Table of Contents

IRS Form 1099-DIV – Dividends and Distributions – Dividends and distributions from investments are a key source of passive income for many Americans, but they come with important tax obligations. If you’re an investor receiving payouts from stocks, mutual funds, or real estate investment trusts (REITs), understanding IRS Form 1099-DIV is essential. This form reports dividends and distributions to both you and the IRS, ensuring accurate tax reporting.

In 2025, as tax season approaches for the 2024 tax year, staying compliant with Form 1099-DIV requirements can help you avoid penalties and maximize deductions. This guide breaks down everything you need to know about Form 1099-DIV dividends and distributions, from filing rules to box-by-box explanations. Whether you’re a payer issuing the form or a recipient using it for your return, we’ve got you covered with insights from official IRS sources.

What Is IRS Form 1099-DIV?

IRS Form 1099-DIV, officially titled “Dividends and Distributions,” is an information return used by financial institutions to report certain payments to the IRS and taxpayers. Payers—such as banks, brokerage firms, mutual funds, and corporations—must issue this form when they distribute dividends, capital gains, or other payouts exceeding specific thresholds.

The primary purpose of Form 1099-DIV is to track taxable income from investments. It helps the IRS verify that individuals and entities report these earnings correctly on their tax returns, like Form 1040. For tax year 2024 (filed in 2025), the form remains in continuous use, meaning updates are made as needed without annual revisions.

Common types of payments reported include:

- Ordinary dividends from stocks or funds.

- Qualified dividends eligible for lower tax rates.

- Capital gain distributions from mutual funds.

- Exempt-interest dividends from municipal bonds.

- Liquidation distributions from corporate wind-downs.

If you’re unsure if a payment qualifies as a dividend, err on the side of reporting it—better safe than audited.

Who Must File Form 1099-DIV?

Not everyone dealing with investments needs to file Form 1099-DIV, but payers have clear responsibilities. You must file if you paid any of the following to a person during the tax year:

- At least $10 in dividends (including capital gain or exempt-interest dividends) or other distributions in money or property.

- Any foreign tax withheld on dividends or distributions.

- Backup withholding on dividends (federal income tax withheld due to missing TIN).

- $600 or more in liquidation distributions.

Exceptions: When You Don’t Need to File

Certain payments are exempt to avoid duplicate reporting:

- Taxable dividends from life insurance contracts or employee stock ownership plans (use Form 1099-R instead).

- Substitute payments in lieu of dividends (report on Form 1099-MISC).

- Payments to corporations, tax-exempt organizations, IRAs, HSAs, government entities, or registered dealers.

If a distribution might be a dividend but you’re uncertain by the filing deadline, report the full amount as ordinary dividends to stay compliant.

Key Deadlines for Form 1099-DIV in 2025

Timing is critical for 1099-DIV tax reporting. For the 2024 tax year, key dates include:

| Action | Deadline | Notes |

|---|---|---|

| Furnish to Recipients | January 31, 2025 | Send Copy B to individuals by this date. |

| File with IRS | February 28, 2025 (paper) or March 31, 2025 (electronic) | Extensions available via Form 8809 (up to 30 days). |

| State Reporting (if required) | Varies by state | Check state tax agency for specifics. |

Missing these can trigger penalties starting at $60 per form, escalating to $630 for intentional disregard. Always use certified mail for paper filings.

IRS Form 1099-DIV Download and Printable

Download and Print: IRS Form 1099-DIV

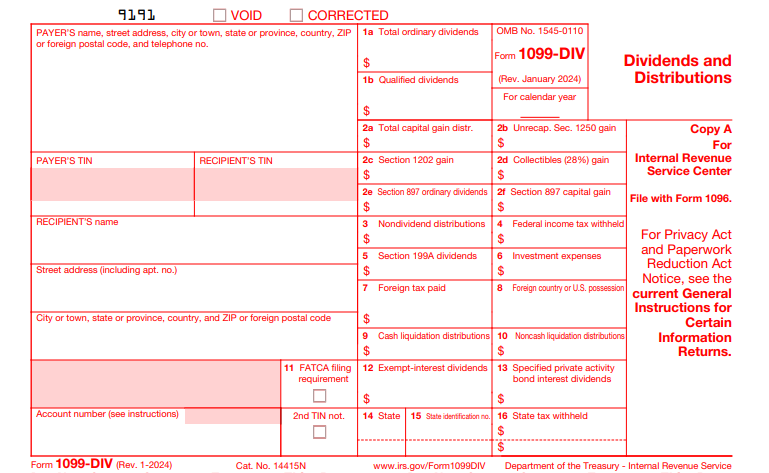

Breaking Down the Boxes on Form 1099-DIV

Form 1099-DIV features 16 boxes, each detailing a specific type of distribution or withholding. Understanding these ensures accurate dividends and distributions reporting. Here’s a box-by-box guide based on the latest instructions:

- Box 1a: Total Ordinary Dividends – The bulk of reportable dividends, including money market fund payouts, short-term capital gains from mutual funds, and reinvested amounts. S corporations report only from accumulated earnings.

- Box 1b: Qualified Dividends – Portion of Box 1a eligible for preferential capital gains rates (0%, 15%, or 20%). Must meet holding period rules (e.g., 61+ days for common stock).

- Box 2a: Total Capital Gain Distributions – Long-term capital gains passed through from funds or trusts.

- Box 2b: Unrecaptured Section 1250 Gain – Gain from depreciable real estate, taxed at up to 25%.

- Box 2c: Section 1202 Gain – Exclusion-eligible gain from qualified small business stock (up to 100% exclusion).

- Box 2d: Collectibles (28%) Gain – Gains from collectibles like art or coins, taxed at 28%.

- Box 2e: Section 897 Ordinary Dividends – Gain from U.S. real property interests (for non-U.S. persons via RICs/REITs).

- Box 2f: Section 897 Capital Gain – Similar to 2e but for capital gains on U.S. real property.

- Box 3: Nondividend Distributions – Return of capital, reducing your stock basis (not taxed until basis hits zero).

- Box 4: Federal Income Tax Withheld – Backup withholding amount (24% rate in 2024).

- Box 5: Section 199A Dividends – Qualified business income from REITs or funds, eligible for 20% deduction.

- Box 6: Investment Expenses – Allocable expenses from non-publicly traded funds (deductible on Schedule A).

- Box 7: Foreign Tax Paid – Taxes withheld by foreign governments (claim as credit on Form 1116).

- Box 8: Foreign Country or U.S. Possession – Identifies the source country for Box 7 amounts.

- Box 9: Cash Liquidation Distributions – Cash from corporate liquidations (taxed as capital gains if exceeding basis).

- Box 10: Noncash Liquidation Distributions – Fair market value of property from liquidations.

- Box 11: FATCA Filing Requirement – Checked for Foreign Account Tax Compliance Act reporting.

- Box 12: Exempt-Interest Dividends – Tax-free interest from municipal bonds (still reportable for AMT).

- Box 13: Specified Private Activity Bond Interest Dividends – Portion of Box 12 subject to alternative minimum tax.

- Boxes 14–16: State Information – State-specific withholdings and payer details (optional federally).

Include an account number if you have multiple accounts per recipient for easier IRS matching.

Electronic Filing Requirements for 1099-DIV

Starting with returns due in 2025 (for 2024), the IRS mandates electronic filing if you submit 10 or more information returns (including all 1099 types) in aggregate. This threshold dropped from 250 in prior years under the Taxpayer First Act.

Benefits of e-filing:

- Faster processing and fewer errors.

- Free File Information Returns (FIRE) system at IRS.gov.

- Required for large-volume filers; waivers rare.

If under 10, paper filing is allowed via Form 1096 transmittal.

Backup Withholding and Foreign Tax on Form 1099-DIV

Backup withholding kicks in at 24% if a recipient doesn’t provide a valid TIN (via W-9) or is subject to IRS notices. Report it in Box 4 and remit to the IRS quarterly.

For international investors, Box 7 captures foreign taxes paid, which recipients can claim as a credit. Box 11 flags FATCA compliance for U.S. accounts held by foreign financial institutions.

Common Mistakes with Form 1099-DIV and How to Correct Them

Even seasoned filers slip up. Top pitfalls:

- Forgetting to report reinvested dividends (they’re taxable!).

- Misclassifying qualified vs. ordinary dividends, leading to overpayment.

- Late filing without requesting an extension.

To correct: File an amended return marked “Corrected” with the original and updated info. Use the same deadlines as originals.

How to Use Form 1099-DIV on Your Tax Return

Recipients: Transfer Box 1a ordinary dividends to Schedule B (if over $1,500) and Form 1040, line 3b. Qualified dividends (Box 1b) go to the Qualified Dividends and Capital Gain Tax Worksheet for lower rates. Capital gains (Box 2a) flow to Schedule D.

Payers: Download the form PDF from IRS.gov and use tax software for bulk filing.

Frequently Asked Questions (FAQs) About IRS Form 1099-DIV

1. When will I receive my 1099-DIV in 2025?

By January 31, 2025, for 2024 activity.

2. Do I need a 1099-DIV for Roth IRA distributions?

No—Roth distributions are generally non-reportable on 1099-DIV.

3. What if I didn’t receive a 1099-DIV but earned dividends?

Contact your broker; you’re still required to report the income.

4. Are there penalties for not filing Form 1099-DIV?

Yes, up to $630 per form for intentional failures.

5. How has Form 1099-DIV changed for 2025?

No major form changes, but e-filing is now required for 10+ returns.

For the latest updates, visit IRS.gov/forms-pubs/about-form-1099-div. Consult a tax professional for personalized advice—investing wisely starts with compliant reporting.

This article is for informational purposes only and not tax advice. Always refer to official IRS guidance.