Table of Contents

IRS Form 13844 – Application For Reduced User Fee For Installment Agreements – Struggling with IRS tax debt? An installment agreement (payment plan) can spread payments over time, easing the burden without liens or levies—but setup fees often add insult to injury, ranging from $31 to $225 depending on the plan type. For low-income taxpayers, IRS Form 13844—the Application for Reduced User Fee for Installment Agreements—slashes that to just $43, and in some cases, waives or reimburses it entirely if you opt for electronic payments. In 2025, with over 3 million active installment agreements and fees adjusted for inflation, Form 13844 (Rev. February 2025) is a game-changer for families earning ≤250% of federal poverty guidelines (e.g., $37,650 for a single person). This SEO-optimized guide, based on the latest IRS updates, covers eligibility, step-by-step filing, and tips to secure your reduced fee amid rising enforcement.

What Is IRS Form 13844?

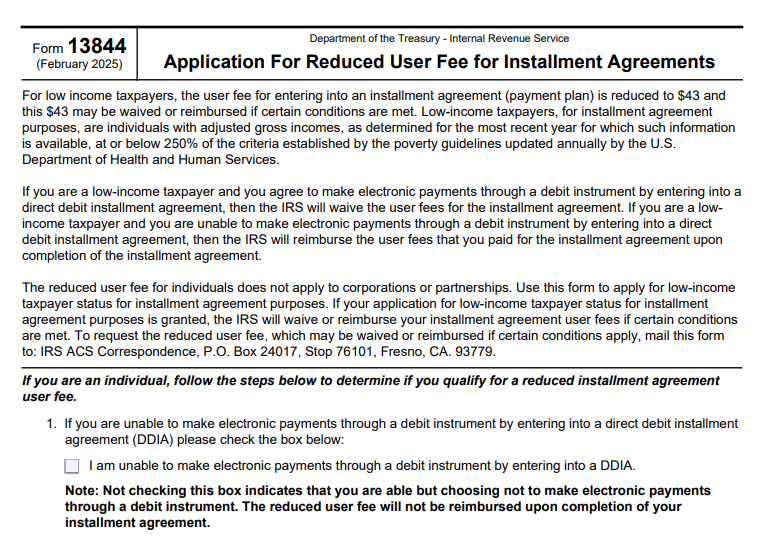

IRS Form 13844 is a one-page application allowing low-income taxpayers to request a reduced user fee when setting up an IRS installment agreement under IRC Section 6159. It certifies eligibility based on adjusted gross income (AGI) from your most recent return, potentially dropping the setup cost from $225 (standard long-term plan) to $43. If you choose direct debit (electronic payments), the IRS may waive or reimburse that $43 upon agreement completion—saving up to $225 total.

Key benefits:

- Fee Reduction: $43 for low-income vs. full rates; no fee for short-term plans (≤180 days).

- Waiver/Reimbursement: Automatic for direct debit installment agreements (DDIA) if low-income certified.

- Easy Certification: Based on AGI ≤250% of federal poverty guidelines (e.g., $78,000 for a family of four).

The February 2025 revision (Rev. 2-2025, Catalog No. 62979N) clarifies AGI thresholds and adds guidance for electronic submission via the Online Payment Agreement tool. Download the PDF from IRS.gov/pub/irs-pdf/f13844.pdf.

Who Qualifies for a Reduced User Fee with Form 13844 in 2025?

Form 13844 is for individuals (not corporations/partnerships) who qualify as low-income and are applying for an installment agreement. The IRS automatically applies reductions if your AGI is on file, but if not flagged, submit this form within 30 days of agreement acceptance.

| Qualification Factor | 2025 Details |

|---|---|

| AGI Limit | ≤250% of federal poverty guidelines (e.g., $37,650 single; $78,000 family of 4—varies by household size/location). |

| Agreement Type | Long-term (>180 days) or short-term; DDIA eligible for full waiver/reimbursement. |

| Filing Status | Individuals only; joint filers use combined AGI. |

| Exemptions | No fee for short-term plans or low-income auto-flagged; corporations ineligible. |

If your AGI qualifies but wasn’t recognized, Form 13844 triggers review—ideal for recent filers or those with updated income.

Filing Deadlines and Submission for Form 13844 in 2025

Submit Form 13844 after receiving your installment agreement acceptance letter but within 30 days—late requests may deny the reduction. For 2025 agreements (e.g., applied in Q1), file by April 30 if letter dated March 31.

- With New Agreement: Attach to Form 9465 (Installment Agreement Request) or submit post-acceptance via mail.

- Post-Acceptance: Mail within 30 days of letter date; no extensions.

- Where to Submit: IRS ACS Correspondence, P.O. Box 24017, Stop 76101, Fresno, CA 93779-76101.

- Electronic: Online Payment Agreement (OPA) tool at IRS.gov auto-applies if AGI qualifies; upload Form 13844 if needed.

Processing: 4-6 weeks; IRS notifies approval/denial. Reimbursements post-completion (e.g., after 24 months).

Step-by-Step Guide to Completing IRS Form 13844

The form is simple—fillable PDF takes 5 minutes. Gather your latest Form 1040 (AGI) and agreement letter.

- Certification Statement: Pre-printed—review AGI/family size against guidelines (e.g., $78,000 for family of 4).

- Taxpayer Info: Name, SSN, spouse details, current address.

- Agreement Details: Enter installment agreement number (from acceptance letter) and date.

- Payment Method: Check if DDIA (direct debit) for waiver eligibility.

- Signature: Both spouses if joint; under penalty of perjury—certify low-income status.

- Date: Within 30 days of acceptance letter.

- Mail: To Fresno address; certified for proof.

If denied, appeal via letter explaining AGI proof (e.g., attach 1040).

2025 Installment Agreement User Fees and Reductions

Fees vary by plan; low-income via Form 13844 cuts them significantly.

| Plan Type | Standard Fee | Low-Income Reduced Fee | Waiver Conditions |

|---|---|---|---|

| Short-Term (≤180 days) | $0 | $0 | N/A |

| Long-Term (Direct Debit) | $31 | $0 (reimbursed) | AGI ≤250% poverty; complete agreement. |

| Long-Term (Non-Direct Debit) | $130 | $43 | AGI ≤250% poverty. |

| Partial Payment | $225 | $43 + possible waiver | Based on financial review. |

OPA tool auto-waives for qualifiers; Form 13844 for manual requests.

IRS Form 13844 Download and Printable

Download and Print: IRS Form 13844

Common Mistakes When Filing Form 13844 and How to Avoid Them

Approvals exceed 90% if accurate—sidestep these:

- AGI Mismatch: Using wrong year’s return—attach latest 1040.

- Late Submission: Over 30 days—file immediately upon acceptance.

- No Payment Method: For waiver, specify DDIA—update via IRS.gov/OPA.

- Joint Oversights: Forgetting spouse signature—both if filing jointly.

- Wrong Address: Fresno P.O. Box only—verify in instructions.

Use the AGI table in Form 13844; call 800-829-1040 for help.

No Penalties for Form 13844—But Fees Add Up Without It

Filing is penalty-free; it’s a request, not a return. However, skipping it means full fees ($130-$225), potentially $225 extra per agreement. Denied requests get explanations—appeal with AGI proof. Fraudulent claims risk perjury (§7206).

Frequently Asked Questions About IRS Form 13844

What’s the low-income AGI limit for 2025?

≤250% federal poverty guidelines (e.g., $37,650 single; $78,000 family of 4).

Can Form 13844 waive fees entirely?

Yes—for DDIA low-income; reimbursed post-completion.

When to submit Form 13844?

Within 30 days of installment acceptance letter.

Is Form 13844 for businesses?

No—individuals only; businesses use Form 9465 without reductions.

How long for processing?

4-6 weeks; IRS notifies approval/denial.

Visit IRS.gov/payments/payment-plans-installment-agreements for more.

Final Thoughts: Ease Your Tax Burden with IRS Form 13844 in 2025

IRS Form 13844 is a low-income taxpayer’s ally, trimming installment fees from $130+ to $43—or $0 with DDIA—saving hundreds amid 2025’s 250% poverty thresholds. The February 2025 revision’s simplicity makes it accessible; submit within 30 days of acceptance to lock in relief. Download from IRS.gov today, certify your AGI, and explore OPA for auto-waivers—affordable plans mean sustainable compliance.

Informational only—not tax advice. Consult IRS.gov or a professional.