Table of Contents

IRS Form 1099-MISC – Miscellaneous Information – In the world of tax reporting, few forms carry as much weight for freelancers, businesses, and individuals as IRS Form 1099-MISC. If you’re a payer reporting miscellaneous income or a recipient expecting to receive one, knowing the ins and outs of this form is crucial to avoid penalties and ensure compliance. As we head into tax season for 2025, this guide breaks down everything you need to know about Form 1099-MISC—from its purpose and filing requirements to deadlines and common pitfalls. Whether you’re searching for “what is a 1099-MISC form” or “how to file 1099-MISC in 2025,” you’ve come to the right place.

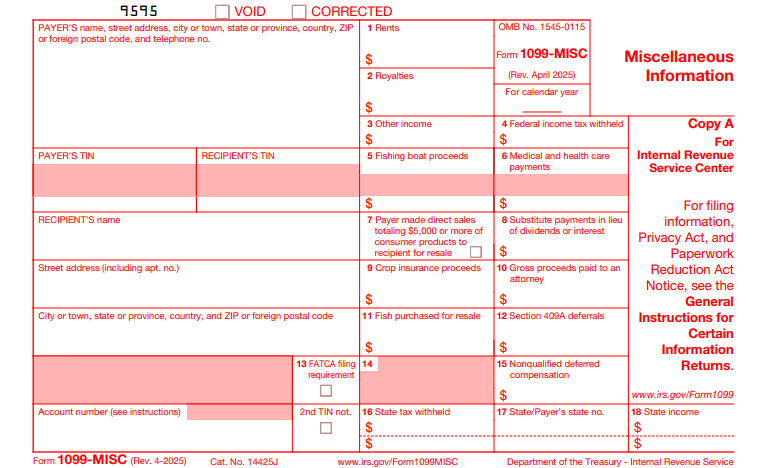

What Is IRS Form 1099-MISC?

IRS Form 1099-MISC, titled “Miscellaneous Information,” is an information return used to report certain types of payments made in the course of a trade or business. Unlike W-2 forms for employees, 1099-MISC is for non-employee compensation and other miscellaneous income sources. It’s essential for the IRS to track income that might otherwise go unreported.

Key purposes include:

- Reporting payments like rents, royalties, prizes, and medical fees.

- Helping recipients report income accurately on their tax returns.

- Ensuring payers comply with backup withholding rules.

For tax year 2024 (filed in 2025), the form remains focused on non-compensation payments, with nonemployee compensation shifted to Form 1099-NEC since 2020.

Who Must File Form 1099-MISC?

Not everyone needs to file a 1099-MISC—only those who make specific reportable payments in a business context qualify as “payers.” This includes:

- Businesses, including nonprofits and trusts.

- Federal, state, or local government agencies.

- Farmers’ cooperatives and exempt organizations under sections 501(c) or (d).

You must file a separate Form 1099-MISC for each person (individual, partnership, estate, or corporation) to whom you paid qualifying amounts during the year. Even if no federal income tax was withheld, filing is required if thresholds are met.

Important thresholds for filing:

- $10 or more in royalties or substitute payments in lieu of dividends or tax-exempt interest.

- $600 or more in rents, prizes/awards, other income, medical/health care payments, crop insurance proceeds, or fish purchased for resale.

- $5,000 or more in direct sales of consumer products for resale (optional checkbox).

- Any amount if backup withholding applies.

Payments to corporations are generally exempt, except for medical payments, attorney proceeds, fish purchases, and substitute dividends.

What Types of Income Does Form 1099-MISC Report?

Form 1099-MISC covers a range of miscellaneous payments. Here’s a breakdown of the most common types:

- Rents (Box 1): $600+ for real estate, equipment, or pasture rentals. Note: Payments to real estate agents aren’t reported here—they issue their own 1099s.

- Royalties (Box 2): $10+ from copyrights, patents, or oil/gas royalties (gross amounts before deductions).

- Other Income (Box 3): $600+ for prizes, awards, taxable settlements, or Indian gaming profits to tribal members.

- Medical and Health Care Payments (Box 6): $600+ to physicians or suppliers, including drug costs.

- Crop Insurance Proceeds (Box 9): $600+ paid to farmers.

- Gross Proceeds to Attorneys (Box 10): $600+ in legal settlements (not fees for services).

- Fishing Boat Proceeds (Box 5): Shares from boat catches.

Recent update: Excess golden parachute payments now go on Form 1099-NEC (Box 3), not 1099-MISC.

For a full list, refer to the official IRS instructions.

Form 1099-MISC vs. Form 1099-NEC: Key Differences

Confused about when to use 1099-MISC versus 1099-NEC? Here’s a quick comparison:

| Aspect | Form 1099-MISC | Form 1099-NEC |

|---|---|---|

| Primary Use | Miscellaneous income (rents, royalties, prizes) | Nonemployee compensation (e.g., contractor fees) |

| Threshold | Varies ($10–$600) | $600+ |

| Filing Deadline | Recipient copy: Jan 31; IRS: Feb 28 (paper)/Mar 31 (e-file) | Recipient copy: Jan 31; IRS: Same as 1099-MISC |

| Boxes for Compensation | None (use Box 7 for sales only) | Box 1 for services |

Since 2020, nonemployee pay shifted to 1099-NEC to streamline reporting. Always double-check the payment type.

How to Fill Out and File Form 1099-MISC

Step-by-Step Instructions

- Gather Recipient Info: Collect name, address, TIN (SSN or EIN), and payment details. Request Form W-9 if needed.

- Complete the Boxes: Use the payer’s name/address in the top section. Enter amounts in the appropriate boxes (see above). Check Box 7 for qualifying sales; mark Box 13 for FATCA if applicable.

- Withholding: Report any federal tax withheld in Box 4.

- State Info: Optional Boxes 16–18 for state taxes.

Download the form from IRS.gov as a fillable PDF.

Filing Methods

- Paper Filing: Mail Copy A with Form 1096 to the IRS by February 28, 2026 (for 2025 tax year).

- Electronic Filing: Required if filing 10+ returns (lowered from 250 in 2024). Use the IRS IRIS system or FIRE for secure e-filing by March 31, 2026.

Pro tip: Online fillable Copies B and 2 are available for recipients.

2025 Filing Deadlines for Form 1099-MISC

Timely filing avoids penalties. For tax year 2025:

- Furnish to Recipients: January 31, 2026.

- File with IRS: February 28, 2026 (paper); March 31, 2026 (electronic).

If the date falls on a weekend or holiday, it extends to the next business day.

Common Mistakes and Penalties to Avoid

- Forgetting Thresholds: Reporting under $600 (except royalties) or missing backup withholding.

- Incorrect TINs: Leads to $50–$290 penalties per form.

- Late Filing: Up to $310 per return, plus interest.

Penalties can reach $630,500 for intentional disregard. Use IRS e-file to minimize errors.

Frequently Asked Questions (FAQs) About IRS Form 1099-MISC

Do I need a 1099-MISC for personal payments?

No—only business-related payments count.

What if I receive a corrected 1099-MISC?

File an amended return if it changes your tax liability.

Can I e-file 1099-MISC for free?

Yes, via the IRS IRIS Taxpayer Portal for up to 100 returns.

How do I report 1099-MISC income on my taxes?

Enter it on Schedule C (business) or Schedule 1 (other income) of Form 1040.

Final Thoughts: Stay Compliant with Form 1099-MISC in 2025

Mastering IRS Form 1099-MISC ensures smooth tax reporting and avoids costly surprises. With e-filing mandates tightening and forms like 1099-NEC handling compensation, staying updated is key. Consult a tax professional for complex situations, and always reference official IRS resources.

For the latest forms and instructions, visit IRS.gov. Ready to file? Download your 1099-MISC today and tackle tax season with confidence.

IRS Form 1099-MISC Download and Printable

Download and print: IRS Form 1099-MISC