Table of Contents

IRS Form 1099-B – Proceeds from Broker and Barter Exchange Transactions – If you’re an investor who sold stocks, bonds, or other securities this year—or engaged in barter exchanges—you’ll likely encounter IRS Form 1099-B. This essential tax document reports the proceeds from these transactions, helping the IRS track capital gains and ensure accurate reporting. As we wrap up 2025, understanding Form 1099-B is crucial for timely tax preparation and avoiding penalties. In this comprehensive guide, we’ll break down what Form 1099-B is, who needs it, how to use it, and the latest updates for the 2025 tax year.

Whether you’re a seasoned trader or a first-time seller, this article covers everything from filing deadlines to common pitfalls. Let’s dive in to simplify your 1099-B experience.

What Is IRS Form 1099-B?

IRS Form 1099-B, titled “Proceeds from Broker and Barter Exchange Transactions,” is an information return used to report income from the sale of financial assets or barter activities. Brokers and barter exchanges issue this form to both the IRS and recipients to document gross proceeds, which taxpayers then use to calculate capital gains or losses on their personal tax returns.

Purpose of Form 1099-B

The primary goal of Form 1099-B is to provide transparency on investment and exchange activities. It ensures the IRS receives details on transactions that could generate taxable income, such as stock sales or property swaps through barter networks. Without accurate 1099-B reporting, discrepancies between broker records and your tax return could trigger audits or underpayment notices.

For tax year 2025, Form 1099-B focuses on traditional securities and barter deals, excluding most digital assets (more on that below). This form helps taxpayers reconcile sales data with their basis (original cost) to determine if they owe taxes on profits.

Who Must File Form 1099-B?

Brokers—including stockbrokers, commodity brokers, and certain financial institutions—must file Form 1099-B for any customer who sold reportable securities for cash. Barter exchanges, which facilitate trades of property or services without cash, are also required to issue the form.

Filing is mandatory if the gross proceeds from a single transaction exceed $10 for covered securities or if any barter exchange occurs. Brokers use this form to report details like date of sale, proceeds, and cost basis where applicable.

Who Receives Form 1099-B?

Individuals, trusts, estates, or partnerships that engage in covered transactions typically receive Form 1099-B by mail or electronically from their broker. If you sold stocks, mutual funds, options, or participated in a barter swap in 2025, expect one (or multiple) forms by early 2026. Even if no gain was realized, the form must be issued for sales over the threshold.

Key Information Reported on Form 1099-B

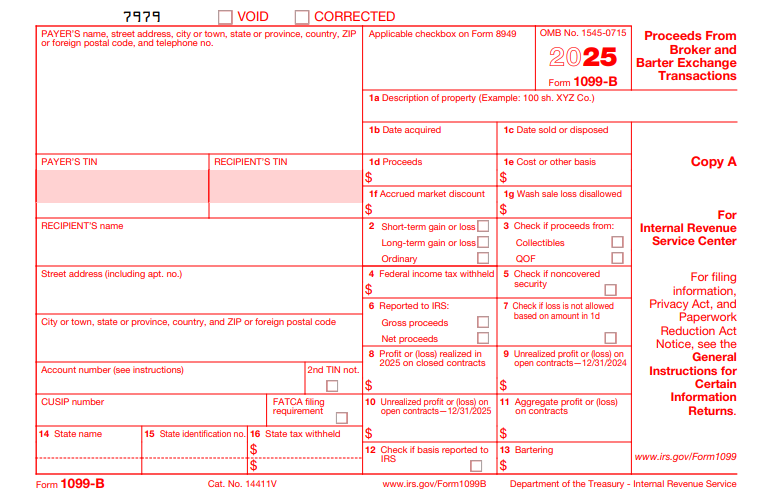

Form 1099-B captures detailed transaction data across multiple boxes. Here’s a breakdown of the essentials:

- Box 1a: Description of Property – Identifies the asset, e.g., “100 shares XYZ Corp.”

- Box 1b: Date Acquired – When you purchased the asset.

- Box 1c: Date Sold or Disposed – The sale date in 2025.

- Box 1d: Proceeds – Gross amount received (your starting point for gain/loss calculation).

- Box 1e: Cost or Other Basis – Reported only for covered securities; otherwise, you provide this.

- Box 2: Type of Gain or Loss – Short-term or long-term.

- Box 3: Check if Basis Reported to IRS – Indicates covered securities.

- Boxes 4–7: Federal Tax Withheld and Adjustments – Any backup withholding or corrections.

- Box 8–12: Barter-Specific Fields – For exchanges, reports fair market value of traded items.

Covered vs. Noncovered Securities

A key distinction on Form 1099-B is between covered securities (where the broker reports cost basis to the IRS) and noncovered securities (basis not reported). Covered examples include stocks bought after 2010, mutual funds after 2011, and options after 2013. For noncovered items like pre-2011 stocks, you’ll need your own records to calculate basis.

This split affects accuracy: Covered transactions reduce errors, but noncovered ones require diligent record-keeping to avoid overpaying taxes.

Barter Exchange Transactions

Barter exchanges—formal networks swapping goods or services—must report the fair market value (FMV) of what you received on Form 1099-B. For instance, if you traded consulting services for equipment worth $5,000, that’s reported as $5,000 in proceeds. Both parties get a 1099-B, and the income is taxable as ordinary income unless it qualifies as a like-kind exchange.

IRS Form 1099-B Download and Printable

Download and Print: IRS Form 1099-B

How to Report Form 1099-B on Your Tax Return

Receiving a 1099-B doesn’t mean you owe taxes immediately—it’s for reporting gains/losses. Use the data to complete Form 8949 (Sales and Other Dispositions of Capital Assets) and Schedule D (Capital Gains and Losses) on your Form 1040.

Step-by-Step Reporting Process

- Gather All Forms: Compile 1099-Bs from multiple brokers if applicable.

- Calculate Gain/Loss: Subtract cost basis (Box 1e or your records) from proceeds (Box 1d). Positive = gain; negative = loss.

- Categorize Transactions: Short-term (held ≤1 year) on Part I of Form 8949; long-term on Part II.

- Enter on Form 8949: List each transaction, checking boxes for basis reporting (A, B, or C).

- Transfer to Schedule D: Total gains/losses flow to Line 7 or 15, then to Form 1040 Line 7.

- Apply Adjustments: Report wash sales or other corrections in Column (g).

Tax software like TurboTax automates this, importing 1099-B data directly. Short-term gains are taxed at ordinary rates (up to 37%); long-term at 0–20%.

Pro tip: Keep records for at least three years, as the IRS can audit capital gains claims.

Deadlines for Filing Form 1099-B in 2025

For tax year 2025 transactions, key dates are:

- Furnish to Recipients: February 17, 2026.

- File with IRS: March 31, 2026 (electronic); May 1, 2026 (paper, but e-filing is encouraged).

- Extensions: Brokers can request up to 30 days for recipient copies; 90 days for IRS filing in some cases.

Late filing incurs penalties starting at $60 per form, up to $310 if intentional. E-filing via IRS FIRE system is mandatory for 10+ forms.

Recent Changes to Form 1099-B for Tax Year 2025

While Form 1099-B remains stable, a major shift impacts digital asset users: Starting with 2025 sales, brokers report most crypto and NFT proceeds on the new Form 1099-DA (Digital Asset Proceeds from Broker Transactions), not 1099-B. Exceptions include “dual-classified” assets (e.g., tokenized securities treated as stocks).

This separation streamlines reporting—1099-DA focuses on gross proceeds for crypto, while 1099-B handles traditional brokers. No other box changes for 1099-B, but always check IRS.gov for updates.

Common Mistakes to Avoid with Form 1099-B

Even pros slip up—here’s how to stay compliant:

- Forgetting Noncovered Basis: Don’t rely solely on the form; track your own costs to avoid inflated gains.

- Ignoring Barter FMV: Undervaluing trades can lead to IRS adjustments and interest charges.

- Wash Sale Oversights: If you repurchased the same stock within 30 days, adjust losses per IRS rules.

- Missing Multiple Forms: Consolidate from all brokers to prevent double-reporting.

- Deadline Delays: Mark your calendar—late 1099-Bs trigger automated notices.

Consult a tax pro for complex portfolios, especially with options or futures.

Frequently Asked Questions (FAQs) About IRS Form 1099-B

Do I Need to File Form 1099-B If I Had No Gain?

Yes, if proceeds exceed thresholds, the broker files regardless. You report even losses to offset future gains.

What If My Broker Doesn’t Send a 1099-B?

Contact them immediately. You’re still required to report the transaction using your records.

How Does Form 1099-B Affect My Taxes?

It reports proceeds, but your tax bill depends on net gains after basis. Losses can reduce taxable income up to $3,000 annually.

Is Cryptocurrency Reported on Form 1099-B in 2025?

Generally no—use 1099-DA for most digital assets. Check if your crypto qualifies as a security.

Where Can I Get the Latest Form 1099-B Instructions?

Download from IRS.gov/Form1099B or the 2025 PDF instructions.

Final Thoughts: Stay Ahead of Your 1099-B Obligations

IRS Form 1099-B is your roadmap to compliant reporting for broker transactions and barters. By understanding its sections, deadlines, and nuances—like the 2025 digital asset pivot—you’ll file confidently and minimize surprises come tax season. Review your brokerage statements now, and consider professional help for intricate trades.

For the most current details, visit the official IRS page on Form 1099-B. Got questions? Drop a comment below—we’re here to help demystify tax forms!

This article is for informational purposes only and not tax advice. Consult a qualified professional for personalized guidance.