Table of Contents

IRS Form 1099-LTC – Long-Term Care and Accelerated Death Benefits – In an era where long-term care (LTC) insurance is becoming essential for many Americans planning for aging and health challenges, understanding IRS Form 1099-LTC is crucial. This form reports payments from long-term care insurance policies and accelerated death benefits, which can have significant tax implications. Whether you’re a policyholder receiving benefits or a payer distributing them, knowing the ins and outs of Form 1099-LTC ensures compliance and potential tax savings. In this comprehensive 2025 guide, we’ll break down what the form entails, who files it, tax treatments, and more—all based on the latest IRS guidelines.

What is IRS Form 1099-LTC?

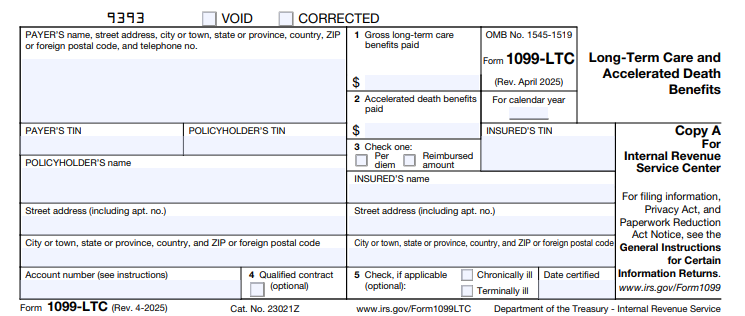

IRS Form 1099-LTC, officially titled “Long-Term Care and Accelerated Death Benefits,” is an information return used to report distributions from qualified long-term care insurance contracts or life insurance policies that provide accelerated death benefits. Issued by the IRS, it helps the government track these payments, which are often related to chronic or terminal illnesses.

The form’s primary purpose is to disclose gross payments without determining their taxability—that responsibility falls to the recipient when filing their personal tax return. For tax year 2025, the form remains largely unchanged from prior years, with revisions effective April 2025 emphasizing electronic filing options due to low paper volume.

Long-term care benefits cover expenses like nursing home stays, home health aides, or assisted living, while accelerated death benefits allow terminally or chronically ill individuals to access a portion of their life insurance payout early.

Who Needs to File Form 1099-LTC?

Not everyone dealing with LTC policies must file this form. Payers—including insurance companies, governmental units (like state programs), and viatical settlement providers—are required to issue Form 1099-LTC if they distribute any reportable benefits to an individual policyholder.

Viatical settlement providers, who buy or assign life insurance contracts from terminally or chronically ill individuals, must also comply if they meet state licensing requirements. Payments are reportable even if made to third parties on behalf of the insured.

If you’re a recipient (policyholder or insured), you won’t file the form yourself but must use it to report income on your Form 1040. Always receive a copy by January 31, 2026, for 2025 payments.

Key Information Reported on Form 1099-LTC

Form 1099-LTC is straightforward, with five main boxes capturing essential details. Here’s a breakdown for tax year 2025:

- Box 1: Gross Long-Term Care Benefits Paid

This reports the total LTC benefits paid during the year, excluding accelerated death benefits. Include per diem payments (fixed daily amounts) or reimbursements for actual expenses paid to the insured, policyholder, or third parties. No taxability assessment is needed here. - Box 2: Accelerated Death Benefits Paid

Enter gross amounts from life insurance contracts paid to or for a certified terminally or chronically ill insured. This includes viatical settlements. - Box 3: Per Diem or Reimbursed Amount

Check the appropriate box to indicate if payments were per diem (periodic, regardless of expenses) or reimbursed (based on actual costs). Skip this for terminal illness accelerated benefits. - Box 4: Qualified Contract (Optional)

Check if benefits stem from a qualified LTC contract (post-1996 policies meeting IRC Section 7702B, or pre-1997 state-qualified policies). - Box 5: Chronically Ill or Terminally Ill (Optional)

Mark the insured’s status and include the latest certification date if applicable.

Copies are distributed as follows: Copy B to the policyholder, Copy C to the insured (optional if the same person), and Copy A with Form 1096 to the IRS. Truncating the recipient’s TIN on statements is allowed for privacy.

Tax Implications of Long-Term Care and Accelerated Death Benefits

One of the biggest questions around Form 1099-LTC is: Are these payments taxable? The answer depends on the policy type and payment structure, but many qualify as tax-free.

Long-Term Care Benefits

- Qualified Policies: Benefits from tax-qualified LTC contracts are generally excluded from income, up to certain limits. For per diem contracts in 2025, the daily exclusion limit is $420—meaning up to $153,300 annually ($420 x 365) can be tax-free, regardless of actual expenses. Excess amounts may be taxable unless offset by qualified expenses.

- Reimbursed Contracts: These are tax-free only to the extent they cover actual LTC costs; any surplus is income.

Use IRS Form 8853 to calculate and report any taxable portion on your return.

Accelerated Death Benefits

These are typically tax-free if:

- Paid under a qualified LTC rider.

- The insured is terminally ill (life expectancy ≤24 months) or chronically ill (unable to perform two activities of daily living).

- For viaticals, the provider must be licensed.

Non-qualified payments may count as taxable income, potentially triggering the 3.8% Net Investment Income Tax.

Premiums for qualified LTC policies may also be deductible as medical expenses, subject to AGI thresholds.

Filing Deadlines and Requirements for Form 1099-LTC in 2025

Timely filing is key to avoiding penalties. For tax year 2025:

- Recipient Statements: Send Copies B and C by January 31, 2026.

- IRS Filing: Paper returns due February 28, 2026; electronic by March 31, 2026. E-filing is required unless you qualify for a waiver (e.g., fewer than 10 returns).

Use the IRS’s online fillable forms for low-volume filers. Always include an account number for tracking.

IRS Form 1099-LTC Download and Printable

Download and Print: IRS Form 1099-LTC

How to Handle Form 1099-LTC on Your Tax Return

If you receive a 1099-LTC:

- Review Boxes 1–5 for accuracy.

- Complete Form 8853 to determine taxable amounts.

- Report any taxable income on Schedule 1 (Form 1040), line 8z (other income).

- Attach Form 8853 if claiming exclusions.

Consult a tax professional if your situation involves multiple policies or complex illnesses. Tools like TaxAct can simplify importing 1099-LTC data.

Frequently Asked Questions (FAQs) About IRS Form 1099-LTC

Is Form 1099-LTC always taxable?

No—many payments are tax-free under qualified contracts, but calculate using Form 8853.

What if I don’t receive my 1099-LTC by January 31?

Contact the payer immediately; the IRS expects you to report based on records.

Can I deduct LTC premiums on my 2025 taxes?

Yes, up to age-based limits (e.g., $5,880 for those 71+), as itemized medical expenses.

What’s the difference between per diem and reimbursed LTC benefits?

Per diem pays a fixed amount daily (tax-free up to $420/day in 2025), while reimbursed covers actual costs only.

Final Thoughts: Stay Compliant and Maximize Tax Benefits

Navigating IRS Form 1099-LTC doesn’t have to be overwhelming. By understanding its role in reporting long-term care and accelerated death benefits, you can ensure accurate tax filing and potentially exclude thousands in income. For the most current details, visit IRS.gov or consult a certified advisor. As healthcare costs rise, proactive planning with qualified LTC policies remains a smart financial move.

Last updated: December 2025. Always verify with official IRS resources for your specific situation.