Table of Contents

IRS Form 1099-OID – Original Issue Discount – In the world of tax reporting, few forms carry the weight of IRS Form 1099-OID, the key document for tracking Original Issue Discount (OID). If you’re an investor holding bonds, certificates of deposit (CDs), or other debt instruments sold at a discount, understanding Form 1099-OID is essential for accurate tax filing. This guide breaks down everything you need to know about OID, the form itself, reporting requirements, and 2025 updates to help you stay compliant and optimize your deductions.

Whether you’re a payer issuing the form or a recipient reporting income, mastering Form 1099-OID ensures you avoid penalties and maximize your financial strategy. Let’s dive in.

What Is Original Issue Discount (OID)?

Original Issue Discount (OID) is a type of interest income that arises when a debt instrument—such as a bond, note, or CD—is issued or purchased for less than its face value (stated redemption price at maturity). The difference between the discounted purchase price and the full repayment amount is treated as taxable interest, accrued over the instrument’s life using the constant yield method.

Key Characteristics of OID Instruments

- Zero-Coupon Bonds: These pay no periodic interest but are redeemed at face value, making the entire discount OID.

- Deep-Discount Bonds: Issued below par with minimal or no stated interest.

- Stripped Bonds and Coupons: Separated principal and interest components, treated as separate OID instruments.

- Inflation-Indexed Debt (e.g., TIPS): Adjustments for inflation can create OID.

- Tax-Exempt Obligations: OID may be partially or fully nontaxable, but still reported.

OID is calculated daily and prorated for the portion of the year you hold the instrument. For example, if a $1,000 bond is bought for $800 with a 5-year maturity, the $200 discount is OID, spread evenly or via constant yield. Use IRS Publication 1212’s OID tables for publicly traded instruments to simplify calculations, available on IRS.gov with annual updates.

What Is IRS Form 1099-OID?

Form 1099-OID, or “Original Issue Discount,” is an information return used to report OID and related interest to the IRS and recipients. It’s filed by payers (like issuers or brokers) when OID reaches certain thresholds, ensuring the IRS tracks this hidden interest income.

Unlike Form 1099-INT (for straightforward interest), 1099-OID focuses on discounted debt, though it can include other periodic interest. For tax year 2025, the form remains largely unchanged from 2024, with no major regulatory shifts noted in IRS updates as of June 2025.

Who Must File Form 1099-OID and Who Receives It?

Who Files It?

Payers must issue Form 1099-OID if:

- OID includible in the recipient’s gross income is $10 or more.

- Any federal income tax was withheld under backup withholding rules (even if OID < $10).

- Foreign tax was withheld and paid on OID.

Filers include:

- Bond issuers with outstanding OID debt.

- Financial institutions issuing CDs or time deposits over 1 year with OID.

- Brokers or middlemen holding OID obligations as nominees.

- Trustees of widely held fixed investment trusts (WHFITs) or mortgage trusts (WHMTs).

- Real estate mortgage investment conduits (REMICs) or collateralized debt obligations (CDOs).

Exceptions: No filing for payments to corporations, tax-exempt organizations, IRAs, HSAs, government entities, or registered dealers. Short-term obligations (≤1 year) are reported on Form 1099-INT instead.

Who Receives It?

Recipients are holders of record for the OID instrument, typically individual investors or trusts. If you’re a nominee (e.g., broker), you report to the true owner. For 2025, expect delivery by January 31, 2026.

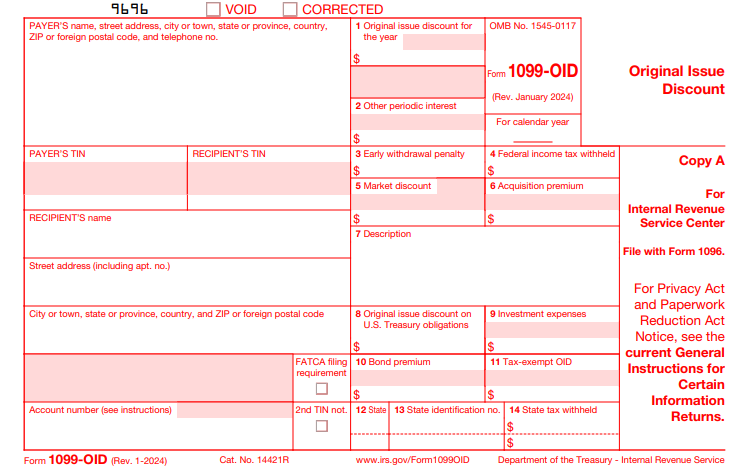

Breaking Down the Boxes on Form 1099-OID

Form 1099-OID has 14 boxes, each capturing specific data. Here’s a quick reference table for tax year 2025:

| Box | Description | Key Notes |

|---|---|---|

| 1 | Original Issue Discount | Taxable OID for the year held (exclude box 8 amounts). Minimum $10 threshold. |

| 2 | Other Periodic Interest | Qualified stated interest paid/credited (can report on 1099-INT instead). |

| 3 | Early Withdrawal Penalty | Forfeited amount on early CD withdrawal (deductible by recipient). |

| 4 | Federal Income Tax Withheld | Backup withholding (24% rate for 2025) on boxes 1, 2, 8. |

| 5 | Market Discount | Accrued market discount ≥$10 on covered securities (constant yield method). |

| 6 | Acquisition Premium | Amortization reducing OID (for covered securities). |

| 7 | Description | CUSIP no., issuer details, maturity date. |

| 8 | OID on U.S. Treasury Obligations | Specific OID for Treasuries (may be negative for deflation). |

| 9 | Investment Expenses | Pro rata share for single-class REMICs (nondeductible). |

| 10 | Bond Premium | Amortization on covered securities (reduces interest in box 2). |

| 11 | Tax-Exempt OID | For tax-exempt obligations (covered securities post-2016). |

| 12 | State | State abbreviation (optional). |

| 13 | State Payer’s ID | State tax ID (optional). |

| 14 | State Tax Withheld | State withholding (optional). |

For covered securities (acquired after 2013/2016), boxes 5, 6, 10, and 11 are mandatory starting in 2025, aiding basis adjustments.

How to Report OID on Your 2025 Tax Return

As a recipient, include OID as interest income on your Form 1040:

- Locate OID: Use box 1 (taxable OID) + box 2 (periodic interest) + box 8 (Treasury OID). Add tax-exempt OID from box 11 to line 2a of Form 1040 (nontaxable interest).

- Adjust for Premiums/Discounts: Reduce OID by acquisition premium (box 6) or bond premium (box 10). Add market discount (box 5) if elected.

- Report on Schedule B: List payers and amounts on Part I, line 1. Note adjustments (e.g., “OID Adjustment”) and subtotal before entering on Form 1040, line 2b.

- Basis Tracking: Increase your basis by accrued OID annually to avoid double taxation on sale (report gains/losses on Form 8949/Schedule D).

- Special Cases:

- Tax-Exempt: Report full OID but exclude taxable portion from income; adjust basis hypothetically.

- Stripped Bonds: Treat as new issues; calculate OID from purchase date.

- Sales/Redemptions: Report gain as interest income if OID instrument.

Even without a form, self-report if OID ≥$10. Use Publication 1212 for calculations if Form 1099-OID is inaccurate.

IRS Form 1099-OID Download and Printable

Download and Print: IRS Form 1099-OID

2025 Filing Deadlines and Requirements for Form 1099-OID

For tax year 2025:

- Furnish to Recipients: January 31, 2026.

- File with IRS: Paper by February 28, 2026; electronically by March 31, 2026 (via FIRE or IRIS systems).

- Electronic Filing Mandate: Required if filing 10+ returns total (all 1099 types combined). Waivers via Form 8508.

- Extensions: 30 days for IRS filing (Form 8809); recipient statements via Form 15397 (fax only).

Penalties for late/inaccurate filing start at $60 per return, escalating to $340 (with caps for small businesses). Backup withholding is 24%; report on Form 945 by February 10, 2026.

Common Mistakes to Avoid When Handling Form 1099-OID

- Ignoring Thresholds: Filing for < $10 OID (unless withholding applies).

- Misclassifying Short-Term Debt: Use 1099-INT for ≤1-year terms.

- Forgetting Basis Adjustments: Leads to overreported gains on sale.

- Overlooking Covered Securities: Mandatory premium/discount reporting post-2016.

- Late E-Filing: Triggers automatic penalties if over 10 returns.

Pro Tip: Use tax software or consult a CPA for complex instruments like REMICs. Always verify CUSIP details in box 7.

Frequently Asked Questions (FAQs) About IRS Form 1099-OID

1. Do I need to file Form 1099-OID for tax-exempt bonds?

Yes, report tax-exempt OID in box 11, but it’s not taxable income.

2. What if my Form 1099-OID is wrong?

Contact the payer for a corrected form (marked “CORRECTED”). Self-adjust on your return with documentation.

3. Is OID reported differently for inflation-protected securities?

Yes, use the discount bond method; deflation reduces reportable OID.

4. Can I e-file Form 1099-OID for free?

Yes, through IRS-approved systems like TaxBandits or directly via FIRE for volumes under 250.

5. What’s new for 2025?

No substantive changes; focus on electronic mandates and updated OID tables in Pub. 1212 (rev. Jan. 2025).

Final Thoughts: Stay Ahead with Proper OID Reporting

IRS Form 1099-OID might seem niche, but it’s crucial for investors in discounted debt to report income accurately and adjust basis effectively. By understanding OID calculations, form boxes, and 2025 deadlines, you’ll minimize errors and penalties while optimizing your tax position.

For the latest forms and tables, visit IRS.gov. If your portfolio includes complex OID instruments, professional advice is invaluable. File on time, report correctly, and invest confidently.

This article is for informational purposes only and not tax advice. Consult a tax professional for personalized guidance.