Table of Contents

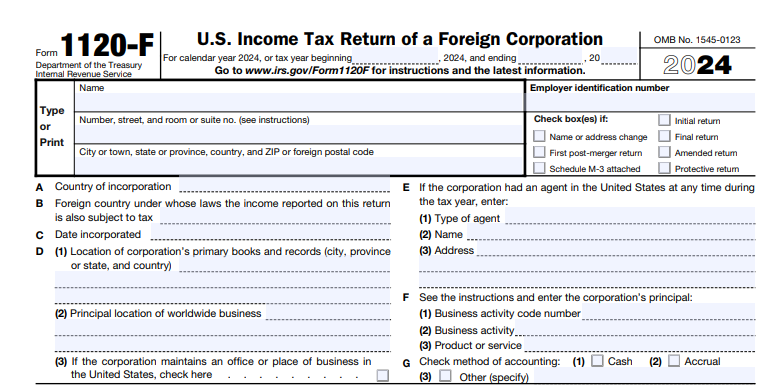

IRS Form 1120-F – U.S. Income Tax Return of a Foreign Corporation – Global business expansion brings opportunities, but U.S. tax compliance adds layers of complexity for foreign corporations earning income here. IRS Form 1120-F—the U.S. Income Tax Return of a Foreign Corporation—is the key document for reporting effectively connected income (ECI), branch profits, and treaty-based positions. For tax year 2025, with the corporate tax rate steady at 21% and no major changes to ECI sourcing rules, Form 1120-F (Rev. December 2024) requires filing by June 16, 2025, for calendar-year filers, including Schedules M-1/M-2 for book-tax reconciliation. This SEO-optimized guide, based on the latest IRS instructions (Rev. 2024), covers eligibility, deadlines, and step-by-step filing to ensure compliance and minimize liabilities amid heightened IRS scrutiny on international transactions.

What Is IRS Form 1120-F?

IRS Form 1120-F is the annual U.S. tax return for foreign corporations engaged in a U.S. trade or business or with U.S.-sourced income, used to report ECI (taxed at 21%), calculate branch profits tax (30% on dividends), and claim treaty benefits under IRC Sections 881-884. It includes Schedules for apportionment (Schedule H), treaty positions (Schedule I), and financial reconciliations (M-1/M-2), with attachments like Form 8833 for disclosures.

Key components:

- Section I: Branch office income/deductions.

- Section II: Income not ECI (e.g., FDAP at 30%).

- Branch Profits Tax: 30% on effectively connected earnings after U.S. tax, reduced by treaties.

The December 2024 revision (Cat. No. 11450V) incorporates CAMT relief (Notice 2024-66) and updated penalty minimums ($510 for late filing). Download the form and instructions from IRS.gov/Form1120F.

Who Needs to File IRS Form 1120-F in 2025?

Any foreign corporation with U.S. ECI or FDAP income must file, unless exempt (e.g., < $300 gross income and no gross transportation income). Treaties may reduce rates but don’t eliminate filing.

| Filing Requirement | Details for 2025 |

|---|---|

| U.S. Trade or Business | ECI ≥$0; report all U.S. activities (e.g., branch sales). |

| FDAP Income | U.S.-sourced dividends/interest ≥$600; 30% withholding, but file for refunds/treaties. |

| Exemptions | No ECI/FDAP < $300; certain treaty-protected income (attach Form 8833). |

| Protective Return | If uncertain ECI—file to preserve refund claims. |

| Amended Returns | Errors within 3 years; use “Amended” label. |

Foreign corps include CFCs; file even if no tax due. Use EIN (apply via Form SS-4); fiscal years end December 31 default.

Filing Deadlines and Extensions for Form 1120-F in 2025

Calendar-year filers due June 16, 2025 (15th day of 6th month after year-end). Fiscal-year: 15th day of 4th month after close.

| Deadline Type | Date for Calendar Year | Notes |

|---|---|---|

| Original Return | June 16, 2025 | E-file or paper; pay 100% tax by due to avoid failure-to-pay penalty (0.5%/month). |

| Extension | Automatic 6 months via Form 7004 (by June 16) | Filing only—no payment extension; pay 90% estimated tax. |

| Amended Return | Within 3 years of original due or 2 years of payment | Mark “Amended” on top; e-file supported. |

| Where to File | Ogden, UT 84201-0005 (no payment) or Kansas City, MO 64999 (with payment); e-file via MeF. |

E-file mandatory for >250 returns; providers like Drake handle international.

Step-by-Step Guide to Completing IRS Form 1120-F

Gather U.S. books, treaties, and apportionment data. Use December 2024 PDF; attach Schedules.

- Header: Foreign corp name, address, EIN, tax year (e.g., 2025).

- Section I: Branch Profits – Gross income (line 1), deductions (2-10), taxable income (11); tax at 21% (12).

- Section II: Non-ECI – FDAP income (line 13), tax at 30% (14); reduced by treaties (15).

- Line 16: Total Tax – Sum Sections I/II; credits (17-20).

- Payments/Refunds: Withholding (21), estimated (22), balance (23).

- Schedules – H (apportionment), I (treaty), M-1/M-2 (reconciliation), P (dispositions).

- Sign: Officer under perjury; date.

Example: $500K ECI, $50K deductions = $450K taxable ×21% = $94,500 tax.

IRS Form 1120-F Download and Printable

Download and Print: IRS Form 1120-F

Key Schedules for IRS Form 1120-F in 2025

Schedules are mandatory for most filers.

| Schedule | Purpose | 2025 Notes |

|---|---|---|

| H | Expense allocation | Apportion global expenses to U.S. ECI; use asset/use methods. |

| I | Treaty positions | Disclose under §6114; attach Form 8833 if needed. |

| M-1/M-2 | Book-tax reconciliation | Required if >$10M assets; detail differences. |

| P | Partnership dispositions | Report sales triggering §864(c)(8) gain. |

Attach Form 8833 for treaty claims; e-file bundles schedules.

E-Filing vs. Paper: Options for Form 1120-F in 2025

E-filing is required for >250 forms and recommended for accuracy; paper for smaller filers.

- E-Filing Pros: MeF deadline same as paper; instant acceptance, error checks; supports Schedules.

- Paper Pros: For <250; mail by June 16.

- Threshold: 250+ returns mandates e-file.

Providers like UltraTax handle international; free MeF for simple.

Common Mistakes When Filing Form 1120-F and How to Avoid Them

Errors trigger audits—top 2025 issues:

- ECI Sourcing: Misclassifying income—use §864(c) rules.

- Treaty Oversights: No Form 8833—disclose positions.

- Apportionment Flubs: Schedule H math—use software.

- Late Payment: Estimated tax short—pay 100% by due.

- Missing Schedules: M-1 for large corps—attach all.

Review Pub. 519; pros reduce errors 90%.

Penalties for Late or Incorrect Form 1120-F Filings in 2025

Tiered under §6651/6662, adjusted for inflation.

| Violation | Penalty | Max |

|---|---|---|

| Late Filing | 5%/month (max 25%) or $510 min if >60 days late | 25% |

| Late Payment | 0.5%/month + interest | 25% |

| Accuracy-Related | 20% underpayment | Varies |

| Failure to File Schedule H | $290/month | $29,000 |

Reasonable cause waives; e-file cuts risks.

Frequently Asked Questions About IRS Form 1120-F

What’s the 2025 due date for calendar-year filers?

June 16, 2025; extend 6 months with Form 7004.

Do treaties eliminate Form 1120-F filing?

No—still file to claim benefits; attach Form 8833.

Is e-filing required?

Yes, for 250+ returns; optional otherwise via MeF.

How to calculate branch profits tax?

30% on ECI after U.S. tax, reduced by treaties.

What if no U.S. income?

No filing if < $300 gross and no transportation income.

Visit IRS.gov/Form1120F for more.

Final Thoughts: Master U.S. Tax Compliance with IRS Form 1120-F in 2025

IRS Form 1120-F is the gateway for foreign corporations to navigate U.S. taxation on ECI and FDAP, claiming treaty relief while reporting branch profits at 21% corporate rates. The December 2024 revision’s e-file support and CAMT updates make it more accessible; file by June 16, 2025, with Schedules H/I for accuracy, and extend if needed. Download from IRS.gov today and consult a cross-border specialist—compliance isn’t just obligation; it’s opportunity in global markets.

Informational only—not tax advice. Consult IRS.gov or a professional.