Table of Contents

IRS Form 1120-C – U.S. Income Tax Return for Cooperative Associations – Cooperative associations play a vital role in sectors like agriculture, consumer goods, and services, pooling resources to benefit members through patronage dividends and per-unit retain allocations. For tax year 2025, accurately reporting income, deductions, and allocations on IRS Form 1120-C ensures compliance under Subchapter T while maximizing tax advantages like deductible patronage distributions. With the corporate tax rate steady at 21% and no major structural changes to the form, this SEO-optimized guide covers everything cooperatives need for filing by March 15, 2026 (or the 15th day of the third month after year-end). Drawing from the latest IRS instructions, we’ll break down eligibility, key schedules, step-by-step completion, and tips to avoid penalties—helping your co-op optimize refunds and deductions.

Whether you’re a farmers’ cooperative exempt under section 521 or a non-exempt service co-op, mastering Form 1120-C can streamline your 2025 return and support member-focused operations.

What Is IRS Form 1120-C?

IRS Form 1120-C, “U.S. Income Tax Return for Cooperative Associations,” is the dedicated tax return for corporations operating on a cooperative basis. It allows co-ops to report gross income, gains, losses, deductions, and credits, then compute taxable income and liability under sections 1381–1388 of the Internal Revenue Code. Unique to co-ops, it facilitates deductions for patronage-sourced dividends and nonpatronage distributions, distinguishing between patronage (business done with/for patrons) and nonpatronage (incidental) income to prevent cross-offsetting losses.

Key features include:

- Patronage Dividends: Deductible allocations to members based on business volume, paid in money, qualified written notices of allocation, or property.

- Per-Unit Retain Allocations: Treated as patronage income if based on quantity or value of business done.

- Schedule G Allocation: Mandatory if receipts or assets exceed $250,000, separating patronage and nonpatronage items.

- Section 199A(g) Deduction: Up to 9% for eligible agricultural/horticultural co-ops on qualified production activities income (QPAI).

For 2025, the form aligns with 2024 revisions but incorporates inflation adjustments and penalty updates. Download the 2025 draft from IRS.gov/Form1120C.

Who Needs to File IRS Form 1120-C in 2025?

File Form 1120-C if your organization is a cooperative association under section 1381(a), including:

- Farmers’, fruit growers’, or like associations (exempt under section 521 or taxable).

- Consumer, service, or marketing co-ops allocating amounts to patrons on a patronage basis.

- Entities with $250,000+ in total receipts (lines 1a + 4–9) or year-end assets, requiring Schedule G.

Exemptions apply to:

- Tax-exempt organizations under chapter 1 (except section 521 farmers’ co-ops).

- Mutual savings banks, insurance companies (subchapter L), or rural electric/telephone providers.

Even with no taxable income, section 521 exempt co-ops must file. Partnerships or S corps don’t use this form—use Form 1065 or 1120-S instead. Attach to consolidated returns via Form 851 if applicable.

Key Schedules and Components of Form 1120-C

Form 1120-C includes multiple schedules for detailed reporting:

| Schedule | Purpose | Key Details for 2025 |

|---|---|---|

| Schedule A (Form 1125-A) | Cost of Goods Sold | Uniform capitalization rules under section 263A; attach if inventory involved. |

| Schedule C | Dividends and Special Deductions | Compute dividends-received deduction (50–65% based on ownership); exclude patronage items. |

| Schedule G | Allocation of Patronage and Nonpatronage Income/Deductions | Separate columns for patronage (a) and nonpatronage (b); patronage losses can’t offset nonpatronage income. |

| Schedule H | Deductions for Dividends Paid | Patronage dividends (line 3), nonpatronage (line 2 for section 521 co-ops), per-unit retains (line 4). |

| Schedule J | Tax Computation | 21% rate on taxable income; add CAMT via Form 4626; subtract credits like Form 3800. |

| Schedule K | Other Information | Business activity code, foreign ownership questions; check if receipts/assets < $250,000 to skip Schedules L/M-1/M-2. |

| Schedules L/M-1/M-2 | Balance Sheet and Reconciliations | Required if assets ≥ $250,000; use M-3 if ≥ $10 million. |

Related forms: Form 4562 (depreciation), Form 8990 (interest limitation), Form 8903 (section 199A(g)).

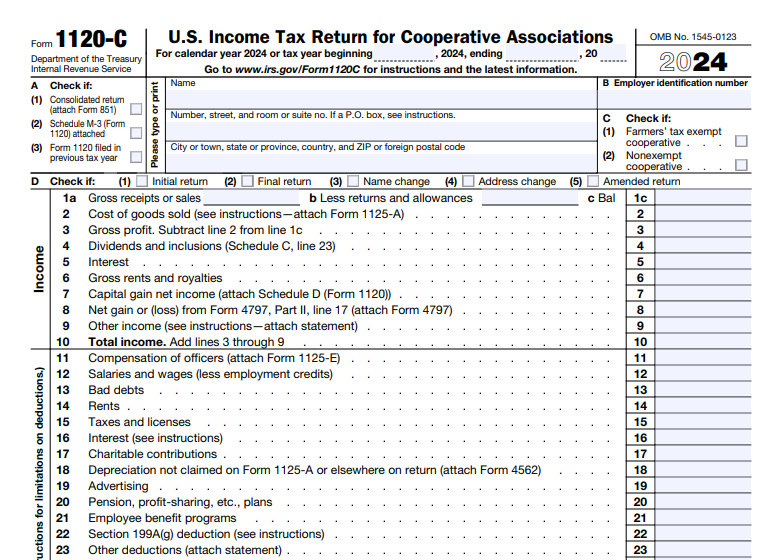

IRS Form 1120-C Download and Printable

Download and Print: IRS Form 1120-C

How to Complete IRS Form 1120-C: Step-by-Step Guide for 2025

Prepare by gathering EIN, financial statements, patronage records, and prior-year data. Use tax software for calculations, but review manually. File electronically if receipts > $10 million.

Step 1: Header and Basic Info

- Enter name, address, EIN, and tax year (calendar or fiscal).

- Item A: Check for consolidated return (attach Form 851).

- Item C: Indicate if section 521 exempt farmers’ co-op.

- Item D: Mark initial, final, amended, or change.

Step 2: Report Income (Page 1, Lines 1–10)

- Line 1a: Gross receipts/sales (exclude patronage on lines 4–9).

- Line 2: Cost of goods sold (from Schedule A).

- Line 4: Dividends (from Schedule C, line 23, col. (a); exclude patronage).

- Line 5: Taxable interest.

- Line 6: Rents/royalties.

- Line 9: Other income, including patronage dividends (money/qualified notices/property at FMV) and per-unit retains; attach statement.

Total income: Line 10.

Step 3: Claim Deductions (Lines 11–27)

- Line 11: Officer compensation (Form 1125-E if receipts ≥ $500,000).

- Line 12: Salaries/wages (reduce for credits).

- Line 13: Bad debts.

- Line 14: Rents (include vehicle lease inclusions for 2025: e.g., $62 for high-value autos).

- Line 15: Taxes/licenses (exclude federal income tax).

- Line 16: Interest (Form 8990 if limited).

- Line 17: Charitable contributions (10% limit; 100% for qualified conservation).

- Line 18: Depreciation (Form 4562).

- Line 20: Pension plans (Form 5500).

- Line 21: Employee benefits.

- Line 22: Section 199A(g) (Form 8903; 9% of QPAI).

- Line 23: Other (e.g., amortization, repairs; 50% meals limit).

- Line 25a: Subtotal before NOL/special deductions (adjust for at-risk via Form 6198).

- Line 25b: Schedule H dividends.

- Line 26a: NOL (80% limit post-2017; patronage can’t offset nonpatronage).

- Line 26b: Special deductions (Schedule C).

- Line 27: Taxable income (≥ nonpatronage from Schedule G, col. (b)).

Step 4: Tax Computation and Payments (Lines 28–35)

- Line 28: Tax (21% × line 27; add Form 4626 for CAMT).

- Lines 30a–30z: Credits/payments (e.g., estimated tax on 30b; overpayment to next year on 30c).

- Line 32: Underpayment penalty (Form 2220; CAMT relief per Notice 2024-66).

- Line 33/34: Amount owed or refund.

Step 5: Complete Schedules and Attach

- Schedule G: Allocate all items; attach if receipts/assets ≥ $250,000.

- Schedule H: Verify dividends paid in payment period (year-start to 8.5 months after end).

- Sign and assemble: Page 1, then schedules alphabetically, forms numerically.

E-file via IRS Modernized e-File (MeF) for faster processing.

Key Changes to IRS Form 1120-C for 2025

While Form 1120-C remains stable, 2025 brings these updates:

- Late Filing Penalty Increase: Minimum $510 (or tax due) for returns >60 days late, filed in 2025.

- CAMT Underpayment Relief: No penalties for corporate alternative minimum tax installments in 2025 (Notice 2024-66).

- Vehicle Lease Inclusions: Updated amounts for leases starting in 2025 (e.g., higher for luxury autos; check IRB early 2026).

- Short-Year Filers: Use 2024 form for 2025 short years (<12 months), adjusting for post-2024 law changes.

No Subchapter T revisions; section 199A(g) limits unchanged.

Common Mistakes to Avoid and Tips for 2025 Filers

- Misallocating Patronage/Nonpatronage: Use Schedule G meticulously—patronage NOLs can’t reduce nonpatronage income, triggering audits.

- Missing Payment Period: Patronage dividends deductible only if paid by the 15th day of the 9th month after year-end.

- Overlooking Attachments: Always include statements for line 9/23; no “See Attached” shortcuts.

- Estimated Tax Shortfalls: Pay quarterly if liability > $500; use Form 1120-W.

Tips:

- Leverage Software: TurboTax Business or ProSeries handles allocations automatically.

- Plan Distributions: Time patronage payments for maximum deductions.

- Check Exempt Status: Section 521 co-ops get broader nonpatronage deductions.

- Seek CPA Help: For complex QPAI or foreign credits.

- E-File Early: Avoid March rush; extensions require full payment.

Final Thoughts: Simplify Your Co-Op’s 2025 Tax Compliance with Form 1120-C

IRS Form 1120-C empowers cooperative associations to fairly tax patronage-driven operations, deducting member allocations that fuel community impact. By following this guide and IRS resources, your 2025 filing will be accurate, timely, and deduction-maximized—potentially saving thousands in liabilities.

For the official 2025 Form 1120-C and instructions, visit IRS.gov/Form1120C. Complex allocations or amendments? Consult a tax professional. Start organizing patronage records today for a seamless March 2026 deadline.