Table of Contents

IRS Form 1120-RIC – U.S. Income Tax Return for Regulated Investment Companies – In the world of mutual funds, ETFs, and money market funds, maintaining tax efficiency is paramount. IRS Form 1120-RIC, the “U.S. Income Tax Return for Regulated Investment Companies,” empowers these entities—known as RICs—to pass through income, gains, and losses to shareholders while avoiding double taxation. If you’re a fund manager searching for “Form 1120-RIC instructions 2025,” a compliance officer tackling “RIC distribution requirements 2025,” or an advisor optimizing “excise tax on undistributed RIC income,” this SEO-optimized guide delivers expert insights. We’ll explore eligibility, filing steps, and 2025 updates to help you meet the March 17, 2026, deadline for calendar-year RICs and sidestep penalties like the new $510 minimum for late filings.

Sourced from the IRS’s 2024 instructions (applicable to 2025 returns) and recent guidance, this resource ensures your RIC complies with Subchapter M rules, including the 90% income distribution mandate and 4% excise tax on shortfalls. With digital signature relief extended and calls for e-filing modernization, 2025 offers opportunities to streamline operations. Let’s navigate your RIC’s tax landscape.

What Is IRS Form 1120-RIC?

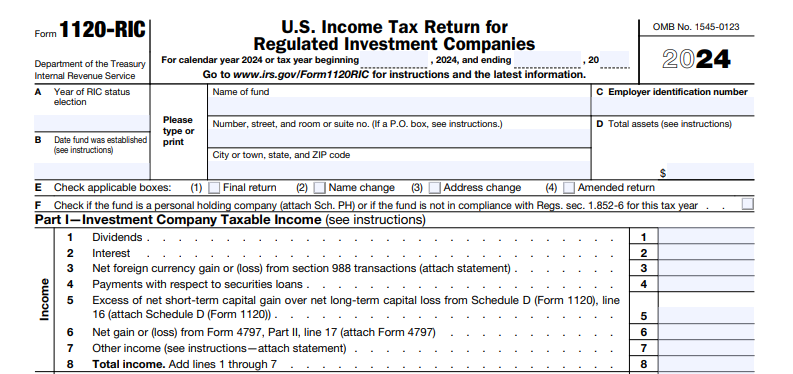

Form 1120-RIC is the specialized federal income tax return for regulated investment companies (RICs) under IRC Section 851, allowing them to report income, deductions, credits, and tax liability while qualifying for pass-through treatment. RICs—typically mutual funds or ETFs—use this form to calculate investment company taxable income (ICTI), claim a dividends-paid deduction, and report undistributed capital gains taxed at the entity level.

Core elements include:

- Pass-Through Benefits: Distribute 90%+ of ICTI to avoid corporate tax; shareholders report on personal returns.

- Schedules: J (tax computation), K (other info), L (balance sheet), M-1 (reconciliation), and attachments like Schedule D for capital gains.

- Excise Tax Integration: Ties into Form 8613 for the 4% tax on undistributed income under Section 4982.

For 2025, filers must address the 21% corporate rate on retained earnings and report QOF investments via Form 8996. This form is essential for preserving RIC status, preventing double taxation, and enabling tax-efficient distributions—potentially saving funds millions in entity-level taxes annually.

Who Must File IRS Form 1120-RIC in 2025?

Any domestic corporation electing RIC status under Section 851 must file Form 1120-RIC, regardless of income level. This includes open-end and closed-end funds, but excludes REITs (Form 1120-REIT).

Eligible Entities

| Entity Type | Filing Obligation | Key Notes |

|---|---|---|

| Mutual Funds & ETFs | Required | Must meet 90% gross income test from dividends/interest/capital gains. |

| Closed-End Funds | Required if RIC-elected | Diversification: No more than 25% in one issuer (50% for top 5). |

| Money Market Funds | Required | Short-term assets; report on calendar year basis. |

| Foreign RICs with U.S. Income | Required | Report effectively connected income; attach Form 1118 for credits. |

| Terminating RICs | Final return marked | Check Item E; attach Form 966. |

Exclusions: Non-RIC investment companies file Form 1120. To elect RIC status, attach a statement to the first return; once elected, it’s irrevocable without IRS consent.

Recent Changes to IRS Form 1120-RIC for Tax Year 2025

The IRS’s 2024 instructions (Rev. Dec. 2024) apply to 2025 filings, with no structural overhaul but procedural enhancements amid modernization efforts:

- Penalty Escalation: Minimum late-filing penalty for returns >60 days late rises to the smaller of tax due or $510 (from $485 in 2024), per annual adjustments.

- Digital Signature Relief: Indefinite extension for Forms 1120-RIC and 8802; rubber stamps/mechanical devices allowed, with calls to expand to Form 8613 (excise tax return).

- E-Filing Push: Industry requests (e.g., ICI) for MeF compatibility on bulky 1120-RIC and 8613 forms; currently paper-only, but PDF submissions to secure email proposed.

- Vehicle Lease Inclusion: For terms starting in 2025, new amounts published in early 2025 IRB; reduces deductions per Pub. 463.

- RIC Excise Tax Rules: Unchanged 4% rate on undistributed income (98.2% of ordinary + 100% of capital gains); Section 4982(e)(4) election available for November/December year-ends to simplify calculations.

- Burden Estimates: FY 2025 projections show ~13,500,000 respondents across 1120 series, with RICs contributing to increased scrutiny on diversification and distributions.

These align with IRS modernization, including post-release tweaks for accuracy.

Step-by-Step Guide: How to Complete IRS Form 1120-RIC for 2025

Use the 2024 form for 2025; e-file where possible, but paper for full attachments. Gather financials, shareholder data, and Form 2439 notices. Based on 2024 instructions:

Header & Basic Info

- Item A: Year of RIC election (e.g., 2020).

- Item B: Establishment date per docs.

- Item C: EIN.

- Item D: Total assets (end of year).

- Item E: Check for final, name/address change, or amended.

Part I: Investment Company Taxable Income

- Lines 1-3: Dividends/interest income; exclude foreign taxes if crediting.

- Line 4: Foreign taxes (if Section 853 election).

- Lines 5-8: Expenses (management fees, legal, state taxes—exclude excise under 4982).

- Line 9: Deductions total.

- Line 10: ICTI before dividends-paid (Line 7 – Line 9).

- Line 11: Dividends-paid deduction (90%+ of Line 10).

- Line 12: Taxable income (usually $0 if compliant).

Example: $10M dividends (Line 1) – $2M expenses (Line 9) = $8M ICTI; $7.2M distributed = $0 taxable (Line 12).

Part II: Tax on Undistributed Net Capital Gain

- Line 1: Net long-term capital gain (from Schedule D).

- Line 2: Tax at 21% (or 35% pre-2018 rates if applicable).

- Line 3: Undistributed amount designated to shareholders (attach Form 2439).

Schedule J: Tax Computation

- Lines 1-3: Tax from Part II + recapture/alternative minimum.

- Lines 4-11: Credits (e.g., Form 3800 general business).

- Lines 12-18: Payments, estimated tax penalty (Form 2220), balance due/refund.

Schedule K: Other Information

- Answer QOF (Form 8996), controlled groups, and diversification questions.

Schedules L & M-1

- L: Balance sheet (book value).

- M-1: Book-to-tax reconciliation.

Filing

- Due: 15th day of 3rd month after year-end (March 17, 2026, calendar); extend via Form 7004 (6 months, pay estimates).

- Where: Mail to Ogden, UT; e-file pilots for simpler returns.

- Attachments: Schedule D, Form 2438 (undistributed gains), Form 8613 (excise).

Common Mistakes to Avoid When Filing Form 1120-RIC

RIC filings are audit magnets—avoid these to preserve status:

| Mistake | Why It Happens | How to Fix It |

|---|---|---|

| Under-Distributing ICTI | Miscalculating 90% threshold | Use worksheets; distribute by year-end or elect spillover. |

| Excise Tax Oversight | Forgetting 4% on shortfalls | File Form 8613 by March 15; elect 4982(e)(4) for simplicity. |

| Diversification Errors | Exceeding 25% in one issuer | Monitor quarterly; attach diversification statement. |

| Paper Filing Burdens | Ignoring modernization | Prepare PDFs; advocate for e-file via ICI. |

| Signature Noncompliance | Manual only | Use digital relief; expand to 8613. |

Retain records 7 years; amend via Form 1120X.

Why File Form 1120-RIC Accurately? Real-World Benefits for 2025

A $1B RIC distributing $50M ICTI avoids ~$10.5M corporate tax (21% rate), passing savings to shareholders. Proper excise planning under Section 4982 prevents 4% hits on undistributed amounts, per industry benchmarks. With 2025’s penalty hikes, compliance shields against $510+ fines while supporting fund growth.

Final Thoughts: Streamline Your 2025 RIC Tax Compliance with Form 1120-RIC

IRS Form 1120-RIC is the linchpin of tax efficiency for regulated investment companies, but 2025’s enhanced penalties and e-filing calls demand vigilance. By mastering distributions, excise elections, and diversification, your RIC thrives under Subchapter M.

Download the 2024 form/instructions from IRS.gov and consult a tax specialist for elections like 4982(e)(4). For more, explore Form 8613 guides. Questions on “RIC excise tax 2025“? Comment below!

This article is informational only—not tax advice. Consult a qualified professional for your RIC’s situation.

IRS Form 1120-RIC Download and Printable

Download and Print: IRS Form 1120-RIC