Table of Contents

IRS Form 1099-H – Health Coverage Tax Credit (HCTC) Advance Payments – In the world of tax forms, IRS Form 1099-H stands out as a specialized document tied to health insurance affordability programs. While the Health Coverage Tax Credit (HCTC) program itself expired on December 31, 2021, Form 1099-H remains relevant for reporting any lingering advance payments from prior years or potential future revivals. If you’re a former eligible recipient—such as those affected by trade adjustment assistance—or a health insurance provider, understanding this form is crucial for accurate tax compliance. This guide breaks down everything you need to know about Form 1099-H, including its purpose, eligibility, filing details, and tax implications for 2025.

Whether you’re searching for “IRS Form 1099-H filing deadlines” or “HCTC advance payments 2025,” this article provides clear, actionable insights based on official IRS guidance.

What Is the Health Coverage Tax Credit (HCTC)?

The HCTC was a refundable tax credit designed to help certain displaced workers and retirees afford qualified health insurance premiums. It covered up to 72.5% of monthly premiums for eligible individuals and their families, with advance payments sent directly to insurers to reduce out-of-pocket costs.

Historical Eligibility for HCTC

Before its expiration, the program targeted:

- Trade Adjustment Assistance (TAA) recipients: Workers certified for assistance due to foreign trade impacts.

- Alternative TAA (ATAA) and Reemployment TAA (RTAA) participants: Those opting for wage subsidies or relocation aid.

- Pension Benefit Guaranty Corporation (PBGC) payees: Retirees receiving pension benefits from the PBGC.

- Qualifying family members: Spouses and dependents covered under the same plan.

Eligibility was determined monthly, and participants had to enroll in qualified health plans, such as COBRA continuation coverage or individual market policies. Although the program ended in 2021, similar relief is now available through the Affordable Care Act’s Premium Tax Credit (PTC), which helps low- to moderate-income individuals via Marketplace plans.

For 2025 tax filers, if you received HCTC advance payments in prior years, Form 1099-H ensures proper reconciliation on your return.

What Is IRS Form 1099-H?

Form 1099-H, titled “Health Coverage Tax Credit (HCTC) Advance Payments,” reports the total advance payments made by the U.S. Department of the Treasury to health insurers on behalf of eligible recipients. These payments represent prepaid portions of the HCTC and are not considered taxable income to the recipient—they’re simply an advance on the tax credit you’ll claim (or reconcile) when filing your taxes.

The form is filed by health insurance providers who received these funds, but in practice, the IRS’s HCTC Program handles most filings unless the provider opts in to do so independently. For tax year 2025, the form and its instructions remain unchanged from prior years, ensuring continuity for any required reporting.

Who Receives Form 1099-H?

Primarily, Form 1099-H is furnished to:

- Eligible HCTC recipients: Individuals or families who had advance payments applied to their premiums before the program’s end.

- Health insurance providers: As filers, they (or the IRS) send Copy B to recipients by January 31, 2026, for tax year 2025.

If you’re a former TAA or PBGC recipient reviewing old records, expect this form only if advance payments were processed. Post-2021, new issuances are unlikely due to the expiration. Note: Tax software like TurboTax or TaxAct may prompt for this form if detected in your records.

How to Read and Complete Form 1099-H

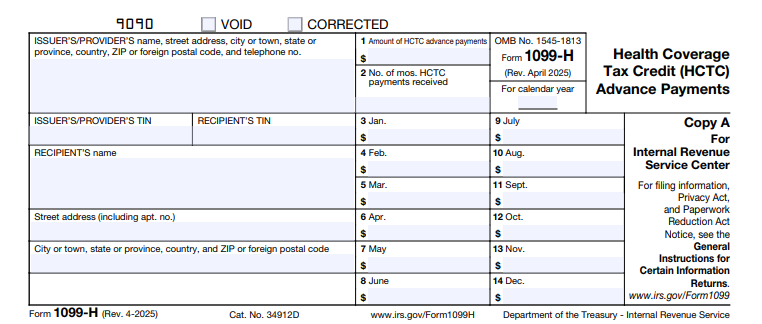

Form 1099-H is straightforward, with key boxes detailing payment history. Here’s a breakdown based on the 2025 instructions:

| Box | Description | Example for 2025 |

|---|---|---|

| 1 | Total Amount of HCTC Advance Payments | Sum of all monthly advances (e.g., $5,200 if 72.5% of $600/month premiums for 12 months). Cannot exceed 72.5% of total premiums. |

| 2 | Number of Months HCTC Payments Received | Total months covered (max 12, e.g., 8 if coverage started mid-year). |

| 3–14 | Monthly Advance Payments | Amount per month (e.g., Box 3 for January: $433). Payments may be received early but must align with coverage months. |

- Recipient’s TIN: Your Social Security Number (SSN), ITIN, or ATIN (truncatable on statements to you, but full on IRS copies).

- Filer’s Info: The insurer’s details.

To complete if filing independently: Download from IRS.gov/Form1099H, enter data accurately, and follow General Instructions for Certain Information Returns.

Filing Requirements and Deadlines for 2025

Health insurance providers must file Form 1099-H if they received HCTC advances, but the IRS HCTC Program defaults to handling this to avoid penalties. If electing to file yourself, notify the program at [email protected].

Key 2025 Deadlines

- To Recipients: January 31, 2026 (Copy B or substitute statement).

- To IRS:

- Paper: February 28, 2026.

- Electronic: March 31, 2026 (required if filing 10+ forms).

Penalties apply for late or incorrect filing (up to $310 per form), but waivers are available for reasonable cause. Electronic filing via IRS FIRE system is recommended for efficiency.

IRS Form 1099-H Download and Printable

Download and Print: IRS Form 1099-H

How Does Form 1099-H Affect Your Taxes?

Form 1099-H doesn’t create new tax liability—advance payments are reconciled against the HCTC you claim on your return using Form 8885.

- If advances match your credit: No adjustment needed; the prepaid amount offsets your tax bill.

- If you overpaid (credit > advances): Claim the difference as a refundable credit.

- If underpaid: You may owe the shortfall.

These payments help lower premiums upfront but require reporting to avoid IRS notices. For post-2021 coverage, shift to Form 1095-A for PTC reconciliation. Consult a tax professional if your situation involves expired ITINs or truncated TINs on statements.

Frequently Asked Questions (FAQs) About IRS Form 1099-H and HCTC

Is the HCTC still available in 2025?

No, it expired on December 31, 2021. Explore PTC eligibility through HealthCare.gov instead.

Do I need to report Form 1099-H on my 2025 tax return?

Yes, if received—attach it with Form 8885 to claim or reconcile the credit.

What if I didn’t receive a Form 1099-H but think I qualify?

Contact the IRS HCTC Program or your insurer; the IRS may have filed on your behalf.

Can penalties be waived for late 1099-H filing?

Yes, if due to reasonable cause (e.g., program handling errors).

Final Thoughts: Navigating HCTC Legacy in 2025

Though the HCTC program has sunset, IRS Form 1099-H ensures transparency for past advance payments, protecting recipients from unexpected tax surprises. For current health coverage needs, the PTC offers broader support—check eligibility at IRS.gov/ACA. Always use trusted tools like IRS Free File for 2025 returns, and keep records handy.

If this guide helped, share it or bookmark for tax season. For personalized advice, visit IRS.gov or consult a certified tax advisor. Stay compliant and covered!

Last updated: December 2025. Information based on IRS publications for tax year 2025.