Table of Contents

IRS Form 1099-A – Acquisition or Abandonment of Secured Property – If you’re a lender dealing with secured loans or a borrower facing foreclosure, repossession, or property abandonment, understanding IRS Form 1099-A is crucial. This form reports key details about the acquisition or abandonment of property used as loan security, helping the IRS track potential capital gains, losses, or debt-related income. In this comprehensive 2025 guide, we’ll break down everything you need to know about Form 1099-A, from filing requirements to tax implications. Whether you’re searching for “what is IRS Form 1099-A” or “how to report Form 1099-A on taxes,” you’ve come to the right place.

What is IRS Form 1099-A?

IRS Form 1099-A, titled Acquisition or Abandonment of Secured Property, is an information return used by lenders to report when they acquire an interest in property securing a loan or learn that the property has been abandoned. This typically occurs in scenarios like foreclosure, repossession, or voluntary conveyance in lieu of foreclosure.

The form’s primary purpose is to notify the IRS and the borrower of the event, ensuring accurate reporting of any resulting gain or loss on the borrower’s tax return. Lenders must issue it even if they’re not in the business of lending money, as long as the loan ties to their trade or business. Borrowers receive Copy B by January 31, while the IRS gets its copy by the filing deadline.

Related forms include Form 1099-C for canceled debt, which may apply if debt forgiveness accompanies the acquisition.

Who Needs to File Form 1099-A?

Not every lender files Form 1099-A—it’s triggered by specific events. You must file if:

- You lend money in connection with your trade or business.

- In full or partial satisfaction of the debt, you acquire an interest in the secured property.

- You have reason to know the property has been abandoned by the borrower.

Key filers include:

- Banks, credit unions, and other financial institutions.

- Governmental units or subsidiaries lending secured loans.

- Trustees or record owners for pooled loans or bond issues (only one form per borrower is needed).

- Subsequent holders of transferred loans, reporting post-transfer events.

If multiple lenders are involved (e.g., first and second mortgages), each affected lender may need to file if their security interest is impaired.

Exceptions apply: No filing for tangible personal property (like a car) securing a loan to an individual for personal use, or for foreign property if the borrower certifies exempt status.

When to File Form 1099-A in 2025

Timing is critical for compliance. File Form 1099-A in the year following the calendar year of the acquisition or abandonment event.

- Furnish to Borrower: By January 31, 2026, for 2025 events.

- File with IRS:

- Paper filing: March 2, 2026.

- Electronic filing: March 31, 2026 (mandatory if filing 10 or more information returns).

For 2025, note the expiration of certain relief provisions: Exclusions for discharged mortgage debt on principal residences and qualified student loans end December 31, 2025, potentially increasing reportable income.

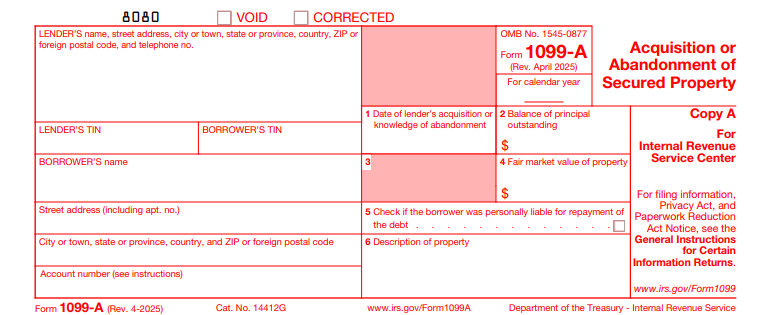

What Information is Reported on Form 1099-A?

Form 1099-A has six boxes for essential details. Here’s what each requires:

- Box 1: Date of Lender’s Acquisition or Knowledge of Abandonment – The date title/possession transfers (earlier date) or abandonment is known. For sales, use the later of sale date or redemption period end.

- Box 2: Balance of Principal Outstanding – Unpaid principal only (exclude interest or costs) at acquisition or abandonment.

- Box 4: Fair Market Value (FMV) of Property – Sale proceeds for foreclosures; appraised value if abandoned and borrower was personally liable (otherwise, leave blank).

- Box 5: Was Borrower Personally Liable? – Check “X” if yes at loan creation or last modification.

- Box 6: Description of Property – Address for real estate; type/make/model for personal property (e.g., “2024 Honda Accord”).

- Box 7: Multiple Owners? – Check if undivided interests exist.

Use the latest April 2025 revision of the form.

IRS Form 1099-A Download and Printable

Download and Print: IRS Form 1099-A

Tax Implications for Borrowers Receiving Form 1099-A

Receiving Form 1099-A doesn’t automatically mean owing taxes, but it signals a potential “sale” of the property for tax purposes. Treat the transfer or abandonment as a sale, calculating gain or loss as follows:

- Amount Realized:

- Recourse debt (personal liability): FMV from Box 4.

- Nonrecourse debt (no personal liability): Full outstanding debt (Box 2) plus any cash/other property received.

- Gain/Loss: Amount realized minus adjusted basis in the property.

Report on:

- Schedule D (Form 1040) and Form 8949 for personal/investment property.

- Form 4797 for business property.

If debt cancellation occurs simultaneously, expect Form 1099-C instead—the forgiven amount is generally income, unless excluded (e.g., insolvency; see Form 982). For principal residence foreclosures, special rules may apply until 2025 ends.

Contact the lender for corrections if info is wrong.

Common Scenarios Requiring Form 1099-A

Form 1099-A pops up in real-world situations like:

- Foreclosure or Repossession: Lender takes property via court action.

- Deed in Lieu of Foreclosure: Borrower voluntarily transfers to avoid foreclosure.

- Abandonment: Borrower walks away; lender learns within 3 months or reports at period’s end.

- Third-Party Sale: Property sold at auction, treated as abandonment.

These events often follow economic hardship, like job loss or market downturns.

How to File Form 1099-A

- Gather Data: Collect dates, balances, FMV (via appraisal or sale proceeds), and property details.

- Prepare Forms: Use IRS fillable PDFs for Copies B, 2, and C; e-file via FIRE system for efficiency.

- Furnish Copies: Send Copy B to borrower by Jan. 31; keep Copy C.

- Submit to IRS: Include with Form 1096 transmittal; e-file if over 10 returns.

- Correct Errors: File Form 1096 marked “CORRECTED” with updated 1099-A.

Penalties apply for late or incomplete filing—up to $310 per return.

Exceptions and Special Rules for 2025

- No Report for Personal-Use Tangibles: Cars or furniture for non-business use.

- Foreign Property Exemption: If borrower certifies under penalties of perjury.

- Pooled Loans: Single form by trustee.

- Student Loan Relief: Safe harbor under Rev. Proc. 2020-11 for discharged loans.

- Online Tools: IRS now offers fillable Copy B online.

Frequently Asked Questions (FAQs) About IRS Form 1099-A

What if I receive a Form 1099-A but didn’t abandon my property?

Contact the lender immediately for a correction—errors happen.

Does Form 1099-A mean I owe taxes on the full loan amount?

No; it’s about gain/loss on the property, not the debt itself (unless canceled, triggering 1099-C).

Can I e-file Form 1099-A for 2025?

Yes, required for 10+ returns; use IRS-approved software.

What’s the difference between recourse and nonrecourse debt on Form 1099-A?

Recourse: Personal liability—FMV used for gain/loss. Nonrecourse: No liability—full debt amount used.

Final Thoughts: Stay Compliant with Form 1099-A in 2025

Navigating IRS Form 1099-A ensures lenders report accurately and borrowers handle tax consequences properly, avoiding audits or penalties. With 2025 marking the end of some debt relief exclusions, review your secured loans closely. Consult a tax professional for personalized advice, and always reference official IRS resources for the latest updates.

This article is for informational purposes only and not tax advice. For specifics, visit IRS.gov or speak with a qualified advisor.