Table of Contents

IRS Form 1099-PATR – Taxable Distributions Received From Cooperatives – Agricultural producers, rural electric users, and other cooperative members often receive patronage dividends that boost their bottom line—but these payments come with tax reporting obligations. IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives, ensures these distributions are accurately reported to the IRS, helping members claim deductions like the Qualified Business Income (QBI) under Section 199A while avoiding penalties. For tax year 2025, cooperatives must issue forms for payments of $10 or more, with e-filing mandatory for 10+ returns and deadlines approaching in early 2026. This SEO-optimized guide, drawing on the latest IRS instructions (Rev. April 2025), covers filing essentials, box-by-box breakdowns, and strategies for cooperatives and recipients to stay compliant amid rising patronage from sectors like farming and energy.

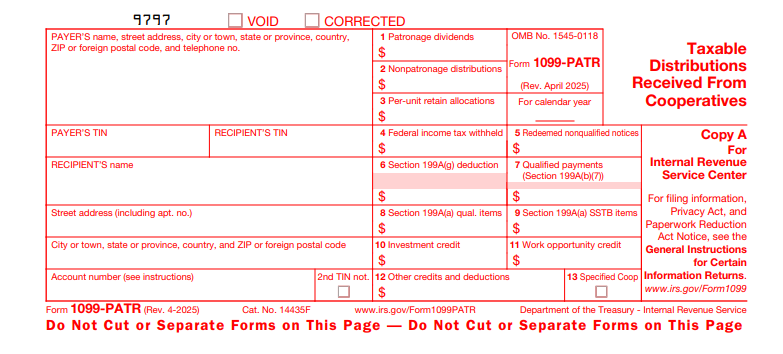

What Is IRS Form 1099-PATR?

IRS Form 1099-PATR reports patronage dividends, per-unit retain allocations, and other taxable distributions from cooperatives to their patrons, as required under IRC Section 6044(b). Issued by cooperatives (e.g., farm supply co-ops or credit unions), it captures cash, qualified written notices of allocation, and nonpatronage refunds—key for patrons deducting these as business expenses on Schedule F or C. Unlike Form 1099-DIV for corporate dividends, 1099-PATR focuses on cooperative-specific items, including Section 199A(g) deductions for eligible ag/horticultural co-ops.

Key purposes:

- Income Tracking: Reports amounts eligible for QBI deduction (up to 20% of qualified income).

- Patronage Reporting: Details deductible allocations, reducing co-op taxable income.

- Backup Withholding: Flags federal tax withheld (24% in 2025) for non-compliant TINs.

The April 2025 revision (Cat. No. 14435F) adds Box 12 for sustainable aviation fuel mixture credits and emphasizes continuous use for 2025+. Download the form and instructions from IRS.gov/Form1099PATR.

Who Needs to File IRS Form 1099-PATR in 2025?

Cooperatives must file for each patron receiving $10+ in reportable distributions or subject to backup withholding, regardless of amount. Exceptions include payments to corporations, tax-exempt organizations, or foreign governments.

| Filer Type | Filing Threshold | Notes |

|---|---|---|

| Agricultural Co-ops | $10+ in patronage dividends/per-unit retains | Includes Section 199A(g) items for QBI pass-through. |

| Non-Ag Co-ops (e.g., Electric, Housing) | $10+ in nonpatronage distributions | Report redemptions of nonqualified notices in Box 2. |

| Patrons (Recipients) | N/A | Report on Schedule F (farming), C (business), or E (rental); no filing required. |

| Small Co-ops (<10 Forms) | Optional e-file | Paper OK; e-file mandatory for 10+ info returns total. |

Use EIN for the co-op; validate patron TINs via IRS TIN Matching System.

Filing Deadlines and Extensions for Form 1099-PATR in 2025

Deadlines for 2025 distributions (reported in 2026) prioritize recipient copies first. E-filing extends IRS submission but not furnishing.

| Deadline | Date | Method |

|---|---|---|

| Furnish to Recipients (Copy B) | January 31, 2026 | Mail/email; include Pub. 970 summary if QBI-related. |

| File with IRS (Copy A) | March 2, 2026 (paper) or March 31, 2026 (e-file) | Include Form 1096; e-file via IRIS/FIRE. |

| Extensions | Automatic 30 days via Form 8809 (by original due) | IRS filing only; additional 30 days for hardship. No extension for recipients. |

- Where to File: Paper to IRS per Pub. 1220 state-based addresses; e-file required for 10+ returns.

- State Filing: Many states (e.g., CA, TX) accept combined federal/state via CF/SF program.

Pre-file from November 2025 for queue priority.

Step-by-Step Guide to Completing IRS Form 1099-PATR

Gather patron records, allocation statements, and withholding data. Use the April 2025 fillable PDF for accuracy.

- Payer Section: Co-op name, EIN, address; account number if multiple per patron.

- Recipient Section: Patron name, address, TIN (truncate on Copy B); check “2nd TIN not” if notified of errors.

- Box 1: Patronage Dividends – Cash, qualified notices, or property (deductible under §1382(b)).

- Box 2: Nonpatronage Distributions – Refunds from nonpatronage sources (§1382(c)).

- Box 3: Per-Unit Retain Allocations – Share of cash/qualified certificates (§1382(b)(3)); deductible for patrons.

- Box 4: Federal Income Tax Withheld – Backup withholding (24%).

- Boxes 5–6: Refund/Investment Credits – Amounts reducing patron investment.

- Boxes 7–9: Section 199A Items – QBI-eligible income (Box 7), SSTB amounts (Box 8), W-2 wages (Box 9).

- Box 10: Section 199A(g) Deduction – Pass-through from ag co-ops.

- Box 11: Qualified Items – Non-SSTB QBI components.

- Box 12: Sustainable Aviation Fuel Credit – New for 2025 mixtures.

- Box 13: Ag/Hort Co-op Indicator – Check for §199A(g) eligibility.

- Sign & Distribute: Officer signs Copy A; furnish Copy B by January 31.

For e-file, use IRS-approved software like TaxBandits; paper requires red-ink scannable forms.

Understanding Key Boxes on IRS Form 1099-PATR

Form 1099-PATR’s boxes align with Subchapter T rules, enabling patrons to deduct distributions as cost of goods sold.

| Box | Description | Tax Impact for Patrons |

|---|---|---|

| 1 | Patronage dividends (cash/qualified allocations) | Deductible on Schedule F/C; QBI-eligible. |

| 3 | Per-unit retain allocations | Deductible as business expense; report on line 23 of Schedule F. |

| 7 | Section 199A QBI-eligible income | Up to 20% deduction; attach to Form 8995. |

| 4 | Backup withholding | Creditable on Form 1040; reduces tax due. |

Per-unit retains (Box 3) are based on units handled, not net margins—key for farmers.

IRS Form 1099-PATR Download and Printable

Download and Print: IRS Form 1099-PATR

E-Filing vs. Paper: Best Practices for Form 1099-PATR in 2025

E-filing is mandatory for 10+ info returns and offers error checks plus instant IRS acknowledgment.

- E-Filing Pros: Reduces penalties (90% error drop); supports bulk uploads; free via IRIS.

- Paper Pros: For <10 forms; mail with Form 1096.

- Threshold: Aggregates with other 1099s (e.g., 1099-MISC).

Use vendors like TaxZerone for TIN validation and USPS address checks.

Common Mistakes When Filing Form 1099-PATR and How to Avoid Them

Avoid IRS notices with these tips:

- TIN Mismatches: Use IRS TIN Matching—prevents $310 penalties.

- Box Misclassification: Confusing patronage (Box 1) vs. nonpatronage (Box 2)—review §1382 rules.

- Missing QBI Data: Omitting Boxes 7–11—calculate per Form 8995-A instructions.

- Late Recipient Copies: Forgetting January 31—set e-delivery reminders.

- No Account Numbers: For multi-account patrons—assign unique IDs.

Document allocations; consult Pub. 542 for co-op specifics.

Penalties for Late or Incorrect Form 1099-PATR Filings

Non-compliance triggers tiered fines under IRC §6721/6722, inflation-adjusted for 2025:

| Violation | Penalty per Form | Max (Small Business) | Max (Large Business) |

|---|---|---|---|

| Timely (Within 30 Days) | $60 | $194,500/year | $556,500/year |

| 31 Days–Aug 1 | $120 | $556,500/year | $1,669,500/year |

| After Aug 1/No File | $330 | $1,291,000/year | $3,873,000/year |

| Intentional Disregard | $660+ or 10% of amount | No max | No max |

Interest accrues monthly; reasonable cause (e.g., vendor error) waives via Notice 972CG response. First-time abatement available.

Frequently Asked Questions About IRS Form 1099-PATR

Do cooperatives file 1099-PATR for payments under $10?

No—threshold is $10+; backup withholding requires filing regardless.

Where do patrons report Box 1 dividends?

On Schedule F (line 6a for farming) or C (line 6); QBI via Form 8995.

Is e-filing required for 5 Form 1099-PATR?

No—but mandatory if total info returns ≥10.

What’s new in the 2025 Form 1099-PATR?

Box 12 for sustainable aviation fuel credits; continuous use revision.

How do per-unit retains (Box 3) differ from dividends?

Retains are unit-based (e.g., per bushel); both deductible but reported separately.

Visit IRS.gov/Form1099PATR for more.

Final Thoughts: Simplify Cooperative Tax Reporting with Form 1099-PATR in 2025

IRS Form 1099-PATR empowers cooperatives to distribute profits transparently while enabling patrons to maximize deductions like QBI on patronage income. With 2025’s April revision enhancing Section 199A tracking and e-filing thresholds at 10 forms, proactive preparation—from TIN validation to timely furnishing—avoids penalties up to $330 per form. Download the latest from IRS.gov today and consider e-filing tools for seamless compliance.

Cooperative success starts with accurate reporting—file right, deduct fully.

This article is informational only—not tax advice. Consult IRS.gov or a professional.