file for accuracy.

Common Mistakes to Avoid When Filing Form 1098-T

IRS notices for TIN mismatches hit over 20% of filers annually—here’s how to dodge them:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Missing TIN | No Form W-9S collected. | Request TINs at enrollment; use backup withholding if refused. | $60–$310 per form. |

| Incorrect QTRE (Box 1) | Including non-qualified fees (e.g., books if not required). | Follow Pub. 970 definitions; exclude athletics unless mandatory. | Student credit denials; IRS CP2000 notices. |

| Overstating Scholarships (Box 5) | Including non-administered grants. | Report only institution-managed funds; note taxable portions. | Taxable income errors. |

| Wrong Enrollment Boxes (7/8) | Misclassifying part-time or grad status. | Verify against academic records; half-time = 6+ credits/semester. | Ineligible for credits; refund delays. |

| Late/Non-Electronic Delivery | Forgetting consent deadlines. | Opt-in by Jan. 1, 2026; mail if opted out. | $120–$630 per violation. |

| Ignoring Adjustments (Box 4) | Skipping prior-year refunds. | Track cross-year changes; report negatives as reductions. | Audit triggers. |

Correct via “CORRECTED” forms; retain records 3 years.

IRS Form 1098-T Download and Printable

Download and Print: IRS Form 1098-T

2025 Updates and Special Considerations for Form 1098-T

The 2025 instructions maintain the post-2018 payments focus, with no new boxes but refined guidance:

- Credit Limits: American Opportunity: 100% of first $2,000 + 25% of next $2,000 (max $2,500; 40% refundable)—for first 4 years, half-time undergrads. Lifetime Learning: 20% of up to $10,000 (max $2,000)—no year/enrollment limits.

- Phase-Outs: Full credits up to $80,000 MAGI (single)/$160,000 (joint); partial to $90,000/$180,000 (inflation-adjusted).

- Scholarships: Box 5 amounts over Box 1 may be taxable; report emergency grants as non-qualified if not for tuition.

- E-Filing: IRIS system updates for secure TINs; 10+ forms mandatory.

For 529 distributions, coordinate with Form 1099-Q; nonresident aliens follow special rules.

Final Thoughts: Maximize Your Education Tax Savings with Form 1098-T

IRS Form 1098-T is your gateway to reclaiming thousands in tuition costs through credits that reduce tax bills or boost refunds. For 2025, ensure timely receipt and accurate use—download from IRS.gov, cross-check with Pub. 970, and file Form 8863 early. Institutions: Prioritize TIN collection and e-delivery for compliance.

Consult a tax pro for complex cases like multiple students. This guide is informational; always verify with official sources.

Not tax advice. Refer to IRS.gov for your situation.

FAQs About IRS Form 1098-T

What is the maximum American Opportunity Credit for 2025?

Up to $2,500 per eligible student (100% of first $2,000 + 25% of next $2,000 in QTRE).

When will I receive my 2025 Form 1098-T?

By January 31, 2026, from your school (electronic if consented).

Does Form 1098-T include room and board?

No—only qualified tuition and required fees; exclude optional expenses.

Who claims the credit if parents pay tuition?

The taxpayer claiming the dependent (usually parents) on Form 1040.