Table of Contents

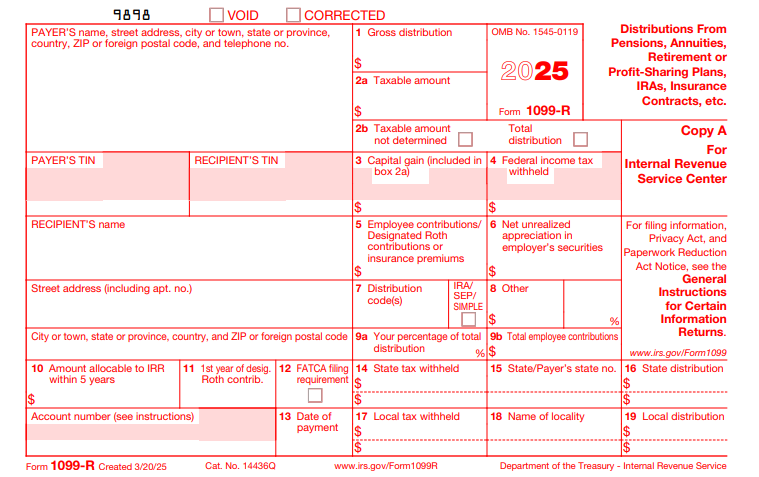

IRS Form 1099-R – Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc – As retirement savers navigate withdrawals from pensions, IRAs, and other plans, accurate tax reporting is crucial to avoid IRS penalties and ensure proper income calculation. IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is the key document for these transactions. For the 2025 tax year, the IRS has introduced updates like a new distribution code for qualified charitable distributions (QCDs), making compliance both easier and more precise.

This SEO-optimized guide, drawing from the official 2025 Instructions for Forms 1099-R and 5498 released in May 2025, covers the form’s purpose, filing requirements, step-by-step completion, deadlines, and pitfalls to sidestep. Whether you’re a plan administrator or a retiree reviewing your forms, this resource helps you stay compliant amid evolving rules like the optional Code Y for QCDs. Let’s break it down.

What Is IRS Form 1099-R?

Form 1099-R is an informational return used to report distributions of $10 or more from retirement plans, annuities, pensions, profit-sharing plans, IRAs (traditional, Roth, SEP, SIMPLE), and certain insurance contracts. It details gross amounts, taxable portions, withholdings, and distribution codes, helping the IRS verify income and apply rules like the 10% early withdrawal penalty under section 72(t).

Payers (e.g., trustees, custodians) issue the form to recipients and the IRS; recipients use it to report on Form 1040 (lines 4a/4b for IRAs, 5a/5b for pensions). For 2025, key updates include relief for commercial annuity issuers on Box 8 reporting and the new Code Y in Box 7 for QCDs, which excludes amounts from taxable income for those 70½ or older.

Key Fact: Even non-taxable events like direct rollovers or QCDs must be reported, but Box 2a may show $0 taxable if fully excludable.

Who Must File Form 1099-R?

Payers must file Form 1099-R for each designated distribution of $10 or more (or any amount if federal tax is withheld) from covered plans. This includes:

- Trustees/Custodians of IRAs/SEPs/SIMPLEs: For any withdrawals, rollovers, or recharacterizations.

- Plan Administrators: For pensions, 401(k)s, 403(b)s, profit-sharing plans.

- Insurance Companies: For annuity payments or death benefits (reportable under section 6047(d)).

- Tiered Structures: Upper-tier plans report credits from lower-tier withholdings.

Exceptions:

- De minimis distributions under $10 (unless withholding applies).

- Worthless securities (no FMV reporting required).

- Foreign financial institutions (FFIs) follow FATCA rules but check IRS.gov/Form1099R for specifics.

E-filing is mandatory for 10+ returns; all payers must furnish Copy B to recipients by January 31, 2026.

Step-by-Step Guide: How to Complete IRS Form 1099-R for 2025

Use the 2025 form from IRS.gov (Rev. April 2025); software like TaxBandits automates Box 2a calculations. Gather distribution records, TINs, and codes from Pub. 575.

1. Header Information

- Payer’s Details: Name, address, TIN (no truncation).

- Recipient’s TIN/Name/Address: Full SSN/ITIN; truncate on Copy B only for privacy.

- Account Number: Optional, but use for tracking.

2. Boxes 1–2: Distribution Amounts

- Box 1 (Gross Distribution): Total paid, including rollovers (e.g., FMV of securities).

- Box 2a (Taxable Amount): Generally matches Box 1 unless excludable (e.g., $0 for QCDs); payers may leave blank if unknown—recipient computes via Form 8606.

- Box 2b (Taxable Checkbox): Check if fully taxable.

- Box 2c (Total Employee Contributions): N/A for most; use for certain annuities.

3. Boxes 3–6: Capital Gains, Withholdings, and Net Unrealized Appreciation

- Box 3 (Capital Gain): From lump-sum distributions.

- Box 4 (Federal Withholding): 20% mandatory for non-rollover eligible plans.

- Box 5 (Employee Contributions/Designated Roth): After-tax amounts or Roth basis.

- Box 6 (Net Unrealized Appreciation): For employer securities in lump sums.

4. Boxes 7–9b: Codes and Plan Details

- Box 7 (Distribution Codes): Critical—use Table 1 in instructions (e.g., Code 7: Normal; new Code Y for QCDs with 4/7/K). Multiple codes allowed (e.g., J+S for early Roth SIMPLE).

- Box 8 (Other): Actuarial value for annuities (relief for commercial contracts in 2025).

- Box 9a/9b (Payments to Others): Split if multiple recipients.

5. Boxes 10–14: Additional Details

- Box 10 (Net Unrealized): See Pub. 575.

- Box 11 (1st Roth Year): For designated Roth accounts.

- Box 12 (FATCA Checkbox): For chapter 4 reporting.

- Box 13 (State): Distribution subject to state tax.

- Box 14 (State Withholding): Amount withheld.

Pro Tip: For recharacterizations, use Code N (2025 contributions) or R (prior years); report FMV in Box 1, $0 in 2a.

Deadlines and How to File Form 1099-R for 2025 Distributions

For 2025 activity, deadlines align with IRS General Instructions:

- Furnish to Recipients (Copy B): January 31, 2026 (or next business day: February 2, 2026, as Jan. 31 is Saturday).

- File with IRS:

- Paper: February 28, 2026 (with Form 1096).

- Electronic: March 31, 2026 (mandatory for 10+ returns; use IRIS/FIRE system).

No extensions for recipient furnishing; for IRS filing, request via Form 8809 (up to 30 days) before deadline. Mail paper to IRS addresses in instructions; e-file for speed and accuracy.

Common Mistakes to Avoid When Filing Form 1099-R

IRS data shows Box 7 code errors cause 40% of corrections; underreporting withholdings adds scrutiny. Here’s a table of top issues for 2025:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Incorrect Box 7 Code | Using outdated codes (e.g., missing Y for QCDs). | Reference 2025 Table 1; pair Y with 4/7/K. | $60–$660 per form; IRS notices. |

| Wrong Taxable Amount (Box 2a) | Leaving blank when computable or including excludables. | Use simplified method for annuities; $0 for rollovers. | Mismatch audits; 10% penalty misapplication. |

| TIN/Name Mismatch | Typos or truncation errors. | Verify via TIN Matching; full TINs to IRS. | CP2100 notices; $60 per. |

| Missing QCD Reporting | Not using Code Y (optional but recommended). | Flag QCDs; inform recipients for Form 1040 exclusion. | Taxable income overstatement. |

| Late or Incomplete Filing | Forgetting Form 1096 for paper. | E-file; set reminders for Jan. 31 recipient deadline. | Up to $660 intentional; max $4M/year. |

| Box 8 Errors for Annuities | Reporting actuarial values without relief. | Commercial issuers: Leave blank per Oct. 2025 update. | Processing delays; refiling. |

Correct via “CORRECTED” form; Type 1 errors need one corrected 1099-R, Type 2 require full refile.

IRS Form 1099-R Download and Printable

Download and Print: IRS Form 1099-R

2025 Updates and Special Considerations for Form 1099-R

The 2025 instructions (Rev. April 2025) bring targeted changes:

- New Code Y (Box 7): Optional for QCDs; pair with 4 (death), 7 (normal), or K (no FMV). Eases Form 1040 reporting.

- Code Combinations: J+S now valid for early Roth SIMPLE distributions.

- Annuity Relief: Commercial issuers skip Box 8 actuarial values (Oct. 9, 2025 update).

- E-Filing Threshold: Remains 10+ returns; aggregate all 1099 types.

- Recharacterizations: Code N for 2025 IRA shifts; report DVECs per Rev. Rul. 2020-24.

For Roth SEP/SIMPLE contributions, report per updated guidance; monitor for TCJA extensions.

Final Thoughts: Navigate Retirement Reporting with Form 1099-R

Form 1099-R ensures transparency for retirement distributions, supporting IRS enforcement while guiding taxpayers on taxable income. For 2025, embrace updates like Code Y to streamline QCDs and avoid common errors—e-file early for peace of mind. Download the latest form and instructions from IRS.gov; consult Pub. 575 for recipient details.

If managing multiple plans, partner with a tax professional. This guide is informational; seek personalized advice.

Not tax advice. Refer to IRS resources for your situation.

FAQs About IRS Form 1099-R

What is the 2025 deadline for sending Form 1099-R to recipients?

January 31, 2026 (February 2 if weekend).

What does the new Code Y mean on 2025 Form 1099-R?

It identifies QCDs (optional); excludes from income when paired with other codes.

Who receives a Form 1099-R?

Anyone with $10+ distribution from covered plans; payers file with IRS too.

How do I correct a 2025 Form 1099-R error?

File a “CORRECTED” form; e-file if original was electronic.