Table of Contents

IRS Form 1099-K – Payment Card and Third Party Network Transactions – In today’s digital economy, selling goods online, freelancing via apps, or accepting payments through platforms like PayPal, Venmo, or Stripe has never been easier. But with convenience comes responsibility—especially when it comes to taxes. Enter IRS Form 1099-K, the key document for reporting payment card and third-party network transactions. If you’re a small business owner, gig worker, or casual seller, understanding this form is crucial to avoid surprises during tax season.

As of 2025, the IRS has reinstated familiar reporting thresholds, providing relief from earlier proposed changes. This guide breaks down everything you need to know about Form 1099-K, from who files it to how it impacts your taxes. Whether you’re searching for “1099-K threshold 2025” or “what is Form 1099-K,” we’ve got you covered with the latest from trusted IRS sources.

What Is IRS Form 1099-K?

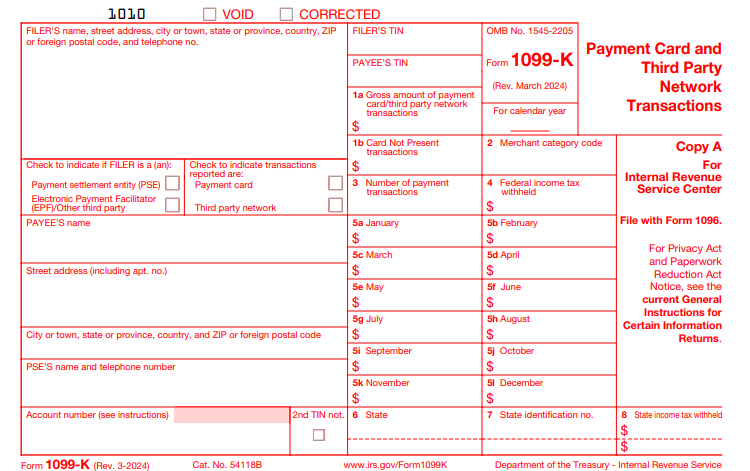

Form 1099-K, officially titled “Payment Card and Third Party Network Transactions,” is an information return filed with the IRS to report certain payments made to you for goods or services. It’s not a tax bill—it’s simply a record of gross payments processed through payment settlement entities (PSEs), like credit card companies or online marketplaces.

The form helps the IRS track income to promote voluntary compliance, but it doesn’t calculate your actual taxable income. For example, if you sell a used item for a loss, the gross amount on the 1099-K isn’t your profit—you’ll need your own records to figure that out.

Key purposes:

- Reports gross payments from credit/debit cards, stored-value cards (e.g., gift cards), payment apps, and online platforms.

- Ensures sellers report business income accurately on their tax returns.

If you’re new to this, think of it as the IRS’s way of saying, “We know you got paid—now show us how it fits into your taxes.”

Who Must File Form 1099-K?

Not everyone handling payments needs to worry about filing Form 1099-K—that’s on the PSEs. Here’s who is responsible:

- Payment Settlement Entities (PSEs): These include:

- Merchant acquiring entities for payment card transactions (e.g., banks processing Visa or Mastercard payments).

- Third-party settlement organizations (TPSOs) for network transactions (e.g., PayPal, Venmo, or eBay).

- When They File: A PSE must issue the form if your payments meet the reporting thresholds (more on that below). They file with the IRS and send you a copy.

- Special Cases:

- If a PSE uses a third-party facilitator (like an electronic payment facilitator), the entity submitting fund transfer instructions handles the filing.

- Governmental units and foreign PSEs must also report.

- Franchisors in aggregated payee setups report to banks, then allocate to franchisees.

PSEs can’t charge you fees for preparing or filing the form, so watch for that in your agreements.

Current Reporting Thresholds for Form 1099-K in 2025

One of the most searched topics is the “1099-K threshold 2025.” Good news: Recent legislation has rolled back aggressive changes, keeping things manageable for most users.

Under the One, Big, Beautiful Bill (OBBB), enacted retroactively, the thresholds revert to pre-2021 levels for tax year 2025:

| Transaction Type | Threshold for Reporting | Notes |

|---|---|---|

| Payment Card Transactions (e.g., credit/debit cards) | No minimum—report all, even $0.01 | No de minimis exception; every transaction counts. |

| Third-Party Settlement Organization (TPSO) Transactions (e.g., PayPal, Venmo for goods/services) | More than $20,000 AND more than 200 transactions | De minimis exception: No penalties if below this. States may have lower rules. |

- Why the Change? The American Rescue Plan Act of 2021 aimed to lower the TPSO threshold to $600 with no transaction minimum, but implementation was delayed multiple times (via IRS Notices 2023-10, 2023-74, and 2024-85). The OBBB fully reinstates the $20,000/200 rule for 2025, with phased relief leading to potential $600 implementation in 2026.

- Voluntary Reporting: PSEs can still send forms below thresholds to help with your deductions (e.g., tracking tips).

If your payments are for personal items like family reimbursements, they often don’t trigger reporting—more on that later.

What Information Does Form 1099-K Report?

The form captures gross payments—not your net profit. Here’s what you’ll see:

- Box 1a: Gross Amount of Payment Card/Third Party Network Transactions – Total dollars from reportable sales, excluding fees, refunds, shipping, or discounts. It doesn’t subtract your cost basis.

- Box 2: Merchant Category Code (MCC) – A four-digit code for payment cards only (e.g., 5732 for Electronics Stores). TPSOs don’t report this. Use the primary MCC if multiple apply.

- Box 4: Federal Income Tax Withheld – If backup withholding applies (e.g., missing TIN), this shows amounts withheld.

Other details include your name, address, TIN (SSN or EIN), and the PSE’s info.

Important: This gross figure isn’t your taxable income. For business sales, report on Schedule C. For personal sales, calculate gain (proceeds minus basis) on Form 8949/Schedule D—losses aren’t deductible.

Filing and Furnishing Deadlines for 2025

Timelines are strict to keep the IRS wheels turning:

- Furnish to Payee (Copy B): By January 31, 2026, for 2025 payments. Can be paper or electronic (with consent).

- File with IRS:

- Paper: Due February 28, 2026.

- Electronic: Due March 31, 2026 (mandatory if filing 10+ returns; use FIRE or IRIS systems).

Extensions are available, but plan ahead. TIN verification via the IRS Matching Program is required to avoid backup withholding.

Common Situations: When Do You Get a 1099-K?

Wondering if that side hustle will trigger a form? Here are real-world scenarios:

- Gig Economy Workers: If you earn over $20,000 from 200+ Uber rides or Etsy sales via PayPal, expect one.

- Online Sellers: eBay or Facebook Marketplace payments count if thresholds hit; personal item sales (e.g., garage sale via Venmo) may not if not for goods/services.

- Family and Friends Payments: Gifts or reimbursements (e.g., splitting dinner) aren’t reportable. If you get a form by mistake, contact the PSE or zero it out on your return (e.g., on Schedule 1, line 8z).

- Crowdfunding: Rewards-based (taxable); pure donations (often not). Track carefully.

- Children/Dependents: If they sell items or provide services, they may need to file.

- Ticket Scalping: Post-2025, interacts with Executive Order 14254—report gains if thresholds met.

- Abroad Sellers: U.S. citizens report worldwide income.

For multiple 1099-Ks, combine totals but track separately for gains/losses.

IRS Form 1099-K Download and Printable

Download and Print: IRS Form 1099-K

Recent Changes and Updates for Form 1099-K in 2025

The landscape shifted in 2025:

- OBBB Impact: Retroactively sets $20,000/200 for TPSOs, easing burdens on small sellers.

- FAQ Revisions: IRS Fact Sheet 2025-08 (October 23, 2025) updates guidance, superseding prior versions. New rules for erroneous personal sales: Net on Schedule 1 for 2024+ returns.

- Penalty Relief: Continued from prior notices for good-faith efforts.

- State Variations: Check local rules—some states require reporting below federal thresholds.

These updates aim for smoother compliance without overwhelming casual users.

How to Handle Your Form 1099-K: Tips for Taxpayers

Received a 1099-K? Don’t panic—follow these steps:

- Verify Accuracy: Compare to your records. Contact the PSE if errors (e.g., included refunds).

- Calculate Taxable Income:

- Business: Deduct expenses on Schedule C.

- Personal: Report gain only (use Publication 551 for basis rules). Estimate if needed via receipts or seller contacts.

- Report on Your Return:

- Use Schedule 1 (line 8z) for non-business proceeds.

- Form 1040 for overall income.

- If No Form but Income Exists: Self-report—all income is taxable.

- Backup Withholding: Claim credit for any amounts in Box 4.

Keep detailed records: Apps blur personal/business lines, so log everything. Tools like QuickBooks or Excel templates can help.

Final Thoughts: Stay Compliant and Stress-Free

IRS Form 1099-K is a tool for transparency in our cashless world, but with 2025’s reinstated $20,000/200 threshold, it’s less daunting for most. Whether you’re a full-time e-commerce pro or occasional seller, understanding these rules ensures accurate filing and avoids audits.

For more, download the official Instructions for Form 1099-K or consult IRS Publication 334 (Tax Guide for Small Business). If in doubt, a tax pro is your best bet.

Last updated December 2025. Always verify with IRS.gov for personalized advice.