Table of Contents

IRS Form 1099-LS – Reportable Life Insurance Sale – In the evolving landscape of tax reporting, life insurance policy sales have gained new scrutiny under the Secure 2.0 Act. If you’ve sold or acquired a life insurance contract this year, IRS Form 1099-LS—Reportable Life Insurance Sale—could play a pivotal role in your 2025 tax filings. This form ensures transparency in transactions that might otherwise trigger taxable events, helping both sellers and buyers stay compliant. Whether you’re a policyholder considering a life settlement or an investor acquiring policies, this guide breaks down everything you need to know about Form 1099-LS, from filing requirements to tax impacts.

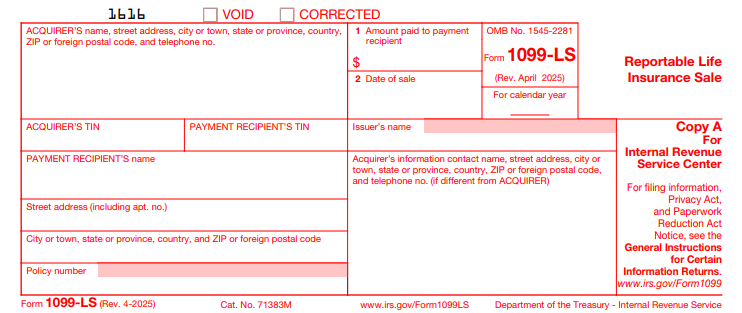

What Is IRS Form 1099-LS?

IRS Form 1099-LS is an information return used to report the acquisition of a life insurance contract (or any interest in one) during a reportable policy sale. Introduced to curb tax evasion in life settlements and viatical settlements, it mandates disclosure of sales where the buyer has no substantial ties to the insured. Unlike traditional 1099 forms for income, 1099-LS focuses on the transaction details rather than direct payments, though it does include the amount paid to the seller.

This form is relatively new, with the first filings required for sales after December 31, 2022, and it’s revised for April 2025 to reflect ongoing refinements in e-filing thresholds. For 2025, expect streamlined online options for Copies B and C.

Who Needs to File Form 1099-LS?

Primarily, the acquirer (buyer) of the life insurance policy or interest must file Form 1099-LS. This includes individuals, businesses, or entities purchasing policies through life settlement companies, viatical providers, or direct transfers. You don’t file if:

- The transfer is gratuitous (e.g., a gift).

- You’re a foreign person acquiring the policy.

- It’s a tax-free Section 1035 exchange (like swapping one policy for another of the same type).

- Another party handles unified reporting on your behalf.

Sellers (payment recipients) receive the form but do not file it. Issuers (insurance companies) may also get a copy for record-keeping.

What Constitutes a Reportable Policy Sale?

A reportable policy sale occurs when there’s a direct or indirect acquisition of a life insurance interest, and the acquirer lacks a “substantial family, business, or financial relationship” with the insured—beyond just the policy itself. Examples include:

- Life settlements: Selling a policy to a third-party investor for cash, often when premiums become unaffordable.

- Viatical settlements: Similar to life settlements but for terminally ill individuals, potentially qualifying for tax exclusions.

- Business transfers: A company selling a key-person policy to an unrelated party.

Indirect acquisitions count too, like buying into a partnership or trust that owns the policy. Payments under $600 to non-sellers (e.g., brokers) are exempt from reporting.

Key Information Required on Form 1099-LS

The form is straightforward, with just two main boxes plus identifying details:

- Box 1: Amount Paid to Payment Recipient – The total cash or value transferred to the seller or intermediary (optional on the issuer’s copy).

- Box 2: Date of Sale – The closing date of the transaction.

Additional fields include:

- Acquirer’s name, address, phone, and TIN.

- Payment recipient’s (seller’s) name, address, and TIN (truncatable on recipient copies for privacy).

- Issuer’s name and policy number.

- Contact info for questions.

A separate form is needed for each recipient and policy interest.

Filing and Furnishing Deadlines for Form 1099-LS in 2025

Timely compliance is crucial. For tax year 2025 sales:

| Recipient Type | Due Date |

|---|---|

| Payment Recipients (Sellers) | February 17, 2026 (Copy B) |

| Issuers (Insurance Companies) | January 15, 2026, or within 20 days of sale (whichever is later, but no later than Jan 15) – Copy C, for direct acquisitions only |

| IRS Filing | February 28, 2026 (paper) or March 31, 2026 (electronic) |

E-filing is mandatory if filing 10 or more returns (aggregated across all 1099s), thanks to the Taxpayer First Act. Use IRS-approved software or services like Tax1099 for seamless submission.

If a sale is rescinded, file and furnish corrections within 15 days of notice.

Tax Implications for Recipients of Form 1099-LS

Receiving a 1099-LS doesn’t automatically mean taxes are due—it signals a potential gain. Compare proceeds (Box 1) to your basis (premiums paid, often reported on Form 1099-SB from the issuer):

- No gain: If proceeds ≤ basis, no tax.

- Ordinary income: Excess up to cash surrender value.

- Capital gain: Any remainder (short-term if held ≤1 year; long-term if >1 year).

- Loss: If proceeds < basis, claim as capital loss to offset other gains.

Report on Schedule D (capital gains/losses) or Form 1040 Line 8 (other income). Viatical settlements for terminally ill may be tax-free under IRC Section 101(g). Always consult a tax pro, as state rules vary.

IRS Form 1099-LS Download and Printable

Download and Print: IRS Form 1099-LS

Common Exceptions and Exclusions

Not every policy transfer triggers a 1099-LS. Key exclusions per IRS regulations:

- Transfers to family members or business partners with substantial ties.

- Gratuitous transfers (gifts).

- Section 1035 exchanges.

- Foreign acquirers.

- Unified reporting by a third-party contractor.

Review Reg. §1.6050Y-2(f) for full details.

How to File Form 1099-LS Electronically

- Gather details: Policy info, TINs (use IRS TIN Matching for accuracy).

- Download the form from IRS.gov (fillable PDFs available).

- Use e-file providers like TaxAct or Tax2eFile for bulk filing.

- Transmit via FIRE system; include Form 1096 transmittal summary.

- Mail Copies B/C or e-deliver as required.

For 2025, the lowered e-file threshold (10 returns) makes digital filing the norm.

Penalties for Non-Compliance with Form 1099-LS

Failure to file or furnish can sting: Up to $310 per form for late filing (2025 rate), escalating to $630 for intentional disregard. Reasonable cause waivers apply for errors like invalid TINs. Aggregate penalties cap at $4,018,500 for small businesses. (From General Instructions; specific to info returns.)

Frequently Asked Questions (FAQs) About IRS Form 1099-LS

Do I need a 1099-LS for every life insurance sale?

No, only reportable ones without substantial relationships qualify.

Can I truncate TINs on the form?

Yes, on recipient copies (last four digits), but not for IRS filings.

What if I receive multiple 1099-LS forms?

Aggregate proceeds and basis for tax calculation; report each on your return.

Is Form 1099-LS the same as 1099-SB?

No—1099-SB reports basis from issuers; 1099-LS covers sales from acquirers.

How has Form 1099-LS changed for 2025?

Minor updates for e-filing (threshold now 10) and online fillable forms; no major overhauls.

Final Thoughts: Stay Ahead on Life Insurance Tax Reporting

Navigating IRS Form 1099-LS ensures you’re not caught off-guard by reportable life insurance sales. With deadlines approaching in early 2026, review any 2025 transactions now—consult the official IRS instructions and a tax advisor for personalized advice. Proper reporting not only avoids penalties but also unlocks potential deductions or exclusions. For more tax tips, explore IRS.gov or tools like TaxAct.

Last updated: December 2025. Always verify with the latest IRS guidance.