Table of Contents

IRS Form 1099-SA – Distributions From an HSA, Archer MSA, or Medicare Advantage MSA – If you’re managing a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA, staying on top of tax reporting is crucial. One key document you’ll encounter is IRS Form 1099-SA, which details distributions from these tax-advantaged health accounts. As we head into the 2025 tax season, understanding this form can help you avoid penalties, maximize deductions, and ensure compliance with IRS rules. In this guide, we’ll break down everything you need to know about Form 1099-SA, from what it reports to how it impacts your taxes.

Whether you’re withdrawing funds for qualified medical expenses or facing a non-qualified distribution, this SEO-optimized resource draws from official IRS guidance and expert insights to keep you informed.

What Is IRS Form 1099-SA?

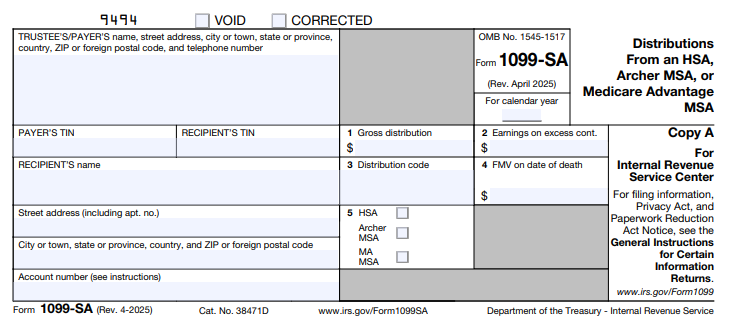

IRS Form 1099-SA is an information return used to report distributions—also known as withdrawals—from three types of medical savings accounts: Health Savings Accounts (HSAs), Archer MSAs, and Medicare Advantage Medical Savings Accounts (MA MSAs). These distributions might go directly to you or to a medical provider on your behalf, and the form helps the IRS track whether the funds were used for eligible healthcare costs.

Unlike W-2s or 1099-NECs for employment income, Form 1099-SA focuses solely on health-related withdrawals. It’s filed by the financial institution or trustee administering your account, not by you as the account holder. A separate 1099-SA is required for each account type, ensuring accurate reporting for HSAs versus MSAs.

For 2025, no major structural changes have been announced, but filers must now e-file if submitting 10 or more returns—a threshold lowered in 2024 to promote efficiency. This form pairs with Form 5498-SA, which reports contributions to these accounts, giving you a full picture of your health savings activity.

Who Receives Form 1099-SA and When?

You, as the account holder, will receive Form 1099-SA if your HSA, Archer MSA, or MA MSA had any distributions during the tax year—even if the amount is zero (though zero distributions typically aren’t reported). Trustees send Copy B to recipients by January 31 of the following year, with the IRS receiving it by the same deadline (or March 31 for electronic filers).

Common recipients include:

- HSA holders: Most prevalent, as HSAs are popular for high-deductible health plans.

- Archer MSA users: Less common, limited to self-employed individuals or small business employees.

- Medicare Advantage MSA participants: For those in eligible Medicare plans.

If you’re the beneficiary after an account holder’s death, you may also get this form for post-death distributions. Always check your mail or online account portal by early February to ensure you have it for tax prep.

Breaking Down the Key Boxes on Form 1099-SA

Form 1099-SA is straightforward, with five main boxes providing essential details. Here’s what each means for HSA distributions and similar withdrawals:

| Box | Description | Example for 2025 |

|---|---|---|

| Box 1: Gross Distribution | Total amount withdrawn, including any earnings. This includes direct payments to providers. | $5,000 total withdrawal from your HSA for doctor visits and prescriptions. |

| Box 2: Earnings on Excess Contributions | Net income earned on over-contributed funds returned to you. Included in Box 1. | $150 earnings on a $1,000 excess contribution refunded by your tax deadline. |

| Box 3: Distribution Code | A single-digit code indicating the type of distribution (e.g., 1 for normal, 2 for excess contributions, 3 for disability, 4 or 6 for death-related). | Code 1: Standard qualified medical expense withdrawal. |

| Box 4: Fair Market Value (FMV) on Date of Death | Account value at death, reduced by qualified expenses paid within one year after. | $10,000 FMV if the account holder passed away mid-year. |

| Box 5: HSA/ MSA Checkbox | Indicates the account type (HSA, Archer MSA, or MA MSA). | Checked for HSA if that’s your plan. |

These boxes help the IRS (and you) determine if the distribution is taxable. Trustee-to-trustee transfers between similar accounts aren’t reported here.

Tax Implications of HSA and MSA Distributions

The beauty of HSAs and MSAs lies in their triple tax advantage: contributions are pre-tax, growth is tax-free, and qualified withdrawals are tax-free. But non-qualified distributions from an HSA or MSA trigger taxes plus a 20% penalty (unless you’re 65+ or disabled).

- Qualified Distributions: No tax or penalty for medical expenses like copays, deductibles, or prescriptions. Report on Form 8889 but subtract from taxable income.

- Non-Qualified Distributions: Taxed as ordinary income + 20% penalty. For example, using HSA funds for a vacation? Expect to owe on the full amount.

- Excess Contributions: Earnings on overages are taxable; principal may not be if corrected timely.

- Death Distributions: Spousal beneficiaries treat as their own; non-spouses face income tax on the value.

For 2025, keep receipts for qualified expenses—they’re your proof if audited. Prohibited transactions (e.g., non-medical use) could disqualify the entire account.

IRS Form 1099-SA Download and Printable

Download and Print: IRS Form 1099-SA

How to Report Form 1099-SA on Your 2025 Tax Return

Reporting is simple but essential. Use the info from your 1099-SA to complete Form 8889 (HSAs) or Form 8853 (Archer/MSA), attached to your Form 1040.

- Enter Box 1 gross distribution on Line 14a of Form 8889.

- Subtract qualified expenses on Line 14b to find taxable amount (Line 15).

- Calculate the 20% penalty on Line 17 if applicable.

- Transfer to Form 1040, Line 8 (other income) for taxes, and Schedule 2 for penalties.

Tax software like TurboTax automates this, pulling data directly from your uploaded 1099-SA. File by April 15, 2026, or extend to October— but pay any owed taxes by April to avoid interest.

Common Mistakes to Avoid with Form 1099-SA

Even seasoned filers slip up. Here’s how to steer clear:

- Forgetting to Report: All distributions must be included, even if non-taxable—omission can trigger IRS notices.

- Misclassifying Expenses: Not all “health” costs qualify (e.g., gym memberships usually don’t). Review IRS Pub 502 for eligible items.

- Ignoring Codes: Wrong Box 3 code? It could lead to incorrect penalties.

- Late Filing by Trustees: If you don’t get your form by Feb 1, contact your provider—delays don’t excuse your reporting duty.

- Double-Reporting Transfers: Skip these on 1099-SA to avoid phantom income.

Pro tip: Track expenses year-round with apps like Receipt Hog for easy reconciliation.

Frequently Asked Questions (FAQs) About IRS Form 1099-SA

Do I need Form 1099-SA if my distribution was $0?

No—only reportable if there’s an actual distribution. But confirm with your trustee.

Can I deduct HSA distributions on my taxes?

Qualified ones aren’t taxed at all; non-qualified are added to income.

What if my 1099-SA has an error?

Request a corrected form (1099-SA with “CORRECTED” marked) from your trustee.

Are there 2025 updates to Form 1099-SA?

Primarily e-filing mandates; no box changes noted yet.

How does Form 1099-SA differ for HSAs vs. Archer MSAs?

HSAs are more flexible with broader eligibility, but reporting is identical—separate forms per type.

Final Thoughts: Stay Compliant and Save on Healthcare Taxes

Mastering IRS Form 1099-SA empowers you to leverage HSAs, Archer MSAs, and MA MSAs without tax surprises. By understanding distributions, reporting accurately, and using qualified withdrawals wisely, you can optimize your health savings for 2025 and beyond. Consult a tax pro for personalized advice, and always reference official IRS resources for the latest.

Last updated: December 2025. This article is for informational purposes only and not tax advice.