Table of Contents

IRS Form 1099-INT – Interest Income – Interest income from savings accounts, CDs, bonds, and other investments is a common earner for many Americans, but properly reporting it to the IRS is crucial to avoid penalties or audits. IRS Form 1099-INT, also known as the Interest Income form, is the key document for tracking and disclosing this income. Whether you’re a saver dipping into high-yield accounts or an investor holding Treasury bonds, understanding Form 1099-INT ensures compliance and maximizes your tax strategy.

In this comprehensive guide, we’ll break down everything you need to know about Form 1099-INT for the 2024 tax year (filed in 2025), including who receives it, what it reports, filing deadlines, and how to integrate it into your tax return. We’ll draw from official IRS resources and trusted tax experts to keep you informed with the latest updates as of December 2025.

What Is IRS Form 1099-INT?

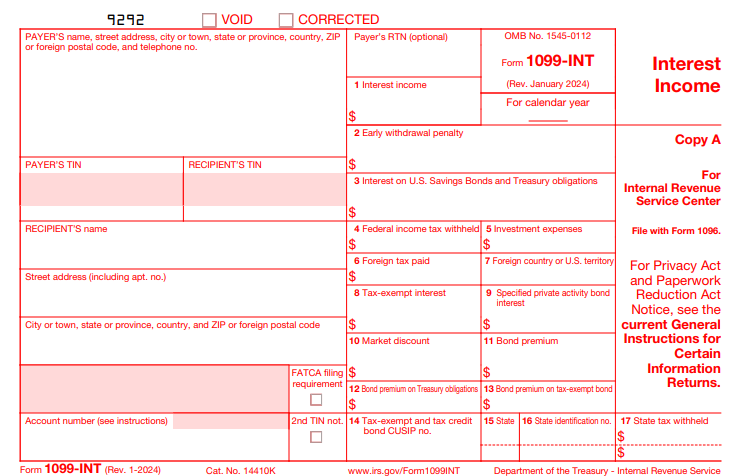

Form 1099-INT is an information return used by payers—such as banks, credit unions, brokerage firms, and government entities—to report interest payments of $10 or more made to recipients during the tax year. It’s part of the IRS’s broader 1099 series, designed to ensure all taxable interest is accounted for and helps the agency cross-check against your Form 1040.

The form captures various types of interest, from everyday bank earnings to specialized income like tax-exempt municipal bond interest. Payers must issue it regardless of whether the interest is taxable, as long as the threshold is met. For 2024, the form was revised in January 2024, with no major structural changes from prior years, but filers should note ongoing emphases on electronic filing and FATCA reporting for foreign accounts.

Who Must File Form 1099-INT?

Not everyone issues a 1099-INT—only those making reportable payments in the course of a trade or business, including federal agencies, nonprofits, and nominees acting on behalf of others. Key triggers include:

- Paying $10 or more in interest reportable in Boxes 1, 3, or 8.

- Withholding and paying foreign tax on interest.

- Applying backup withholding (typically 24%) due to missing taxpayer ID numbers (TINs), regardless of the payment amount.

Exemptions apply to payments to corporations, tax-exempt organizations, IRAs, HSAs, foreign entities under certain rules, and interest from non-U.S. sources paid outside the U.S. If you’re a payer, e-filing is mandatory if you issue 10 or more information returns in 2024.

Who Receives Form 1099-INT?

Taxpayers receive a 1099-INT if they earned at least $10 in qualifying interest from a single payer. Common recipients include:

- Individuals with savings or checking accounts.

- Bondholders earning interest on corporate, municipal, or Treasury securities.

- Those receiving refunds with interest from the IRS or states.

Even if you don’t receive the form (e.g., for amounts under $10), you’re still required to report the income if known. Banks and institutions must send copies by January 31, 2025, for 2024 earnings.

Key Boxes on Form 1099-INT: What Each One Means

Form 1099-INT has 17 boxes, but not all apply to every situation. Here’s a breakdown of the most common ones for 2024, based on IRS instructions:

| Box | Description | Example | Tax Treatment |

|---|---|---|---|

| 1: Interest Income | Taxable interest of $10 or more (e.g., from bank accounts, CDs, corporate bonds). Includes trade/business interest of $600+. | $150 from a high-yield savings account. | Taxed as ordinary income; report on Form 1040, Line 2b. |

| 2: Early Withdrawal Penalty | Forfeited interest/principal from early CD withdrawals. | $20 penalty on a 6-month CD cashed early. | Deductible on Schedule 1 (Form 1040) as an adjustment to income. |

| 3: Interest on U.S. Savings Bonds and Treasury Obligations | Interest from U.S. government securities (not in Box 1). | $50 from Series EE bonds. | Taxable; may qualify for education exclusion via Form 8815. |

| 4: Federal Income Tax Withheld | Backup withholding (24%) applied. | $36 withheld on $150 interest. | Credits against your tax liability on Form 1040. |

| 6: Foreign Tax Paid | Foreign taxes withheld on interest (report in USD). | $10 Canadian tax on bond interest. | Claim foreign tax credit on Form 1116. |

| 8: Tax-Exempt Interest | Nontaxable interest of $10+ (e.g., municipal bonds). | $200 from city bonds. | Not taxed but reported for AMT/calculation purposes. |

| 9: Specified Private Activity Bond Interest | Interest from private activity bonds (subset of Box 8). | $30 from qualified school bonds. | May trigger Alternative Minimum Tax (AMT). |

For a full list, including bond premiums (Boxes 11–13) and state info (15–17), consult the IRS form PDF. Note: Original Issue Discount (OID) is reported on Form 1099-OID, not 1099-INT, unless it’s qualified stated interest.

Filing Deadlines for Form 1099-INT in 2025

Timely filing avoids penalties up to $310 per return (or more for intentional disregard). For tax year 2024:

- Furnish to Recipients: January 31, 2025 (or March 15 for REMIC/WHFIT interests).

- File with IRS (Paper): February 28, 2025 (or March 31 if 10 or fewer forms).

- File with IRS (Electronic): March 31, 2025 (or April 30 if 10 or fewer).

Extensions are available via Form 8809, but only for good cause. Corrections? File amended forms promptly with the IRS and notify recipients. E-filing through services like TaxBandits streamlines this, with recipient delivery options starting at $0.80 per form.

How to Report Form 1099-INT on Your 2024 Tax Return

Don’t attach the form to your return—summarize the data instead. Here’s a step-by-step:

- Enter Taxable Interest (Box 1): On Form 1040, Schedule 1, Line 2b (or directly on 1040, Line 2b). If total interest > $1,500, attach Schedule B listing all payers.

- Tax-Exempt Interest (Box 8): Report on Form 1040, Line 2a for informational purposes—it affects calculations like Social Security taxation or AMT.

- Withheld Taxes (Box 4): Add to Form 1040’s federal payments section for credits.

- Penalties (Box 2): Deduct on Schedule 1, Line 24.

- Special Cases: For U.S. bond interest (Box 3), use Form 8815 if qualifying for education exclusions. Nominees subtract their share on Schedule B and issue 1099-INT to true owners.

Tax software like TurboTax automates this, pulling data directly from uploaded PDFs. Interest is taxed at your ordinary rate (up to 37% in 2024), but tax-exempt types avoid federal (though not always state) taxes.

IRS Form 1099-INT Download and Printable

Download and Print: IRS Form 1099-INT

Common Mistakes When Handling Form 1099-INT—and How to Avoid Them

Even seasoned filers slip up. Watch for these pitfalls:

- Underreporting Small Amounts: Report all interest, even under $10—no form needed, but accuracy matters.

- Forgetting Schedule B: Required over $1,500; list every source to match IRS records.

- Ignoring Tax-Exempt Reporting: Box 8 isn’t taxed but must be disclosed to prevent AMT surprises.

- Mishandling Withholdings: Claim Box 4 credits, or risk overpaying taxes.

- Nominee Errors: If holding for others, report and distribute properly.

Pro Tip: Review all 1099s by mid-February 2025 and consult a tax pro for complex investments.

Frequently Asked Questions (FAQs) About IRS Form 1099-INT

Do I need to file taxes if my only income is from interest under $10?

No form is issued, but report it if your total income meets filing thresholds (e.g., $14,600 for single filers under 65 in 2024).

Is municipal bond interest always tax-exempt?

Yes federally (Box 8), but check state rules—some states tax out-of-state bonds.

What if I don’t receive my 1099-INT by January 31?

Contact the payer; the IRS gets a copy, so report based on your records to avoid mismatches.

Can I e-file my personal taxes with 1099-INT data?

Yes—import PDFs into software for seamless Schedule B generation.

For more, visit IRS.gov or tools like H&R Block’s tax dictionary.

Final Thoughts: Stay Compliant and Optimize Your Interest Earnings

Form 1099-INT is more than paperwork—it’s your ticket to accurate tax filing and potential deductions like early withdrawal penalties or education exclusions. With deadlines approaching in early 2025, gather your forms now, use e-filing for efficiency, and consider high-yield options that maximize after-tax returns.

For personalized advice, consult a CPA or use trusted software. Questions? The IRS’s updated instructions are your best resource. File confidently, and here’s to growing your nest egg in 2025!