Table of Contents

IRS Form 12203 – Request for Appeals Review – If you’ve received a letter from the IRS proposing changes to your tax return after an audit (examination) and you disagree with those adjustments, you have the right to request an independent review. IRS Form 12203, titled Request for Appeals Review, is the key tool for taxpayers seeking this review when the disputed amount is $25,000 or less per tax period (including tax, penalties, and interest).

This form allows you to appeal directly to the IRS Independent Office of Appeals, an impartial body separate from the examination team. Understanding Form 12203 can help you protect your taxpayer rights and potentially resolve disputes without going to court.

What Is IRS Form 12203?

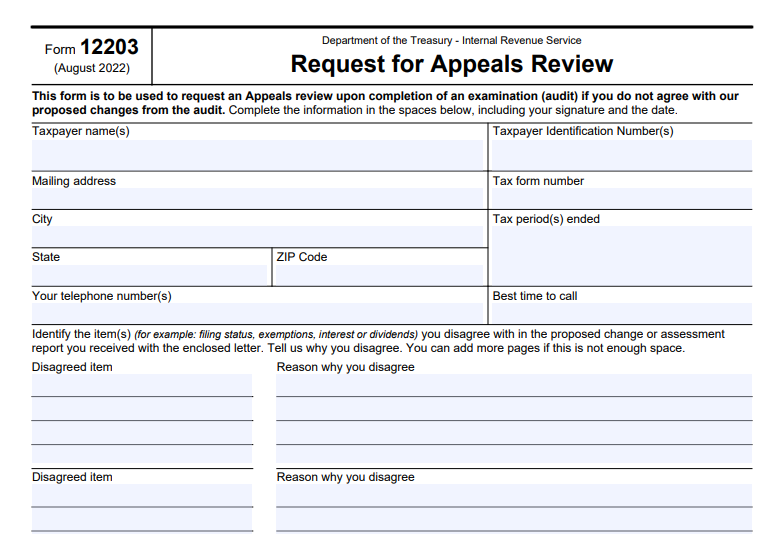

IRS Form 12203 (Rev. August 2022) is a one-page document used to formally request a review by the IRS Independent Office of Appeals. According to the official IRS website and the form itself:

“This form is to be used to request an Appeals review upon completion of an examination (audit) if you do not agree with our proposed changes from the audit.”

The current version remains the August 2022 revision, with no updates released as of December 2025. You can download the latest PDF directly from irs.gov/pub/irs-pdf/f12203.pdf.

Form 12203 is specifically designed for small case requests – a streamlined, informal process for lower-dollar disputes.

When to Use Form 12203

Use Form 12203 in these situations:

- You disagree with proposed tax adjustments from an IRS audit (in-person or correspondence).

- The total proposed additional tax, penalties, and interest is $25,000 or less for each tax period.

- You’ve received an IRS letter (such as Letter 525 or a 30-day letter) explaining your appeal rights and enclosing or referencing Form 12203.

Common scenarios include:

- Disagreements over income reporting (e.g., CP2000 underreporter inquiries).

- Deduction or credit denials.

- Penalty assessments (including some preparer penalties).

Important: Form 12203 is not for collection actions like liens, levies, seizures, or installment agreement terminations. For those, use Form 9423 (Collection Appeals Request) or Form 12153 (Collection Due Process Hearing).

It also cannot be used for:

- Employee plan or exempt organization cases.

- S corporation or partnership cases.

- Cases exceeding $25,000 per period (these require a formal written protest).

Eligibility for Small Case Request Using Form 12203

To qualify:

- Proposed changes ≤ $25,000 per tax year/period.

- The case must stem from an examination (audit).

- You must file within the deadline stated in your IRS letter (typically 30 days from the letter date).

If eligible, the Appeals process is more informal – often handled via correspondence or phone, without the need for a detailed formal protest.

How to Fill Out and File IRS Form 12203: Step-by-Step Instructions

- Download the Form: Get it from the official IRS site.

- Provide Taxpayer Information:

- Name(s), Taxpayer Identification Number (SSN or EIN).

- Address and phone number.

- Tax form number (e.g., 1040) and tax periods.

- List Disagreed Items:

- Describe each issue you disagree with.

- Explain your position briefly (facts and law supporting your view).

- Include supporting documents (receipts, records, etc.).

- Space is limited; use attachments if needed.

- Sign and Date:

- You (and spouse if joint) must sign.

- If using a representative, attach Form 2848 (Power of Attorney).

- Mail It:

- Send to the address shown on your IRS letter (not directly to Appeals).

- Use certified mail for proof of timely filing.

Timely submission is critical – missing the 30-day window may forfeit your Appeals right, leading to a Notice of Deficiency and potential Tax Court petition.

IRS Form 12203 Download and Printable

Download and Print: IRS Form 12203

What Happens After Filing Form 12203?

- The examination team reviews your request first.

- If valid, it’s forwarded to the Independent Office of Appeals.

- An Appeals Officer (independent from the auditor) reviews your case.

- You may have a conference (phone, virtual, or in-person).

- Appeals aims for fair resolution; most cases settle here.

- If no agreement, you’ll receive a Notice of Deficiency, giving you 90 days (150 if abroad) to petition U.S. Tax Court.

For more details, refer to IRS Publication 5 (Your Appeal Rights and How to Prepare a Protest If You Disagree) and Publication 556 (Examination of Returns, Appeal Rights, and Claims for Refund).

Key Benefits of Using Form 12203

- Informal and Faster: Less paperwork than formal protests.

- Independent Review: Appeals officers are impartial.

- No Prepayment Required: Unlike some court options.

- High Settlement Rate: Many disputes resolve favorably.

Alternatives If Form 12203 Doesn’t Apply

- Over $25,000: Submit a formal written protest (see Pub. 5).

- Collection Disputes: Form 9423 or 12153.

- Offer in Compromise Rejection: Form 13711.

Always consult a tax professional for complex cases.

Final Tips for Success

- Act quickly – respect the 30-day deadline.

- Be clear and factual in your explanations.

- Keep copies of everything.

- Consider professional representation (CPA, enrolled agent, or attorney).

By using Form 12203 correctly, you exercise your fundamental taxpayer rights. For the most current information, visit irs.gov/appeals or call the IRS at 1-800-829-1040.

Sources: Official IRS website (irs.gov), Form 12203 PDF, Publications 5, 556, and 3498 (as of December 2025).