Table of Contents

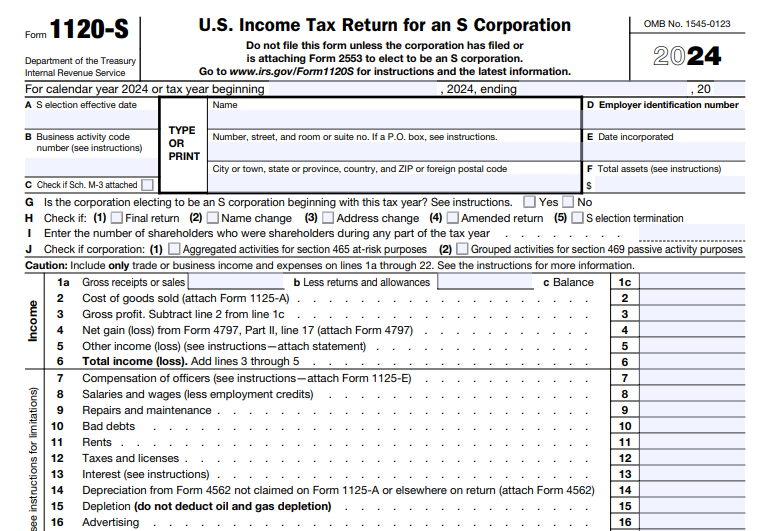

IRS Form 1120-S – U.S. Income Tax Return for an S Corporation – As an S corporation owner, navigating U.S. federal income tax requirements is essential for maintaining compliance and maximizing pass-through benefits. IRS Form 1120-S, the U.S. Income Tax Return for an S Corporation, is the key document for reporting your business’s income, deductions, credits, and other items. Filed annually, it ensures that profits and losses flow directly to shareholders’ personal tax returns, avoiding double taxation at the corporate level.

In this comprehensive guide, we’ll cover everything you need to know about Form 1120-S for tax year 2025—from eligibility and deadlines to filing tips and recent updates. Whether you’re a first-time filer or refreshing your knowledge, this resource is designed to help you file accurately and on time. Let’s dive in.

What Is IRS Form 1120-S?

IRS Form 1120-S is the official tax return used by domestic S corporations to report their financial activities for the tax year. Unlike C corporations, which pay taxes at the entity level, S corps are pass-through entities. This means the form doesn’t calculate a corporate tax liability; instead, it aggregates income, gains, losses, deductions, and credits on Schedule K, which are then allocated to shareholders via individual Schedule K-1 forms.

The form covers:

- Ordinary business income or loss from trade or business activities.

- Rental real estate income (via Form 8825).

- Portfolio income like interest and dividends.

- Capital gains and losses (via Schedule D).

- Deductions such as salaries, depreciation, and interest.

- Credits for items like low-income housing or research expenses.

For tax year 2025, the form remains structurally similar to prior years, but includes enhanced reporting for digital assets and new elections for certain deductions.

Who Must File Form 1120-S?

Not every business files Form 1120-S—it’s specifically for entities that have elected S corporation status under Subchapter S of the Internal Revenue Code. To qualify:

- The entity must be a domestic corporation or eligible entity (e.g., LLC) with no more than 100 shareholders.

- All shareholders must be U.S. citizens, residents, certain trusts, or estates (no partnerships or corporations as owners).

- Only one class of stock is allowed.

You must file if:

- Your S election (via Form 2553) is in effect and accepted by the IRS.

- The corporation was engaged in a trade or business during the year.

- Gross receipts were $250,000 or more, or total assets exceeded $250,000 (even if no income).

Exemptions apply to dormant entities with no activity. If your S status terminates (e.g., due to excess passive income over three years), revert to Form 1120 for C corp filing.

Due Dates and Extensions for Form 1120-S in 2025

Timing is critical to avoid penalties. For calendar-year S corporations (January 1–December 31, 2025), the due date is March 15, 2026. If the 15th falls on a weekend or holiday, it’s the next business day (e.g., March 16, 2026).

| Tax Year End | Due Date Without Extension | Extended Due Date (Form 7004) |

|---|---|---|

| December 31, 2025 (Calendar) | March 15, 2026 | September 15, 2026 |

| Fiscal Year Ending June 30, 2025 | September 15, 2025 | December 15, 2025 |

| Fiscal Year Ending September 30, 2025 | December 15, 2025 | March 15, 2026 |

- Extensions: File Form 7004 by the original due date for an automatic six-month extension. No reason needed, but it doesn’t extend payment deadlines—pay any estimated tax owed to avoid penalties.

- Dissolved Corporations: File by the 15th day of the third month after dissolution.

- Short Years: Adjust based on the tax year length.

Always check IRS Publication 509 for the full 2026 tax calendar.

How to File Form 1120-S: Electronic vs. Paper Options

The IRS strongly encourages electronic filing (e-file) for faster processing and fewer errors. Mandatory e-filing applies if:

- Your S corp filed 10 or more returns (e.g., Forms 940, 941) in the prior year.

- Total assets are $10 million or more at year-end.

Paper filing is allowed otherwise, but mail to:

- Without payment: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0013.

- With payment: Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409.

Payments over $25,000 must be electronic via EFTPS. Use tax software like TurboTax Business or hire a CPA for complex returns.

Required Schedules and Forms for Form 1120-S

Form 1120-S requires several attachments, depending on your activities. Attach them in numerical order, and complete every line—use “See Attached” only for detailed statements.

| Schedule/Form | When Required | Purpose |

|---|---|---|

| Schedule K | Always | Aggregates pass-through items for shareholders. |

| Schedule K-1 | One per shareholder | Reports each shareholder’s pro rata share (furnish by due date). |

| Schedule B | Always | Business activity and ownership info. |

| Schedule L | If assets ≥$250K | Balance sheet per books. |

| Schedule M-1 | If Schedule L required | Book-to-tax income reconciliation. |

| Schedule M-2 | Always | Accumulated adjustments account analysis. |

| Schedule M-3 | Assets ≥$10M | Detailed book-to-tax reconciliation. |

| Schedule D & Form 8949 | Capital transactions | Gains/losses from asset sales. |

| Form 4797 | Business property sales | Ordinary gains/losses. |

| Form 8825 | Rental real estate | Income and expenses. |

| Form 1125-A | Inventory sold | Cost of goods sold. |

| Form 3800 | Business credits | General credits like R&D or energy. |

| Schedules K-2/K-3 | International activity | Foreign tax items (exceptions expanded for 2025). |

For full list, see the 2025 instructions.

Step-by-Step Guide to Completing Form 1120-S

Filling out Form 1120-S involves gathering financials from your books. Use accrual or cash method consistently.

- Header Info: Enter name, EIN, address, business code (from NAICS), and total assets (from Schedule L).

- Income Section (Lines 1–6): Report gross receipts (Line 1a), less returns (1b) and COGS (2 via Form 1125-A), plus other business income (5).

- Deductions (Lines 7–20): Detail officer compensation (7), salaries (8), repairs (9), rents (11), taxes (12), interest (13, limited by §163(j)), depreciation (14 via Form 4562), and other (19).

- Ordinary Income (Line 22): Total income minus deductions.

- Taxes and Credits (Lines 23–28): Compute built-in gains tax (23b), credits (24), and balance due/refund.

- Schedules: Complete K for aggregates, K-1s for allocations, and others as needed.

Pro tip: Use IRS worksheets for complex items like QBI deductions (Form 8995).

IRS Form 1120-S Download and Printable

Download and Print: IRS Form 1120-S

Common Mistakes to Avoid When Filing Form 1120-S

- Incomplete K-1s: Forgetting to issue or delaying shareholder statements.

- Misclassifying Income: Mixing rental/portfolio with business income.

- Balance Sheet Errors: Inconsistent book vs. tax basis on Schedule L.

- Missing Attachments: Forgetting Form 4562 for depreciation.

- Digital Asset Oversight: Failing to check the “Yes” box if your S corp handled crypto in 2025.

Double-check with tax software or a professional to catch these.

Penalties for Late or Incorrect Filing of Form 1120-S

Non-compliance can be costly:

- Late Filing: $290 per month per shareholder (up to 12 months); minimum $525 if over 60 days late for 2026 returns.

- Late K-1: $340 per form (up to $3,400 max).

- Underpayment: 0.5% per month on unpaid tax (up to 25%).

- Estimated Tax Penalty: If underpayment exceeds $1,000 (Form 2220).

Reasonable cause waivers are possible—document everything.

Recent Updates for IRS Form 1120-S in Tax Year 2025

The IRS released draft instructions in 2025 with key changes:

- Research Expenses (§174): New election to deduct or amortize pre-2025 amounts (code BA on K-1).

- Farmland Sales (§1062): Separate Schedule A per qualified sale; report via code ZZ.

- Rural Loan Interest (§139L): 25% exclusion for ag loans post-July 4, 2025 (code ZZ).

- Digital Assets: Mandatory disclosure if transacted.

- K-2/K-3 Exceptions: Expanded for low-activity international ops, with deadlines up to August 15, 2026 for extensions.

These align with the Inflation Reduction Act and other reforms—review Rev. Proc. 2025-28 for details.

Resources and Professional Help for Form 1120-S

- Official IRS Site: Download forms and instructions at IRS.gov/Form1120S.

- Free File: Use IRS Free File for eligible businesses.

- Publications: Pub 535 (Business Expenses) and Pub 541 (Partnerships, but useful for pass-throughs).

- Help: Consult a CPA or enrolled agent, especially for international or credit-heavy returns. Tools like TaxAct or Thomson Reuters can automate filing.

Conclusion: Stay Compliant and Optimize Your S Corp Taxes

Filing IRS Form 1120-S correctly ensures your S corporation’s pass-through status and avoids costly penalties. With the March 15, 2026 deadline approaching for 2025 returns, start gathering documents now. By understanding the form’s requirements and leveraging 2025 updates, you can streamline the process and focus on growing your business.

For personalized advice, always consult a tax professional. Questions? Visit IRS.gov or comment below. Stay tax-smart!