Table of Contents

IRS Form 14039 – Identity Theft Affidavit – Tax-related identity theft occurs when someone uses your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) to file a fraudulent tax return, often to claim a refund. IRS Form 14039, the Identity Theft Affidavit, allows you to officially report this to the IRS and protect your tax account.

In 2025, the IRS encourages online submission where possible, and many victims receive automatic protections like an Identity Protection PIN (IP PIN). This guide explains what Form 14039 is, when to file it, how to complete and submit it, and steps to prevent future issues—all based on official IRS guidance.

What Is IRS Form 14039?

Form 14039 serves as an official declaration that you are (or may be) a victim of identity theft affecting your federal tax matters. The IRS uses it to:

- Mark your account with an identity theft indicator.

- Investigate fraudulent returns.

- Process your legitimate tax return and issue refunds if applicable.

The form is free and available as a fillable PDF or online version. It applies to individuals, dependents, or deceased persons (filed by representatives).

Note: Businesses use Form 14039-B instead.

IRS Form 14039 Download and Printable

Download and Print: IRS Form 14039

When Should You File Form 14039?

File Form 14039 only in specific tax-related identity theft situations. Many cases are handled automatically by the IRS without this form.

File If:

- Your e-filed return is rejected because a duplicate return was already filed using your SSN/ITIN (after checking for errors).

- A dependent’s SSN/ITIN was used on another return without your permission.

- You receive an unexpected tax transcript you didn’t request.

- You get IRS notices about owed taxes, offsets, or collection actions for a year you didn’t file or had no income.

- You receive income reporting (e.g., W-2 or 1099) from an unknown employer.

- An Employer Identification Number (EIN) was assigned without your request.

Do NOT File If:

- You received IRS Letter 5071C, 4883C, or 5747C—these require identity verification (online, phone, or in-person) instead.

- The identity theft is non-tax-related (e.g., fraudulent credit cards or unemployment claims)—report to the FTC at IdentityTheft.gov and credit bureaus.

- You’ve already submitted Form 14039 for the same incident.

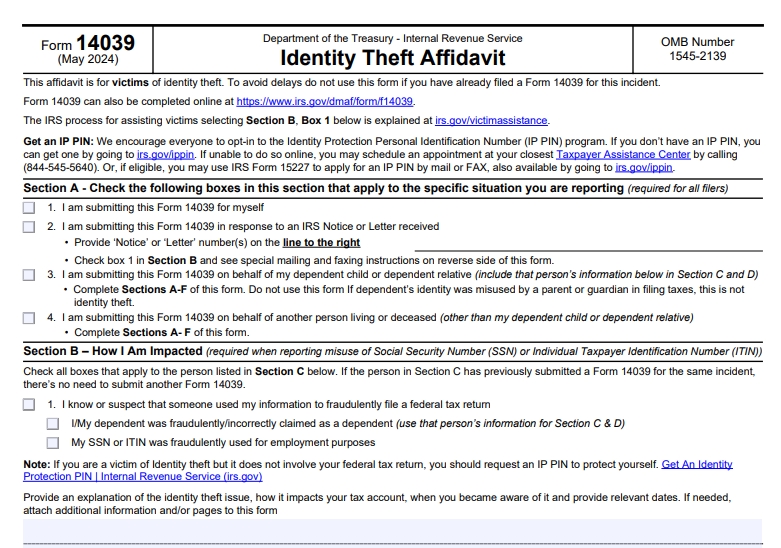

How to Complete IRS Form 14039 Step by Step

You can fill it out online (recommended) or download the PDF.

- Section A: Who Is Filing

Check boxes for yourself, in response to an IRS notice, or on behalf of a dependent/other person. - Section B: Impact Description

Check applicable boxes (e.g., fraudulent tax return filed, dependent claimed incorrectly, SSN used for employment). Provide a detailed explanation, including dates and how you discovered the issue. - Section C: Victim Information

Enter the victim’s name, SSN/ITIN, current and prior addresses, phone, and preferred language. - Section D: Tax Account Details

Note the last tax year filed and impacted years (or “Unknown”). - Section E: Signature

Sign under penalty of perjury. - Section F: Representative Info (if applicable)

Provide details and attach required documents (e.g., death certificate, power of attorney).

No supporting ID copy is generally required unless specified.

How to Submit Form 14039

Choose one method only:

- Online (Preferred) → Go to irs.gov and complete the guided form.

- Fax → Use 855-807-5720 (toll-free) or the number on your IRS notice.

- Mail → Send to Fresno, CA 93888-0025 (or address on notice). If attaching to a paper tax return (e.g., after e-file rejection), mail to your normal filing location.

What Happens After Filing Form 14039?

The IRS assigns your case to the Identity Theft Victim Assistance (IDTVA) team. They:

- Review affected tax years.

- Remove fraudulent returns.

- Process your legitimate return/refund.

- Add an identity theft marker to your account.

You’ll typically be enrolled in the IP PIN program—a unique six-digit PIN mailed annually for secure filing.

Resolution usually takes 120 days, though backlogs may extend it (current average ~582 days, improving). Avoid duplicate submissions or status inquiries, as they cause delays.

Preventing Tax-Related Identity Theft

- Get an IP PIN proactively at irs.gov/ippin.

- File your tax return early.

- Use secure networks for e-filing.

- Monitor your credit reports and IRS account.

- Report non-tax issues to the FTC and place fraud alerts.

For more resources, visit IRS Identity Theft Central at irs.gov/identity-theft-central.

If you suspect identity theft, act quickly—filing Form 14039 correctly can resolve issues and protect your future refunds. Always use official IRS sources for the latest updates.