Table of Contents

IRS Form 1099-CAP – Changes in Corporate Control and Capital Structure – Mergers, acquisitions, and restructurings can reshape a company’s future, but they also trigger complex tax reporting for shareholders. IRS Form 1099-CAP—Changes in Corporate Control and Capital Structure—ensures the IRS receives details on distributions from these events, helping shareholders calculate potential capital gains while avoiding penalties up to $500 per day per transaction. For 2025, the form’s April revision emphasizes electronic filing for 10+ returns and a $1,000 de minimis exemption for recipients, aligning with T.D. 9972 rules. This SEO-optimized guide, based on the latest IRS instructions, breaks down filing requirements, deadlines, and strategies for corporations, brokers, and shareholders navigating high-stakes deals exceeding $100 million.

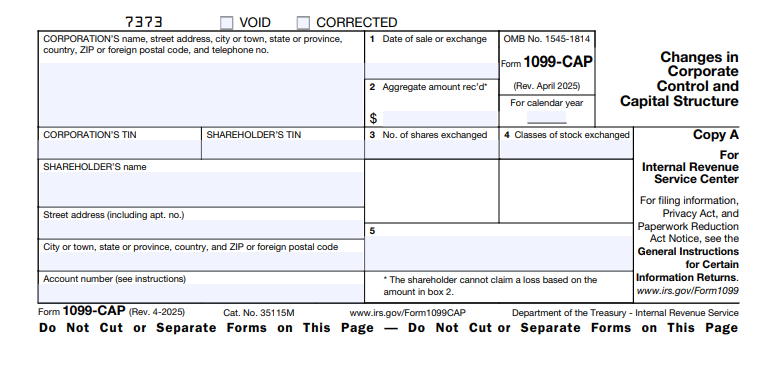

What Is IRS Form 1099-CAP?

IRS Form 1099-CAP is an information return used by domestic corporations or brokers to report cash, stock, or other property distributed to shareholders during an acquisition of control or substantial change in capital structure, where gain recognition applies under IRC Section 367(a). It supports IRS oversight of transactions valued at $100 million or more, preventing underreporting of taxable events like mergers or asset transfers. Unlike Form 1099-B (for broker sales), 1099-CAP focuses on corporate restructurings, providing shareholders with data to report gains on Form 8949 and Schedule D.

Key features:

- Proceeds Reporting: Captures aggregate amounts received, including fair market value (FMV) of stock/property.

- De Minimis Relief: No filing for recipients with $1,000 or less in distributions.

- Clearing Organization Rules: Special January 5 furnishing deadline for brokers holding shares.

The April 2025 revision (Cat. No. 35115M) is a continuous-use form with online fillable PDFs, per Publication 1220. Download it and instructions from IRS.gov/Form1099CAP.

Who Needs to File IRS Form 1099-CAP in 2025?

Domestic corporations filing Form 8806 (Information Return for Acquisition of Control or Substantial Change in Capital Structure) must issue Form 1099-CAP to non-exempt shareholders receiving distributions. Brokers file if holding shares in affected corporations, unless exempt. No filing if the transaction falls below $100 million or involves exempt recipients.

| Filing Party | Requirements for 2025 |

|---|---|

| Domestic Corporations | File for each non-exempt shareholder in control acquisitions (≥50% voting power/FMV) or substantial changes (e.g., mergers, asset transfers ≥$100M with gain recognition). |

| Brokers/Transfer Agents | Report if shares held for customers; exempt if Form 1099-B filed under §6045. |

| Clearing Organizations | Receive Copy B by January 6, 2025 (or January 5 thereafter); no furnish if corporation elects IRS publication on Form 8806. |

| Exempt Recipients | No form: Corporations (non-S corps), tax-exempt orgs, IRAs, governments, REITs/RICs, foreign persons with W-8BEN, or ≤$1,000 receipts. |

Use EIN for filers; truncate TINs on Copy B but not IRS copies. Coordinate with Form 8806 for consent elections.

Filing Deadlines and Extensions for Form 1099-CAP

Deadlines for 2025 transactions (reported in 2026) prioritize furnishing to recipients. E-filing extends IRS filing but not recipient deadlines.

| Deadline Type | Date for 2025 Transactions | Notes |

|---|---|---|

| Furnish to Recipients (Copy B) | January 31, 2026 (general); January 6, 2026, for clearing orgs. | Use fillable PDF; electronic OK with consent. |

| File with IRS (Copy A) | February 28, 2026 (paper) or March 31, 2026 (e-file) | Include Form 1096; e-file if ≥10 returns. |

| Extensions | Automatic 30 days via Form 8809 (by original due) | IRS only; hardship adds 30 more days. Adjust for weekends/holidays per Pub. 509. |

- E-Filing: Mandatory for 10+ info returns (aggregated); use IRIS/FIRE system.

- Where to File: Paper to IRS per state in Pub. 1220; e-file via approved software.

- Corrections: File amended forms with explanation; no penalty for inconsequential errors.

Special rule: Corporations electing IRS publication on Form 8806 skip clearing org furnishing.

Step-by-Step Guide to Completing IRS Form 1099-CAP

Gather transaction docs, shareholder lists, and FMV appraisals. Use the April 2025 fillable PDF; no red-ink required.

- Filer Info: Enter corporation/broker name, EIN, address, phone.

- Recipient (Boxes 1a–1e): Shareholder name, address, TIN (full on Copy A, truncated on B); account number.

- Box 2: Date of Sale or Exchange: Trade date (MM-DD-YYYY) of the transaction.

- Box 3: Aggregate Amount Received: Cash + FMV of stock/property exchanged (round to whole dollars).

- Box 4: Number of Shares Exchanged: Total shares surrendered.

- Box 5: Classes of Stock Exchanged: Abbreviate (e.g., “C” for common, “P” for preferred).

- Sign & Attach: Authorized officer signs Copy A; prepare Copy B for recipients.

- Transmit: File with Form 1096; furnish Copy B timely.

For multiple classes, list separately. Brokers: Exclude if Form 1099-B covers it.

Key Boxes on IRS Form 1099-CAP Explained

The form’s five boxes provide concise data for gain calculations—shareholders use Box 3 for basis adjustments.

| Box | Description | 2025 Tip |

|---|---|---|

| 2 | Date of sale/exchange | Determines holding period for long/short-term gains; use trade date. |

| 3 | Aggregate amount received | Cash + FMV (appraised if non-public); excludes boot in §368 reorganizations. |

| 4 | Shares exchanged | Total count; impacts per-share gain. |

| 5 | Stock classes | Abbreviate to fit; critical for diversified holdings. |

No Box 1 (TIN) truncation on IRS filings—full disclosure required.

E-Filing vs. Paper: Filing Options for Form 1099-CAP in 2025

Low-volume filers (under 10 returns) can paper-file, but e-filing is required for more and offers efficiency.

- E-Filing: Mandatory ≥10 returns; deadline March 31, 2026; use IRIS for acknowledgments and corrections.

- Paper: Allowed for few forms; mail Copy A + Form 1096 by February 28; scannable black/white.

- Threshold: Aggregates all 1099s; vendors like Tax1099 support bulk.

E-file reduces errors; low volume justifies paper for rare events like one-off mergers.

Common Mistakes When Filing Form 1099-CAP and How to Avoid Them

Restructurings are infrequent, but errors compound penalties—avoid these:

- Missing Exemptions: Filing for ≤$1,000 recipients or exempt entities—review Pub. 1220 list.

- Threshold Oversights: Reporting < $100M deals—confirm FMV and §367(a) gain.

- FMV Errors: Undervaluing stock/property—use qualified appraisals.

- Clearing Org Lapses: Forgetting January 6 furnish—elect Form 8806 consent if applicable.

- TIN Issues: Invalid numbers—pre-validate via IRS matching.

Document elections; consult Treas. Reg. §1.6043-4 for guidance.

Penalties for Late or Incorrect Form 1099-CAP Filings

Penalties under §6652(l) treat all 1099-CAPs per transaction as one return, capping at $100,000.

| Violation | Penalty | Maximum per Transaction |

|---|---|---|

| Late Filing/Furnishing | $500/day | $100,000 |

| Intentional Disregard | $500/day + 5% of aggregate proceeds | No cap |

| E-File Non-Compliance | Up to $340/form (aggregated) | $1,366,000 (small biz) |

Interest accrues; reasonable cause (e.g., reliance on agent) waives. Criminal penalties for willful failures (§7203/7206).

IRS Form 1099-CAP Download and Printable

Download and Print: IRS Form 1099-CAP

Frequently Asked Questions About IRS Form 1099-CAP

When is Form 1099-CAP required for 2025 mergers?

If ≥$100M, ≥50% control acquired, and §367(a) gain recognized—exempt for affiliated groups.

Do exempt recipients get Form 1099-CAP?

No—includes corps, tax-exempts, IRAs, or ≤$1,000 receipts.

What’s the e-filing threshold for 2025?

10+ info returns total; paper OK otherwise.

How do shareholders report 1099-CAP proceeds?

On Form 8949/Schedule D; adjust basis per transaction docs.

Can corporations elect out of clearing org reporting?

Yes, via Form 8806 consent for IRS publication.

Visit IRS.gov/Form1099CAP for more.

Final Thoughts: Navigate Corporate Restructurings with IRS Form 1099-CAP in 2025

IRS Form 1099-CAP ensures transparency in high-value corporate shifts, empowering shareholders to report gains accurately while shielding filers from steep penalties. With the April 2025 revision’s de minimis relief and e-file mandates, corporations can streamline compliance—furnish by January 31, 2026, and e-file by March 31 to stay audit-proof. Download the form from IRS.gov today and consult Treas. Reg. §1.6043-4 for deal-specific advice.

Restructurings build empires—precise reporting sustains them.

This article is informational only—not tax advice. Verify with IRS or a professional.